Tax1099 offers this form through the platform for 499. It also lists deductions such as FICA and payments made to a health care plans.

Computer Payroll Software Ezpaycheck Updated For Kentucky Small Business

Regardless of the form volume e-filing is more convenient and you can save time by filing multiple W-2s at once.

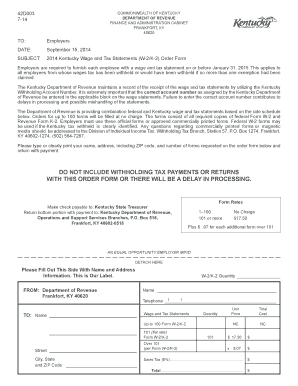

W2 form kentucky. The state of Kentucky does not accept paper copies of W-2 forms. We will update this page with a new version of the form for 2023 as soon as it is made available by the Kentucky government. The Commonwealth of Kentucky is one employer so a transfer from one state agency to another will not result in separate W-2s.

You will receive a single W-2 no matter how many different state agencies you work for. To e-file W-2s Create a FREE account with TaxBandits. Quick steps to complete and e-sign Ky W2 online.

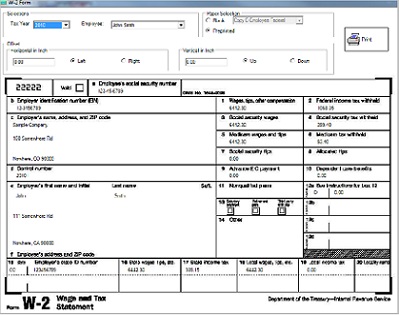

Kentucky mandates that employers submit Form W-2 to report an employees statement of wages and taxes including gross wages social security Medicare taxes withheld. Form W-2 is filed by employers to report wages tips and other compensation paid to employees as well as FICA and withheld income taxes. Yes the Kentucky Department of Revenue mandates the filing of Form W2 if you have withheld state taxes.

The Kentucky Department of Revenue conducts work under the authority of. Use PDF signer to sign documents online with no need to travel to collect signatures. If the agency cannot access the requested W-2 they will need to submit a request using the Business Request form.

