In addition if employees use the second option in Step 2b for multiple jobs they will enter the amount from line four of the multiple jobs worksheet on page three in Step 4c along with any other additional withholding. You fill out this form with your job.

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg)

W 4 Form How To Fill It Out In 2022

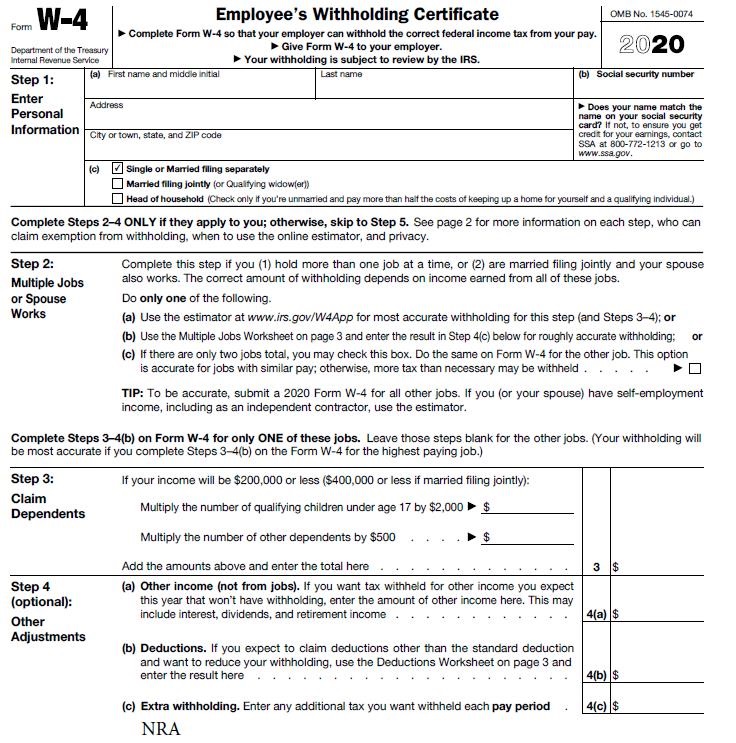

The W-4 form tells the employer the correct amount of federal tax to withhold from an employees paycheck.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

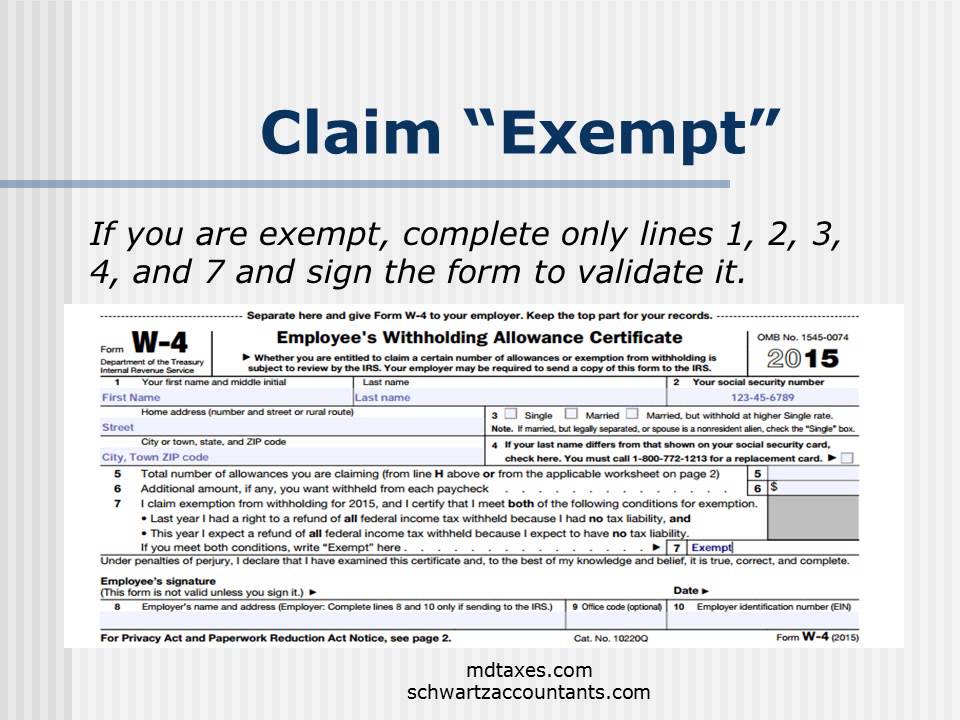

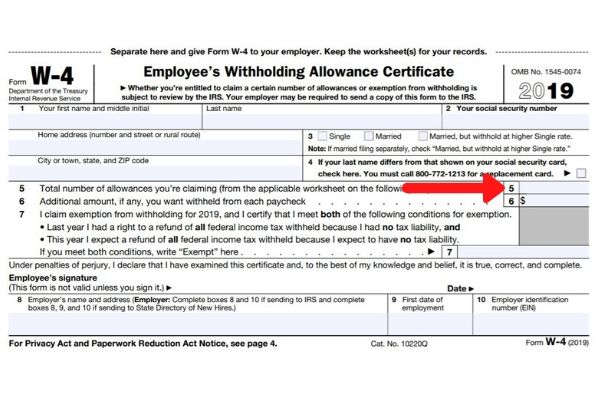

W4 form help. Non-resident aliens like yourself on F1OPTCPT are not permitted to claim exemptin the line no. 7 of w4 form. You should complete the redesigned W-4 only if you started a new job or if your filing status or financial situation has changed.

