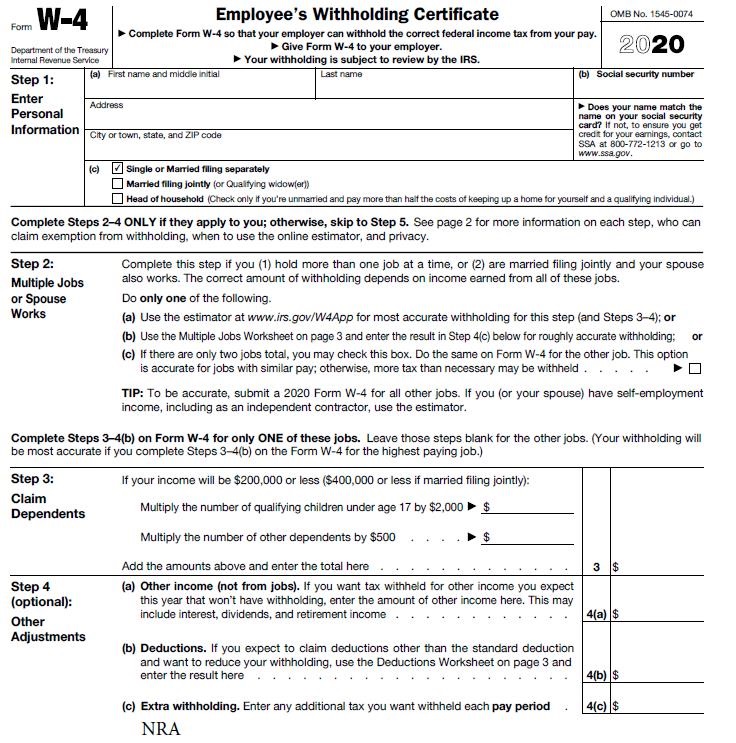

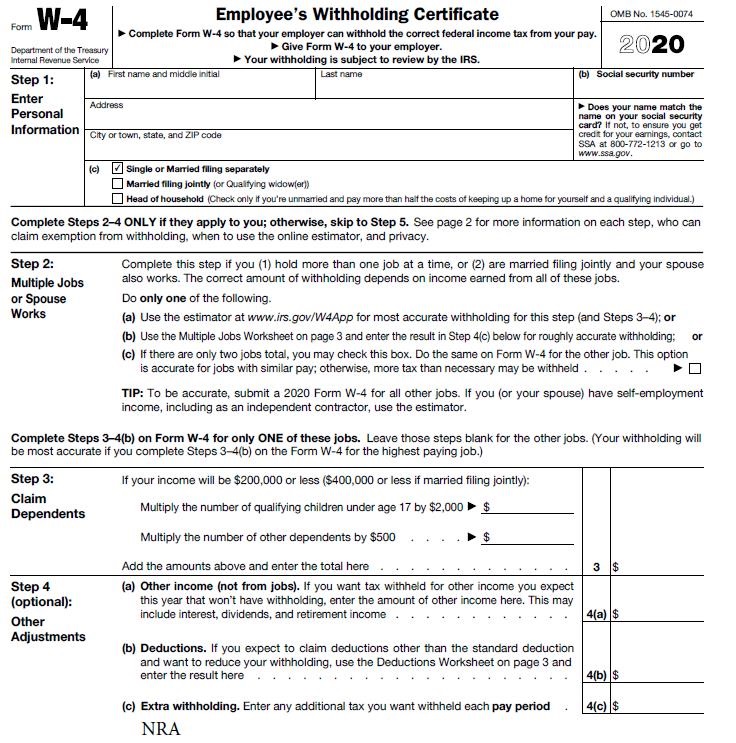

Update Your W-4 Now Ways to compute. IRS Form W-4 tells your employer how much federal income tax to withhold from your paycheck.

