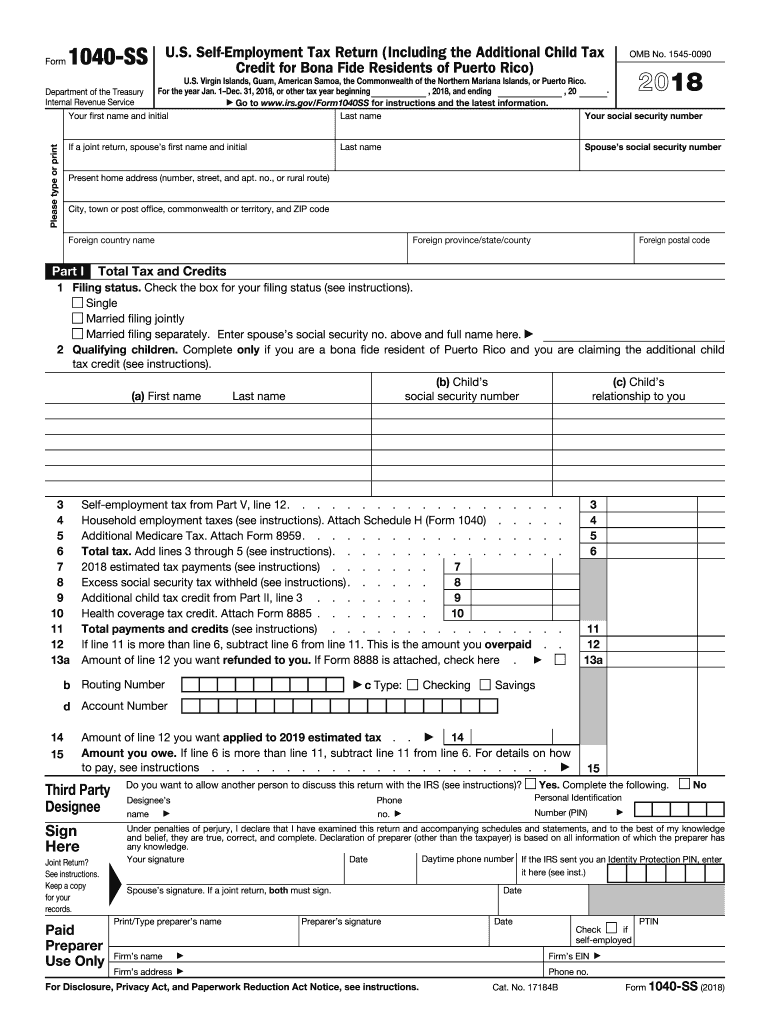

A Form 1040-A is a federal tax document used by certain individuals to complete their US federal taxes. Please note that while Form 1040 which is the return form for individuals relates to the previous year the estimated tax form Form 1040-EZ calculates taxes for the current yearAs far as the tax return under tax laws of Californa State is concerned the Schedule CA 540 Form is to be used for filing state income tax return.

What Is The 1040 And What S The Difference Between The 1040 1040a And 1040ez

Form 1040-EZ is a short-version tax form for annual income tax returns filed by single filers with no dependents.

1040 t tax form. The Form 1040 is one of the simplest forms available to accurately and completely file income taxes. Those who want to use this tax document also may not claim the alternative minimum tax AMT for stocks. It also allows the taxpayer to.

Form 1040 US. These changes eliminate the 1040a form and make it a schedule A attached to the newly designed 1040 tax form. The short forms are less complicated and provide only the necessary.

