As partly taxable on lines 5a and b. Report on Form 1099-R not Form W-2 income tax withholding and.

Irs Form 1099 R Which Distribution Code Goes In Box 7 Ascensus

On the 1099R block 7 what is code 7.

Form 1099-r code 3 in box 7. If the client meets an exception to the early withdrawal penalty but code 1 early distribution no known exception is shown in Box 7 of Form 1099-R then add Form 5329 to the tax return. Does the code 3 on 1099-r mean that the distribut. However the payer has reported your complete TIN to the IRS.

When entering the Distribution Code in Box 7 if the Code is a 3 the 10 Additional Tax for Early Withdrawal does not apply and no further action is necessary upon exiting this 1099-R menu. One of the most difficult aspects of reporting IRA and qualified retirement plan QRP distributions is determining the proper distribution codes to enter in Box 7 Distribution codes on IRS Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. This code is in scope only if taxable amount has been determined.

Because the distribution is from a pension plan or IRA the. And unfortunately retirees do have their medical insurance paid with pre-tax monies. A for a normal distribution from a plan including.

Within the program if your loan is treated as a deemed distribution please enter in box 7 Code L plus Code 1 or Code B whichever is applicable. However when the Distribution Code in Box 7 is a 1 or 2 the program prompts the user to select a Form 5329 Transfer Option. Form 1099-R Box 7 Distribution Codes continued Box 7 Distribution Codes Explanations A May be eligible for 10-year tax option This code is Out of Scope.

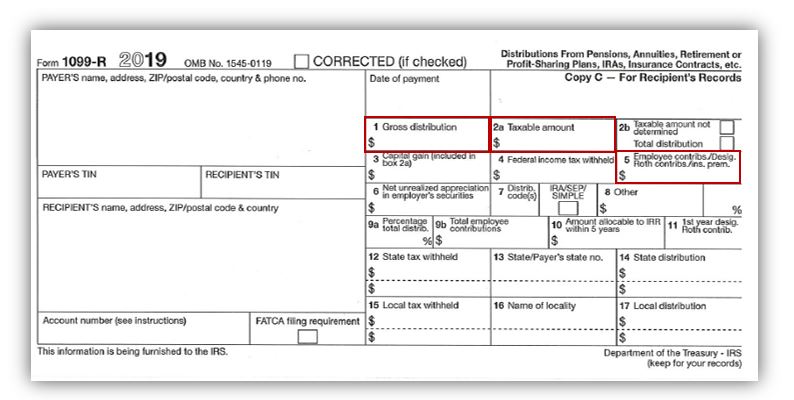

Since these distributions are taxed as wages until you reach the minimum retirement age and reported on line 7 of the 1040 this would be considered earned income and if that total is above 5500 or 6500 if over 50 you could fund. Other than zero attach Copy B of your Form 1099-R to your federal income tax return. The 3 in box 7 tells the IRS that this pension is being paid due to disability so that you will not be penalized for receiving it before minimum retirement age.

For example Code 6 is a 1035 tax-free transfer and Code 7 is a normal distribution. In Part 1 select the client who received the distribution if MFJ. In box 7 enter L1 or LB whichever is applicable to your situation.

Consider the following common IRA and QRP distribution. Code 3 may be used with code D. Use Code 1 even if the distribution is made for medical expenses health insurance premiums qualified higher education expenses a first-time home purchase or a qualified.

Would be non taxable to a disabled person. Recipients taxpayer identification number TIN. Do not combine with any other codes.

1099-R Codes for Box 7. Jane has met the minimum retirement age and received a Form 1099-R with code 3 in box 7. Find the explanation for box 7 codes here.

The federal codes in Box 7 of Form 1099-R may help indicate the taxability of a distribution. Qualified disability income reported on Form 1099-R with a Distribution Code 3 in Box 7 is reported as earned income wages on Form 1040 until the minimum retirement age is met. D Annuity payments.

1099-R with code 3 in box 7 for a disability pension at an age younger than the minimum work retirement age. Your loan is taxable code L will be shown in box 7. Select Other Taxes then select Begin next to Tax on Early Distribution.

