If a charge or payment was made against the cash value of an annuity Qualified plans and section 403b plans. Complete the 403b Distribution Request Form and the Transaction Routing Request form.

Seven Form 1099 R Mistakes To Avoid Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

If you receive your forms by mail when applicable Forms 1099-DIV and Form 1099-B will be mailed in the same envelope.

1099 form 403 b. Qualified plans and section 403b plans. Section 403b plans and governmental section 457b plans insurance contracts etc are reported to recipients on Form 1099-R. Section 403b plans and governmental section 457b plans insurance contracts etc are reported to recipients on Form 1099-R.

403b7 TAX WITHHOLDING NOTICE The Unemployment Compensation Act of 1992 requires withholding of Federal Income Tax from 403b distributions unless the proceeds are being paid to another Retirement TrusteeCustodian in the form of a direct transfer or direct rollover. Qualified plans and section 403b plans. Calculate taxable income on IRS Form 1040 and statelocal tax returns.

If your annuity starting date is after 1997 you must use the simplified method to figure your taxable amount if your payer didnt show the taxable amount in box 2a. Most contributions to a 403 b plan are tax-deductible. WHY DID I RECEIVE MORE THAN ONE FORM 1099-R.

Yes the IRA custodian is required to have issued a Form 1099-R for a rollover from a traditional IRA to a 403 b. With the Withholding Notice below relating to distributions from 403bs. WHY DID I RECEIVE A FORM 1099-R.

Organizations to issue a Form 1099 to any individual or unincorporated business paid in excess of 600 per calendar year for services rendered. It is the responsibility of the treasurer to keep up with changes to taxes and reporting. Qualified plans and section 403b plans.

Form 1099-C. The IRS regulates the operation of 403 b plans which must conform to certain contribution and participation rules in order to maintain tax-deferred status. Be shown in box 7.

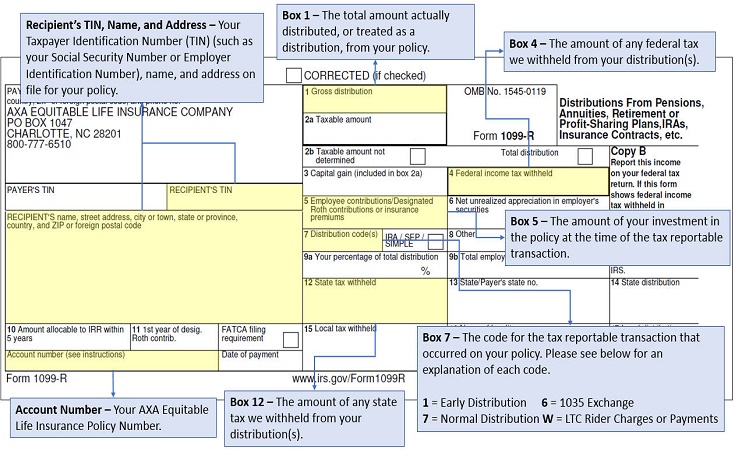

2020 1099-R Instructions for Recipient Generally distributions from retirement plans IRAs qualified plans section 403b plans and governmental section 457b plans insurance contracts etc are reported to recipients on Form 1099-R. 2018 1099-R Instructions for Recipient Generally distributions from retirement plans IRAs qualified plans section 403b plans and governmental section 457b plans insurance contracts etc are reported to recipients on Form 1099-R. Qualified plans and section 403b plans.

Form 1099 reports cancellation of debt. Only distributions are reportable on a 1099-R and thus a 403 b plan-to-plan transfer is NOT reportable on a 1099-R. If the rollover was a direct rollover paid from the IRA directly to the 403 b for your benefit the Form 1099-R must have the gross amount in box 1 a zero in box 2a code G in box 7 and the IRASEPSIMPLE box marked.

If your annuity starting date is after 1997 you must use the simplified method to figure your taxable amount if your payer didnt show the taxable amount in box 2a. Depending on the type of account of type of account you own and your account activity during the tax year you may receive a tax form from Fidelity. A 403b does not have this provision.

