1-2003 Part I Part II Business name if different from above Cat. In case you have your own business or work as an independent contractor or a freelancer then you are required to fill out and submit a W-9 form.

Ultimate Questrade Review 2022 50 10 000 Questrade Offer Code

10231X Check appropriate box.

Questrade w 9 form. Ad We Checked All the Forex Brokers. Form W-9 should be reviewed and updated yearly. The W-9 is an official form furnished by the IRS for employers or other entities to verify the name address and tax identification number of an individual receiving income.

October 2021 Department of the Treasury Internal Revenue Service Certificate of Foreign Status of Beneficial Owner for United. Generally only a nonresident alien individual may use the terms of a tax treaty to reduce. Blank 2022 Printable W 9 IRS Form W-9 Request For Taxpayer Identification Number And Certification is a one-page IRS tax legal document that businesses or individuals use to send out the accurate taxpayer ID number to customers individuals banks or financial institutions.

Person and a requester gives you a form other than Form W-9 to request your TIN you must use the requesters form if it is substantially similar to this Form W-9. The information taken from a W-9 form is often used to generate a 1099 tax. You can get Forms W-7 and SS-4 from the IRS by visiting wwwirsgov or by calling 1-800-TAX-FORM 1-800-829-3676.

W-9 Form Blank PDF - Auto Fillpdf. The W-9 form includes detailed instructions from the IRS. Information about Form W-9 Request for Taxpayer Identification Number TIN and Certification including recent updates related forms and instructions on how to file.

See The Results Start Trading Now. Dec 9th 2011 911 am. Ad We Checked All the Forex Brokers.

If you are self-employed you can send the form to someone. The W-9 Form is an essential tool for employers to gather information about contractors for income tax purposes. This form is used to get information from a person who you may be hiring or an independent contractor you are planning on using.

I have no idea what do they do and what form they fill or not. Status and avoiding withholding on its allocable share of net income from the partnership conducting a trade or business in the United States is in the following cases. Participating foreign financial institution to report all United States 515 Withholding of Tax on Nonresident Aliens and Foreign Entities.

If you are asked to complete Form W-9 but do not have a TIN write Applied For in the space for the TIN sign and date the form and give it to the requester. Owner of a disregarded entity and not the entity. W-9 You are a beneficial owner claiming that income is effectively connected with the conduct of.

Verifying the information on this form and keeping it up-to-date ensures you collected accurate personal information. Form W-9 is used to provide a correct TIN to payers or brokers required to file information returns with IRS. Nonresident alien who becomes a resident alien.

Individual The individual The actual owner of the account or if combined funds the first individual on the account 1 2. 12-2000 Page 2 What Name and Number To Give the Requester For this type of accountGive name and SSN of. The following is a summary of those instructions and a sample W-9 form is on the next page.

United States provide Form W-9 to the partnership to establish your US. Under penalties of perjury I certify that. The W8BEN form not required by Questrade.

Status and avoid section 1446 withholding on your share of partnership income. The payer receives W-9 forms or W-8 or equivalent forms from foreign persons and non-resident aliens from payees and keeps these W9 forms. Start Trading with one of the leading brokers you choose easy comparison.

Blank Fillable W 9 Form IRS Form W-9 Request For Taxpayer Identification Number And Certification is a one-page IRS tax legal document that businesses or individuals use to give the accurate taxpayer ID number to consumers individuals banks or financial institutions. However if a contractor provides you with an updated address or a. A W-9 form is used for tax filing purposes.

Person including a resident alien to provide your correct TIN to the person requesting it the requester and when. For federal tax purposes you are considered a US. W-9 Form Blank PDF - Auto Fillpdf.

Form W-9 is an IRS form that is used to confirm a persons name address and taxpayer identification number TIN for the purpose of employment or other modes of income generation. Form W-9 officially the Request for Taxpayer Identification Number and Certification is used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service IRS. Two or more individuals joint account 3.

2 In the cases below the. They will then be. Purpose of Form Form W-9 Rev.

If the landlord has a second business name such as a doing. From the W-9 forms the payer prepares information tax return Form1099-NEC nonemployee compensation and Form 1099-MISC miscellaneous information. 1-2011 Page 2 The person who gives Form W-9 to the partnership for purposes of establishing its US.

