1099-R and Form 5498. How to complete any Form Instruction 1099-R 5498 online.

5498 Software E File Print And Mail 5498 Forms And Envelopes Data Is Entered Onto Windows That Resemble Th Irs Forms Fillable Forms Letter Template Word

Place an electronic digital unique in your Form Instruction 1099-R 5498 by using Sign Device.

1099-r form 5498. Receiving Form 1099-R. Form 1099-R is used to report designated distributions from retirement plans annuities IRAs and other sources. But when I put 7000 into field for.

The form is used to report distributions from annuities retirement plans profit-sharing plans IRAs insurance contracts andor pensions. Very carefully confirm the content of the form as well as grammar along with punctuational. In addition to reporting retirement plans 1099-Rs are used to report other sources of.

Taxpayer identification numbers. Keep Form 5498 with your records for future reference when you need to determine the end of year value or your non-deductible investment basis of your IRA accounts. DRAFT 2022 Instructions for Forms 1099-R and 5498.

If you received a distribution of 10 or more from your retirement plan then you should receive a copy of Form 1099-R or some variation. Thanks to this communitys swift assistance I was able to figure out how to do this. On November 1 2021 the IRS published DRAFT 2022 Instructions for Forms 1099-R and 5498 Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc.

Only if federal income tax is withheld in box 4 of Form 1099-R is Copy B of Form 1099-R attached to Form 1040. Form 5498 Vs 1099-R Roth Ira A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. Instructions for Forms 1099-R and 5498 Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc and IRA Contribution Information Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code.

Forms 1099-R and 5498 do not report income obtained through an IRA such as interest and dividends. Form 1099-R is filed for anyone who has received a distribution of 10 or more from the mentioned items. In 2018 I took a distribution from one institution to put into a different one with whom my financial advisor works.

I am over 65. Stick to the fast guide to do Form Instruction 1099-R 5498 steer clear of blunders along with furnish it in a timely manner. Only the 1099-R needs to be reported on your tax return.

Forms 1099-MISC 5498 and 1099-R. The IRS has released the 2021 versions of Forms 1099-R and 5498 their combined instructions and the general instructions that explain how to file these and various other IRS forms. Form 1099-R Statements to recipients.

Corrected and void. One key update is that as of January 1 2022 payments made from qualified plans to state. An IRS Form 5498 will be generated for an incoming rollover.

Most public and private pension plans use the standard 1099-R Tax Form. The IRA owns shares in a company also referred to as protocol shares It works like a standard IRA only it holds bullion bars or. 2021 IRS 1099-R Form Instructions.

Recipients Form 1099-R and participants Form 5498 Who must file nomineemiddleman. So if the funds came out of your mothers IRA and were rolled over to an IRA in your fathers name then the same amounts should be on both forms. IRS 1099-R Form is the version of Form 1099 that is used to report distributions from pensions annuities retirement or profit-sharing plans IRAs charitable gift annuities and insurance contracts.

After the form is fully gone media Completed. This form reports how much you withdrew how much of the distribution was taxable and how much if any was withheld for federal and state taxes. A transfer of a qualified plan type between different plan types ie 401k to IRA TSA to IRA.

In the United States Form 1099-R is a variant of Form 1099 used for reporting on distributions from pensions annuities retirement or profit sharing plans IRAs charitable gift annuities and Insurance Contracts. No IRS Form 5498 or IRS Form 1099-R is generated. Filers of Forms 1099-R and 5498 must show the Penalties.

Form 1099-R is filed for each person who has received a distribution of 10 or more from any of the above. You dont need to enter information from your Form 5498 IRA Contribution Information into TurboTax. Therefore on April 2 I contributed 7000 to my Roth for 2019.

When it comes to IRAs Form 1099-R is used to report IRA withdrawals whereas Form 5498 is used to report IRA contributions. Forms 1099-R and 5498 and their instructions such as legislation enacted after they were published go to IRSgov Form1099R or IRSgovForm5498. Navigate to Support area when you have questions or perhaps handle our Assistance team.

The internal revenue service has announced the 2020 versions of 1099-r forms and 5498 and their. Form 5498 Vs 1099-R Roth Ira Overview. Payments from qualified plans to state unclaimed property funds under escheat laws must be reported on Form 1099-R.

Form 1099-R is issued by the IRS and is part of a series of forms called information returns. January 2022 is now a continuous use form and includes updates such as new checkbox 12 for FATCA Filing Requirement and a renumbering of subsequent boxes. Section 113 of the Setting Every Community Up for Retirement Enhancement Act of 2019 SECURE Act which is.

When and where to file. Forms 1099-R and 5498 and their instructions such as legislation enacted after they were published go to IRSgovForm1099R or IRSgovForm5498. Whats New Form 1099-R Distributions for qualified birth and adoption.

See Plan Escheatment later. Complete identifying number on all copies of the forms. On the site with all the document click on Begin immediately along with complete for the editor.

If you took a distribution of more than 10 from your IRA during the year your plan custodian will also send you a Form 1099-R. A 1099-R reports a distribution and a 5498 reports an IRA contribution or rollover to an IRA. On December 10 2021 the IRS published a few Forms 1099 of note.

February 20 2020 The IRS posted a final version of the 2020 Instructions for Forms 1099-R and 5498 on February 19 2020. My schedule C income was over 10000 with over 500 in W2 income so my total earned income was way higher than 7000. Included in the final version of the instructions includes the following reporting requirements for IRA providers as it relates to Qualified Birth and Adoptions Distributions and the repayment of such distributions.

