Click on the Sign icon and create a signature. Experience a faster way to fill out and sign forms on the web.

New Updates To Form 1099 Nec For The 2021 22 Tax Year Tax1099

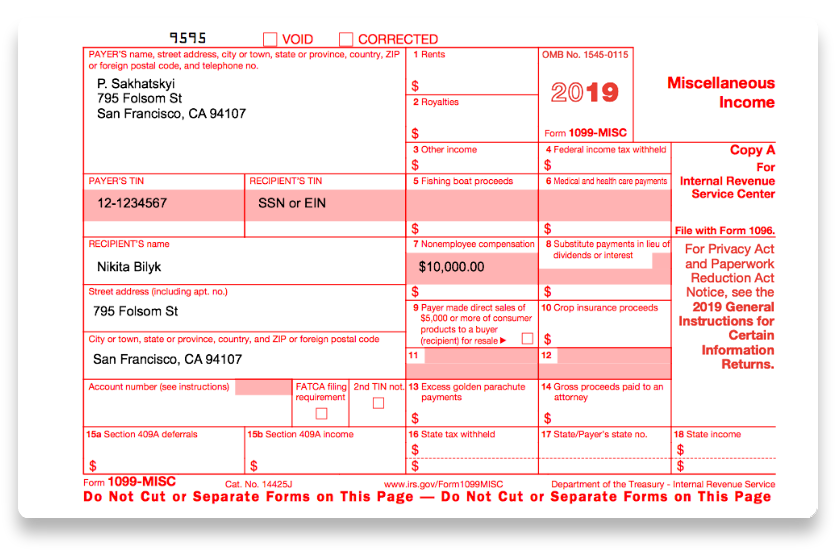

Copy A is sent to the Revenue Service.

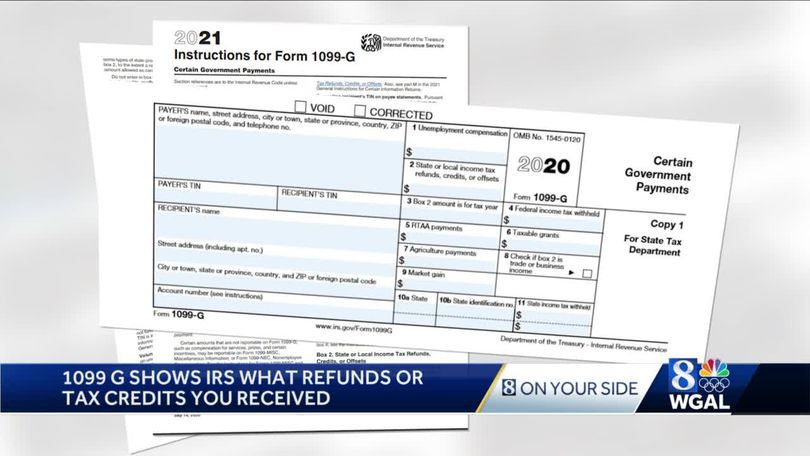

How to fill out 1099 g form. When filing form 1099 2021 for the return you should include the number from Box 1 on your 1040 1040A or 1040EZ. Scroll down to All Income and select Unemployment. There are seven unnumbered boxes on the left side of the 1099.

Box 2- State Refunds Box 3- indicates tax year This information is provided to you by your state. Use Get Form or simply click on the template preview to open it in the editor. Depending on what box you have an entry in on your 1099-G depends on where you report it in the program.

You can request a TCC by filling out Form 4419 and then mailing or faxing it to the IRS. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Box 1- Unemployment Compensation.

Fill out securely sign print or email your 2012 1099 g form instantly with signNow. Input your information aka payers information Add in the recipients information. This form must be.

Ensure that the information you fill in 1099 G is updated and correct. Fill in all necessary fields in the selected doc making use of our powerful PDF editor. Specific Instructions for Form 1099-MISC File Form 1099-MISC Miscellaneous Income for each.

Also you can create PDF forms and share them via email Dropbox or Google Drive. To report unemployment compensation. For more information about filling out Form 1099-MISC check out the IRSs Form 1099-MISC Instructions.

That means you need to know how to fill out 1099 for contractor by the deadline. Click on the orange Get Form option to start editing. Switch the Wizard Tool on to finish the process even easier.

Proceed through the screens and enter the information as prompted. Among the numerous tax forms the IRS will be expecting you to fill out a 1099-MISC form in two casesyou made payments to freelancers or independent contractors for business-related services totaling at least 600 within the yearor you paid minimum 10 in royalties or broker payments in lieu of dividends or tax-exempt interestHowever if you made any payments for. From now on easily cope with it from your apartment or at your place of work from your mobile device or desktop computer.

