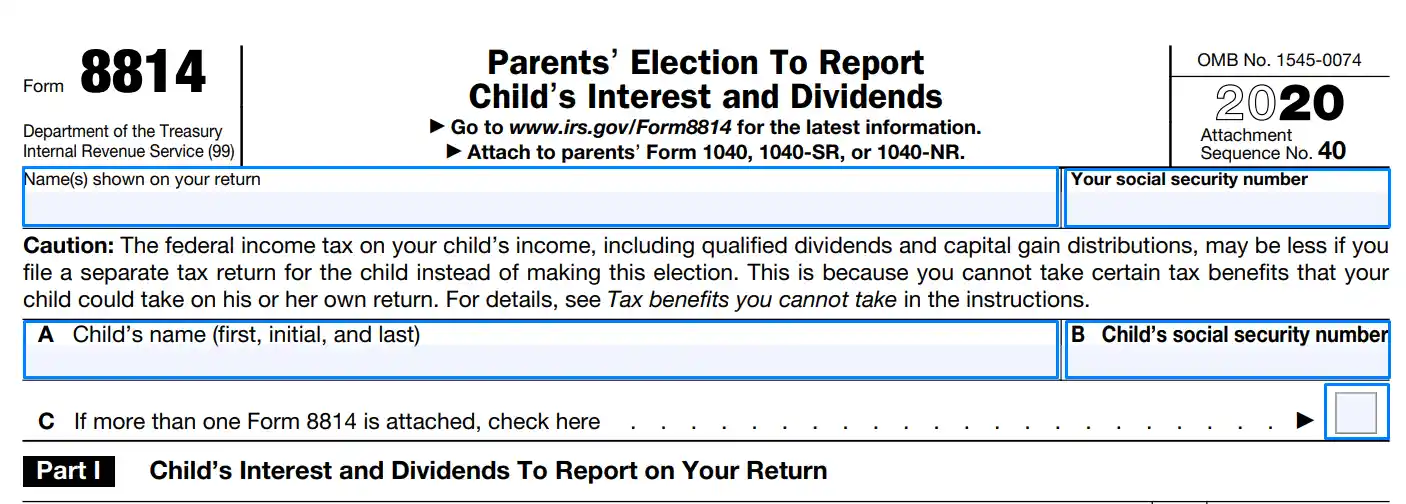

Form 10401040-SR or 1040-NR line 16. To determine if you and your child qualify to use form 8814 see our Knowledgebase Article.

Irs Form 8814 Fill Out Printable Pdf Forms Online

Received a distribution from or was the grantor of or transferor to a foreign trust.

