You will need to provide your name address Social Security number the name of the employer and an estimate of the wages you earned. Scroll down and click on Add a State.

When Should You Amend Your Tax Return The Turbotax Blog

Your W-2 is lost in the mail.

My w2 form got lost in the mail. This will take you back to the 2019 online tax return. As day turned. The quickest way to replace your lost W-2 is to contact your employer and request a copy.

I spoke with her on the phone and she said I mailed it to my old address and it never came back to me so it is between you and the post office What should I do. You may need to correct your tax return if you get your missing W-2 after you file. The first thing you need to do is go to our website and submit your request to replace your lost W2 by filling out all of the relevant details including a valid email address.

This method is often the easiest and quickest way to get a copy of a W-2 if you cant download a copy. Make sure they have your correct address. If you lost misplaced or never received your W-2 form ask your employer for a copy.

2018 osha form 300a printable. How you chose to pay the taxes owed will be on the Federal Filing Instructions page included with your tax return. From address errors to address changes mix-ups at the Post Office and more a host of issues can get between you and your tax documents.

If you dont receive the copy by the deadline to file your tax return complete IRS Form 4852. One for Brent Laidlaw and another for his Brents brother Jarold. And a W2Tax stuff if you were self employed.

They might have mailed the form but it got lost in the mail or went to the wrong address. Whether your W2 was lost in the mail or you accidentally threw it away its always possible to recover your information and file. Javier Morgan is a CPA who prepares between 215 and 250 returns annually.

I moved last year and a former employer mailed my w2 to my previous address. Make sure you file your request by midnight on April 15. In most cases you wont have to do anything except check your mail.

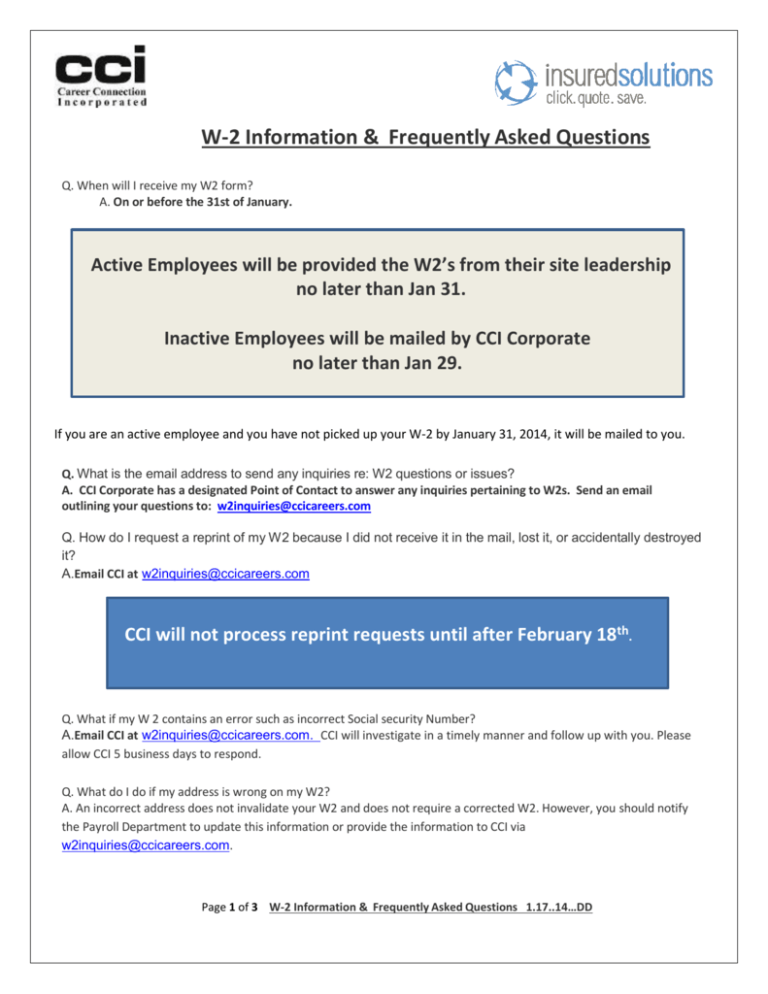

You can call the. Your employer has until the end of January to provide you with your W-2 so dont worry about not receiving yours until at least the end of the month. You should also contact your employer to give you aW-2 or to substitute that which you missed.

Contact human resources or the person in charge of payroll for the company to send you a copy of your W-2 form. Thats because employers are required to send W-2s to all employees by the end of January. Individual Income Tax Return.

2017 Irs Tax Tables For 1040. Unless your employer made the w-2 available on a company website or third party on. And now im reading all this stuff about sending in a couple years worth.

If your W2 is lost missing or maybe you havent received it yet what should you do. My parents also said that I shouldnt file another tax return in case the first one does go through. If you never received your W2 form and now have concerns that it was lost in the mail wait to ask for a copy.

