Like the 5498 the 5498-SA is a souvenir only. However if you or your spouse was an active participant in an employers pension.

Irs Form 5498 Sa Fill Out Printable Pdf Forms Online

This box is for the total HSA and Archer MSA contributions made during the current year and earmarked for the last tax year.

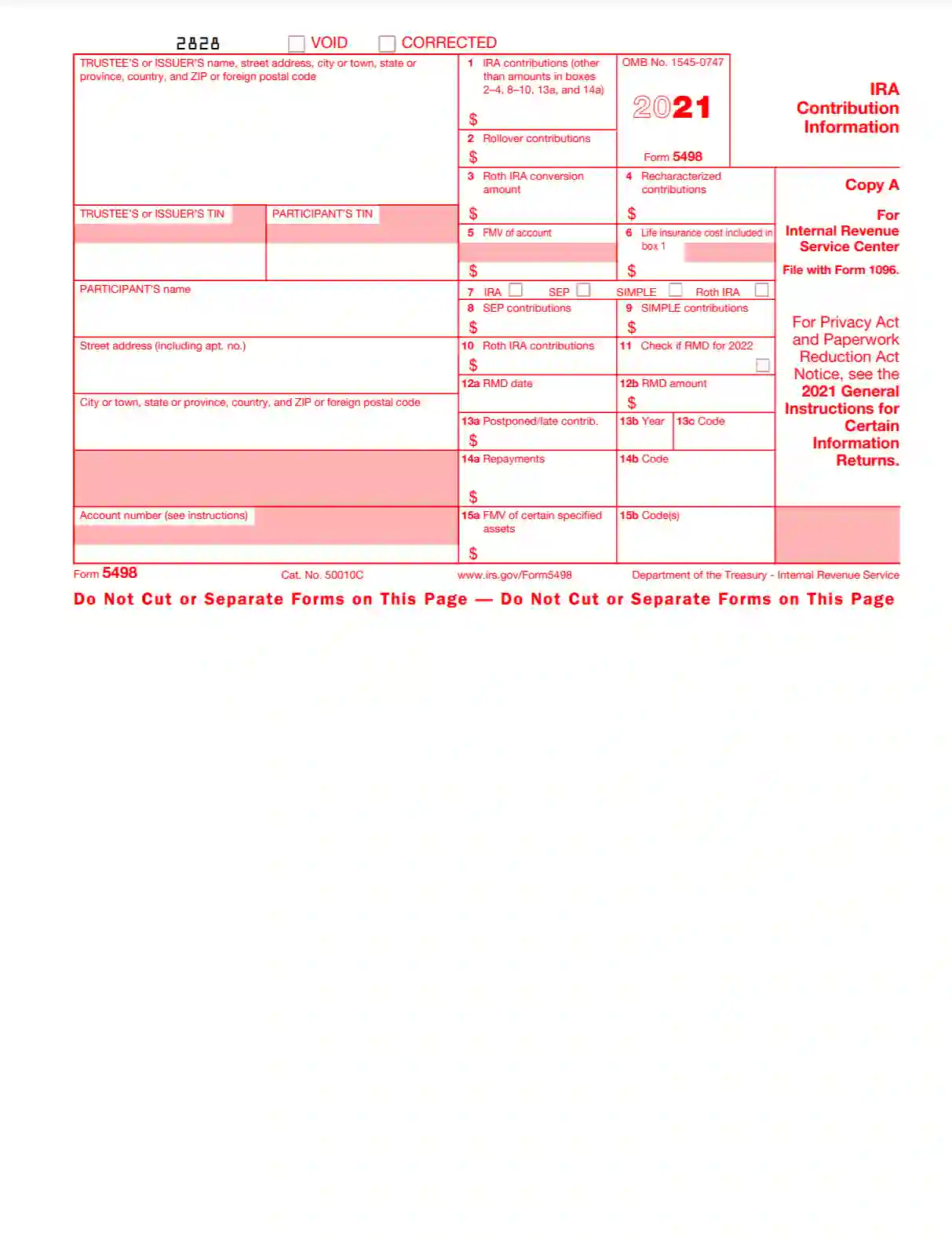

1040 form 5498. Why does Form 5498 come out in May. Shows traditional IRA contributions for 2018 you made in 2018 and through April 15 2019. These contributions may be deductible on your Form 1040.

