This is your taxable income. Reports and info about W-2 and W-3 forms.

Have Your W 2 Form Here S How To Use It The Motley Fool

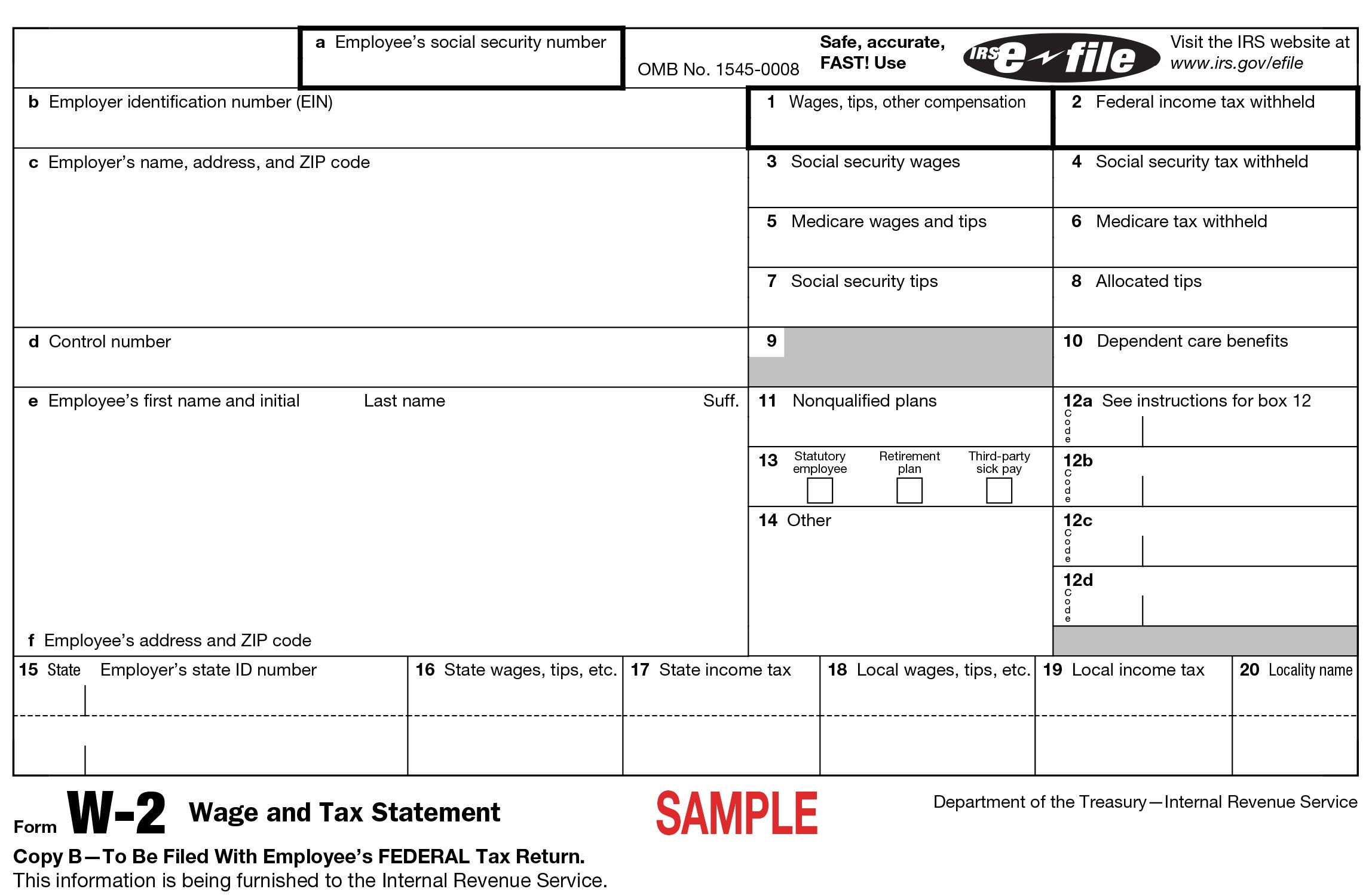

Description of each box on form W2 Box 1 Wages tips other compensation.

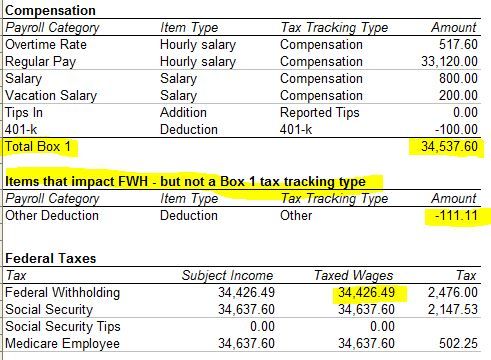

How to calculate w2 boxes. For many people this will be an hourly rate multiplied by a certain number of hours a week. This is for married person. Subtract the nontaxable income from the total earned income.

The amounts in box 1 and box 3 of your W-2 will be different if you had a pre-tax deduction. Be sure to combine your results from both W-2 forms if your status is married filing jointly. Governments to determine whether you are permitted to truncate SSNs on copies of Form W-2 submitted to the government.

