The form will be received and recorded by the United States Internal Revenue Service. You do not report the employee portion of the Solo 401k contribution on Schedule C.

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

The first seven lines of the back page of the 1040 form are devoted to counting your income.

1040 form 401k line. Unselect the second box and the income will report on the Pensions and Annuities line of the 1040. Subtract the amount on Line 10c total income from Line 9 adjustments. Line 16a reports the total distribution amount and line 16b reports the taxable amount.

Compute taxable and nontaxable income Distinguish between earned and unearned income Report income correctly on Form 1040 Time Required. You take the amount from Schedule 1 of your other income and put that amount on line 8 on your form 1040 when you are doing your taxes. Enter the total amount of the 401k or other qualified plan such as 403b and 457b plan funds transferred to your Solo 401k on line 16a of your 1040.

Individual Income Tax Return. Line 6 calculates line 5 minus line 4. If you made charitable contributions and you take the standard deduction enter the charitable contributions on Line 10b and enter the total adjustments on Line 10c.

Entering Individual Retirement Arrangement IRA deductions on Line 32 of Form 1040 using the 1040 worksheet and Publication 590-A. 30 minutes Income from Form 1040 Lines 1-3 and Schedule 1 Lines 10-11 3. On the 2020 1040 these fields are instead subdivided into line 4a line 4b line 5a and line 5b.

You use the 1040 Line 32 if you are eligible to make a deduction for IRA contributions during the tax year. If filing Schedule A line 17 of Schedule A must have an amount or this line will not calculate the amount from Schedule A line 5. On 1040 form Line 15a has a blank to fill in IRA distributions.

Individual Income Tax Return and it will be used by people who need to file their yearly income tax return. The full amount of your 401k distributionas reported on the 1099-R form would be reported on line 16a for the form 1040. Employer-Provided Dependent Care Benefits - some or all of these benefits may be excludable.

Please amend your tax return. If filing FORM 1040A not FORM 1040. Enter Rollover next to line 16b of your 1040.

If all of the contributions that you made to your 401k plan were on a pre taxbasis then the entire amount you withdrew is taxable so you would enter the same. Lines 3 and 4 are manual entry. Enter on line 4a the distribution from Form 1099-R box 1.

If you have a 401k plan contributions you make for yourself including your employer contribution are deductible on line 28 of your Form 1040 excluding elective Roth deferrals. Filing 401K contributions on form 1040. Enter the taxable amount of the transfer 0 on line 16b of your 1040.

No you shouldnt have entered anything in that field. This part indicates that you also use both lines for a 401k rollover. After filling out this form you will know the amount of your tax for Form 1040 line 58 if you have any special circumstances pertaining to the early withdrawal.

Wages go on line 1 while interest and dividends go on lines 2 and 3 respectively. Corrective distributions of excess salary deferrals or other excess contributions to retirement plans and payments from disability pensions received before youve reached the minimum age for retirement benefits as set by your employer. The taxable portion of the withdrawal is then shown on line 16b.

The form walks you through calculating your AGI and claiming any credits or deductions for which you qualify. Accordingly if the distribution that you received from the 401k plan was fully taxable ex. Objectives Income from Form 1040 Wages Interest etc.

The form is known as a US. There are eight sections to this form. Distributions from a 401k that are reported on a Form 1099-R are reported on Lines 16a and 16b of Form 1040.

The Form 1040 is one of the simplest forms available to accurately and completely file income taxes. Contributions you make for employees are deductible on line 19 of your Schedule C. Other income includes earnings other than wages or income from self-employment retirement income investments foreign income and canceled debts.

It was completely funded with deductible contributions then you would report the distribution amount on line 4d of Form 1040 as noted above. The following types of retirement income should be reported on line 1 of Form 1040 rather than on line 5a. If you are a Partner Solo 401k contributions for yourself are shown on the Schedule K-1 Form 1065 Partners Share of Income Deduction Credits etc you get from the partnership.

Any employer - sponsor retirement contributions are already listed on your W2 box 12. Fill out Form 5329 if you are under the age of 59 ½ years old and received a 401k early withdrawal. The form ends with helping you to determine your refund or how much you owe.

Line 5 is a manual entry. On Line 24 enter any penalties owed if applicable. These benefits are reported on the W-2 in box 10.

Use lines 4a and 4b to report a rollover including a direct rollover from one qualified employers plan to another or to an IRA or SEP. For transfers from an IRA to your Solo 401k. If you need to write a word code andor dollar amount on Form 1040 or 1040-SR to explain an item of income or deduction but dont have enough space to enter the word code andor dollar amount you can put an asterisk next to the applicable line number and put a footnote at the bottom of page 2 of your tax return indicating the line number and the word code andor dollar.

Any taxable portion will be reported on line 1 with the literal DCB. Sole proprietors and partners deduct Solo 401k contributions for themselves on line 28 of Form 1040 US. The Form 1040 is the basic form for filing your federal income taxes.

Add lines 10 through 21 on Schedule 1 and enter the results on Line 8b of Form 1040. Review the 2441 page 2 Part III in view mode for more. Report the employer and employee contribution to the Solo 401k on Schedule 1 line 15 of the IRS tax form 1040.

Important Distinction for Claiming Contributions. These lines need to be used to report distributions from Roth accounts and from Traditional accounts which means Lines 4a and 4b capture both. Lines 2b through 2t are manual entry.

Line 2a is a calculated field from Schedule A line 7 or Form 1040 line 12. Enter the total amount of the. Entering W2 form into Turbo Tax exactly as it appears is the only entry required.

The Form 1040 is used for tax filing purposes.

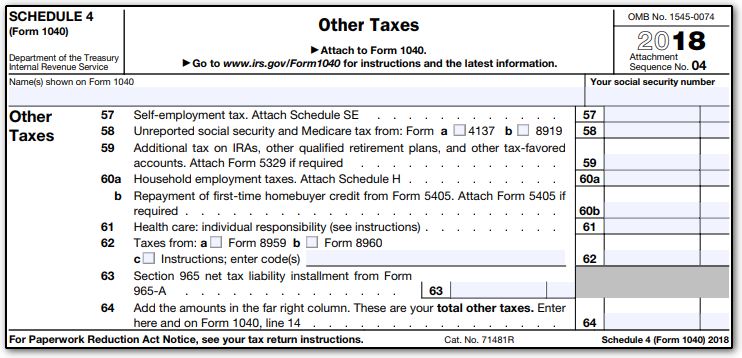

1040 Schedule 4 Drake18 Schedule4 Schedulese

Certificate Of Deposit Certificate Of Deposit Investing Income Investing

How To Fill Out Irs Form 1040 For 2020 Youtube

Instructions For Form 1040 Nr 2020 Internal Revenue Service

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Your Guide To The New 1040 Tax Form The Motley Fool

Happy Tax Day Sounds About Right Lol Tax Quote Cheeky Quotes Quotes

How Much Does The Average American Make Breaking Down The U S Household Income Numbers Income Multiple Streams Of Income Financial Wealth

/ScreenShot2021-02-11at10.43.53AM-9e425788de3d4ad493784be2f13f752d.png)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

Discover Tax Deductions You Don T Have To Be Wealthy For To Claim The Finance Genie Tax Deductions Certified Public Accountant Deduction

How Much Did Your Parent Earn From Working In 2019 Federal Student Aid

Your Guide To The New 1040 Tax Form The Motley Fool

Retirement Account Roadmap An Easy Guide To Setting Up Your Investments Saving For Retirement Retirement Accounts Retirement

Post a Comment

Post a Comment