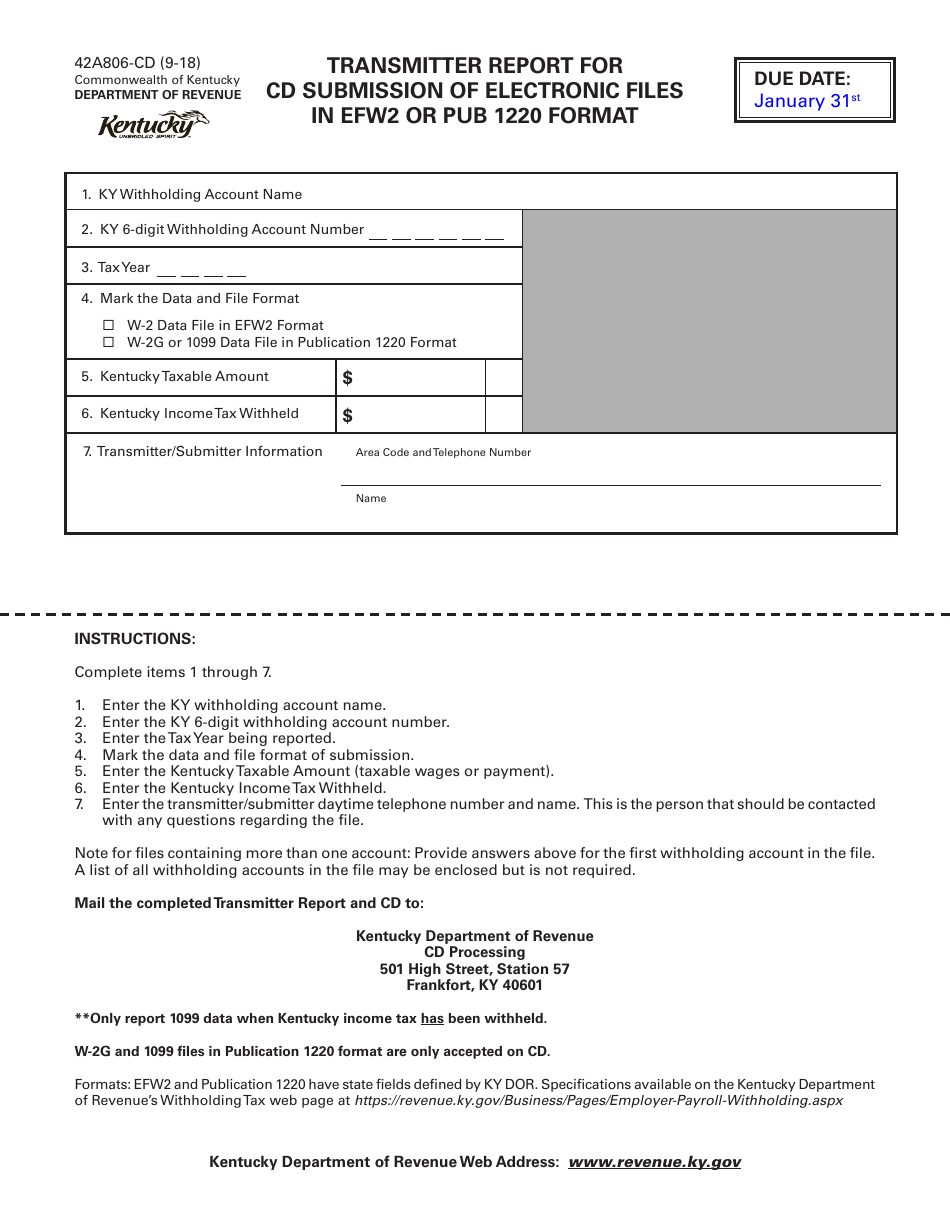

They will have a paper W-2 form printed and mailed by Northern Kentucky University no later than January 31 to the employees mailing address on file in the SAP HRPayroll system. Employers in Kentucky must file Form W-2 with the state in addition to federal filing only if there is a state withholding to report. The withholding statement information Forms W-2 W-2G and 1099 Series must be reported to the Kentucky Department of Revenue DOR on or before the January 31 due date.

Use our W2 Mate 2020 2021 Solution to file Kentucky 1099-NEC 1099-MISC 1099-R 1099-C 1099-A 1099-OID and other information returns using paper forms Print and Mail and electronic processing Online E-File Submission methods to the. Form W-2 - Wage and Tax Statements. Use PDF signer to sign documents online with no need to travel to collect signatures.

As an employer in the state of Kentucky you must file. The Internal Revenue Service requires that every. File Kentucky W2 1099 Forms Online Electronically or Print on Paper Kentucky Business Filers and CPA Firms.

Does Kentucky require any additional forms to be submitted while filing W-2. Utilize the Circle icon for other YesNo questions. This schedule must be fully completed in order to receive proper credit for Kentucky income tax withheld.

A W-2 form contains information regarding your total earnings for the year and the amount of taxes paid. Complete this Schedule KW-2 to determine the total Kentucky income tax withholding to be entered on Kentucky Form 740 740-NP or 740-NP-R. Employees who have separated employment from Northern Kentucky University will have a W-2 paper form printed and mailed.

Ad The best PDF signer to complete contracts and send them to clients for final e-signature. An Official Website of the Commonwealth of Kentucky Skip Content A site for state employee and benefit participant team members. Include multiple Schedule KW-2s as needed to report all Kentucky income tax withholdings.

We last updated Kentucky Schedule KW-2 in January 2022 from the Kentucky Department of Revenue. Remember you must e-file W-2s if you file more than 25 forms. Paystub Form W-2 Create your W-2 Form Step 1 - Company Information Step 2 - Employee Information Step 3 - More Information Step 4 - Preview Your Stub Step 1 Company Information Step 2 Employee Information Step 3 More Information Step 4 Preview Your Stub.

However the state accepts only the electronic filing of W-2. The employers should file Form W2 electronically with the State agency even if there is no Kentucky state withholding. Yes you can submit W-2c with the State of Kentucky if you find errors on the previously filed W-2.

Information about Form W-2 Wage and Tax Statement including recent updates related forms and instructions on how to file. This form is for income earned in tax year 2021 with tax returns due in April 2022. Form K-5 - Transmittal of Tax Statements.