Go directly to the payroll office as most managers will not be able to assit you or know how this is done. You can also mail Form 4868 Application for Automatic Extension of Time to File US. W-2s can get lost in the mail and sometimes they are misplaced by the taxpayer after receiving them.

Federal law says that your employer has until the end of January to mail your W-2 to you. Replacing your lost W2 tax form with us is extremely easy and intuitive so anyone can do it. Contact the IRS at 800-829-1040 if you do not receive the replacement W-2 form.

If youve lost your W2 dont despair. If you do not obtain a response by February 14 the IRS will notify you to call. Theres one problem.

I was planning on sending him my W2 once i got it this month just to have supporting evidence and to be on the safe sideunfortunatly it didnt come until after i sent him my I-134 package with all my work in it. Even if your employer has gone out of business you as an individual taxpayer are required to wait at least until February 15th to contact the IRS and ask for permission to file without a W-2. If the company does not have an HR department call your former manager.

I even filed a lost mail request at. The problem is that they want you to attach your W2 to your tax return and the other one says its a copy for your own use so Im not sure if I can use that copy. Businesses by law have to mail or make W-2 forms available.

Offer to pick up your W-2 in person to save time. Should I contact the USPS or the IRS about this. Keep in mind that the forms only have to be in the mail by the end of January.

2017 1040 tax table. You can file the modified return if you get aW-2 after the tax deadline. The original W-2 may have been returned to the employer or lost in the mail because of an invalid or incomplete address.

If your employer fails to produce a copy call the IRS at 800-829-1040 and a staff member will contact your employer on your behalf to request your W-2. Theoretically your tax forms should have come in the mail by January 30 th but things happen. These Are The States That Will Not Mail You Form 1099.

Our licensed tax professionals have helped thousands of clients file their returns correct mistakes and prepare for their financial future. As soon as we get our hands on your lost W2 form we will send it directly to your inbox. The estimated arrival date was March 24th.

However this doesnt always happen. Thank youJK Optional Information. Among those returns are two Forms 1040.

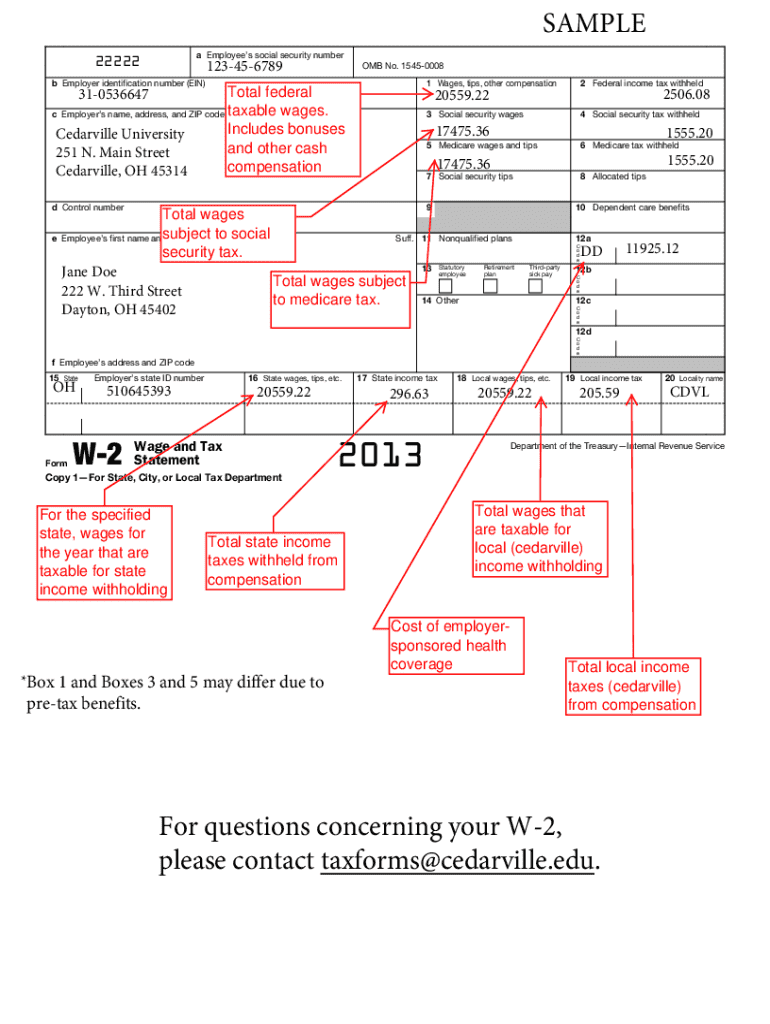

How To Read Your W 2 Justworks Help Center

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Internal Revenue Service Irs How Do You Attach A W2 Form To Your Tax Return Quora