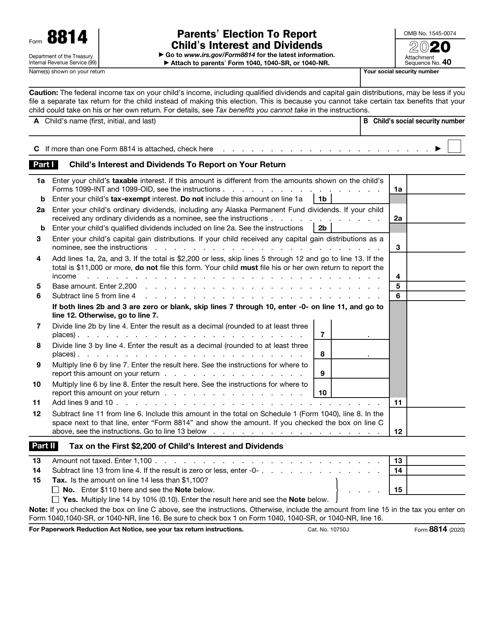

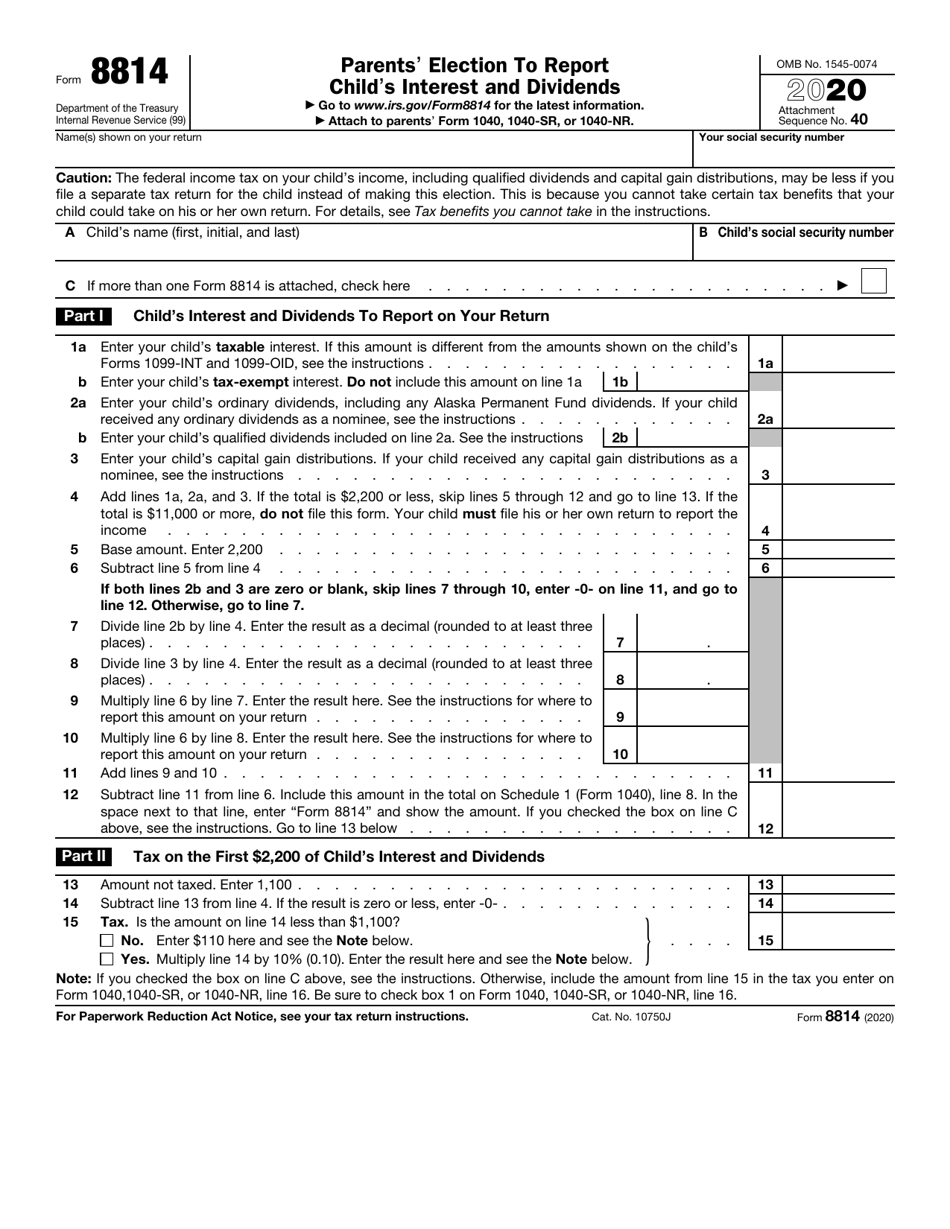

1040 form 8814. Use this form if the parent elects to report their childs income. Be sure to check box a. Enter Form 8814 and this amount on the dotted line next to line 13 of Schedule D or.

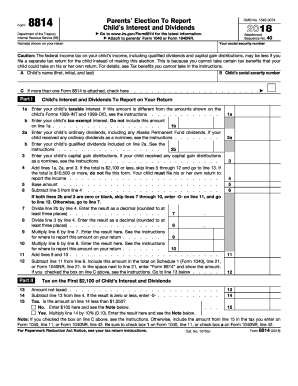

Start a free trial now to save yourself time and money. Figuring child income for Form 8814. Enter Form 8814 and the total of the line 12 amounts on the dotted line next to line 21.

If any of the childs capital gain distributions were reported on. Form 8615 - Attach to the childs Form 1040 or Form 1040-NR Form 8814 - Attach to parents Form 1040 or Form 1040-NR Note that any link in the information above is updated each year automatically and will take you to the most recent version of the document at the time it. Enter the total dividend amount on line 9 of Form 8814 on lines 9a and 9b of the 1040 Form or 10a and 10b of the 1040NR Form.

You qualify to make this election if you file Form 1040 1040-SR or 1040-NR and any of the following apply. Be sure to check box 1 on Form 1040 1040-SR or 1040-NR line 16. Follow our instructions line by line to file Form 1040 on paper or electronically.

To report a childs income the child must meet all of the following conditions. Below you can see the instructions for it line by line to help you do taxes. The most secure digital platform to get legally binding electronically signed documents in just a few seconds.

The following tips can help you complete Form 1040 Form 8814pdf - Form 8814 Department Of The. Or Form 1040NR line 14. You must complete Schedule B Form 1040 Part III and file it with your tax return if your child.

Enter Form 8814 on the dotted line next to line 7a or line 8 whichever applies. If Form 8814 is being filed for a dependent entered in the 1040 screen the childs name is automatically filled out based on the Social Security number selected. 1040 - Form 8814.