1 Early distribution no known exception 2 Early distribution exception applies 3 Disability 4 Death 5 Prohibited transaction 6 Section 1035 exchange 7 Normal distribution. Click Retirement Plan Income in the Federal Quick Q. Income Select My Forms IRAPension 1099-R 1099-RRB.

1 Early distribution no known exception in most cases under age 59-12. How will Jane report the disability income on her Form 1040. Box 7 Codes.

Financial organizations may ask IRA owners for a copy of the signed Physicians Statement or an equivalent statement signed by a physician before using code 3. Use Code 1 only if the solo 401k participant was not age 59 12 or older at time of the distribution AND codes 23 and 4 do not apply. As fully taxable on.

Use Code 1 only if the employeetaxpayer has not reached age 59 12 and you do not know if any of the exceptions under Code 2 3 or 4 apply. B Designated Roth account distribution Code B is for a distribution from a designated Roth account. See Form 5329 For a rollover to a traditional IRA of the entire taxable part of the distribution do not file Form 5329.

As fully taxable on line 7. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Add or Edit Form 1099-R.

The Schedule R instructions include a Physicians Statement that may be used to verify that the individual is permanently and totally disabled. See the instructions for Form 1040. Defines how the money that has been taken out is reported to the IRS.

Governmental section 457b plans. Code G is used for rollovers from one institution to another that are tax-free. Code 1 or 2 Early Distribution is generally taxable for Pennsylvania purposes unless it was an eligible plan and you retired after meeting the plan age requirement or years of service requirement.

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Click Quick Entry or Step-by-Step Guidance to enter or review the. Review the software entries in the Volunteer Resource Guide Tab D Form 1099-R Rollovers and Disability Under Minimum Retirement Age.

If you take a retirement distribution because of disability the distribution is taxed as wages until you reach the minimum retirement age. For your protection this form may show only the last four digits of your TIN SSN ITIN ATIN or EIN. Clients 1099-R will show 2 3 or 4 in Box 7.

Here are the various codes listed in box 7 of Form 1099-R. Heres a handy list of codes. 2020 1099-R Box 7 Distribution Codes.

This is an identifier the IRS uses to help determine if the transaction is taxable. No box 7 code 3 does not mean it is a non taxable distribution. Box 7 of Form 1099-R shows the distribution code for the transaction.

Code 7 in box 7 on Form 1099-R means normal distribution for a retirement account.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