1099-R and Form 5498. 1099-R and 5498 forms--can someone advise. The new Form 1099-MISC Rev.

Whats New Escheat to state. An IRS Form 1099-R. The permitted Roth contribution for 2019 is 7000 if you are over 65.

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Form 1099 R Instructions Information Community Tax

Reporting Contributions On Forms 5498 And 5498 Sa Ascensus

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

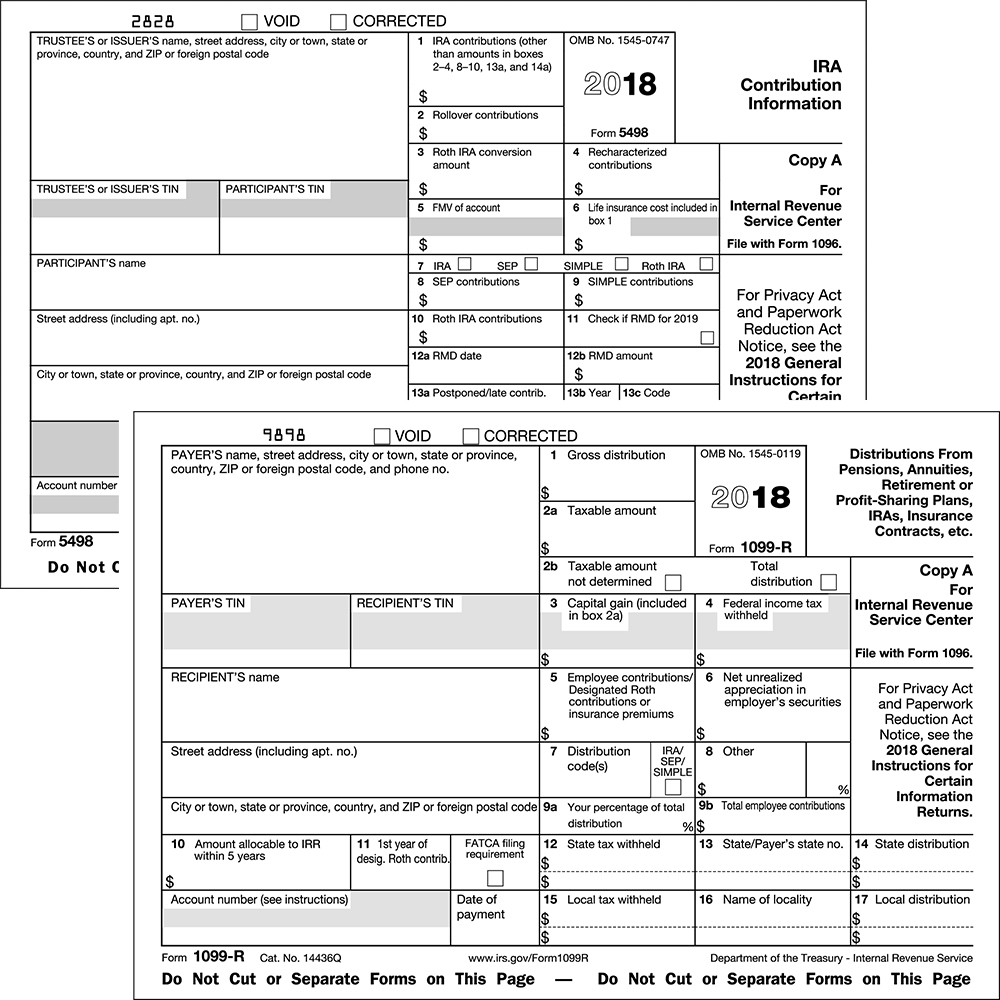

2018 Forms 5498 1099 R Come With A Few New Requirements Ascensus

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Tax Forms

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

American Equity S Tax Form 1099 R For Annuity Distribution

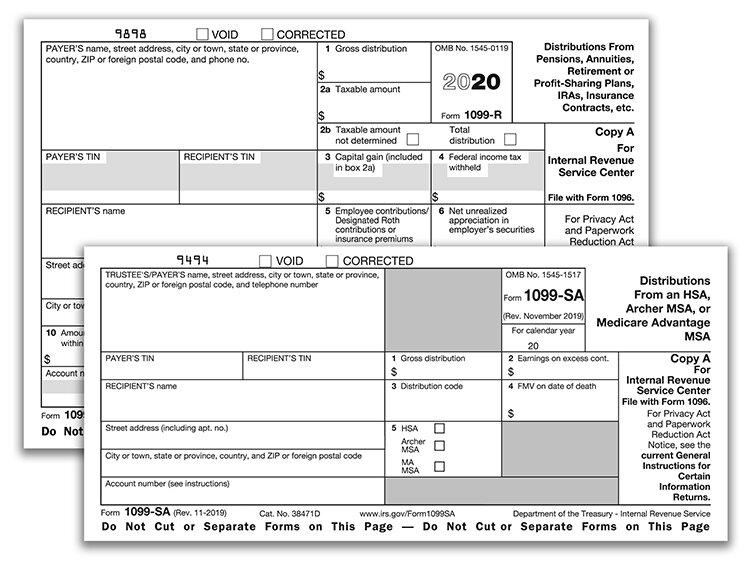

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Due Dates For Your W 2 1099 Other Tax Forms In 2018 And What To Do If They Re Missing Tax Forms Student Loan Interest Finance Saving

What Is A 1099 5498 Udirect Ira Services Llc

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

B98msfd05 Form 5498 Sa Hsa Archer Msa Or Medicare Advantage Msa Information Copy A Federal Nelcosolutions Com

Post a Comment

Post a Comment