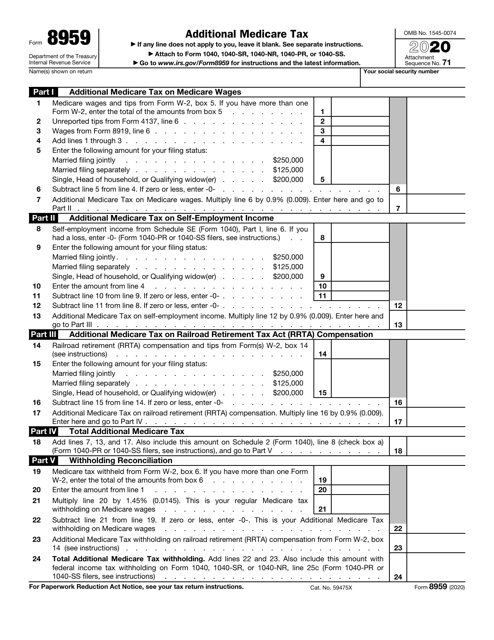

When filing a tax return the worker uses Form 8919 to calculate and report the employees share of uncollected Social Security and Medicare taxes due on their compensation. Remove the 1099-Misc self-employment income.

1099 Int 2017 Tax Forms 1099 Tax Form Irs Forms

Fill out forms electronically working with PDF or Word format.

1099 form 8919. Wage and Tax Statement or Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Ins. Form 8919 Department of the Treasury. The 1099 is specifically for a type of worker called an independent contractor and the W-2 is designed for traditional employees.

In the 2020 tax return I was able to generate the employee side of your payroll taxes but it was reported on IRS Form 1040 Schedule SE not IRS Form 8919. The valid codes are. A - The person has filed Form SS-8.

Form 1099-MISC lists the workers wages. You must remove the link that is not applicable. Save forms on your personal computer or mobile device.

The valid codes are. Workers can file and. An independent contractor receives Form 1099-MISC each year.

For each firm listed on Form 8919 or each Form 1099-NEC with an entry in box 7 that is reported on Form 8919 a reason code must be entered. Uncollected Social Security and Medicare Tax on Wages 2019 Form 8919. This code identifies the reason for filing Form 8919.

The amount on Form 1099-MISC should have been included as wages on Form W-2. Due to the widespread problem of employees getting 1099-MISCs from their employers instead of W-2s the IRS created a new form in 2007 the Form 8919Using this form has saved employees thousands of dollars while protecting their Social Security records and their tax status. Uncollected Social Security and Medicare Tax on Wages 2020 Form 8919.

At tax time employees should receive Form W-2 from their employer. As a 1099 independent contractor it is your responsibility to pay all your Medicare and Social Security taxes. Anything that was paid to the recipient of the 1099 should be on the 1099.

For each firm listed on Form 8919 or each Form 1099-MISC with an entry in box 7 that is reported on Form 8919 a reason code must be entered. How to fill IRS 1099-MISC 2022. A - The person has filed Form SS-8 and received a determination letter stating that I am an employee of this firm.

Filling out Form 8919 will permit one to credit all social security income to ones social security account. If the Form 8919 should not be present in the return and the Non-employee compensation should flow to 1040 Line 21 as other income. You can only use Form 8919 if one of the following factors applies to your situation.

Income Uncommon Income Other Income Form 8919 is used to report your share of uncollected Social Security and Medicare taxes due on your compensation if you were an employee but were treated as an independent contractor by your employer. Form 1099-NEC worksheet company name of company that paid me. Answer 1 of 6.

Uncollected Social Security and Medicare Tax on Wages 2018 Form 8919. Since Box 6 amounts are normally reportable on Schedule C for an individual they would most likely be part of the compensation referred to by Form 8919. Both forms record the amounts of money the respective individuals earned but they differ to reflect the type of work each person performed for the company and their professional relationship with that business.

Again what matters is reporting on Form 8919 compensation received if you were an employee but were treated as an independent contractor by your employer. It is then up to the recipient to break out their costs on the Cost of Goods Solds and the other expense portion of the filing. A link to Schedule C and a link to either Schedule F Form 8919 Wages or Other Income Statement have been selected to report nonemployee compensation.

Make them reusable by generating templates include and fill out fillable fields. H- I received a Form W-2 and a form 1099-MISC from this firm for 2016. Approve documents with a legal electronic signature and share them by using email fax or print them out.

If you choose to report nonemployee compensation as wages on the 1040 the 8919 is required. Eliminates common costly errors from pdf forms. Uncollected Social Security and Medicare Tax on Wages 2021 Form 8919.

Provide the most recent copy of each workers 1099 form if one has been filed. Form 8919 is used by certain employees to report uncollected social. Download or print the 2021 Federal Form 8919 Uncollected Social Security and Medicare Tax on Wages for FREE from the Federal Internal Revenue Service.

This code identifies the reason for filing Form 8919. Workers must file Form 8919 Uncollected Social Security and Medicare Tax on Wages if they did not have Social Security and Medicare taxes withheld from their wages. You must also complete form 8919 and attach it to your return.

