However state or local information isnt included with the Form W-2 information. How do I enter my 16 year old childs W2.

Instant W2 Form Generator Create W2 Easily Form Pros

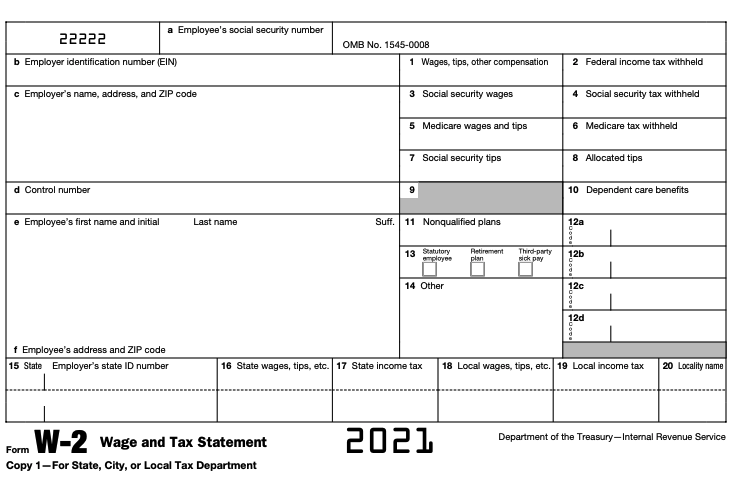

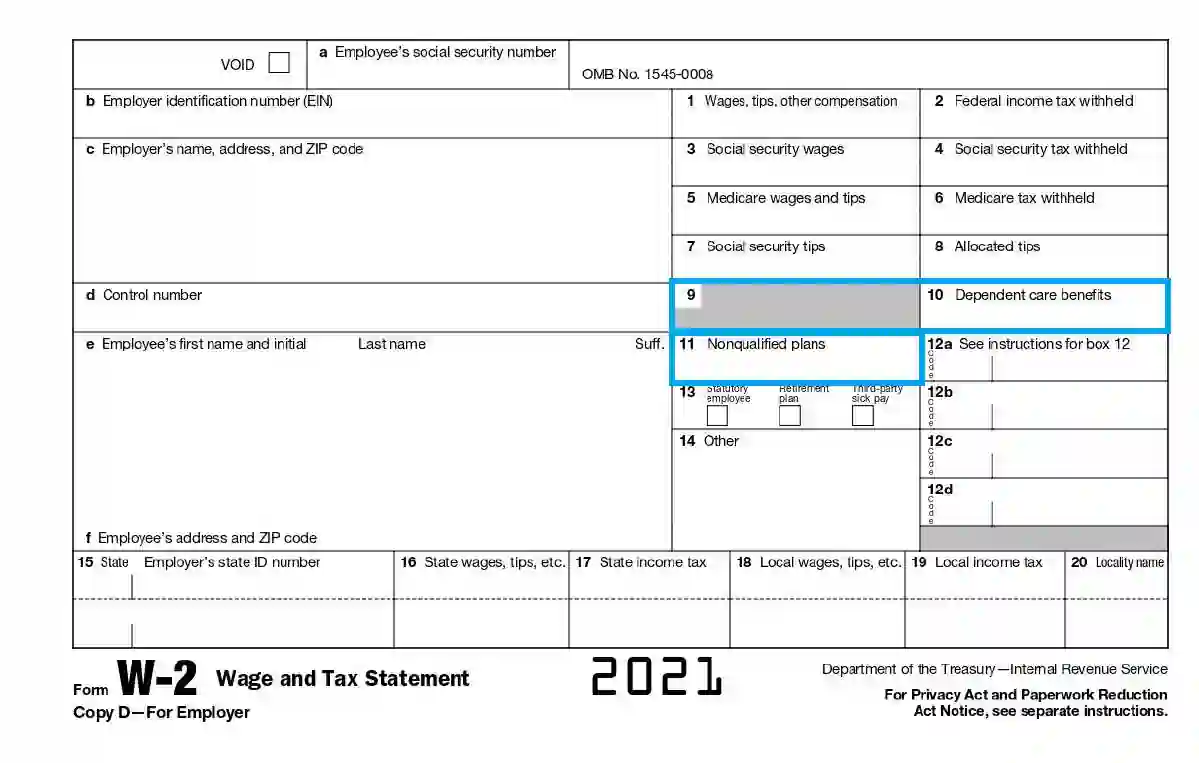

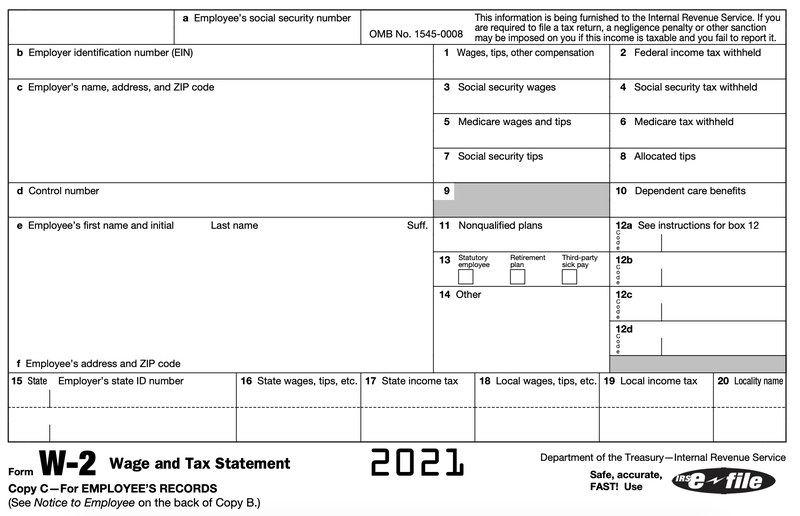

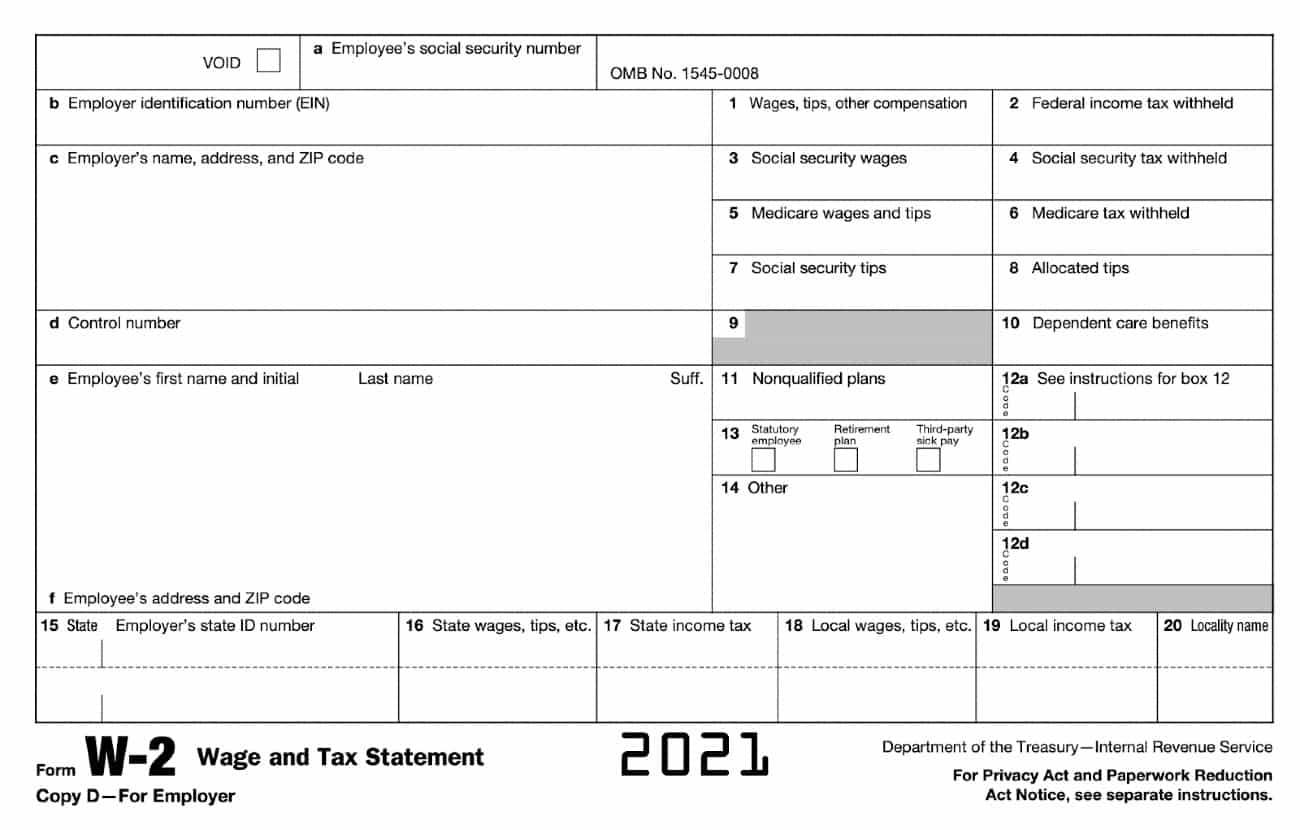

The fields on each W-2 form are the same.

W2 form for 16 year old. The IRS will then review your information and handle the rest from there. Form right side of the work permit stating the types of work to be done and the hours to be workedThe parent along with the youth signs the form and the youth returns it to. Visit our e-filing portal select your sources of income upload form 16.

This service is free of charge. You will need a form 1040 schedules 1 C and SE. 16-18-Year-Olds To Get Licence To Ride 100cc Automatic Scooters.

These transcripts are available for the past ten tax years but information for the current tax year may not be complete until July. If you made less than 12000 you wont owe any income tax. The government is considering to allow teenagers in the age group of 16-18 years old to ride automatic scooters up to 100cc.

