Turn them into templates for numerous use incorporate fillable fields to gather recipients. Click to see full answer.

Tax Forms To File Income Tax To A Refund Editorial Photo Image Of Installments Calculation 141427091

Use Screen CAELF to enter the applicable data.

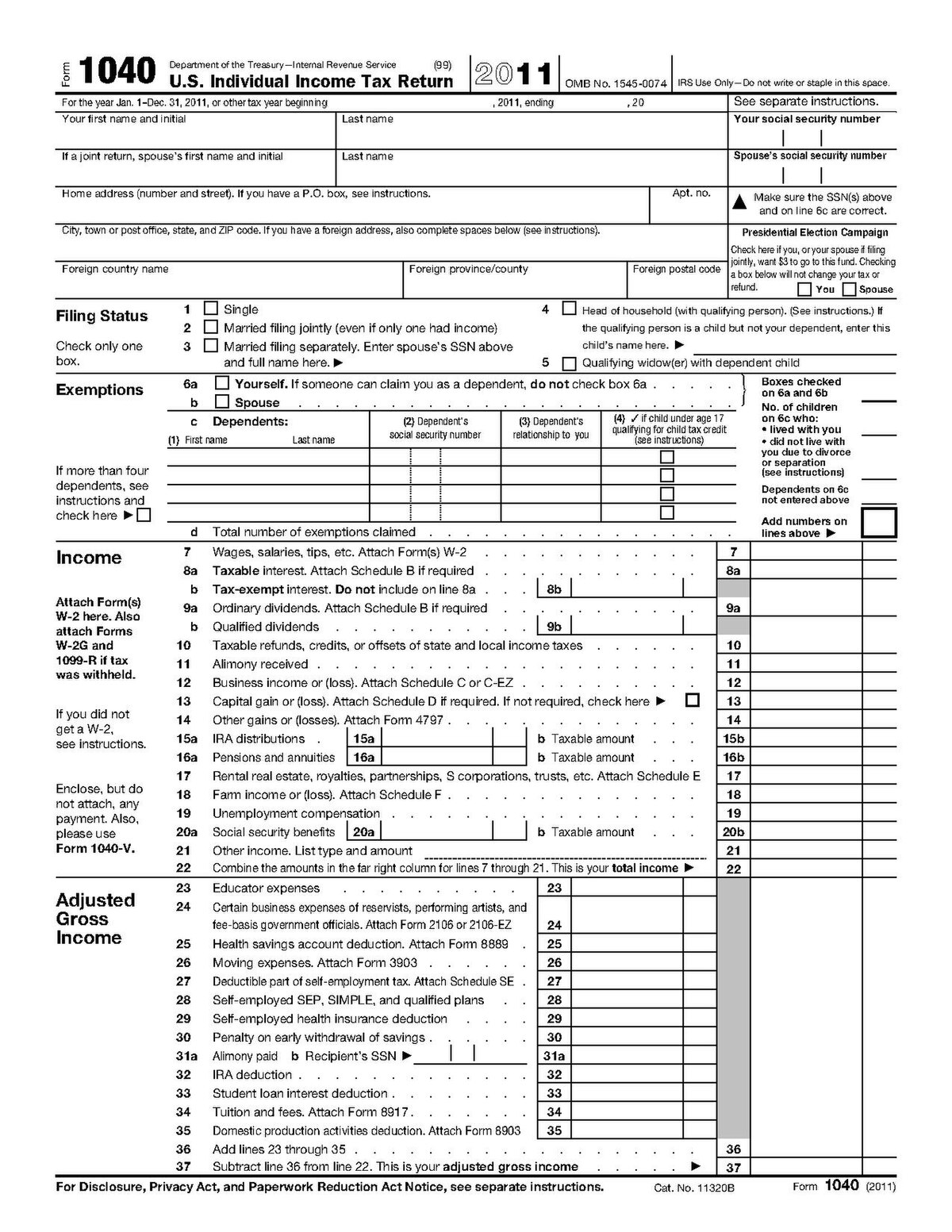

1040 form vs 8879. In section 2 - Paperless E-file enter a Y in field 1 to Use the practitioner PIN program. No 8879 is the e-signature authorization form and 1040 is the actual tax form. Form 1040 is also known as an USIndividual Income Tax Return.

Many types of these forms are available and the form used depends on the business type. Form 8879-C IRS efile Signature Authorization for Form 1120and Form 8879-S IRS efile Signature Authorization for Form 1120S. What Is a 1040 Form.

Purpose of Form Form 8879 is the declaration document and signature authorization for an e-filed return. Individual Income Tax Return. A 1040 form on the other hand is a tax return form that a taxpayer fills out.

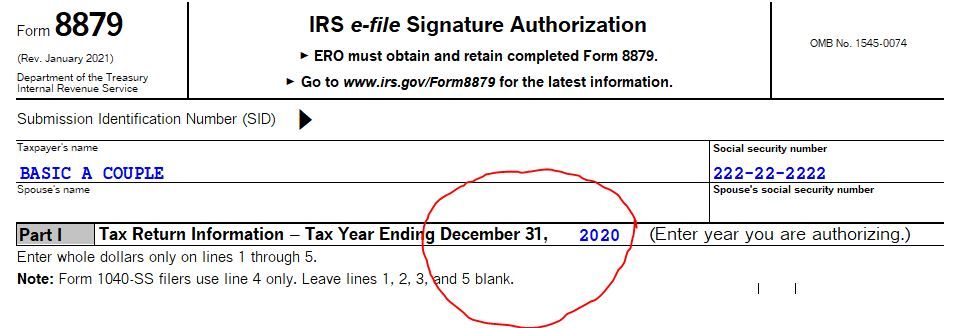

Form 8879 is an electronic signature document that is used to authorize e-filing. The taxpayer authorizes the ERO to enter or generate the taxpayers personal identification number PIN on his or her e-filed individual income tax. Form 8879 officially authorizes the Internal Revenue Service to accept a personal identification number on behalf of a business owner for aiding in paying business taxes.