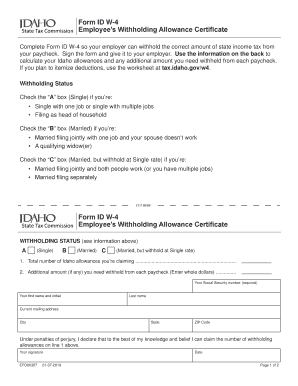

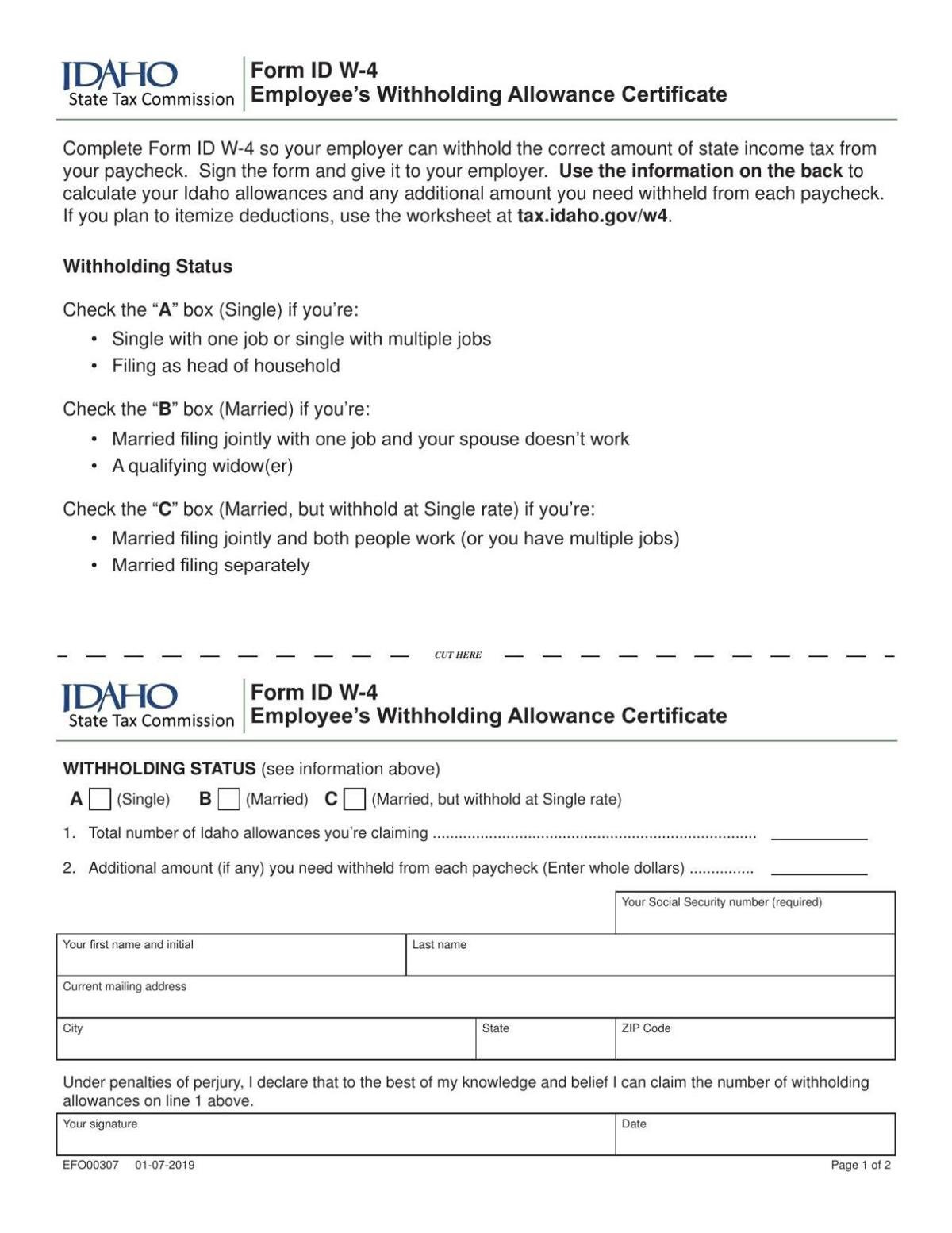

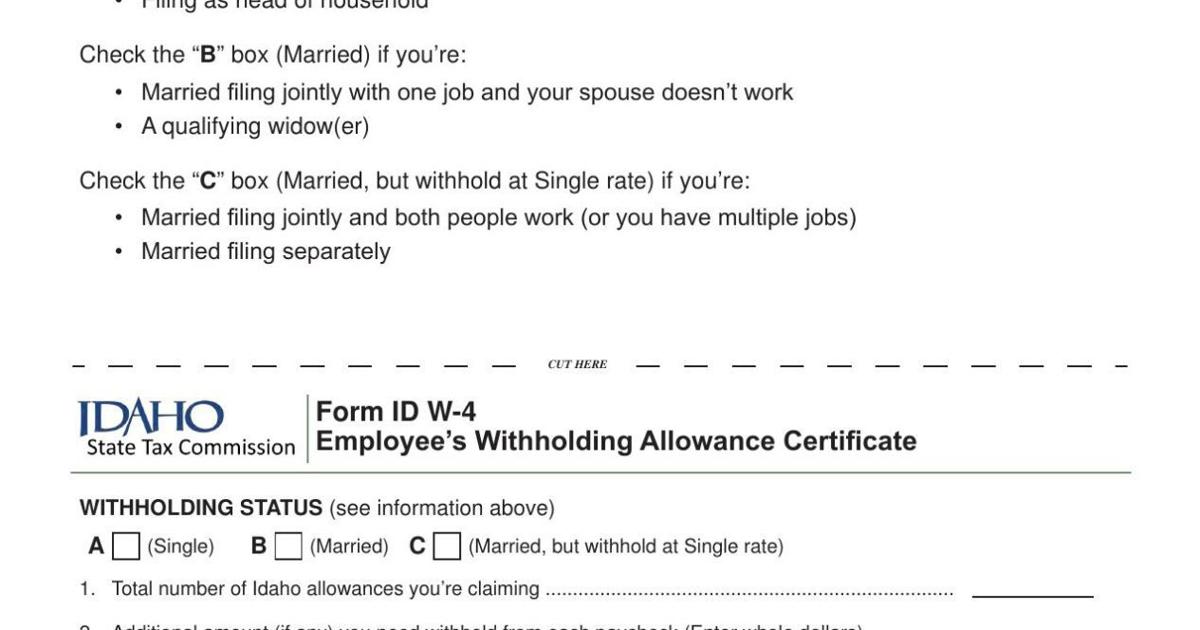

Encourage employees to complete a federal Form W-4 as well as an Idaho Form ID W-4.

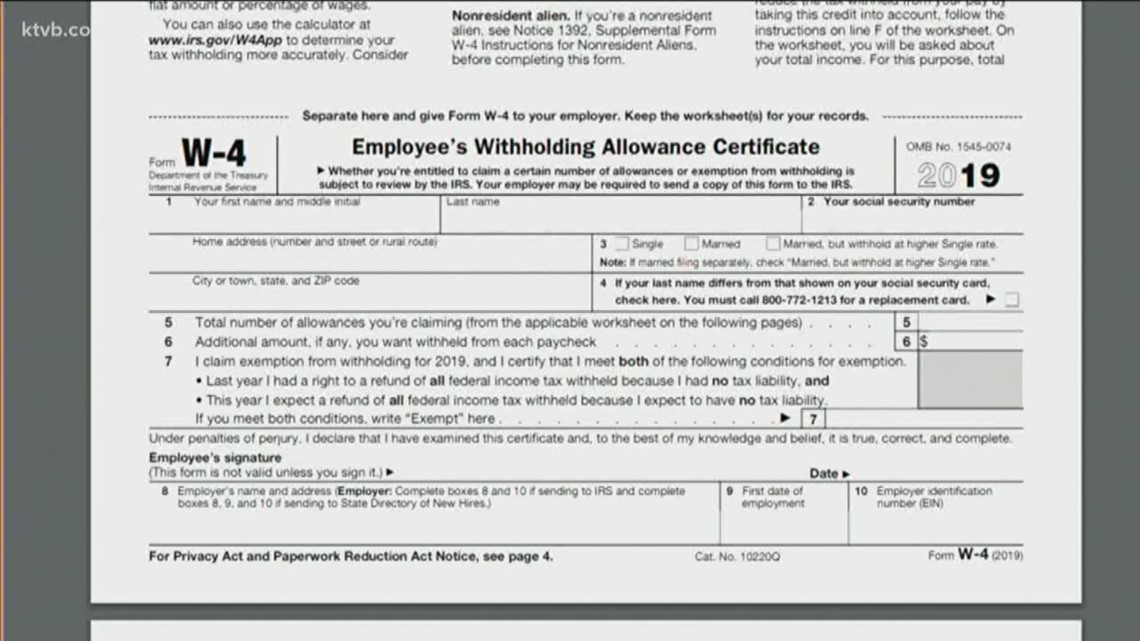

W4 form idaho. You must also file the following information returns with the Tax Commission in. Use the information on the back. The Internal Revenue Service has released a new W-4 form for the 2020 tax season.

You will also file a state income tax withholding form. In addition to the federal income tax withholding form W4 each employee needs to fill out a W4 form for their Idaho State income tax withholding. The Idaho State Tax Commission has released a further revision to the publication A Guide to Idaho Income Tax Withholding containing several updatesThe Commission has also created a Form W-4 worksheet that Idaho employees can use to determine how to complete the form for Idaho income tax withholding purposes.

Update the federal Form W-4 with that information. Use the information on the back to calculate your Idaho allowances and any additional amount you need withheld from each paycheck. Types of information that are used to determine your withholding may include your marital status age and number.

You can also submit a new W-4 to your HR or payroll department when you have a life event that affects your taxes eg getting married or divorced or having a baby or if you paid too little or too much in taxes. If you plan to itemize deductions use the worksheet at. Withholding Certificate for Pension or Annuity Payments.