16 year old with w2 form. 29 CFR 570120 The following is a. If the form shows 400 or more then you must file a federal tax return.

However if you want to know the IQ of a child between the ages of 7 and 16 there are several tests that can help you. Occupations 16 and 17 year olds may not perform. However you will only receive a copy of your actual W-2 if you paper-filed your taxes that year.

To order official IRS information returns such as Forms W-2 and W-3 which include a scannable Copy A for filing go to IRS Online Ordering for Information Returns and Employer Returns page or visit wwwirsgovorderforms and click on Employer and Information returns. Please see IRS Tax Tip 2018-30 February 27 2018 IRS Can Help Taxpayers Get Form W-2 for updated information. No state filing is needed since FL does not have an income tax.

If my 20 year old daugter made more than me can i get the child tax credit if she was in collage more than 6 months last year. IRS Tax Tip 2016-12 February 3 2016. There is an IQ test for children developed by us which unlike similar ones can also determine the IQ level of children at the age of 6 yearsThe child will be shown a series of three pictures arranged with some regularity.

Form W-2 Wage and Tax Statement shows your income and the taxes withheld from your pay for the year. If you have already had a full-validity 10 year passport issued to you when you were age 16 or older you may use Form DS-82 to renew your passport. You enter information that is already available from payroll and personnel records.

Well mail you the scannable forms and any other products you order. I am 18 years old and i have a one year old child but i only made 4000 for the year can you tell me how much earned income credit i will get. You can use this form for any of the missing documents in the title of the form.

Most people get their W-2 forms by the end of January. Our advanced software automatically picks up the required information fill your details by itself. Simply review the information.

The SSA only accepts e-filed forms not photocopies. To get a copy from the IRS you must order a copy of your entire tax return by using Form 4506. It shows the data reported to us on information returns such as Forms W-2 Form 1099 series Form 1098 series and Form 5498 series.

