2020 1099-R Box 7 Distribution Codes. Disclaimer of California Attorney.

However the 10 penalty.

What does distribution code 1 mean on a 1099-r. The participant has reached age 59. Therefore correct entry of these codes is really important. Either code could be used upon termination of employment.

Early distribution exception applies under age 59½. 1 Early distribution no known exception. However if the Distribution Code is 1 a prompt will be given to Select Form 5329 Options which is the 10 Additional Tax for Early Withdrawal.

In the questions after you enter the 1099-R it will ask you about your retirement age. What is distribution code G in box 7 on 1099-R. See Form 5329 For a rollover to a traditional IRA of the entire taxable part of the distribution do not file Form 5329.

A code T in box 7 of 1099-R is for a Roth IRA distribution when an exception applies. What does Distribution Code 4 mean on a 1099 R. The box 1 amount will appear on Form 1040 line 5a but the zero amount in box 2a means that none of this will be included in the taxable amount on line 5b.

2 Indicate if. Use code 7 Normal distribution when the IRA owner or plan participant is age 59½ or older use code 1 if the individual is age 59½ or older but modified a series of substantially equal periodic payments before five years. Yes the Form 1099-R must be entered into TurboTax.

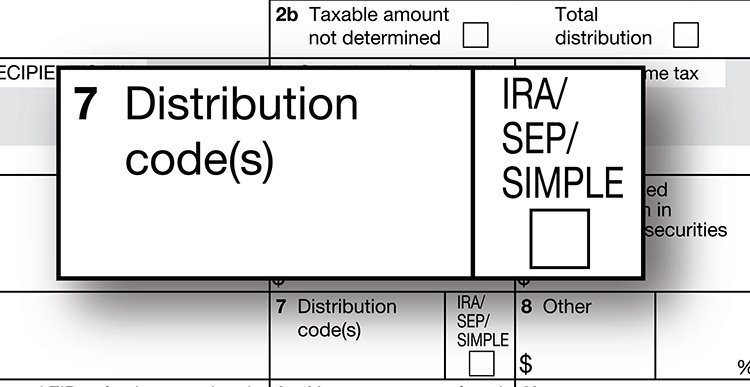

Unreimbursed medical expenses that exceed 75 percent of adjusted gross income health. Which code is used upon termination depends on whether one of the several exceptions to the 10 penalty apply in your circumstances. The codes entered in Box 7 of Form 1099-R indicate the type of distribution received and its taxability.

We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Code 7 may be used in combination with codes A B D K L or M. Can I use TurboTax free with a 1099-R.

If Box 7 of your 1099-R shows a 7 in it this distribution isnt taxable if you met the plan requirements the age andor years of service required by the plan for retirement and you retired after meeting those requirements. The participant is disabled. Following are some key items for entering retirement account income from clients 1099-Rs.

A Code 3 in Box 7 of a 1099-R means you are taking the distribution as a result of a disability. 1 Early distribution except Roth no known exception. See Form 5329 For a rollover to a traditional IRA of the entire taxable part of the distribution do not file Form 5329.

L1 and M1 distribution codes on 1099R. 1 Early distribution no known exception in most cases under age 59 12 2 Early distribution exception applies under age 59 12 3 Disability. This distribution is not subject to the 10 early distribution tax.

See the instructions for Form 1040. Use Code 1 Early distribution no known exception for Traditional and SIMPLE IRAs and QRPs only if the individual is not age 59½ or older and codes 2 3 and 4 do not apply. So if the preparer believes this is a qualified distribution and the distribution is not subject to tax they need to use code Q instead.

We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Code 1 is early distribution no known exception while Code 2 is early distribtuion exception applies. Use even if the individual is withdrawing the money for one of the following penalty tax exceptions.

What does the code in box 7 on Form 1099-R mean. These show payment due to death of the account owner. Box 7 is the distribution code that identifies the type of distribution received.

Distribution Codes Explanation Used With. Early distribution 2020 1099-R Box 7 Distribution Codes. The participant died or.

Note A code of T means the issuer of the 1099-R knows the recipient is over age 59 12 but does not know if the Roth IRA was held at least five years. Regarding 1099-R distribution codes retirement account distributions on Form 1099-R Box 7 Code 4 are still taxable based on the amounts in Box 2a. What are the distribution codes for 1099 R.

