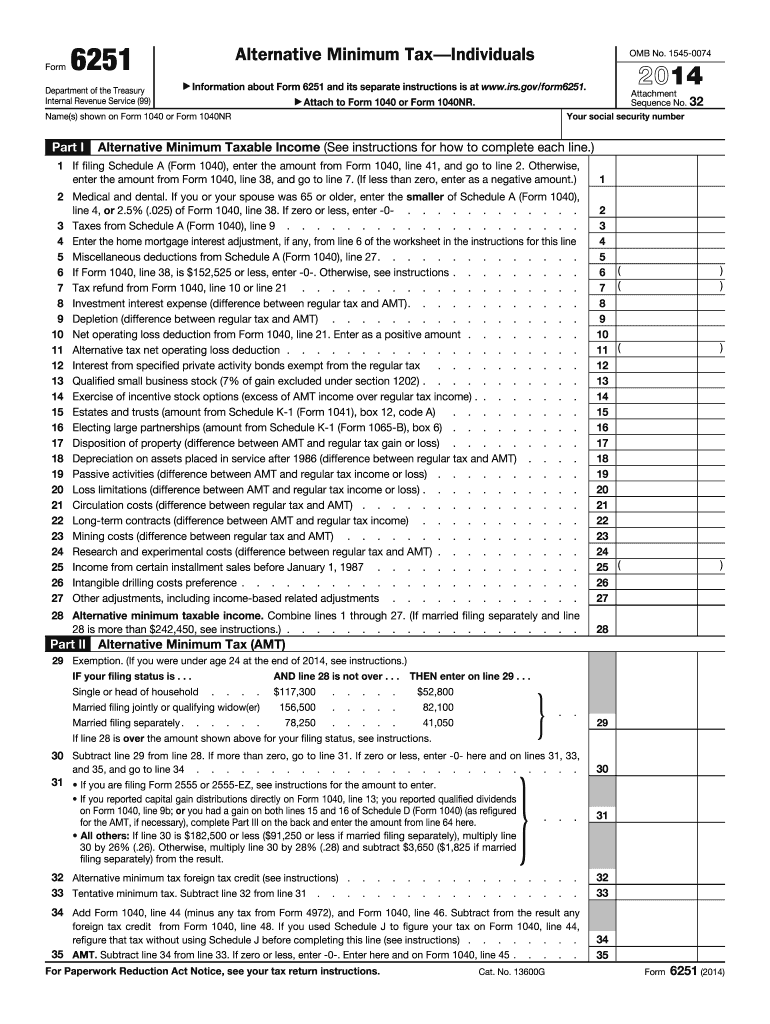

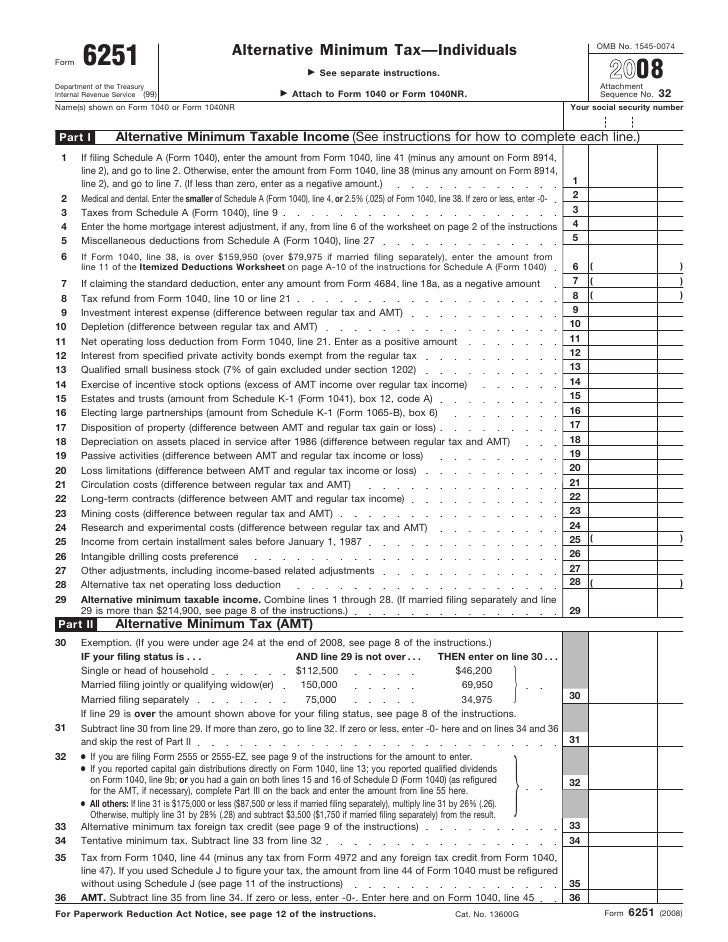

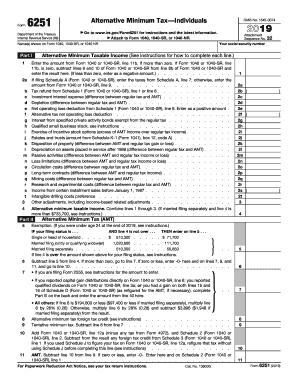

Form 6251 Alternative Minimum TaxIndividuals is a tax form that calculates whether youre liable for paying the alternative minimum tax and if so how much you should pay. Click the Pages that can be forced to print option in the Focus group box at the top of this dialog.

Form 6251 Fill Online Printable Fillable Blank Pdffiller

Also see the K1 Reconciliation - AMT Worksheet for a breakdown of an individual activity.

1040 form 6251. If Form 1040 or 1040-SR line 11b is zero subtract lines 9 and 10 of Form 1040 or 1040-SR from line 8b of Form 1040 or 1040-SR and enter the result here. The Form 6251 AMT Disposition of Property WOrksheet calculates the difference between AMT and Regular tax gain or loss and reports it on Form 6251 line 2k. General Instructions Future Developments For the latest information about developments related to Form 6251 and its instructions such as legislation.

The total of Form 6251 lines 2c through 3 is negative and line 7 would be greater than line 10 if you did not take into account lines 2c through 3. You claim the qualified electric vehicle Form 8834 or credit for prior year minimum tax Form 8801. 2 3 Add lines 1 and 2.

