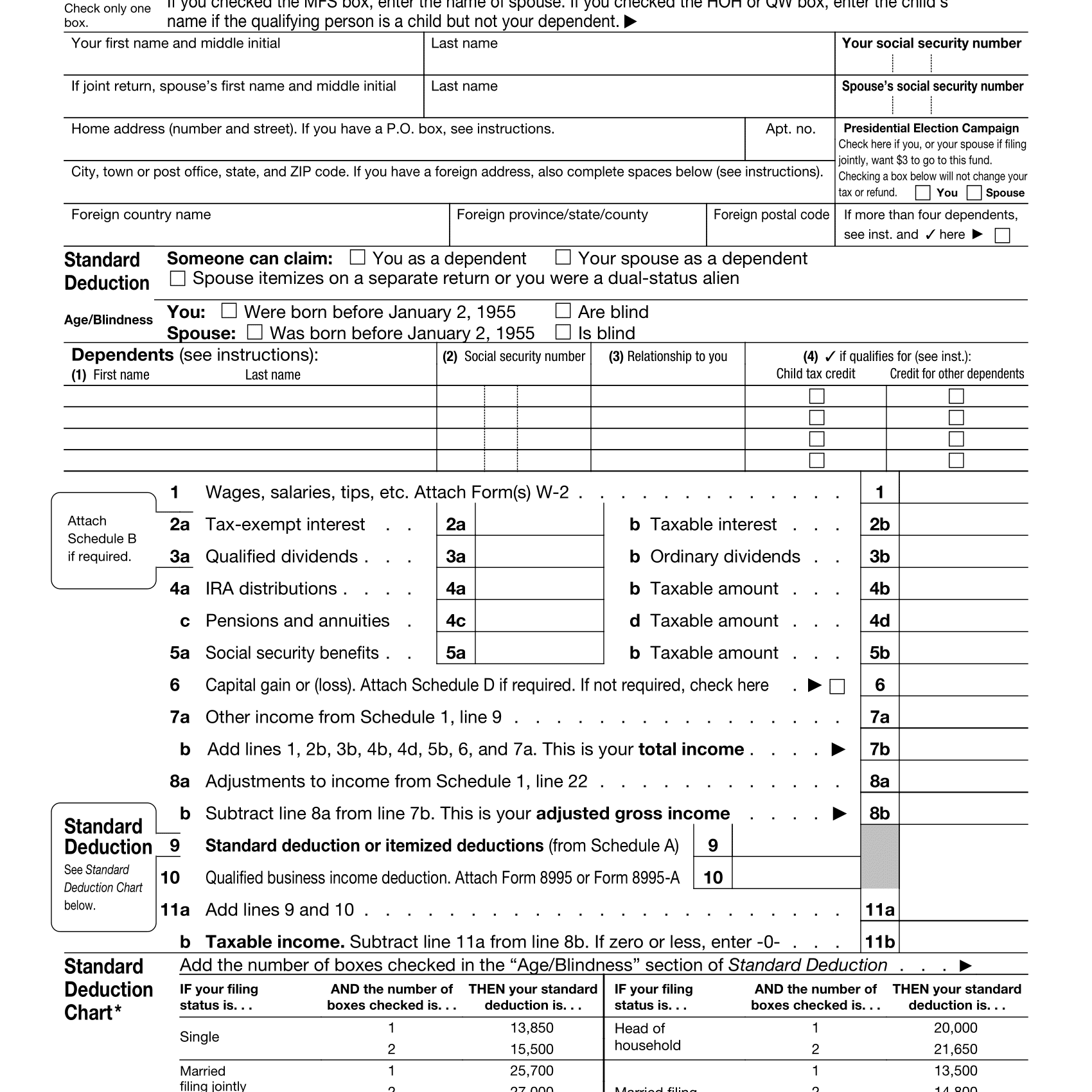

Itemized Deductions 7A Paid SCHEDULE A IRS On average this form takes 5 minutes to complete. 123-00-8888 Forms Included in the Scenario.

Standard Deduction 2020 Senior Standard Deduction 2021

Go to the 2106 screen and check for entries in boxes 7a and 7b under the heading Reimbursements NOT included in Box 1 of Form W-2.