No extension is provided for the filing of any return other than the Form 1040 series and the Form 5498 series for the 2020 taxable year. On page 4 of Form 5498. But this year the deadline has been moved to July 15In response to the coronavirus COVID-19 pandemic the IRS issued Notice 2020-23 extending the 2019 forms June 1 2020 deadline to July 15 2020.

However if you or your spouse was an active participant in an employers pension. The information on Form 5498 is submitted to the IRS by the trustee or issuer of your individual retirement arrangement IRA to report contributions including any catch-up. This form must be mailed to participants and the IRS by May 31.

The end of May is normally when the previous years IRS Form 5498 IRA Contribution Information or an allowable substitute form is due. IRS Form 5498 is the IRA Contribution Information form. Youll also find details about any contributions youve made through a Savings Incentive Match Plan for Employees SIMPLE IRA or a Simplified Employee Pension SEP-IRA.

Contributions to similar accounts such as Archer Medical Savings Accounts and Medicare Advantage MSAs will also warrant a Form 5498-SA. One of my clients received form 5498 IRA contribution Information. When it comes to IRAs Form 1099-R is used to report IRA withdrawals whereas Form 5498 is used to report IRA contributions.

Shows traditional IRA contributions for 2021 you made in 2021 and through April 18 2022. Information about Form 5498 IRA Contribution Information Info Copy Only including recent updates related forms and instructions on how to file. Their titles and functions are similar but they report information for different kinds of savings accounts.

File Form 5498 IRA Contribution Information with the IRS by May 31 2023 for each person for whom in 2022 you maintained any individual retirement arrangement IRA including a deemed IRA under section 408q. Form 5498 IRA Contribution Information. Extended deadline for filing and furnishing the Form 5498 series.

It is not necessary to file a Form 5498 for each investment under one plan. File this form for each person for whom you maintained any individual retirement arrangement IRA including a. These contributions may be deductible on your Form 1040 or 1040-SR.

You should for example include all contributions made in 2022 and designated for year 2021 in this box if youre filling out the form to report contributions for 2021. These contributions may be deductible on your Form 1040. Form 5498 reports IRA contributions rollovers Roth IRA conversions and required minimum distributions RMDs to the IRS.

The information on Form 5498 is submitted to the IRS by the trustee or issuer of your individual retirement arrangement IRA to report contributions including any catch-up. However if you or your spouse was an active participant in an employers pension plan these. Form 5498 on 1040 form.

Your IRA trustee or custodian is. These contributions may be deductible on your Form 1040 or 1040-SR. IRA contributions are tax-deductible up to certain limits.