Inst 1040 Schedule B Instructions for Schedule B Form 1040 or Form 1040-SR Interest and Ordinary Dividends. Get And Sign Form 6251 Line 11b if more than zero. AMT calculato is a quick finder for your liability to fill IRS Form 6251.

View 1040 Form 6251pdf from TAX 650 at Southern New Hampshire University. Form 6251 Department of the Treasury Internal Revenue Service 99 Alternative Minimum TaxIndividuals Go OMB No. This form 6521 is a prescribed form and required to be filed by every taxpayer liable to pay alternative minimum tax AMT AS you know the AMT applies to taxpayers who have certain types of income that receive favorable treatment or who qualify for certain deductions under the tax.

Attach Form 6251. Your social security number. The spreadsheet also includes several worksheets.

At Jackson Hewitt We Get You Your Biggest Refund Guaranteed. Attach Form 8962. File with Jackson Hewitt Tax Pro For Our Biggest Refund Guarantee.

Enter here and on Form 1040 1040-SR or 1040-NR line 17. 1 2 Excess advance premium tax credit repayment. Names shown on Form 1040 or Form 1040NR.

Click the Tax Return button in the Collation group box. Form 6251 Passive Activities and Loss Limitations Adjustment Worksheet provides a breakdown of each activitys adjustments. Your social security number.