The Roth deduction is not exempt from taxes so we do not need to subtract this amount from the gross taxable income. Add GTL imputed income from Box 12C on your W-2 The resulting amounts should equal Box 1 Federal Wages and Box 16 State Wages on your W-2. That means his company is paying a difference of 1321400 per year or 25412 per week for the remainder of our health insurance premiums.

See Regulations section 316051-1a1iA and 3016109-4b2iv. Knowing the differences in Boxes 1 3 and 5 on a W-2 is important in determining income. You calculate your adjusted gross income by taking your gross income on your W2 and subtracting all your deductions.

W2 form boxes explained. Estimate Your Annual Taxes. However this can get a little complicated.

In box 12a on his W-2 with the code DD is the whopping amount of 1710800. You will subtract any of these items from your gross taxable wages. Im working with a gross wages as 5799976.

Limit on health flexible spending arrangement FSA. Box 1 shows your Federal Income Tax Wages for the year and Box 2 shows the amount withheld from those wages for the year. The number you come to should match the number you see in Box 1 on your W2 when you receive it.

Section 125 deductions medical dental vision dependent care pre-tax commuter benefits etc. W2- Box 1 and 16 calculation issues W2 Box 1 - National Sick Pay 2 S-Corp Health Insurance in W2 box 3 and 5 QBO. The following guide will walk you through the bonus reporting process.

For 2021 a cafeteria plan may not allow an. On your paystub check the current tax column and write down the local state and income taxes that were withheld. Other pre-tax deductions only reduce your taxable income box 1.

This is federal taxable income for payments in the calendar year. An employers EIN may not be truncated on any form. To find your earned employment income from 2020s W-2 you can usually just add Box 2 to Box 1 to see what you earned before federal taxes were withheld.

Some employees may see a difference between Box 1 Federal Wages and Box 16 State Wages due to the value of certain pre-tax transportation benefits. And if you need help completing W2s 1099s or any other tax and wage form remember that AMS has powerful tools to support. Similarly Box 5 represents Medicare wages and Box 6 are the taxes on those Medicare wages.

The first step of calculating your W2 wages from a paystub is finding your gross income. Box 3 on the W2 forms represents Social security wages and Box 4 are the social security taxes on those wages. The pay period of the check is unimportant.

Just in case you want to print W-2 feel free to read this article for the detailed steps and information. The amount is calculated as YTD earnings minus pre-tax retirement and pre-tax benefit deductions plus taxable benefits ie certain educational benefits. An employer should report bonuses paid to an employee in box 1 of a W2.

This is the total Federal Income Tax amount withheld from your checks over the year. Youll take these same steps when figuring out your state taxable income. Your paystub will show you this amount.

Box 2 Federal income tax withheld. Some pre-tax deductions reduce your taxable income box 1 and your social security income box 3. That value is what the employer actually withheld from your pay and sent to the state for you as a prepayment for the state taxes for the year.

This is federal income tax withheld. Hereof how is Box 3 calculated w2. The purpose of box 11 is for the SSA to determine if any part of the amount reported in box 1 or boxes 3 andor 5 was earned in a prior year.

The SSA uses this information to verify that they have properly applied the social security earnings test and paid the correct amount of benefits. W-2 Box 1 is the amount of pay subject to income tax. On a W-2 that is not a calculated number that you have to figure out.

The Simple Way to Calculate W-2 Income Tax Return. Family Lawyers Know Income Determination is Critical for Spousal and Child Support. Pre-tax contributions to a 401k or 403b will not show in Box 1 but will be in Box 3 and 5 amounts.

Enter this amount in box 1 of Form W-2. Depending on when you get paid multiply the amount by that particular pay period. This is the total amount of money youve earned without deductions or tax withholdings.

Based on IRS guidelines this will include all paycheck dates from January 1st through December 31st of the W2 year. How do i calculate for w2s box 171819 for new york state. Know Your W-2 Form.

What matters for W2 forms purposes is the actual check date. IF the employer didnt withhold any state taxes then that box will be blankand you leave it that way and continue on. Federal income Tax Withheld.

The result will be the amount of federally taxable income earned during the year.

W10 Form What Does A W10 Look Like 10 Disadvantages Of W10 Form What Does A W10 Look Like An Business Letter Template Fillable Forms Tax

Basic Thumb Rules Used In Construction By Civil Engineers Grade Of Concrete Civil Engineering Civilization

Solved W2 Box 1 Not Calculating Correctly

Understanding Your W 2 Controller S Office

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

W 2 Wage And Tax Statement Data Source Guide Dynamics Gp Microsoft Docs

Bbox E10dv 10 Inch Dual Vented Dived Chamber Subwoofer Enclosure Dual 10 Inch Divided Chamber Dual Vent Subwoo Subwoofer Enclosure Subwoofer Speaker Enclosure

Lets S Understand W 2 Boxes And W 2 Tax Codes W2 Tax2020 Turbotax Youtube

How To Read Your W 2 University Of Colorado

Log In Financial Education Curriculum

How To Read Your Military W 2 Military Com

The Cost Of Health Care Insurance Taxes And Your W 2

Post a Comment

Post a Comment