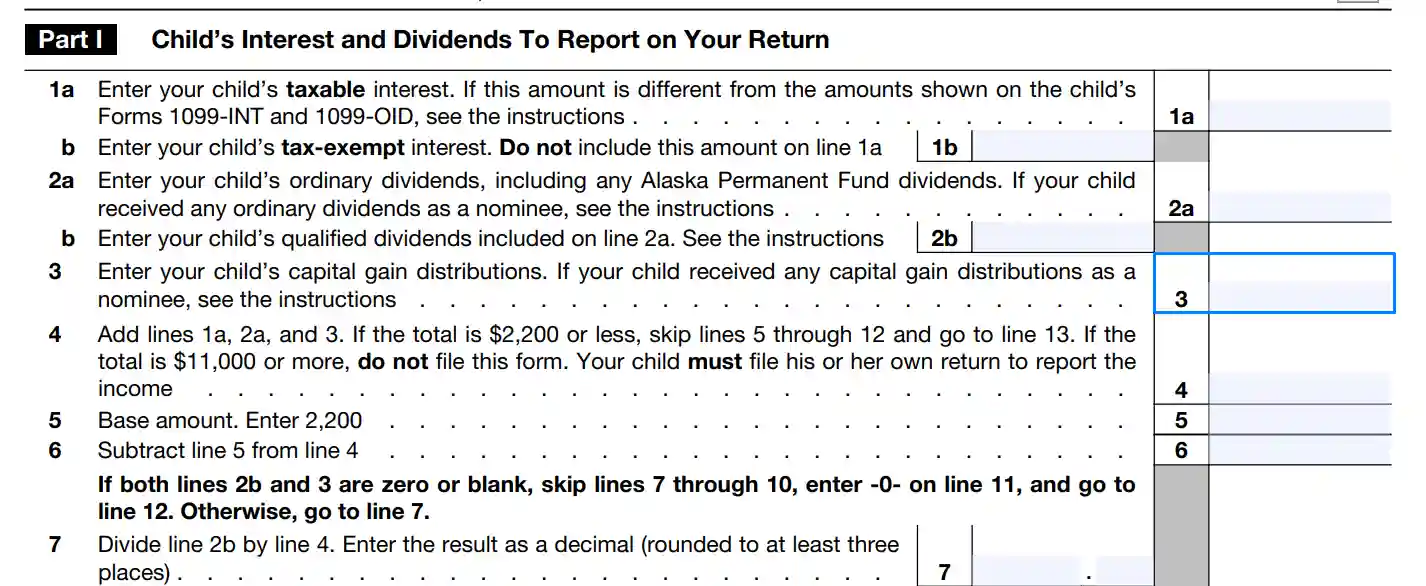

Identify taxation amount for the first 2200 of childs income Put value 1100 in line 13 it is an untaxable part of income. Do not include these dividends on line 12 of Form 8814. Inst 1040 Schedule B Instructions for Schedule B Form 1040 or Form 1040-SR Interest and Ordinary Dividends.

Download or print the 2021 Federal Form 8814 Parents Election To Report Childs Interest and Dividends for FREE from the Federal Internal Revenue Service. If you checked the box on line C add the amounts from line 15 of all your Forms 8814. Be sure to check box 1 on Form 1040 line 11 or check box a on Form 1040NR line 42.

A separate Form 8814 must be filed for each child whose income you choose to report. We last updated Federal Form 8814 in January 2022 from the Federal Internal Revenue Service. Form 1040 line 13.

Parents use Form 8814 to report their childs income on their return so their child will not have to file a return. Why is Form 8814 Parents Election To Report Childs Interest and Dividends not produced. If Form 8814 is being filed for a non-dependent enter the name of the child in this field.

If Form 8814 is being filed for a dependent entered in the 1040 screen the childs name is automatically filled out based on the Social Security number selected. Complete the necessary boxes which are marked in yellow. For Paperwork Reduction Act Notice see your tax return instructions.

If income is reported on a parents return the child doesnt have to file a return. Fill out securely sign print or email your 2019 Form 8814. 2 Months Ago 1040 Individual Generally.

IRS Form 8814 is used for parents to report a dependents unearned income in their income taxes so their child does not have to file a tax. 10750J Form 8814 2018. Open the template in our full-fledged online editing tool by clicking on Get form.

Information about Form 8814 Parents Election to Report Childs Interest and Dividends including recent updates related forms and instructions on how to file. If you choose this election your child may not have to file a return. Drake Tax does not produce Form 8814 if the childs income equals or exceeds the threshold amount for the tax year.