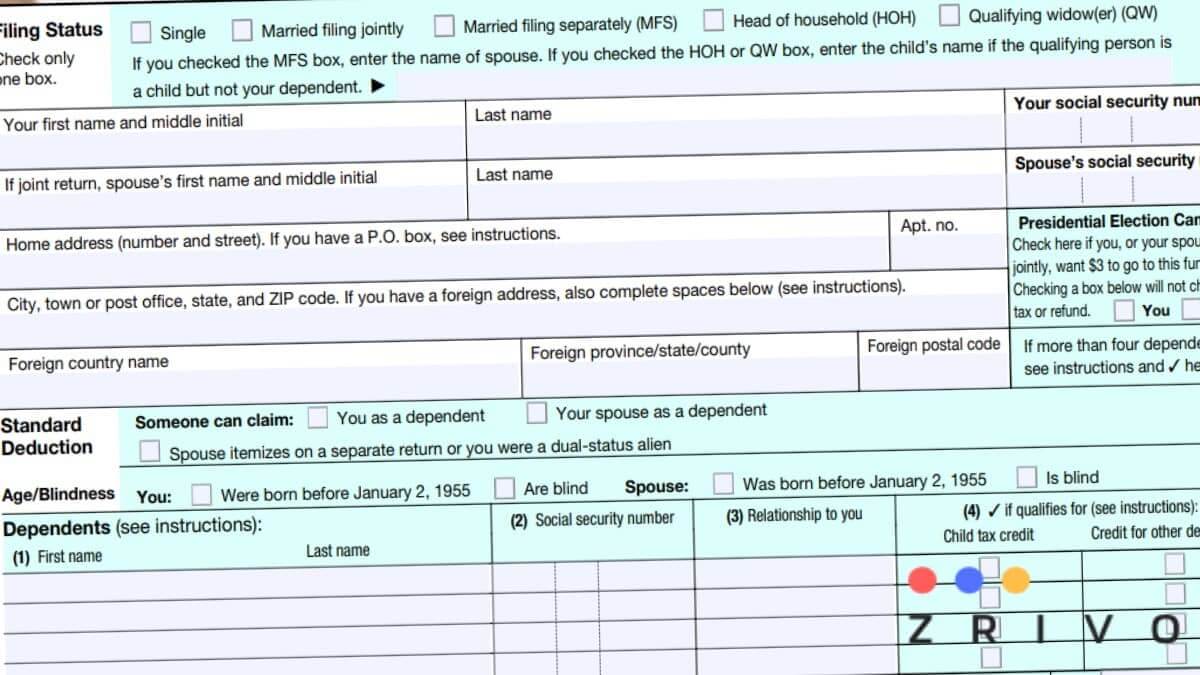

Individual income tax return. Married filing separately MFS Head of household HOH Qualifying widower QW. You may have received a Form 1040A or 1040EZ in the mail because of the return you filed last year.

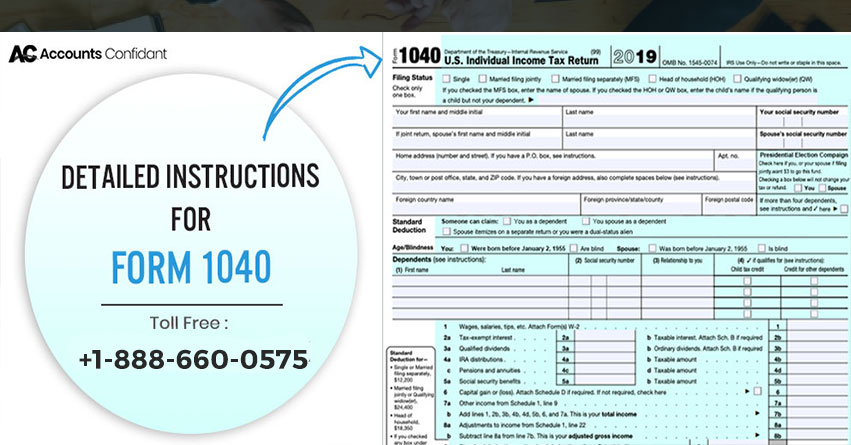

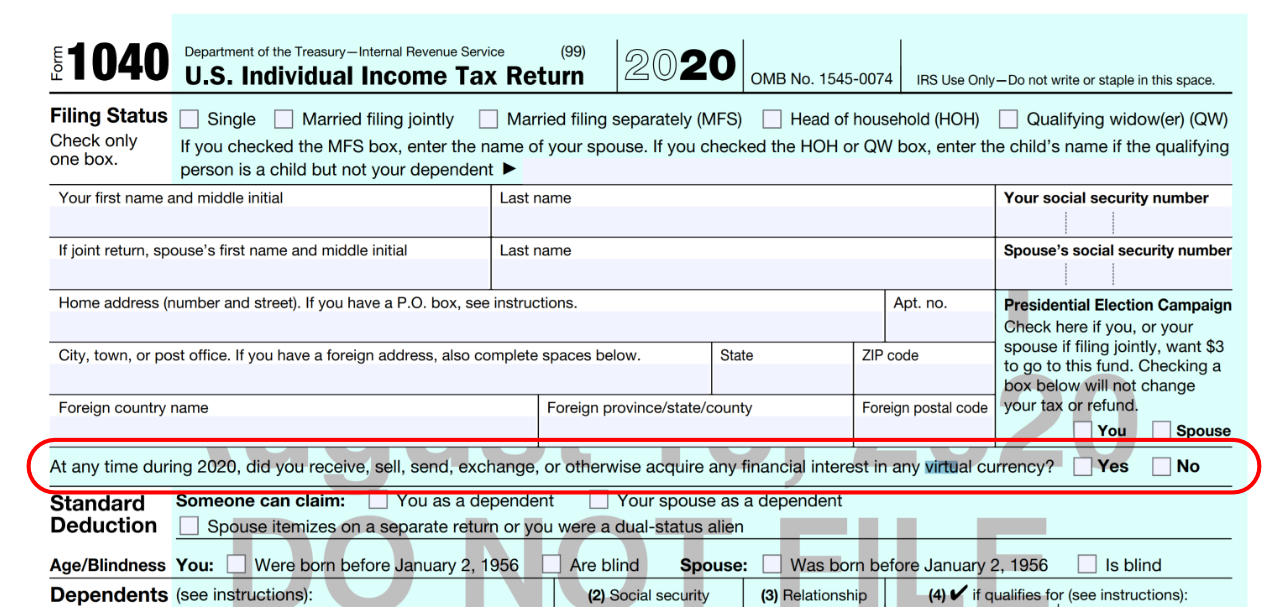

The Form 1040 is used for tax filing purposes. Form 1040 is a lengthy document consisting of nearly 100 lines that must be completed prior to submission. The new revision is a minor one to the crypto question.