The W-2 is simple and straightforward. Copy A goes to the Social Security Administration SSA along with a W-3 form that includes a summary of all of the W-2s for every worker on payroll. Under the child labor laws of the Fair Labor Standards Act employers may employ 16 and 17 year olds for any job unless it has been deemed particularly hazardous for such youth or detrimental to their health or well-being.

A child labor form work permit form 62-2203 from an issuing officer to give to employersThe. These certificates provide details of TDS TCS for various transactions between deductor and deductee. Method 3Method 3 of 3Requesting a Duplicate W-2 from a Previous Tax Year.

Copy 1 of the W-2 form goes to the appropriate state city or local tax department. Use Form 4506 to order a copy of a previous years tax return from the IRS. TDS certificate form 1616A.

If you are not sure if you have online access please check with your company HR or Payroll department. Please see Renew a Passport by Mail to see if. But you will still owe self employment tax which is why you still need to file.

The IRS keeps copies of W-2 forms from your previous tax years. Use the IRSs Get Transcript tool if you only need the information contained in the W-2 and the W-2 you need is less than 10 years old. It is mandatory to issue these certificates to Tax Payers.

29 US Code 203 l 2. You can upload income tax form 16 and e-file your return with Tax2win by following some simple steps. It will also show the state and federal taxes social security Medicare wages and tips withheld.

By January 31 of each year your employer even if you dont work there anymore will give you an IRS Form W-2 Wage and Tax Statement showing how much you earned in wages tips and other compensation from the previous year. Employer needs to complete the employer portion of the child labor. Your dependent may file a return ifshehe got a W-2 for 2016 and had federal income taxwithheld.

Form 16 is a TDS certificate issued by an employer to his employee at the end of the financial year. If your income is below the basic exemption limit your employer is not required to deduct TDS on your salary. If shehe files an income tax return shehe may get arefund.

Use form 4506 if you need your W-2 form and you need other information from that years completed taxes. It comprises details of Salary Income and TDS deducted on such income. 2021 Form W-2 and the General Instructions for Forms W-2 and W-3 updated for section 9632 of the American Rescue Plan Act of 2021-- 24-NOV-2021.

If your employer does not provide online access to your W-2 they must mail or hand-deliver your W-2 to you no later than January 31st. See the instructions below. Your employer is required to provide you with Form W-2 Wage and Tax Statement.

2021 Forms W-2 Reporting of Qualified Sick Leave Family Leave Wages Paid Under the Families First Coronavirus Response Act as amended by the American Rescue Plan-- 26-NOV-2021. When can a 16-17 year old use Form DS-82. Lets break this down even further.

You will also need to have some information about your business such as an Employer Identification Number EIN and in most cases a State ID Number. Form 16 16A is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. How should a 16 year old fill out his W-4 form that is working 24 hrs or less per week and is still a dependent on his.

If your former employer is refusing to issue you a W2 you can file an IRS substitute W-2 form on your own Form 4852 using the information from your records. Mn w 4 for 16 year old.

Learn How To Fill W 2 Tax Form Tax Forms Letter Example Cover Letter Template

W 2 Irs Form 2013 Irs Forms Employer Identification Number Federal Income Tax

How To Read Your W 2 Justworks Help Center

What Is A W 2 Form W2 Forms Job Application Template Printable Job Applications

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

2015 W2 Fillable Form 1099 Form Required By Law Workbook Helpsiteworkbook Help 1099 Tax Form Irs Forms Fillable Forms

W 2 Wage And Tax Statement Data Source Guide Dynamics Gp Microsoft Docs

2015 W2 Form Free Printable Irs Form 1099 Misc For 2015 For Taxes To Be Fillable Forms Independent Worker 1099 Tax Form

Irs Form W 2 Fill Out Printable Pdf Forms Online

Super Forms Miscs305 1099 Miscellaneous Information 3 Part Set Preprinted Sale Reviews Irs Tax Forms Tax Forms Irs Taxes

3 Ways To Send Forms W 2 To Your Employees In 2022 The Blueprint

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

Post a Comment

Post a Comment