1040 form 7a. A new address shown on Form W-7A will not update your record. Individual Income Tax Return. Ca 7A Form Fill Out and Use.

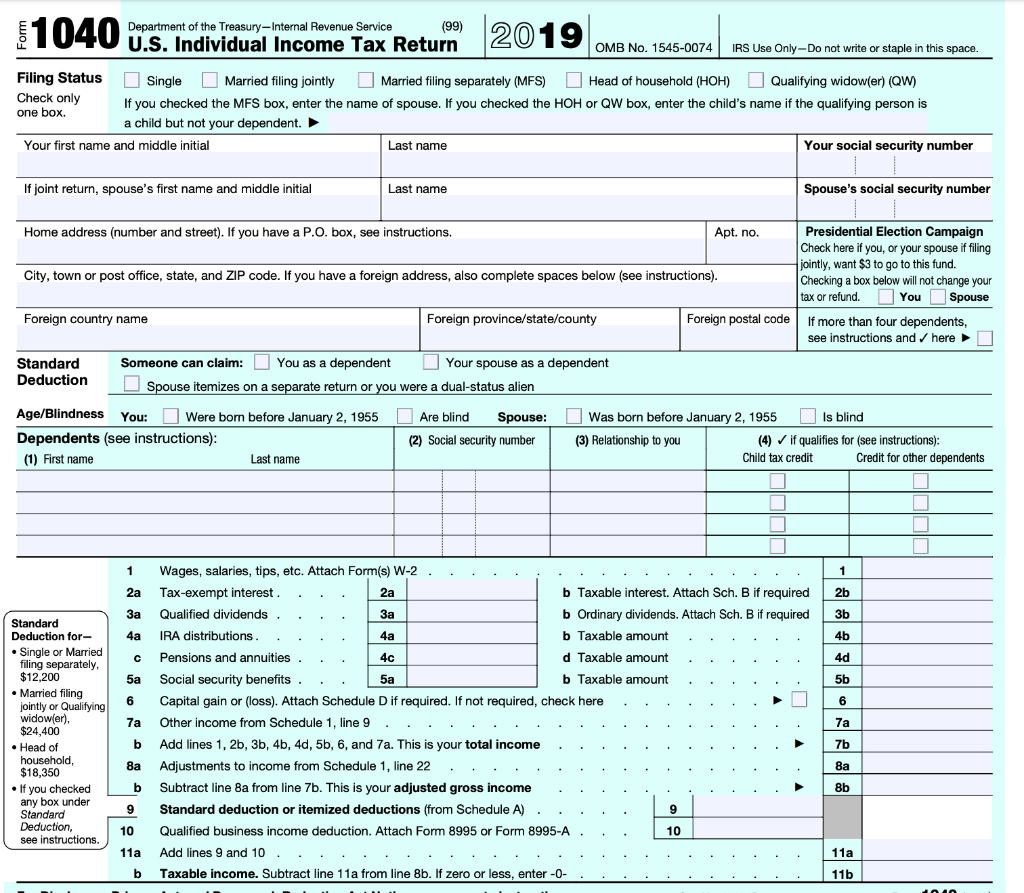

1545-0074 Additional Taxes Form 1040 Department of the Treasury Internal Revenue Service Go Attachment Sequence No. The Form 1040-SR Tax Return for Seniors 2019 form is 2 pages long and contains. Form 1040 Department of the TreasuryInternal Revenue Service 99 US.

Form 1099-C Generally if a taxpayer receives Form 1099-C for canceled credit card debt and was solvent assets greater than liabilities immediately before the debt was canceled all the canceled debt will be included on the tax return as other income. Use Fill to complete blank online IRS pdf forms for free. On average this form takes 25 minutes to complete.

An y device may be used including a phone tablet or laptop. Enter the childs adoptive name as it will appear on your tax return. Itemized Deductions 7A Paid SCHEDULE A IRS form is 1.