How To Read Your W 2 Justworks Help Center

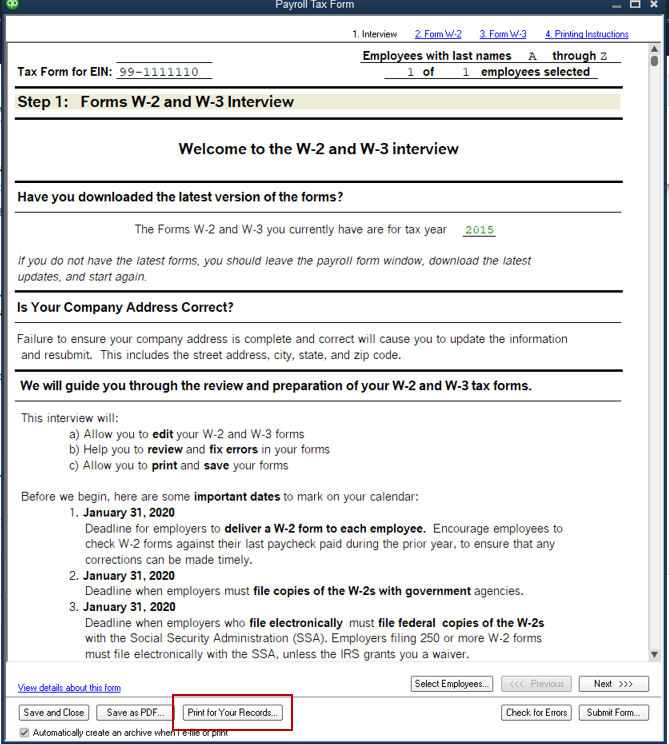

I Need To Reprint Last Years W 2 S Where Are My Old W 2 S Kept

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

Useful Vocabulary And Writing Skills For Job Application Cover Letter Close Activity Fo Job Application Cover Letter Application Cover Letter Job Cover Letter

How To Find Your W2 Form Online Finding Yourself W2 Forms Online

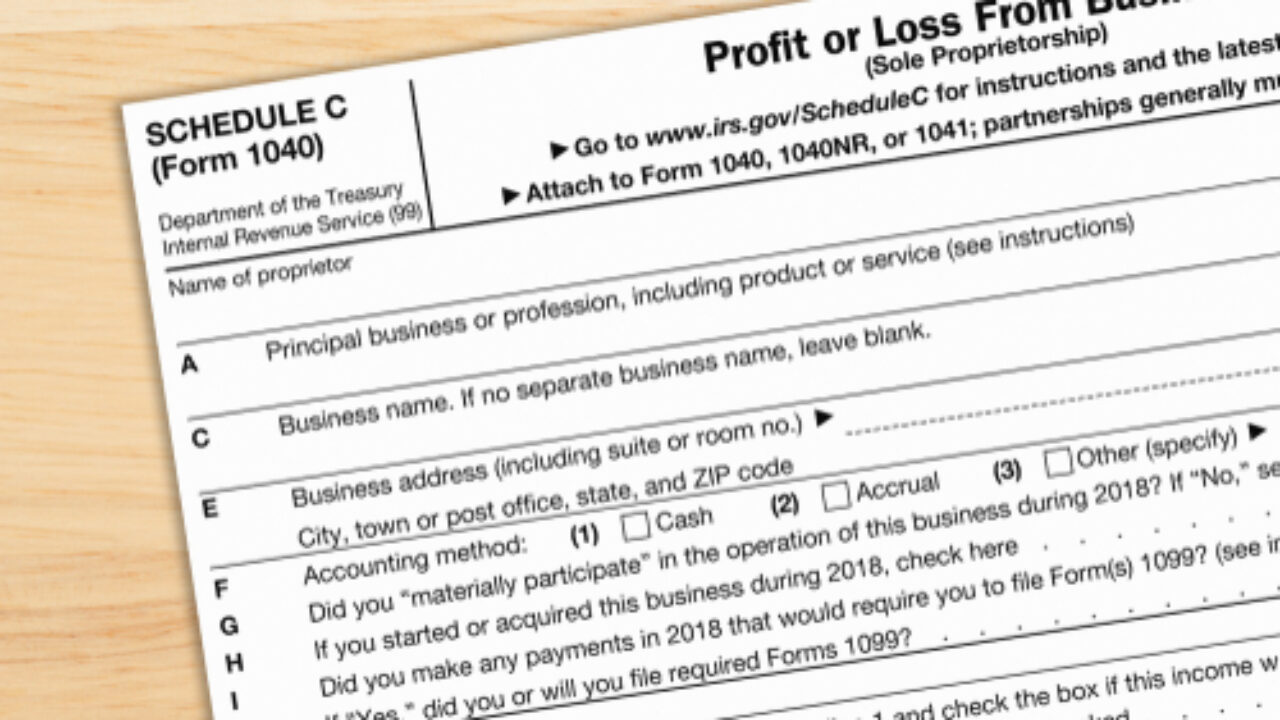

Filing A Schedule C For An Llc H R Block

What To Do If You Haven T Received A W 2 Turbotax Tax Tips Videos

Circle K W2 Fill Online Printable Fillable Blank Pdffiller

Post a Comment

Post a Comment