Your company can still use the information provided on the old W. Hopefully this guide and toolkit will help you through the process of filling out your W-4 form. If you want a bigger refund or smaller balance due at tax time youll have more money withheld and see less take home pay in your paycheck.

Completing Form W-4 is required to determine which taxes will be withheld from your earnings on a weekly or monthly basis. This form guides an employers calculation of the amount of income tax to withhold from your paycheck. Enter Personal Information a.

The IRS W-4 calculator or. The Internal Revenue Service has launched an online assistant designed to help employers especially small businesses easily determine the right amount of federal income tax to. Withholding for this type of income is made by claiming extra withholdings on line 4c.

If you have two jobs or youre filing jointly with a spouse who also works 2 jobs total youll fill out line 1. The W-4 is a form that you complete and give to your employer not the IRS for federal tax and the equivalent form for state tax withholding. Mail or fax this form to the University Payroll Office to make changes to your exemptions.

If the person is eligible to claim a tax exemption under an income tax treaty then heshe needs to complete the Form 8233 in addition to Form W-4. Faculty and staff who are not a US. Make adjustments to your W-4 with your employer to account for your self-employment income or pay quarterly estimated taxes to cover this income using Form 1040-ES Estimated Tax for Individuals.

It determines how much money your employer must withhold from your income. Single filer married filer etc. The form lets you know how much federal income tax to withhold from employees wages.

The IRS recommends you update this form regularly. Go to the table on page 4 of the form and use the table based on how youre filing eg. Form W-4 completed will apply at the time a treaty-based exemption no longer.

Citizen or Permanent Resident CANNOT change State of Michigan tax withholding information using the Wolverine Access website. Every so often the IRS changes the documents to make them more accessible for people to understand and to correspond with changes in tax rules and exemption guidelines. The W-4 form has been changed for 2021 and looks different than the W-4 forms from previous years.

Employees Withholding Certificate is filled out by an employee to instruct the employer how much to withhold from your paycheck. If your marital status has recently changed a next step might be to revise your W-4 form. Finally if you claim 15 or more exemptions on your Form IL-W-4 without claiming at least the same number of exemptions on your federal Form W-4 and your employer is not required to refer your federal Form W-4 to the Internal Revenue Service for review your employer must refer your Form IL-W-4 to the Department for review.

Your withholding is subject to review by the IRS. Click the Link to MI W-4 Form at the top of the page to print and fill out the Michigan W-4 form. Give Form W-4 to your employer.

Form W-4 Department of the Treasury Internal Revenue Service Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Accurately completing your W-4 can help you prevent having a big balance due at tax time. If employees use the Tax Withholding Estimator to help them complete their 2020 Form W-4 theyll enter the amount the estimator provides in Step 4c.

You are not permitted to treat employees as failing to furnish Forms W-4 if they dont furnish a new Form W-4. IRS Form W-4 is completed and submitted to your employer so they know how much tax to withhold from your pay. Whether this is the first time you have filled out a W-4 or if you have filled out several over the course of your career it is always good to have a refresher in order to understand what is happening with your earned pay at every step.

Form W-4 otherwise known as the Employees Withholding Allowance Certificate is an Internal Revenue Service IRS tax form completed by an employee in the United States to indicate his or her tax situation exemptions status etc to the employer. Your W-4 can either increase or decrease your take home pay. You do not need to fill out the new form if you have not changed employers.

Kaylee DeWitt Feb 22 2016. On the 2021 W-4 form you can still claim an exemption from withholding. The W-4 communicates to your employers how much federal andor state tax you - and your spouse if she works - wish to have withheld from each paycheck in a pay period.

What is a W-4 Form. Guide Your Employees with Easy-to-Understand Form W-4 Help. It ensures that the company they work for correctly deducts taxes from the workers earnings.

You might want to use a W4 calculator and submit a new form each year. The W-4 Form is an IRS form that you complete to let your employer know how much money to withhold from your paycheck for federal taxes. When you hire employees you should have them complete Form W-4 when they start work.

Form W-4 is a short form but it can still be confusing. Note that special rules apply to Forms W-4 claiming exemption from withholding. Before you complete the form consult an accountant or IRS literature to understand the ramifications of the choice you make.

It can also help you avoid overpaying on your taxes so you can put more money in your pocket during the year. Form W-4 is an important document for every US employee including a Work and Travel program participant who works for a US company. After finding the box where the higher salary and the lower salary meet put that number on.

The 2018 W4 tax form is for your federal income tax. There are worksheets in the Form W-4 instructions to help you estimate certain tax deductions you might have coming.

How To Fill Out The New W 4 Form Correctly 2020

45 Of Taxpayers Don T Remember When They Last Updated Their Withholding Cpa Practice Advisor

Help Working Kids And Students Correctly Complete A W 4 Form Youtube

How To Fill Out The New W 4 Form Arrow Advisors

Did You Fill Out Your W 4 Federal Tax Withholding Form Correctly The Mint Hill Times

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

How To Fill Out Your W4 The Right Way The Motley Fool

How To Complete The W 4 Tax Form The Georgia Way

What Is Form W 4 What Do I Do As An Employer Updated For 2019 Gusto

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

What You Should Know About The New Form W 4 Atlantic Payroll Partners

Understanding Your W 4 Mission Money

Post a Comment

Post a Comment