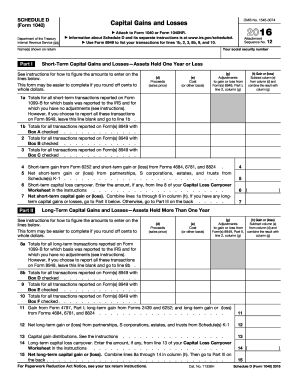

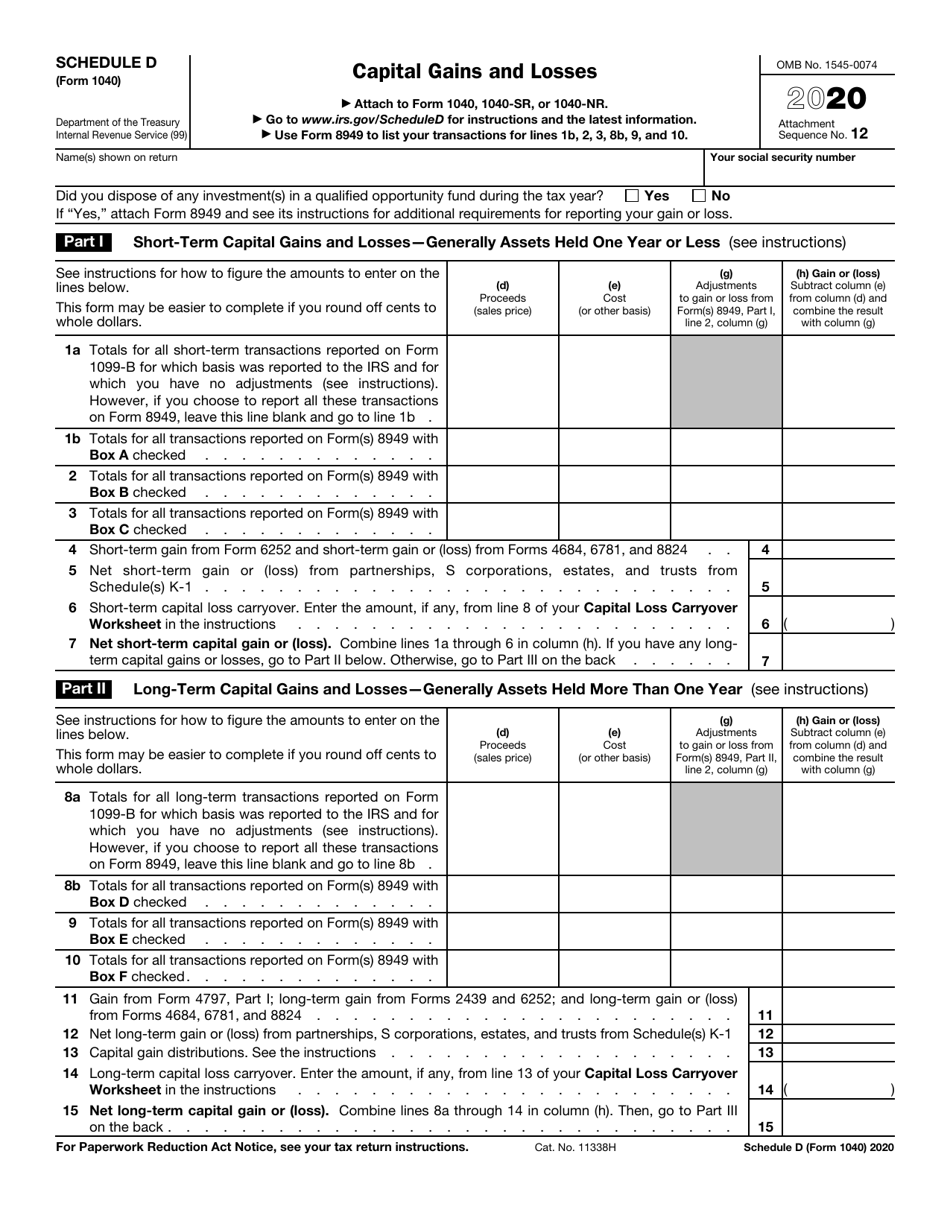

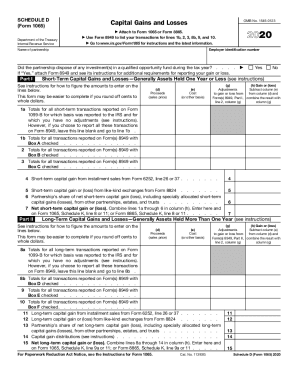

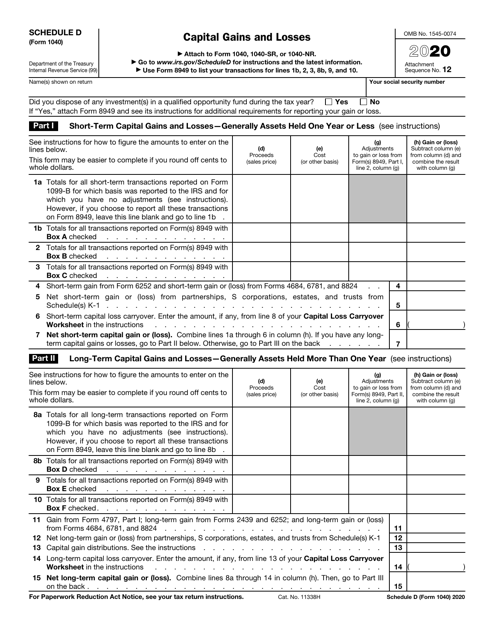

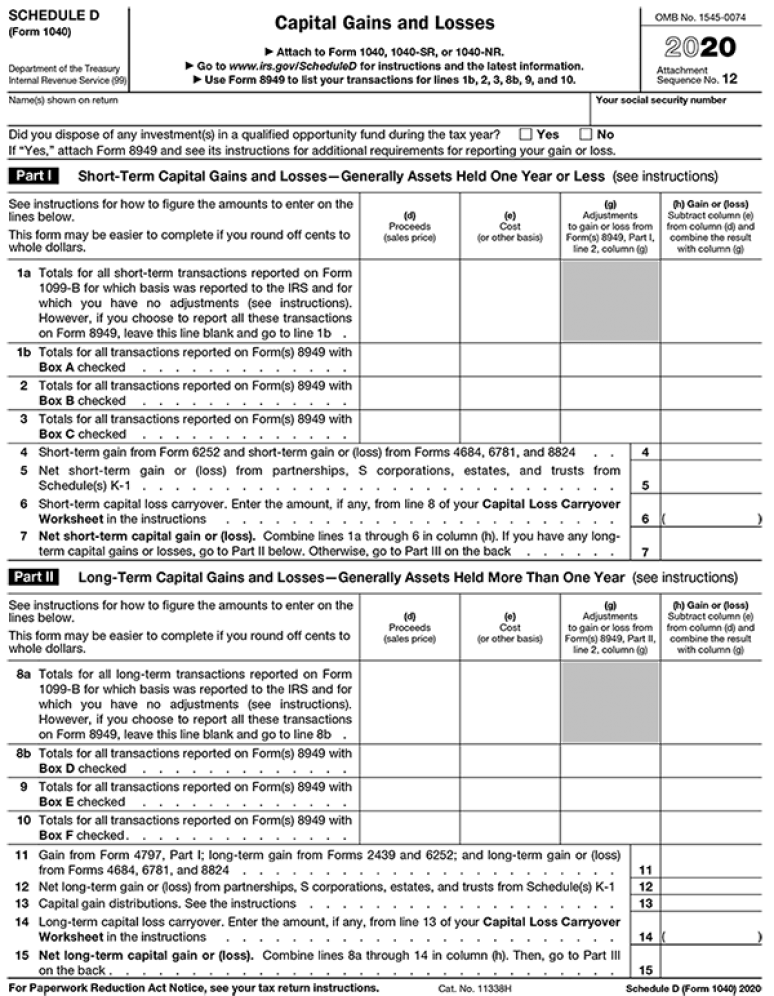

This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as soon as it is made available by the Federal government. The Schedule D is known as a Capital Gains and Losses form.

Irs Schedule D 1040 Form Pdffiller

IRS Use OnlyDo not write or staple in this space.

Schedule d 1040 form 2020. Form 1040 PR Schedule H Household Employment Tax Puerto Rico Version 2021. Information about Schedule D Form 1040 or 1040-SR Capital Gains and Losses including recent updates related forms and instructions on how to file. Schedule C instructions follow later usually by the end of November.

These free PDF files are unaltered and are sourced directly from the publisher. 02 Your social security number Name s shown on Form 1040 1040-SR or 1040-NR Part I 2020 Attach to Form 1040 1040-SR or 1040-NR. Tax form 1040 Schedule D is used to report capital gains for the purpose of income tax.

It will be required by certain parties for a complete income tax return. Instructions for Form 1040 or Form 1040-SR US. Use this worksheet to figure your capital loss carryovers from 2020 to 2021 if your 2020 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2020 Schedule D line 16 or b if the amount on your 2020 Form 1040 or 1040-SR line 15 or your 2020 Form 1040-NR line 15 if applicable would be less than zero if.