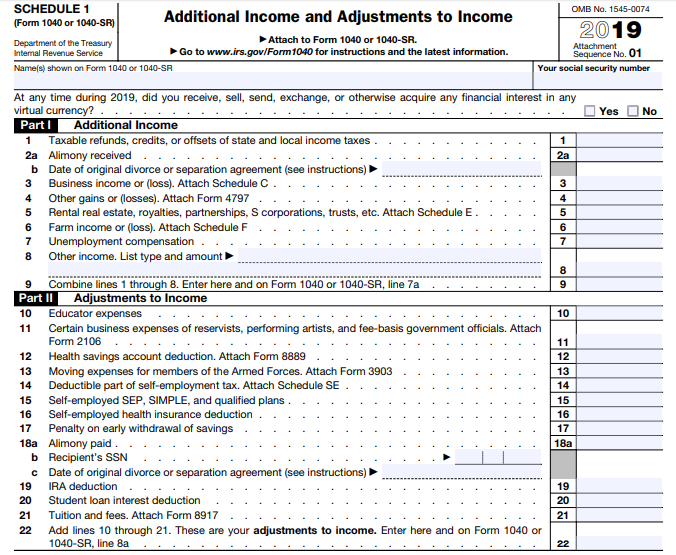

Because only nonbusiness. I have filled out all of the above bar the 1040. Line 9 calculates adding lines 1 through 8.

1545-0074 IRS Use OnlyDo not write or staple in this space. Sometimes Form 1099-C will show an interest amount in Box 3. However if you acquired a tax-exempt bond at a premium only report the net amount of tax-exempt interest on line 2a of your Form 1040 or 1040-SR that is the excess of the tax-exempt interest received during the year over the amortized bond premium for the year.

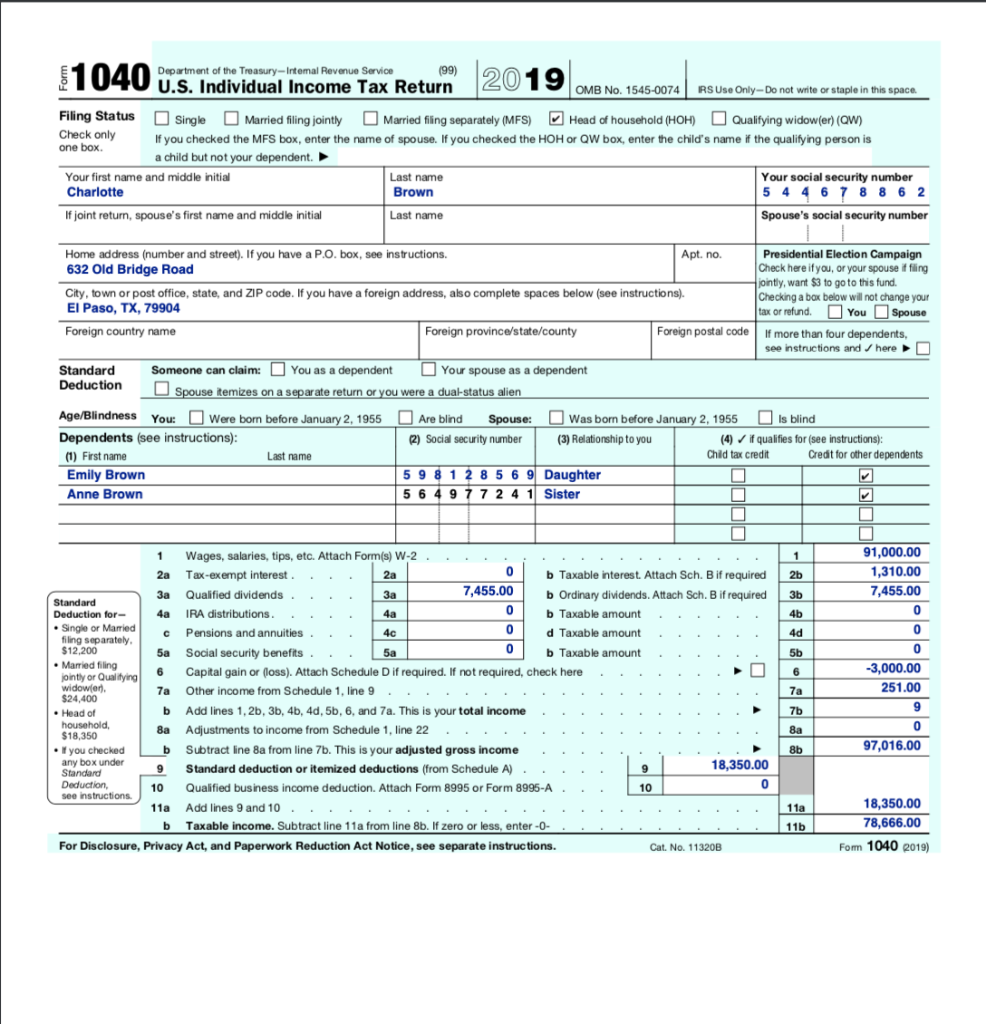

Filing Status Check only one box. There are two Add buttons. See instructions Yes or No 5.