1 Do not forget to include tax withholding if reported on 1099-R. Early distribution no known exception. Code L on the back of the form stats Loans treated as distributions The client states that they had borrowed money from their 401k and were laid off work before being able to pay the loan back.

What does Distribution Code 7 mean on a 1099. It is used for a distribution from a Roth IRA if the IRA custodian does not know if the 5-year holding period has been met but. The codes in Box 7 of your 1099-R helps identify the type of distribution you received.

Death regardless of the age of the employeetaxpayer to indicate to a decedents beneficiary including an estate or trust. Box 7 is the distribution code that identifies the type of distribution received. 2 Early distribution except Roth exception applies.

This distribution is subject to the 10 penalty. Posted February 12 2010. 1 Early distribution no known exception in most cases under age 59-12.

The following are the codes and their definitions. 30 rows Distribution Code Description Valid Combinations. As KatrinaB states above the Box 7 codes identify the type of distribution and whether the distribution is taxable andor subject to a penalty.

8 Excess Contributions Excess Deferrals and Excess Aggregate Contributions taxable in year of distribution B Designated Roth monies L Deemed Distribution from Loan. The following are the codes and their definitions. The codes in Box 7 of your 1099-R helps identify the type of distribution you received.

I agree there should have been no code L1 2019 Form 1099-R since the loan was satisfied by the 2018 offset distribution reported on the code M1 2018 Form 1099-R and you had no loan in 2019 on. Hi This is the first time Ive ran across a code L in the distribution code of a 1099R. What does distribution code 1 mean on a 1099-R.

Early distribution no known exception in most cases under age 59½. 1 Early distribution no known exception in most cases under age 59 12 2 Early distribution exception applies under age 59 12 3 Disability. When entering the Distribution Code in Box 7 if the Code is a 7 or G no further action is necessary.

Enter all remaining items on the 1099-R. Click on the distribution code for an explanation. 1 Early distribution no known exception in most cases under age 59-12.

/ScreenShot2020-01-28at5.14.18PM-95d56fcae5014d0086b8b50d0f01c9ac.png)

Form 1099 Q Payments From Qualified Education Programs Definition

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

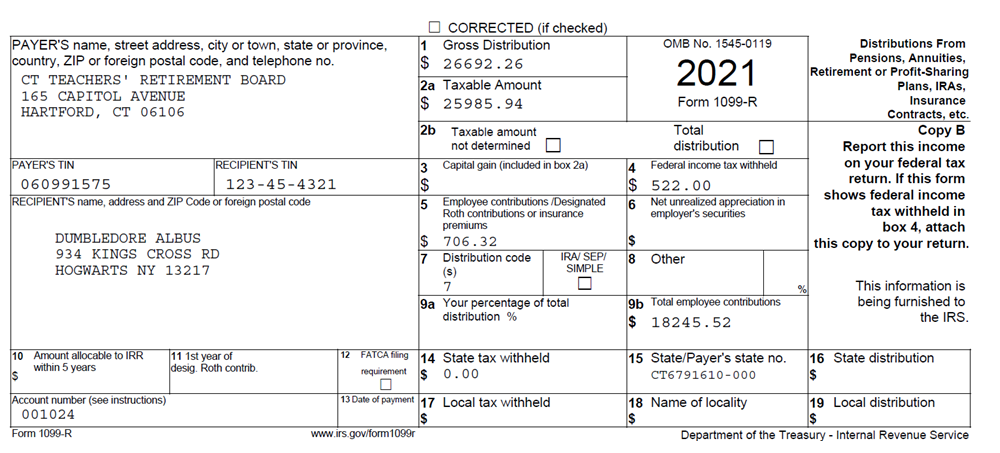

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Irs Form 1099 R Box 7 Distribution Codes Ascensus

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 R Distribution Codes For Defined Contribution Plans Dwc

Irs Form 1099 R Which Distribution Code Goes In Box 7 Ascensus

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Form 1099 R Distribution Codes For Defined Contribution Plans Dwc

Post a Comment

Post a Comment