Completing Forms W-2 941 and 1099 The following information is based on reporting rules as of December 2010. If a recordkeeper issues a 1099-R for a 403 b plan-to. Below is an approximate availability of tax forms.

Qualified plans and section 403b plans. For Hardship and Disability Distributions additional. The OCA Pension Plan is a 401a and not a 403b.

If your annuity starting. Youll receive this information return if a lender forgives debt that you owe such as if you settled a 10000 credit card balance for 5000 and the lender forgave the other half. Form 1099-R reports distributions taken from your IRA Roth IRA SEP SIMPLE or 403b account during 2020.

The IRS takes the position that this forgiven debt counts as income. The Form 1099-R reporting your 403 b distribution will have the gross amount in box 1 the taxable amount in box 2a any after-tax amount in box 5 and code 7 in box 7. Distributions from retirement accounts are not treated as investment income.

You are responsible for determining the taxable amount of your IRA or 403b distributions from your mutual fund accounts. This is required whether these payments are spread out over the course of the year or are paid in one lump sum payment. You cannot make any more employee contributions aka elective deferrals into any 401k or 403b.

And c to report a distribution from a life insurance annuity or endowment contract and for reporting income from a failed life insurance contract. The 403b9 is the only defined contribution plan that includes the unique provision offering retired ministers the ability to have retirement distributions designated as housing allowance. B for a Roth IRA conversion if the participant is at least age 59 12.

Generally distributions from retirement plans IRAs qualified plans section 403b plans and governmental section 457b plans insurance contracts etc are reported to recipients on Form 1099-R. 1099-Consolidated For your convenience this form is used to deliver several types of 1099 including 1099-DIV 1099-B 1099-INT 1099-MISC and 1099-OID. A 403b9 is a defined contribution plan specifically designated for the unique needs of religious organizations.

If your annuity stating. If you completed a rollover from a 401k or other employee-sponsored plan in 2020 you will receive a 1099 but this is not necessarily taxable income. A 403 b plan is a type of tax-deferred retirement plan that is similar to the 401 k plans offered by many employers.

I understand the outstanding loan balance will be deemed a distribution and will generate tax Form 1099-R at the end of the year in. 2020 Form 1099-R IRS Instructions For Recipient Instructions for Recipient Generally distributions from retirement plans IRAs qualified plans section 403b plans and governmental section 457b plans insurance contracts etc are reported to recipients on Form 1099-R. They are not included in Part I of Form 8960.

403b DISTRIBUTION REQUEST FORM. A for a normal distribution from a plan including a traditional IRA section 401k or section 403b plan if the employeetaxpayer is at least age 59 12. The transaction for moving funds from one 403 b plan to another that is known as a plan-to-plan transfer does NOT involve a distribution of plan assets.

Since you have a 403b the 53000 limit 54000 for 2017 is therefore across all 403b and 401k accounts combined according to IRS Pub 571 chapter 3 not for each account like it is with just 401k. Please apply the information on filling out W2 forms beginning with tax year 2013. Trustee-to-trustee transfers are not considered distributions and therefore are not reportable to the IRS.

The taxable amount not determined box is generally marked for mutual fund accounts. This includes IRA distributions that were taken as a rollover. This form is generally not required to be issued to incorporated businesses.

1099 R Ira 403 B Tax Information Thrivent

What Exactly Is The 1099 Form And How Do You Fill It Out Pointcard

Coinbase 1099 What To Do With Your Coinbase Tax Documents Lexology

1099 Nec Or 1099 Misc What Has Changed And Why It Matters Pro News Report

Form 1099 R Distribution Codes For Defined Contribution Plans Dwc

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

403b Withdrawal Request Form Fill Online Printable Fillable Blank Pdffiller

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Irs Form 1099 R Which Distribution Code Goes In Box 7 Ascensus

Metlife Forms Withdrawal 403b Fill Online Printable Fillable Blank Pdffiller

Post a Comment

Post a Comment