While both the W4 and W2 are concerned with payroll their roles are completely different. Information returns 1099s 1098 W-2G Information returns are tax statements you use to report certain types of payments and activities to the IRS. These changes are directly correlated to the.

The Idaho State Tax Commission announced release of a new state Form ID W-4 Employees Withholding Allowance CertificateThe new form may be found on the agencys website and the agency plans to mail copies of the new form to the more than 70000 employers with Idaho payroll withholding accounts. If you are completing an electronic filing of your federal income tax return then you should not complete a form w-4 unless you are preparing your electronically filed return and the IRS asks you to do so. Request for Federal Income Tax Withholding from Sick Pay.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Ad Access Any Form You Need. You must have a federal Form W-4 Employees Withholding Allowance Certificate on file for each employee.

Yes this is the same form but a duplicate copy for state-level income tax withholding needs to be kept on file should you need to produce it. Use page 2 of the Form ID W-4 to estimate your Idaho withholding. A tax-exempt organization must request Form W-4 PDF the employee withholding form and verify employee ID information SSNTo know how much federal income tax to withhold from an employees wages the tax-exempt organization should have a Form W-4 Employees Withholding Certificate on file for each employeeThe amount to be withheld is.

E-filing of W-2 - When you e-file you must include Form 967 Idaho Annual Withholding Report. Give Form W-4 to your employer. The form w-4 is particularly important for people who have a PDA mobile phone or tablet computer because the forms often ask.

Using the information you provide your employer uses this form to determine the correct amount of state income tax to withhold from your pay. Download or Email Fillable Forms Try for Free Now. Form W-4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay.

This form is available online here. Complete Edit or Print Your Forms Instantly. Sign the form and give it to your employer.

Use the withholding estimator at IRSgov to estimate your federal withholding. Information about Form W-4 Employees Withholding Certificate including recent updates related forms and instructions on how to file. Steps to take NOW.

We strongly encourage you to have all your employees use the new January 2019 Form ID W-4 to update their Idaho withholding. Fill out Form ID W-4 with that information. While a W4 tax form tells the employer how much money should be set aside for local state and federal taxes the W2 form tells employees how much money they earned taxes to be paid and where other deductions went health insurance union dues Medicaid etc.

Complete Form ID W-4 so your employer can withhold the correct amount of state income tax from your paycheck. Your withholding is subject to review by the IRS. Complete Edit or Print Your Forms Instantly.

Read more at taxidahogovw4. December 2020 Department of the Treasury Internal Revenue Service. Sign the form and give it to your employer.

Youll be asked to fill one out when you start a new job. Form ID W-4 Employees Withholding Allowance Certificate Complete Form ID W-4 so your employer can withhold the correct amount of state income tax from your paycheck. Read more at taxidahogovw4 Save Yourself from a Tax Bill.

Give both W-4 forms to your employer. Your withholding is subject to review by the IRS. The new draft Form W-4 reflects important feedback from the payroll community and others in the tax community.

Enter Personal Information a. And please take note. Just Create a FREE account with TaxBandits.

Give Form W-4 to your employer. TaxBandits an IRS-Authorized e-file service provider supports both W-2 and Form 967. Download or Email Fillable Forms Try for Free Now.

Form W-4 Department of the Treasury Internal Revenue Service Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. The state of Idaho requires additional forms to be filed along with Form W2 depending on your. Ad Access Any Form You Need.

The Idaho State Tax Commission announced release of a new state Form ID W-4 Employees Withholding Allowance CertificateThe new form may be found on the agencys website and the agency plans to mail copies of the new form to the more than 70000 employers with Idaho payroll withholding accounts.

Withholding Forms Solution I 9 Form Form Jobs For Freshers

Homcom 5 Pieces Dining Set 1 Table 4 Chairs Metal Legs Cushion Seat Wood Color For Home Kitchen Aosom In 2021 Dining Room Table Set High Back Dining Chairs 5 Piece Dining Set

Irs New Form W 4 For 2021 Employee Tax Withholdings Bernieportal

Amazon Sales Tax Bookkeeping Services E Commerce Business Sales Tax

Idaho Tax Commission Offers Help Calculating Withholding

Where To Get Printable Irs Tax Forms Instructions Irs Taxes Tax Forms Irs Tax Forms

Idaho Tax Commission Offers Help Calculating Withholding Ktvb Com

W 4 Form Idaho 2021 Fill Online Printable Fillable Blank Pdffiller

How To Fill Out The New W 4 Form Correctly 2020

Virtual Adaptation Fine Print W4 Form Blog

File Form W 4 2012 Pdf Wikipedia

Post a Comment

Post a Comment