Printable Form 1040 Schedule D. To figure the overall gain or loss from transactions reported on Form 8949. The IRS Schedule D form and instructions booklet are generally published in December of each year.

Individual Income Tax Return 2020 Department of the TreasuryInternal Revenue Service 99 OMB No. We last updated the Capital Gains and Losses in January 2021 and the latest form we have available is for tax year 2020. Inst 1040 Schedule B Instructions for Schedule B Form 1040 or Form 1040-SR Interest and Ordinary Dividends.

This means that we dont yet have the updated form for the current tax yearPlease check this page regularly as we will post the updated form as soon as it is released by the Federal Internal Revenue Service. 2021 Instructions for Schedule DCapital Gains and Losses These instructions explain how to complete Schedule D Form 1040. 2020 Schedule 1 Form 1040 Subject.

Inst 1040 Schedule A Instructions for Schedule A Form 1040 or Form 1040-SR Itemized Deductions. We last updated Federal 1040 Schedule D in January 2022 from the Federal Internal Revenue Service. Use the 2020 Tax Calculator to estimate your 2020 Return.

Gains from involuntary conversions other than from casualty or theft of capital assets not held for business or profit. Federal Self-Employment Contribution Statement for Residents of Puerto Rico. Form 1040 Schedule D Capital Gains and Losses.

SCHEDULE 2 OMB No. The Schedule C form is generally published in October of each year by the IRS. Form 1040 Schedule 1 Additional Income and Adjustments to Income.

62 rows Form 1040 Schedule EIC SP Earned Income Credit Spanish version 2020. Different financial information is required for this form. IRS Income Tax Forms Schedules and Publications for Tax Year 2020.

Fillable Form 1040 Schedule D 2020 Form 1040 Schedule D is the sale or exchange of a capital asset not reported on another form or schedule. 2020 Tax Returns were able to be e-Filed up until October 15 2021. 1545-0074 Additional Taxes Form 1040 Department of the Treasury Internal Revenue Service Go Attachment Sequence No.

A capital gain is any profit made from the sale of. Individual Income Tax Return. The 2020 Schedule 1 Instructions are not published as a separate booklet.

The majority of 2020 Tax Forms are listed. Use Schedule D to report sales exchanges or some involuntary conversions of capital assets certain capital gain distributions and nonbusiness bad debts. Instructions for Form 1040 Schedule 8812 Additional Tax Credit Spanish Version 2020.

2020 Form 1040 Schedule 2. This form is used in conjunction with Form 1040. January 1 - December 31 2020.

On page one of IRS Form 1040 line 8 the taxpayer is asked to add the amount from Schedule 1 line 9 Additional Income. Additional Income and Adjustments to Income Keywords. If published the 2020 tax year PDF file will display the prior tax year 2019 if not.

Inst 1040 Schedule 8812 sp Instructions for Form 1040 Schedule 8812 Credits for Qualifying Children and Other Dependents Spanish Version 2021. FormSchedule Noncalculating Resident Part-year Nonresident 2020 1040 Forms and Schedules Form 40NR Form 40V Form 4952A Form AL-8453 Form EOO Form NOL-85 Form NOL-85A Schedule A B D E NR Schedule A B DC Schedule AAC Schedule AATC Schedule AJA Schedule ARA Schedule CR Schedule D E Schedule DEC. This form will be used to report certain sales exchanges gains distributions or debts.

Click any of the IRS Schedule D form links below to download save view and print the file for the corresponding year. Instead you will need to read the Schedule 1 line item instructions found inside the general Form 1040 instructions booklet. Since that date 2020 Returns can only be mailed in on paper forms.

Complete Form 8949 before you complete line 1b 2 3 8b 9 or 10 of Schedule D.

Irs Schedule D 1040 Form Pdffiller

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Irs Form 1040 Schedule D Download Fillable Pdf Or Fill Online Capital Gains And Losses 2020 Templateroller

Schedule D Capital Loss Carryover Scheduled

Irs Schedule D 1065 Form Pdffiller

Irs Form 1040 Schedule D Download Fillable Pdf Or Fill Online Capital Gains And Losses 2020 Templateroller

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

2020 Tax Form Schedule D U S Government Bookstore

Irs Schedule D 1040 Form Pdffiller

Irs Schedule D Form 1040 Or 1040 Sr Fill Out Printable Pdf Forms

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

What Is Schedule D How To Report Capital Gains And Losses

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Solved How To Report These On Schedule D Tax Return James Chegg Com

Post a Comment

Post a Comment