All forms are printable and downloadable. Information about Form 1040-A US. Our PDF editor lets you edit any form quickly.

Individual Income Tax Return. Employer-Provided Expenses - reimbursements for expenses not included in box 1 of the W-2 will be reported on line 1 as income. 02 Your social security number Name s shown on Form 1040 1040-SR or 1040-NR Part I 2020 Attach to Form 1040 1040-SR or 1040-NR.

Tax return when they qualify as a US. Check only one box. Use Fill to complete blank online IRS pdf forms for free.

Canceled debts and foreign income are typically reported as other income. Say Thanks by clicking the thumb icon in a post. Tax returns are used to report both foreign and domestic income top the IRSThat is because the US.

I only have foreign earned income which I declared on Form 2555. Now go through the questions. There are two main exceptions.

If you checked the HOH or QW box enter the childs name if the qualifying person. SCHEDULE 2 OMB No. Instructions for Form W-7 SP Application for IRS Individual Taxpayer Identification Number Spanish version 1020.

Nonresident aliens use Form 1040-NR and seniors have the option to file Form 1040-SR which is nearly identical but has language tailored to taxpayers aged 65 and older. You should go to. IRS Use OnlyDo not write or staple in this space.

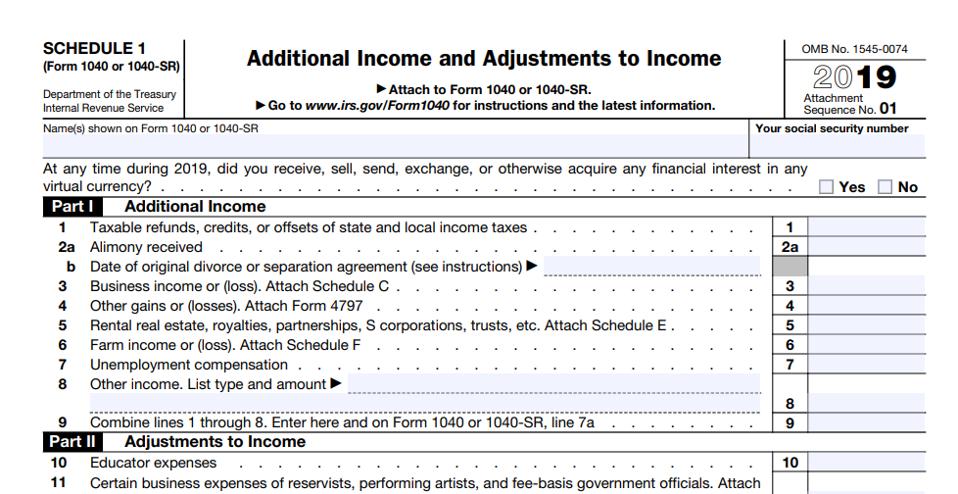

Enter the childs date of birth and sex. Enter the total on line 2a of your Form 1040 or 1040-SR. Form 1040 Schedule 1 Additional Income and Adjustments to Income was created as part of the Form 1040 redesign.

On Schedule B Part III line 7a the form specifically asks you to state whether or not you had a foreign account. Individual Income Tax Return 2019 OMB No. At any time during 2020 did you have a financial interest in or signature authority over a financial account such as a bank account securities account or brokerage account located in a foreign country.

Selecting the first Ad button opens Form 2106 for the TAXPAYER. Part II - Adjustments to Income. This is the place to be at if you need to get access to and acquire ca 7a form.

Single Married filing jointly Married filing separately MFS Head of household HOH Qualifying widower QW. Follows a worldwide income model. Generally these amounts are reported in box 12 of the W-2.