File with Jackson Hewitt Tax Pro For Our Biggest Refund Guarantee. Screen AMT - Form 6251 1040 Form 6251 - Alternative minimum tax FAQs 1040. 3 Part II Other Taxes 4 Self-employment tax.

Instructions for Form 1040 Schedule 8812 Additional Tax Credit Spanish Version 2020. Alternative Minimum Tax-Individuals is an Internal Revenue Service IRS tax form used to determine the amount of alternative minimum tax AMT that a taxpayer may owe. The AMT applies to taxpayers who have certain types of income that receive favorable treatment or who qualify for certain deductions under the tax law.

Inst 1040 Schedule A Instructions for Schedule A Form 1040 or Form 1040-SR Itemized Deductions. Use Form 6251 to figure the amount if any of your alternative minimum tax AMT. Instructions for Form 6251 Alternative Minimum TaxIndividuals Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted.

You claim the qualified electric vehicle credit Form 8834 the personal. The amount reported on Line 2n is generally the difference between regular. Form 6251 Department of the Treasury Internal Revenue Service 99 Alternative Minimum TaxIndividuals Go to wwwirsgovForm6251 for instructions and the latest information.

Lines 16a and 16b Simplified Method Worksheet taxable annuities and pension benefits. All AMT forms are located in the same folder as the regular version of the form. Form 6251 - Alternative minimum tax FAQs 1040.

Names shown on Form 1040 1040-SR or 1040-NR. Click the Federal tab. Form 6251 Line 2n Form 6251 Line 2n difference between AMT and regular tax income or loss takes into account activities that are nonpassive and at-risk.

You claim any general business credit and either line 6 in Part I of Form 3800 or line 25 of Form 3800 is more than zero. Attach to Form 1040 or Form 1040NR. If less than zero enter as a negative amount.

Per the 6251 instructions i f the deduction is being claimed in full then the difference between the amount that would have been deducted through amortization and the full amount must be taken as an AMT adjustment on form 6251 line 2t line 26 in Drake17 and prior. Form 6251 line 7 is greater than line 10. Form 6251 Alternative Minimum Tax Individuals.

Form 6251 Department of the Treasury Internal Revenue Service 99 Alternative Minimum TaxIndividuals Go to wwwirsgovForm6251 for instructions and the latest information. Form 2441 Childcare and Dependent Care Expenses. To force Form 6251 to print if it has data and whether or not it is required choose Setup 1040 Individual.

It adds back various tax breaks you might have claimed on your Form 1040 tax return then determines your taxes owed. Subtract from the amount determined in step 1 the amount that would have been. Attach to Form 1040 1040-SR or 1040-NR.

Attach Form 6251 to your return if any of the following statements are true. The worksheet is located on the AMT Disposition of Property Exemption worksheets located in the 6251Wrk folder. At Jackson Hewitt We Get You Your Biggest Refund Guaranteed.

Line 10 State and Local Tax Refund Worksheet. Lines 20a and 20b Social Security Benefits Worksheet.

Form 6251 Alternative Minimum Tax Miller Financial Services

Form 6251 Alternative Minimum Tax

Photo About Us Tax Form 1040 With New 100 Us Dollar Bills Business Concept Image Of Accounting Preparation Financial 5043875 Us Tax Tax Forms Dollar Bill

Form 6251 Fillable Fill Online Printable Fillable Blank Pdffiller

2020 2022 Form Irs 6251 Fill Online Printable Fillable Blank Pdffiller

12 Irs Non Stimulus Tax Rules You Ll Need This Year Tax Rules Tax Questions Irs

Tax Season Is Right Around The Corner Here S How You Can Get A Head Start Before 2022 Ypr

Form 6251 Fill Online Printable Fillable Blank Pdffiller

Form 6251 Alternative Minimum Tax

Form 6251 Alternative Minimum Tax Individuals

Form 6251 Alternative Minimum Tax

2019 6251 Fill Out And Sign Printable Pdf Template Signnow

Post a Comment

Post a Comment