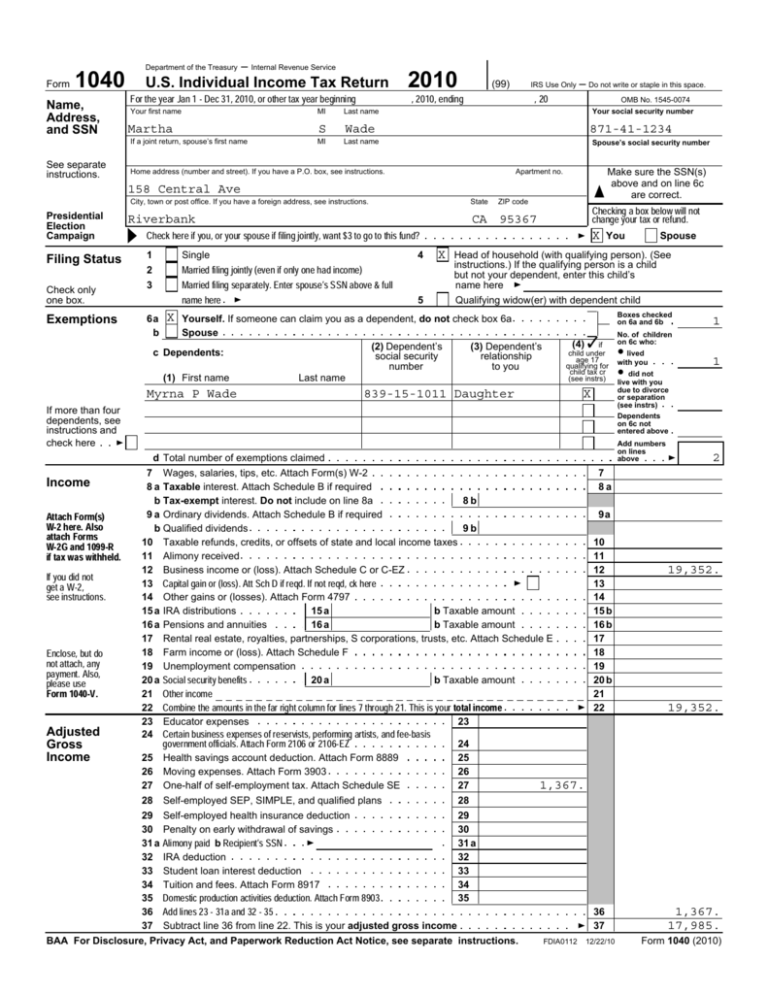

If Form 8814 is being filed for a non-dependent enter the name of the child in this field. Without a doubt Form 1040 is the most complicated IRS tax form that there is. In the space to the left of line 13 of Form 1040 or line 14 of Form.

For Paperwork Reduction Act Notice see your tax return instructions. Instructions for Form 1040 Schedule 8812 Additional Tax Credit Spanish Version 2020. Form 1040 line 11 or Form 1040NR line 42.

This field is mandatory. Click the green arrow with the inscription Next to move on from one field to another. When you are filing several forms 8814 you need to enter numbers from the 12th line of every paper in Form 1040.

Form 8814 - Parents Election to Report Childs Interest and Dividends. Include the total on Form 1040 line 44 or Form 1040NR line 42. Available for PC iOS and Android.

Use Section 1 of Form 8814 to help figure childrens income including both interest and dividends. Parents Election To Report Childs Interest and Dividends instantly with SignNow. Had a foreign financial account or 2.

Instructions below are updated for the 2021 tax season. Form 8814 will be used if you elect to report your childs interestdividend income on your tax return. Form 1040 Line by Line Instructions.

This field is mandatory. Parents who qualify to make the election. This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as.

Inst 1040 Schedule A Instructions for Schedule A Form 1040 or Form 1040-SR Itemized Deductions.

Irs Form 8814 Download Fillable Pdf Or Fill Online Parents Election To Report Child S Interest And Dividends 2020 Templateroller

Publication 929 Tax Rules For Children And Dependents Parent S Election To Report Child S Interest And Dividends

Irs Form 8814 Download Fillable Pdf Or Fill Online Parents Election To Report Child S Interest And Dividends 2020 Templateroller

Publication 17 Your Federal Income Tax Chapter 32 Tax On Investment Income Of Certain Minor Children Parent S Election To Report Child S Interest And Dividends

Form 8814 Fill Online Printable Fillable Blank Pdffiller

Irs Form 8814 Download Fillable Pdf Or Fill Online Parents Election To Report Child S Interest And Dividends 2020 Templateroller

Irs Form 8814 Fill Out Printable Pdf Forms Online

Irs Form 8814 Fill Out Printable Pdf Forms Online

Form 8814 Irs Fill Out And Sign Printable Pdf Template Signnow

Fillable Online 1996 Form 8814 Parent S Election To Report Child S Interest And Dividends Fax Email Print Pdffiller

Form 8814 Parent S Election To Report Child S Interest And Dividends

Form 1040 U S Individual Income Tax Return 2010

Form 1040 Individual Income Tax Return

Post a Comment

Post a Comment