1040 Individual ATS Scenario 18 Taxpayer. I understand the income figure from Schedule 1 goes on the 1040 line 7a in parenthesis. Test for Form 461 OtherIncomeTypeStatement Form 1040 Schedule 1 Part 1 Line 8 Other Income Literal or Code Other Income Amt.

Once completed you can sign your fillable form or send for signing. Instructions for Form W-7-A Application for Taxpayer Identification Number for Pending US. Line 11 calculates from Form 2106 line 10.

Line 10 is a manual entry. Each year Taxpayers are required to complete a Form 1040 US. 2020 Form 1040 Schedule 2.

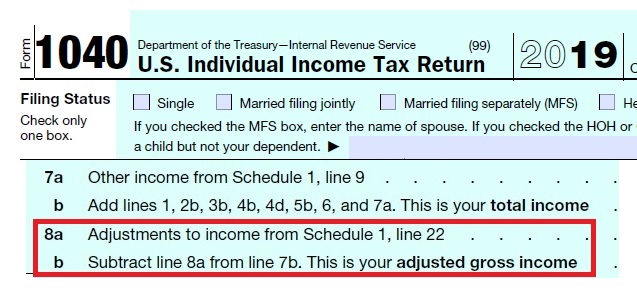

7a 7a b 7b 8a 8a b 8b 9 9 10 11a 11a b 11b Form 1040 Single Married filing separately MFS Head of household HOH If you checked the MFS box enter the name of spouse. Selecting the second Add button opens Form 2106 for. This amount is transfers to Form 1040 line 7a.

Scroll down to Other Tax Forms. Form 1040 Form 1040 Schedule 1 Form 1040 Schedule C Form 461 Form W-2 Return Summary. Once completed you can sign your fillable form or send for signing.

You typically have to report other income if you receive money or goods that arent included on a W-2 or most 1099s. On the form 1040 schedule B. You are required to file Schedule B with your IRS form 1040 each year if among other reasons you had a financial interest in or signature authority over a foreign financial account.

Foreign Income and US. Scroll and select Prepare a report on foreign financial assets. On page one of IRS Form 1040 line 8 the taxpayer is asked to add the amount from Schedule 1 line 10 Additional IncomeThen on line 10 the taxpayer is asked to subtract the amount from Schedule 1 line 26 Adjustments to Income.

Select Miscellaneous Tax Forms. How I can change the 7a and 7b to YES. Individual Income Tax Return form is 2 pages long and contains.

IRS Form 1040 is the basic federal income tax form that almost every taxpayer in the US. Another perjury trap is question 7a on Schedule B of Form 1040 which asks. Application for Taxpayer Identification Number for Pending US.

On average this form takes 24 minutes to complete. Person and have sufficient income to file a tax return. Form 1040-A is used by citizens and residents of the United States who have varied incomes and would like to.

Department of the TreasuryInternal Revenue Service 99 US. All forms are printable and downloadable. Individual Income Tax Return including recent updates related forms and instructions on how to file.

You can get Form 8822 online at IRSgov. If you know the childs birth name enter it on line 3b. Form 1040-SR Tax Return for Seniors 2019.

Married filing separately MFS Head of household HOH Qualifying widower QW. All forms are printable and downloadable. Other income on Form 1040 refers to income that isnt assigned a specific line on a 1040 tax return or Schedule 1 form.

What Are The Required Documents For A Ppp Loan Faq Womply

Total Income Form 1040 Decoded Physician Finance Basics

New Adjusted Gross Income Federal Income Tax Line For Covered California Income Estimates

Solved Department Of The Treasury Internal Revenue Service Chegg Com

Solved Demarco And Janine Jackson Have Been Married For 20 Chegg Com

Do You Need To Submit A Schedule 1 2 And 3 Along With Your 1040 Tax Return Student Financial Aid

Solved 11040 Department Of The Treasury Intemal Revenue Chegg Com

Cryptocurrency Question On Irs Schedule 1 Background Part 1 Of 6 Cointracker

Total Income Form 1040 Decoded Physician Finance Basics

Rental Income Magi Income Line 37 Covered Ca

Over 150 Million Americans Must Report Crypto Taxes With Irs Update Cryptotrader Tax

Solved Complete Page 1 Through Line 8b Of Form 1040 For Chegg Com

Post a Comment

Post a Comment