A W-9 form allows US taxpayers to confirm their Taxpayer Identification Number TIN and details for 1099 reporting. The landlord name as shown on their income tax return either an individual or business should be placed on the Name line. 8-2013 Form W-9 Rev.

A W-9 form is completed by independent contractors and freelancers as a means of gathering information for the Internal Revenue Service. Use Form W-9 only if you are a US. Definition of a US.

A W-9 form is generally used to confirm the TIN of a person or business and to establish that they are a US taxpayerUnlike a W-8 form there is only one version of the W-9 form and it applies to both individuals and entities. You may send the form to someone in the event that you are independent worker. They look at the ID you provide when you signed up the account and automatically fill out the W8BEN for you to prevent any witholding taxes by the US Government.

Start Trading with one of the leading brokers you choose easy comparison. If you are a US. The W-9 or Request for Taxpayer Identification Number and Certification form will provide the employer with personal information such as the employees name address.

It requests the name address and taxpayer identification information of a taxpayer in the form of a Social Security Number or Employer Identification. See The Results Start Trading Now. W-9 forms may be either paper forms or electronic forms.

Person if you are. Instead use the appropriate Form W-8 or Form 8233 see Pub.

Is This A Questrade Only Policy Or Not R Canadianinvestor

What The Hell Is That New Web Platform Ui Questrade R Questrade

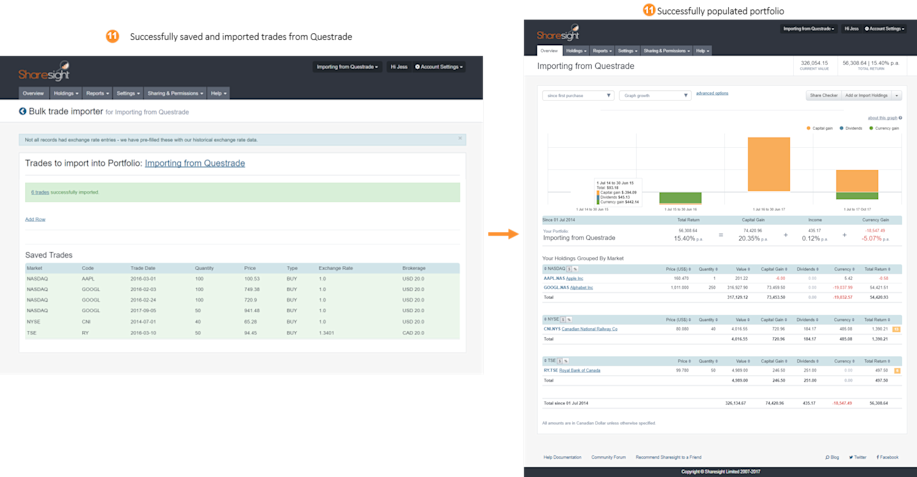

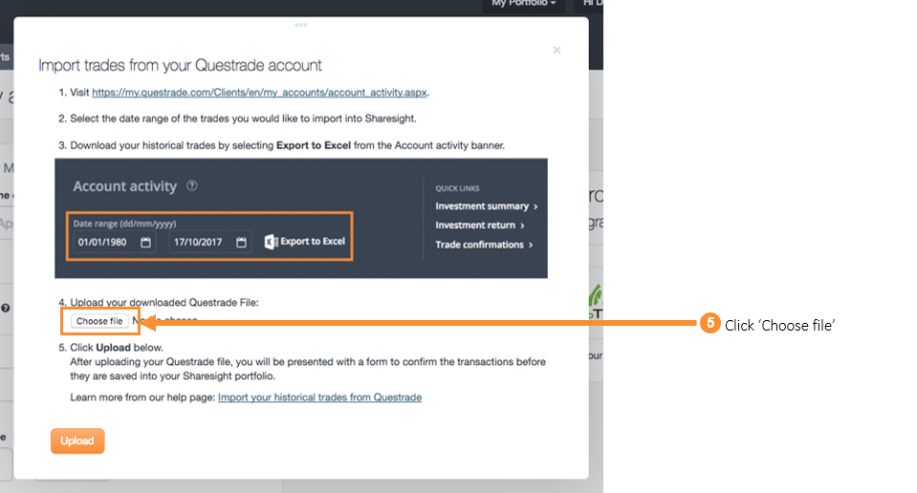

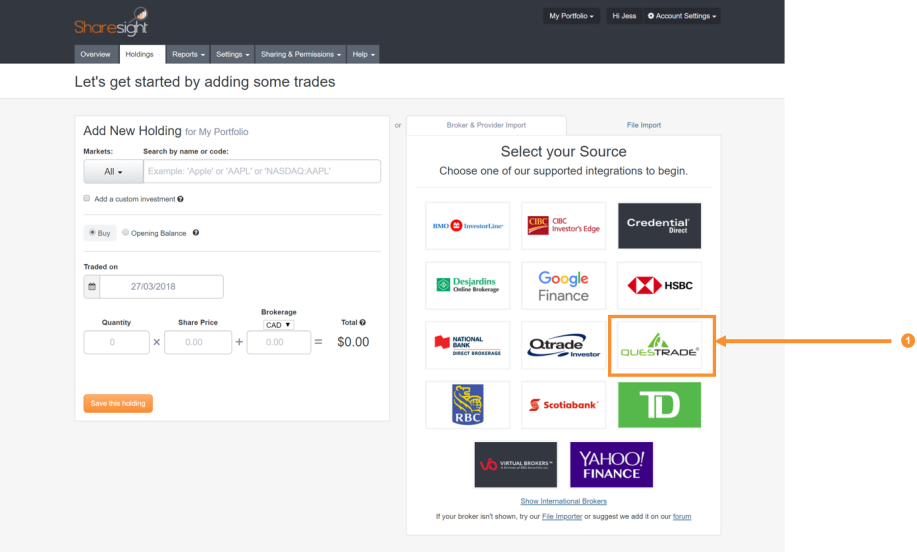

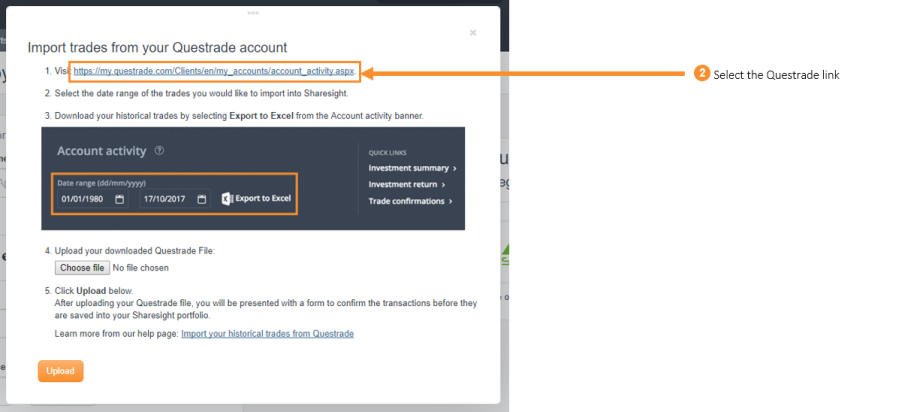

Import Questrade Trades Sharesight Canada Help

Opening Account My Uploaded Ids Say Accepted But Unsure How To Proceed What Do I Do Next On This Screen R Questrade

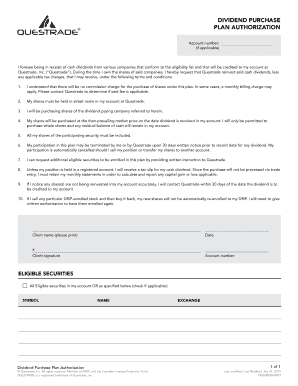

Questrade Beneficiary Form Fill Online Printable Fillable Blank Pdffiller

Step By Step How To Sign Up To Questrade To Buy Etfs

Step By Step How To Sign Up To Questrade To Buy Etfs

Import Questrade Trades Sharesight Help

Ultimate Questrade Review 2022 50 10 000 Questrade Offer Code

Import Questrade Trades Sharesight Help

Step By Step How To Sign Up To Questrade To Buy Etfs

Step By Step How To Sign Up To Questrade To Buy Etfs

/questrade_inv-e266478b8416461c99912d718be1b861.png)

Post a Comment

Post a Comment