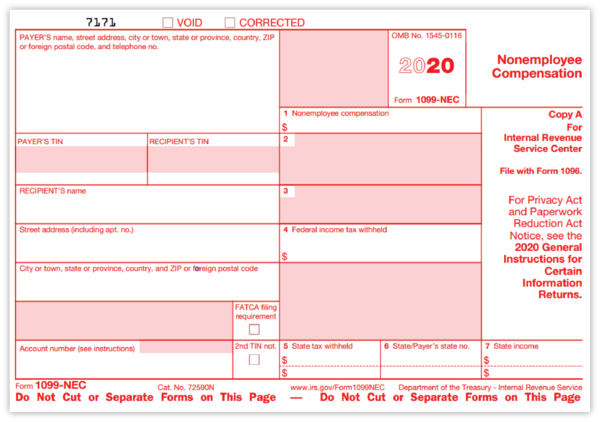

Starting in 2020 the IRS now requires payments to independent contractors are shown on a new form 1099-NEC non-employee compensation instead of the 1099-MISC miscellaneous. This form cannot be downloaded online and must be ordered from the IRS.

What Is The Difference Between A W 2 And 1099 Aps Payroll

If youre an independent contractor and you receive a Form 1099 Copy B from a client you do not need to send it to the IRS.

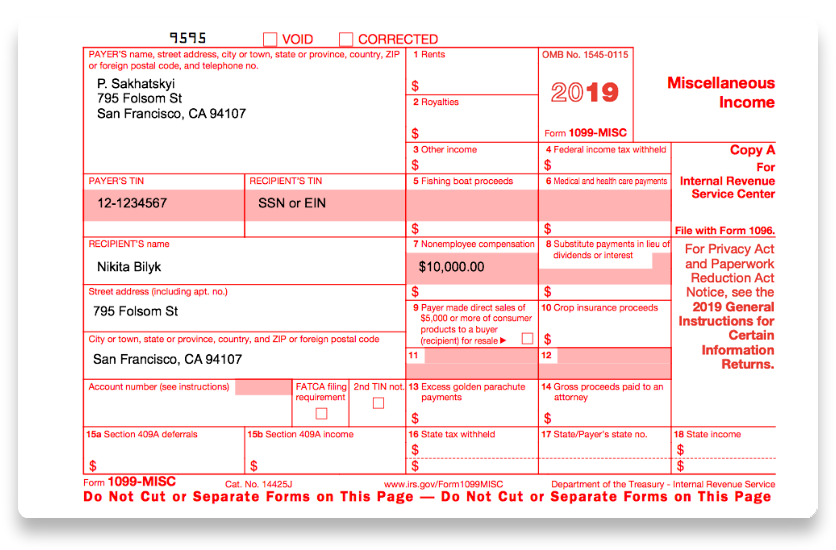

1099 form independent contractor. In a simple context you must file 1099 MISC if you have paid any independent contractor a sum of 600 or more in a year for their services for your business or trade. Report payments made of at least 600 in the course of a trade or business to a person whos not an employee for services Form 1099-NEC. 1099 Form Independent Contractor Printable caniprintmyown1099forms A 1099 form reports certain kinds of income the taxpayer earned over the year.

After generating them the pay stubs can be printed and stored or sent to the necessary parties. You need to remember that the non-employee compensation like payments to such individuals and partnerships are included in it. Usually 1099 independent contractors and W-2 employees are two totally different tax classifications.

1099 Form Independent Contractor Which 1099 form is for independent contractors. You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC. Forms 1099 and W-2 are two separate tax forms for two types of workers.

The answer to this question is almost always 1099 form. An independent contractor 1099 offer letter is between a client employer that hires a contractor to perform a service for payment. Its a new way to report self-employment income taking place of what you would typically report in box 7 of Form 1099-MISC.

See the Instructions for Form 8938. Its used for tracking non-employment income. Independent contractors use a 1099 form and employees use a W-2.

Instead every client that paid you more than 600 is required to send you a 1099 contractor form. After the offer letter is signed an Independent Contractor Agreement should be written between the parties. The IRS has extensive guidance on who must send and receive a 1099.