If filing Form 1040-X the Form 8879 produced will also show a literal of Amended at the top and beside the taxpayers PIN signature lines to indicate that the Form is being signed to authorize e-filing of Form 1040-X. Then in field 2 enter a 5-digit self-selected PIN for taxpayer and a 5-digit self-selected PIN for spouse if applicable in field 3. Anyone can use the form 1040 because it is the general form but certain parameters need to be met in order to use the form 1040A.

If you have less than 100000 annual income then you can use the 1040A. The primary one is how much your income is. Form 8879-PE IRS efile Signature Authorization for Form 1065.

The Practitioner PIN method is used. File with Jackson Hewitt Tax Pro For Our Biggest Refund Guarantee. Taxable interest on investments.

This is the IRS e-file Signature Authorization required for filers of Form 1040 1040A Form 1040EZ or. The tax is then computed and the 1040 form is sent to the IRS. You can find your AGI on Line 1 of Part I.

Purpose of Form A fiduciary and an ERO use Form 8879-F when the fiduciary wants to use a personal identification number PIN to electronically sign an estates or trusts electronic income tax return and if applicable consent to electronic funds withdrawal. What is a 1040 tax form. Form 8879 vs 1040.

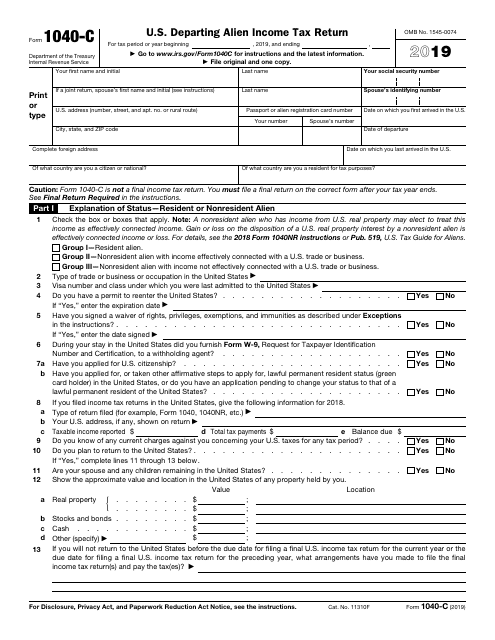

Form 8879 is used for Form 1040 US. January 2021 to authorize e-file of your Form 1040 1040-SR 1040-NR 1040-SS or 1040-X for tax years beginning with 2019. Signature - Form 8879 vs.

If its over 100000 then you must use the form 1040. Form 8879 is the declaration document and signature authorization for an e-filed return filed by an electronic return originator ERO. Do the job from any device and share docs by email or fax.

Form 8453 Using or suppressing taxpayer PIN. Taxpayers can calculate their deductions and future the amount they owe to the government. Use this Form 8879 Rev.

Subsequently one may also ask what is a 8879 form used for. Your 1040 form will also include. Form 8453 Using or suppressing taxpayer PIN California Franchise Tax Board allows individual taxpayers to sign an electronically filed return by using a PIN or a handwritten signature.

Go to General Electronic Filing worksheet. A 1040 tax form lets taxpayers fill out their annual tax return. You can read below about where to find your AGI.

If you are a resident of the US filling the form 1040 is compulsory if you meet the criteria. Complete this form when. Signature - Form 8879 vs.

If this is the second or third amendment the literal will change to say Amended 2 or Amended 3 respectively. Information put and request legally-binding digital signatures. At Jackson Hewitt We Get You Your Biggest Refund Guaranteed.

Make use of a electronic solution to generate edit and sign documents in PDF or Word format on the web. Since Form 8879 pulls the AGI value from Form 1040 it should work as long as it was the final version from the original filing. A fiduciary who does not use Form 8879-F must use Form 8453-FE.

Taxpayers include information such as their income deductions and credits using the 1040 form. View solution in original post. No 8879 is the e-signature authorization form and 1040 is the actual tax form.

Your standard or itemized deductions. The taxpayer along with listing other income sources includes income that is filled out on the 1099 forms that that person received. That is where the Form 8879 series comes in.

1040 California CA California Franchise Tax Board allows individual taxpayers to sign an electronically filed return by using a PIN or a handwritten signature. Form 1040 is the standard Internal Revenue Service IRS form that individual taxpayers use to file their annual income tax returns. No 8879 is the e-signature authorization form and 1040 is the actual tax form.

How do I generate Form 8879 in a 1040 return using worksheet view. It is a two-page document to report and file the income of small businesses and individuals. The latter form is for taxpayers living outside the United States.

Form 8879 is used to authorize the electronic filing e-file of original and amended returns.

Rightsignature Sign 2020 Complete Tax Return In 2021 Tax Return Signs Riverside Drive

The Differences Between Major Irs Tax Forms H R Block

Fillable Form 1040 Schedule R 2018 In 2021 Fillable Forms Form Schedule

Irs Courseware Link Learn Taxes

/ScreenShot2021-02-11at1.09.54PM-a0f5478dda0b440f99a2d4d10e61321e.png)

Form 1040 V Payment Voucher Definition

What Was Your Income Tax For 2019 Federal Student Aid

What Was Your Income Tax For 2019 Federal Student Aid

Solved 2020 1040 Form 8879 Intuit Accountants Community

The Differences Between Major Irs Tax Forms H R Block

Atx Tax Software Login Best Tax Software Tax Software Freeware

Post a Comment

Post a Comment