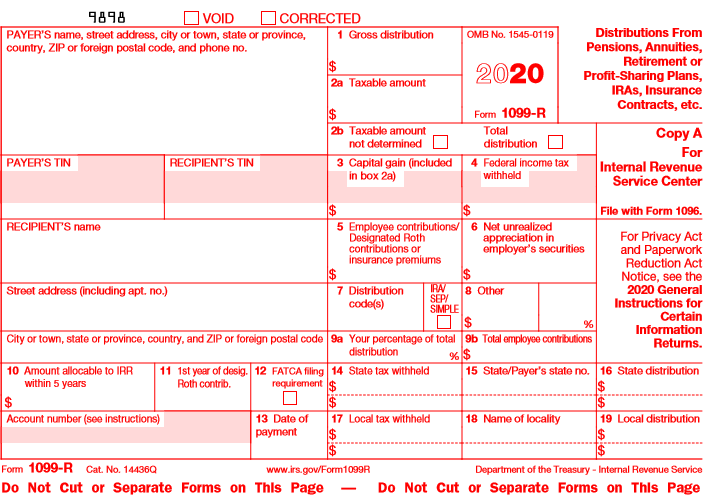

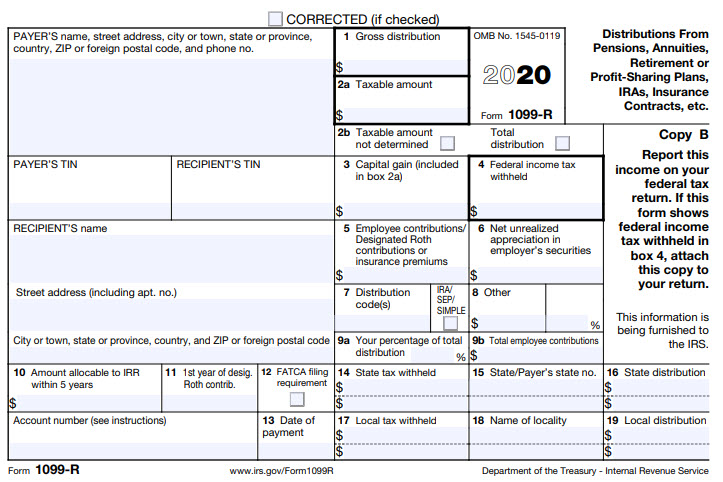

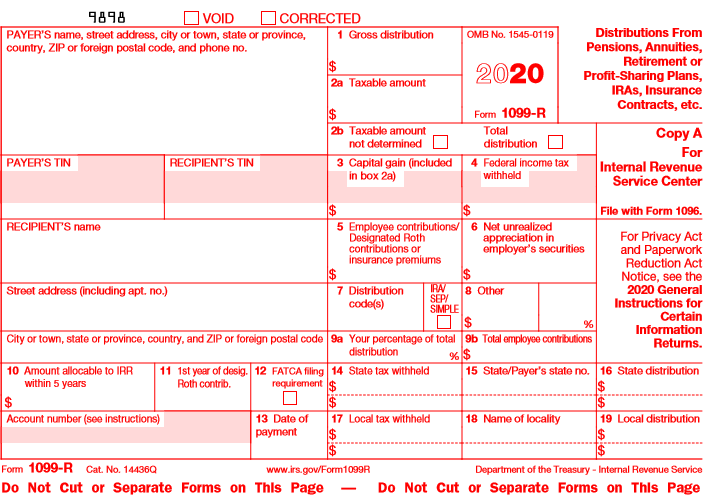

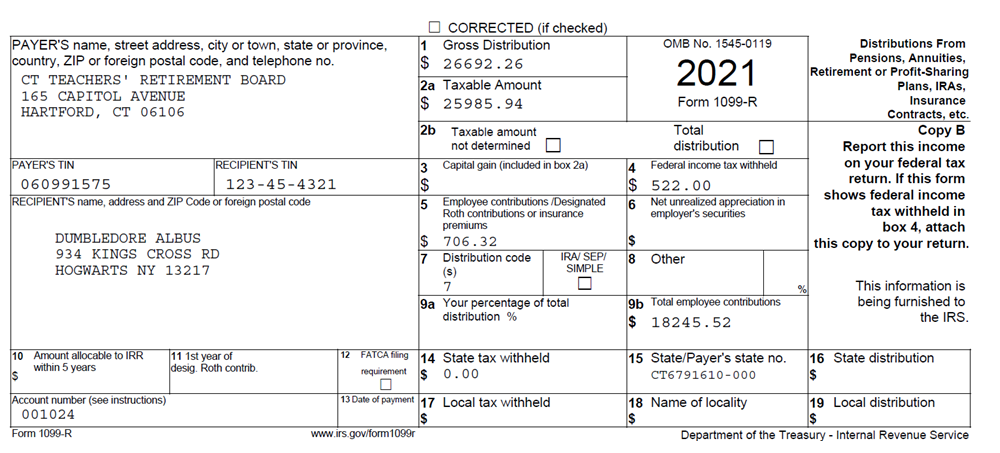

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Eagle Life Tax Form 1099 R For Annuity Distribution

1099 R 2020 Public Documents 1099 Pro Wiki

Irs Courseware Link Learn Taxes

Understanding Your 1099 R Form Kcpsrs

Tax Form Focus Irs Form 1099 R Strata Trust Company

Form 1099 R Instructions Information Community Tax

Form 1099 R Distribution Codes For Defined Contribution Plans Dwc

Understanding Your 2018 1099 R Kcpsrs

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Post a Comment

Post a Comment