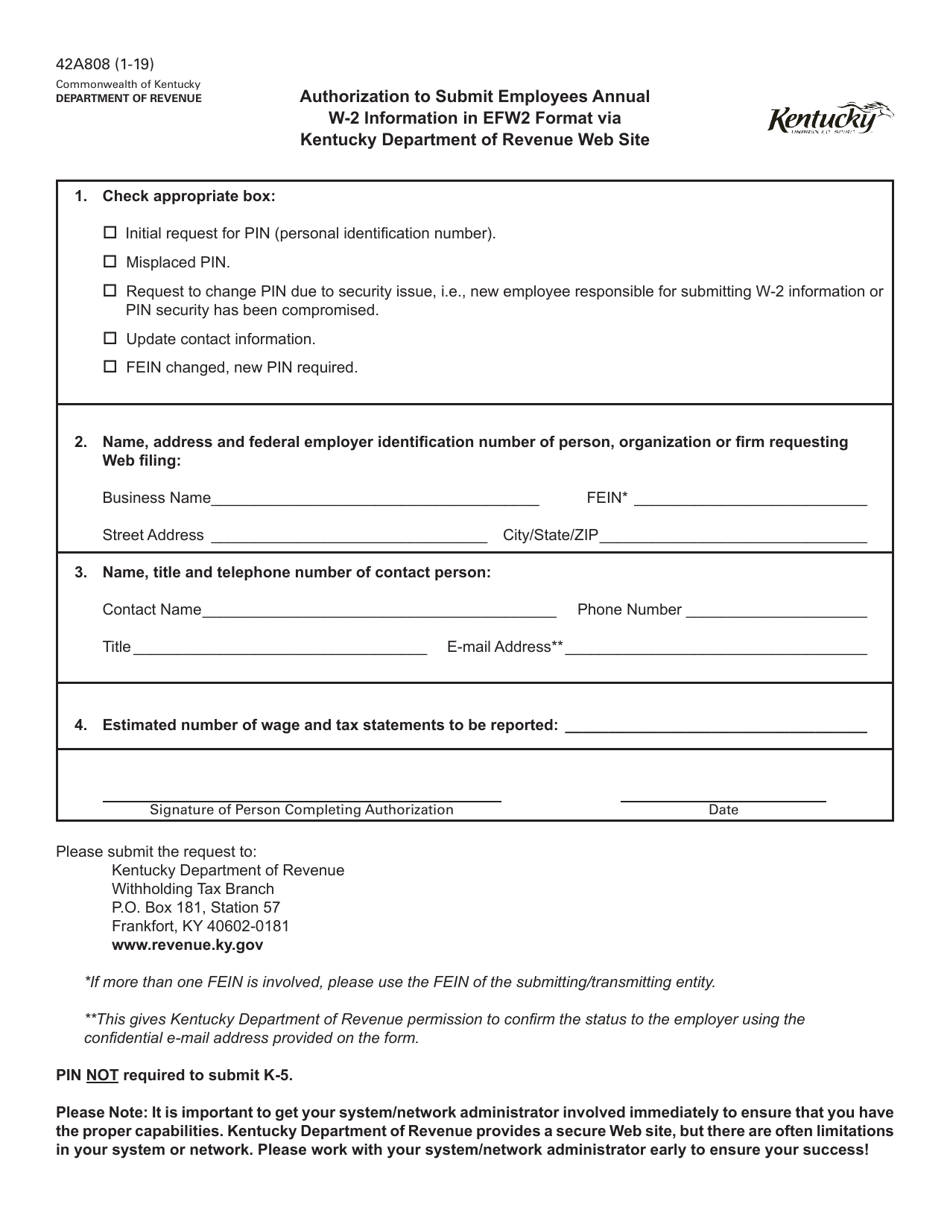

If you have filed K-5 replacing W-2 and found errors you can submit an amended K-5. Ad The best PDF signer to complete contracts and send them to clients for final e-signature. To register use form 42A808 If you are already registered but have forgotten your PIN number send an email to krcwithholdingkygov.

Use Get Form or simply click on the template preview to open it in the editor. Kentucky requires W-2 filing if Kentucky state tax withheld. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

Attention K-5 Filers A Kentucky Online Gateway KOG user account email address and password is required to file Form K-5. Start completing the fillable fields and carefully type in required information. You may be required to file Kentucky state reconciliation form K3.

However you can paper file Form K-5 instead of W-2s when filing 25 forms or less. The state of Kentucky require additional forms to be submitted when filing W-2.

W 2 Wage And Tax Statements Help Accounting And Financial Services Eastern Kentucky University

Tf5202b 2 Up W 2 Laser Employee Copy B Tax Forms In Bulk Packs

W 2 Wage And Tax Statements Help Accounting And Financial Services Eastern Kentucky University

State W 4 Form Detailed Withholding Forms By State Chart

Formsandchecks Help Page State List W 2 And 1099 Forms

W 2 Accessing Online Statement Uk Human Resources

W 2 Select Online Delivery Uk Human Resources

Form 42a808 Download Printable Pdf Or Fill Online Authorization To Submit Employees Annual W 2 Information In Efw2 Format Via Kentucky Department Of Revenue Web Site Kentucky Templateroller

Form 42a806 Cd Download Fillable Pdf Or Fill Online Transmitter Report For Cd Submission Of Electronic Files In Efw2 Or Pub 1220 Format Kentucky Templateroller

Fillable Online Revenue Ky Kentucky Form W 2 K 2 Download Fax Email Print Pdffiller

Post a Comment

Post a Comment