It is also used to report the income of a deceased person or to amend or correct an individuals tax return. Your individual income tax return or known as a 1040 is the most important IRS tax form that youll use when filing your income tax by yourself. The Form 1040EZ is a simplified version of the tax return and the Form 1040A allows for additional adjustments to income and credits available.

Taxpayers to file an. Income tax return filed by. It allows the IRS to count the right amount of tax that should be withheld from the taxpayer and to reveal the debt or the need for tax refunds.

IRS Use OnlyDo not write or staple in this space. To use this form you must also use the standard deduction. 26 rows Form 1040 Schedule 2 Additional Taxes 2021 12032021 Form 1040 Schedule 2.

Individual Income Tax Return and it will be used by people who need to file their yearly income tax return. This form may only be used by individuals who make 100000 or less each year. Single Married filing jointly.

1040 Income or combined incomes over 50000 Itemized Deductions Self-employment income Income from sale of property If you cannot use form 1040EZ or Form 1040A you probably need a Form 1040. On the first page of the Form 1040 x youll fill out information about yourself your dependents and your income. Form 1040 is used by citizens or residents of the United States to file an annual income tax return.

The tax department has been working on cryptocurrency taxation rules for quite a long time and has previously modified the tax form in the past. Form 1040 is used by US. The new 1040 is a shorter version of the original and replaces the 1040ez and 1040a.

Check only one box. Jan - 2022 - 13 January. On the second page youll fill out information related to the tax deductions and credits that you qualify for.

A Form 1040 will. It is a universal form that can be used by any taxpayer. The IRS has made changes to the way we file our 1040 tax forms.

For Tax year 2018 and later you will no longer use Form 1040-A but instead use the Form 1040 or Form 1040-SR. Individual Income Tax Return 2021 Department of the TreasuryInternal Revenue Service 99 OMB No. You do not have any of the special filing situations described below.

Individual Income Tax Return The vast majority of taxpayers must decide between filing a federal form 1040 and a federal form 1040-EZ. File with Jackson Hewitt Tax Pro For Our Biggest Refund Guarantee. The form is known as a US.

And you choose to file a paper tax return try filing a short form. The 1040 form is a core document designed by the Internal Revenue Service to gather information about the taxable income of employees and other entities during the last tax year. The 1040 shows income deductions credits tax refunds or tax owed to the IRS.

The Form 1040 Form 1040A and Form 1040EZ are generally the forms US taxpayers use to file their income tax returns. The Individual Income Tax Return Form MO-1040 is Missouris. Individual Income Tax Return is an IRS tax form used for personal federal income tax returns filed by United States residents.

Form 1040 officially the US. You can use the 1040 to report all types of income deductions and credits. 1040ez Tax Form - If you are looking for an efficient way to prepare your taxes then try our convenient online service.

Form 1040 is the main tax form used to file a US. Form A is a hybrid of the Form 1040 and Form 1040EZ. Form 1040A is used by US.

The form will be received and recorded by the United States Internal Revenue Service. The form allows the taxpayer to claim either the standard deduction or itemized deductions and also to claim personal exemptions. File with Jackson Hewitt Tax Pro For Our Biggest Refund Guarantee.

At Jackson Hewitt We Get You Your Biggest Refund Guaranteed. At Jackson Hewitt We Get You Your Biggest Refund Guaranteed. Taxpayers to file an annual income tax return.

The Form 1040 is used to report an individuals tax liability to the United States Government. If you plan to itemize your deductions you must fill out and attach Schedule A to the new 1040 tax. The United States Internal Revenue Service has revised and finalized the 1040 tax form with new crypto-related questions.

The form calculates the total taxable income of the taxpayer and determines how much is.

Irs Form 1040 How To File Instructions Tips Due Date Penalities

Irs Releases Form 1040 For 2020 Tax Year Taxgirl

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Honey I Shrunk The 1040 Tax Return Don T Mess With Taxes

1040 Form 2019 Printable Fill Out And Sign Printable Pdf Template Signnow

Irs Releases Drafts Of 2021 Form 1040 And Schedules Don T Mess With Taxes

Tcja Changes Form 1040 And Your 2018 Tax Returns State Taxes Are Generally Unchanged Don T Throw Away Your Receipts Opelika Observer

What Was Your Income Tax For 2019 Federal Student Aid

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

Form 1040 U S Individual Tax Return Definition

What Is The New Irs 1040 Form 2021 2022

1040 Form 2021 1040 Forms Zrivo

Irs Prioritizes Cryptocurrency Now First Question On 1040 Tax Form Bitcoin News

Post a Comment

Post a Comment