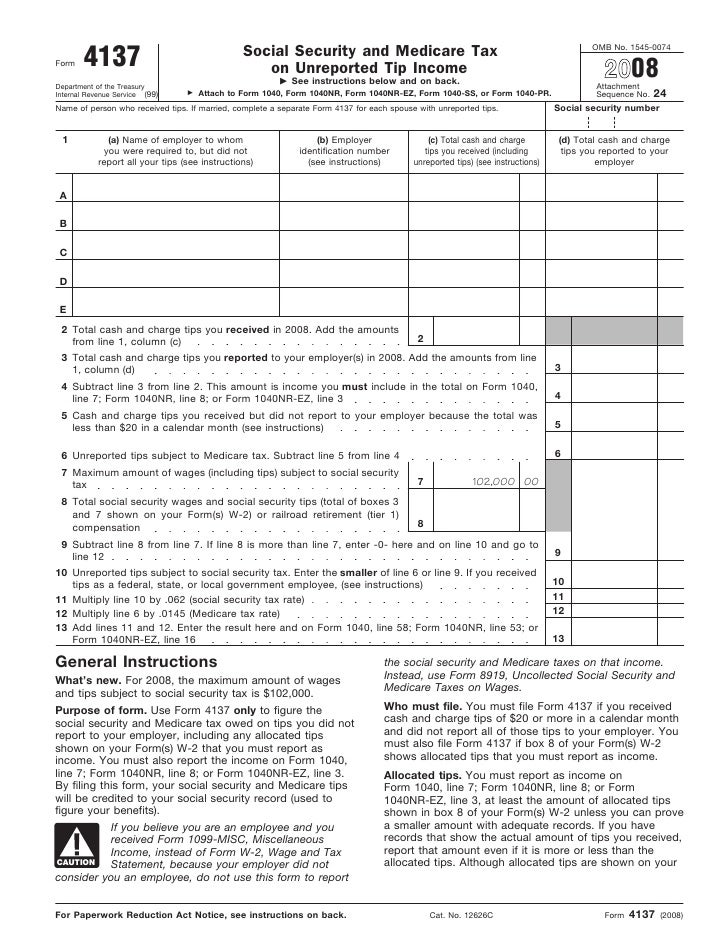

Received a W-2 and a 1099-MISC from one firm in the same tax year and the amount on the 1099-MISC should be included on the W-2 as wages Dont use Form 4137 Prior to the introduction of Form 8919 workers may have used Form 4137 to report Social Security and Medicare amounts. Only one can be selected. Increase your efficiency with effective.

Do not have 2017 tax return readily available to test. Choose online fillable blanks in pdf and add your signature electronically. Income Business Income Form 1099-NEC 1099-MISC Menu Path.

This form was developed in 2007 for workers who believe an employer improperly classified them as independent contractors. In short Form 8919 is used to record the amount of unpaid Social Security and Medicare payments owed to you as compensation if you were an employee but your employer treated you as an independent contractor. IRS Form 8919.

When there is an amount shown on your Form 1099-MISC in Box 7 youre typically considered self-employed. Your Clients 1099 Should Have Been a W-2 By Eva Rosenberg EA. Use the IRS Form 8919 to report and determine your share of uncollected taxes due as if you were an employee rather than an independent contractor.

If a 1099-MISC has income entered in Line 7 - Non-employee compensation and the 1099 is coded as SE income the income will flow to the Form 8919 - Uncollected Social Security and Medicare Tax on Wages and then to the 1040 Line 7 as wages. You add this income. Click Jump to 8919.

On Form 1099-MISC andor 1099-NEC that should be reported as wages on Form W-2 include employee bonuses awards travel expense reimbursements not paid under an accountable plan scholarships and signing bonuses. If youve received a 1099 Form instead of an employee W-2 your company is treating you as a self-employed workerThis is also known as an independent contractor. The date of.

Information about Form 8919 Uncollected Social Security and Medicare Tax on Wages including recent updates related forms and instructions on how to file.

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Fillable Forms Irs Forms 1099 Tax Form

1099 Form Employee Type H R Block

What Is Form 8919 Uncollected Social Security And Medicare Tax On Wages Turbotax Tax Tips Videos

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service Meeting Agenda Template Irs Forms 1099 Tax Form

25 Free Form 1099 Misc Simple Best Form Amp Map Picture In 1099 Template 2016 Free 55004 Tax Forms 1099 Tax Form Templates

How To Classify Workers As Employees Or Contractors Cpa Practice Advisor

Irs Form 8959 Download Fillable Pdf Or Fill Online Additional Medicare Tax 2020 Templateroller

Form 8919 Uncollected Social Security And Medicare Tax On Wages

Form 1 Nec Worksheet A Link To Schedule C Five Things You Probably Didn T Know About Form 1 In 2022 Training Schedule Worksheets Schedule

Form 4137 Social Security And Medicare Tax On Unreported Tip Income

If You Are Looking For Tax Services In Washington Dc We Help You Stay Focused On Your Success Of Income Tax Situat Tax Services Tax Help Income Tax Preparation

Post a Comment

Post a Comment