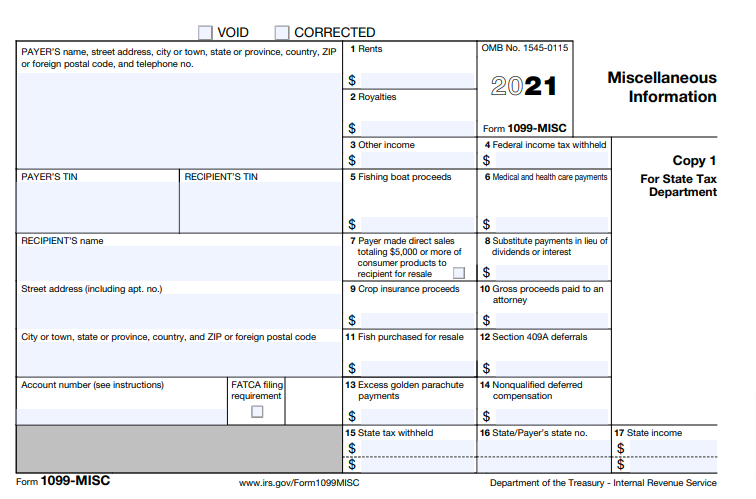

Report payments of 10 or more made in the course of a trade or business in gross royalties or payments of 600 or more made in the course of a trade or business in rents or for other specified purposes Form 1099-MISC. You may simply perform services as a non-employee. As an independent contractor you wont get a W-2 with a tidy list of your income and deductions.

The 1099 miscellaneous form is one of the legal proofs of income for 1099 independent contractors. Shows your total compensation of excess golden parachute payments subject to a 20 excise tax. Contractors are responsible for paying their own payroll taxes and submitting them.

An independent contractor earning 600 or more is eligible for Form 1099-NEC. If you hire an independent contractor you must report what you pay them on Copy A and submit it to the IRS. Form 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the non-employees independent contractor in the course of the trade or business.

The 1099-Misc listed royalties rents and other miscellaneous items but its most common use was for payments to independent contractors. 1099-NEC is the version of Form 1099 you use to tell the Internal Revenue Service whenever youve paid an independent contractor or other self-employed person 600 or more in compensation. As an employer you have fewer tax responsibilities for a 1099 independent contractor than a W-2 employee.

1099-MISC forms go to independent contractors partnerships and other entities with whom you contract for services among others. You must report the same information on Copy B and send it to the contractor. See your tax return instructions for where to report.

On this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code. For W-2 employees all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer. You may also have a filing requirement.

The scope of work should be included in the offer letter along with the rates for providing the service. Thats 600 or more over the course of the entire year. They can be easily generated through several online generators as long as the contractor has the right information to fill in the forms.

If payment for services you provided is listed on Form 1099-NEC Nonemployee Compensation the payer is treating you as a self-employed worker also referred to as an independent contractor. It included all payments made to the contractor even if it was less than 600. Should you give an independent contractor W-2 or 1099 form.

22 rows Form 1099 is one of several IRS tax forms used in the United States to prepare and. If you paid someone who is not your employee such as a subcontractor attorney or accountant 600 or more for services provided during the year a Form 1099-NEC needs to be completed and a copy of 1099-NEC must be provided to the independent contractor by. Form 1099-NEC Introduced by the IRS in 2020 the Form 1099-NEC is for reporting independent contractor income officially termed non-employee compensation.

Clients that paid you less than 600 dont have to send one. Do I need to send 1099 to contractors.

What Is The Difference Between A W 2 And 1099 Aps Payroll

Printable Form 1099 Misc 2021 Insctuctions What Is 1099 Misc Tax Form

Do I Need To File 1099s Deb Evans Tax Company

What Is Form 1099 Misc Income Everyone Is Talking About

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

What Is A 1099 Misc Form Financial Strategy Center

Choosing 1099 Box Types 1099 Nec And 1099 Misc

1099 Misc Form Reporting Requirements Chicago Accounting Company

Form 1099 Nec For Nonemployee Compensation H R Block

Change To 1099 Form For Reporting Non Employee Compensation Ds B

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

Post a Comment

Post a Comment