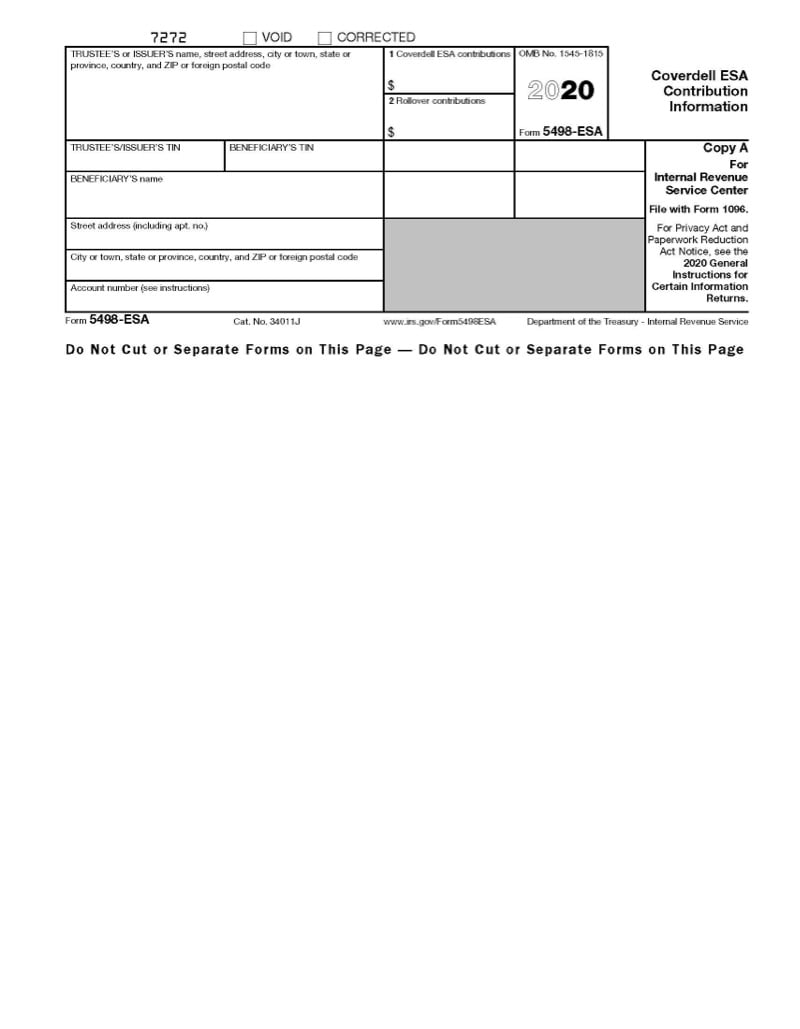

The IRS uses the information on Form 5498 substantiate that you made contributions. An IRA includes all investments under one IRA plan. Form 5498 reports your IRA contribution information while Form 5498-SA reports your Health Savings Account HSA Archer MSA or Medicare Advantage MSA contributions.

Form 8606 is used to record conversions to the IRS. A 5498 is a tax form that IRAR Trust files with the IRS on May 31 st but for the tax year 2020 this was extended to June 30th 2021. However if you or your spouse was an active participant in an employers pension plan these contributions may not be deductible.

The information on Form 5498 is submitted to the IRS by the trustee or issuer of your individual retirement arrangement IRA to report contributions including any catch-up. Form 5498-SA reports your annual contributions to these tax-free accounts that you use to pay for medical expenses. This tax form provides details about contributions youve made throughout the year to traditional and Roth IRAs.

You will enter this under Deductions Health savings account. This Legal Update is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. IRS Form 5498 is an informational statement that reports to you and to the IRS the amount of any IRA contributions you made during the previous tax year.

Form 5498-SA Box 3. To provide feedback on this solution please login. These contributions may be deductible on your Form 1040 or 1040-SR.

Only use Form 5498 for informational reasons. It identifies different transactions that can happen within an IRA like a contribution a rollover or a required minimum distributionRMD. However if you or your spouse was an active participant in an employers pension plan these contributions may not be deductible.

Only if federal income tax is withheld in box 4 of Form 1099-R is Copy B of Form 1099-R attached to Form 1040. In late May you will receive a Form 5498 for any IRA accounts containing contributions deposits. Instructions for Form 5498.

This form will be accessible via the Documents tab at the top of your dashboard. Estimated Tax for Individuals 2021 02042021 Form 1120-F Schedule S Exclusion of Income from the International Operation of Ships or Aircraft Under Section 883 2021 12012021 Inst 5498-ESA.

5498 Ira Esa Sa Contribution Information 1099r

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

Tax Form Focus Irs Form 5498 Strata Trust Company

American Equity S Tax Form 5498 For Ira Contribution

What Is Form 5498 And What Does It Mean For My Roth Conversions Lawrence Financial Planning

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

Learn How To Fill W 2 Tax Form Tax Forms Letter Example Cover Letter Template

Fillable Form 1040 Schedule E 2016 In 2021 Tax Forms Income Tax Real Estate Forms

Account Ability Form 1098 User Interface Mortgage Interest Statement Data Is Entered Onto Windows That Resemble The Actual Accounting Spreadsheet Irs Forms

Pin By Francisco Romero On Information In 2021 Tax Forms Irs Tax Forms Marketing Strategy Social Media

Irs Form 5498 Fill Out Printable Pdf Forms Online

Reporting Contributions On Forms 5498 And 5498 Sa Ascensus

Form 5498 Retirement Contribution Reporting

Entering Information From Form 5498 Form 5498 Esa And Form 5498 Sa

Post a Comment

Post a Comment