The way to complete the IRS 1099-G online. For further information see the instructions later for box 2 Form 1099-NEC or box 7 Form 1099-MISC. This includes local state and federal governments.

Create an account with TaxBandits. Enter your 1099G in FederalWages IncomeUnemployment. Use the Cross or Check marks in the top toolbar to select your answers in.

Copy 1 gets the state tax department. Enter the required Form 1099-S details. Section 6071c requires you to file Form 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures.

Filling out 1099 Form Maryland does not need to be perplexing any longer. Before using FIRE you need a Transmitter Control Code TCC. Form 1099-NEC box 2.

These boxes ask for information about the payer thats you and recipient thats the contractor you paid during the year. Copy B and Copy 2 is got by you the taxpayer Copy C is obtained by the payer or filing agency. Just follow these steps.

That you have been using to certify for weekly benefits to get your 1099G from the states site. Fill in the totals in the applicable boxes. This form will be filed by various government agencies if they have made certain payments during the tax year.

To fill out Form 1099-MISC follow the steps below. Start a free trial now to. It will be used for tax filing purposes and is issued by the Internal Revenue Service.

Reap the benefits of a digital solution to create edit and sign documents in PDF or Word format on the web. It allows you to fill interactive forms by adding texts deleting texts copy texts and images and add links where possible. Start completing the fillable fields and carefully type in required information.

Information put and request legally-binding electronic signatures. Or you might need to go to your states unemployment website and use the password etc. Get the job done from any gadget and share docs by email or fax.

Available for PC iOS and Android. If you received a state or local income tax refund for 2012 and you reside in Conn Mo NJ NY. If you did not receive a Form 1099-G check with the government agency that made the payments to you.

Follow these tips to quickly and correctly complete IRS 1099-G. Select or add the business you are filing for. Fill out each fillable field.

This form must be produced with the help of compatible accounting software. Available for PC iOS and Android. Activate the Wizard mode on the top toolbar to get extra pieces of advice.

Quick steps to complete and e-sign Form 1099 g ny online. Fill out securely sign print or email your 2013 1099 g form instantly with signNow. Thankfully Form 1099-NEC is a short form.

The most secure digital platform to get legally binding electronically signed documents in just a few seconds. The amount was withheld also should be there Box 4. File Form 1099-MISC by March 1 2021 if you file on paper or March 31 2021 if you file electronically.

When you see the screen that says Lets get the details from your 1099-G. The document consists of 5 copies each of which is sent to different departments or recipients. Payers may use either box 2 on Form 1099-NEC or box 7 on Form 1099-MISC to report any sales totaling 5000 or more of consumer products for resale on buy-sell deposit-commission or any other basis.

IRS form 1099 for unemployment Unemployment income from a government is subject to taxes as well. Or Penn your Form 1099-G may be available to you only in an electronic format. E-filing Form 1099-S with TaxBandits Once you have all the necessary information at your fingertips e-filing 1099-S with TaxBandits is simple and straightforward.

Start a free trial now to. A Form 1099-G is also known as a Certain Government Payments form. Select Unemployment and paid family leave.

Click on the button Get Form to open it and start editing. Transform them into templates for multiple use insert fillable fields to collect recipients. You can e-file Copy A of Form 1099-NEC through the IRS Filing a Return Electronically FIRE system.

Include the date to the sample with the Date feature. The total you received should be shown in Box 1. Review and submit Form 1099-S to the IRS.

Access the most extensive library of templates available. Wondershare PDFelement - PDF Editor is the best form of filler that is suitable to fill 1099 r Form 2022.

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

How To Fill Out 1099 Misc Irs Red Forms

I Am Filling Out The Information For My 1099 G Form Is Payer Name My Name Is The Address My Current Address Or The Address When I Collected Unemployment

Printable Form 1099 Misc 2021 Insctuctions What Is 1099 Misc Tax Form

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

1099 G Form Copy B Recipient Discount Tax Forms

Understanding 1099 Form Samples

Form 1099 Misc Requirements Deadlines And Penalties Efile360

How To Fill Out A Pdf Form On Mac Fill In Pdf Forms On Mac

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

All You Need To Know About The 1099 Form 2021 2022

1099 Form Fileunemployment Org

1099 G Tax Form Why It S Important

Post a Comment

Post a Comment