Department of the Treasury - Internal Revenue Service OMB No. If you file 100 or more 1099 returns with the IRS FIRE Production.

The Streeb Greebling Diaries It S All Maths Fibonacci Fibonacci Spiral Fibonacci Sequence

It is asking the info on a 1099-G form that I do not have and can not recall receiving.

1099 form ga. A copy of Form 1099-NEC must be submitted to the independent contractor and the IRS no later than January 31 2021. Use PDF signer to sign documents online with no need to travel to collect signatures. January 31 2022 for Without Tax Withheld.

Unemployment Insurance UI Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Extended Benefits EB Federal Pandemic Unemployment Compensation FPUC and Lost Wages Assistance LWA. January 31 2022 for Georgia State Taxes withheld for 1099-NEC and 1099-R. Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc.

Until 2019 payers used Form 1099-MISC to report miscellaneous payments made to contractors including non employee compensations in Box 7. Can I contact this entity. Form 1099 is a collection of forms used to report payments that typically isnt from an employer There are a variety of incomes reported on a 1099 form including independent contractor income but also for payments like gambling winnings rent or royalties gains and losses in brokerage accounts dividend and interest income and more.

File with Form 1096. 1099 Form FAQs What Is the 1099 Form Used for. File the state copy of form 1099 with the Georgia taxation agency by February 28 2021 January 31 in some cases.

It is not letting me continue because of this. The 1099-G form is used to report taxable benefits when filing with the IRS for anyone who was paid unemployment benefits or Alternative Trade Adjustment Assistance payments during the calendar year January 1 to December 31. Taxpayers now can search for their 1099-G and 1099-INT on the Georgia Tax Center by selecting the View your form 1099-G or 1099-INT link under Individuals.

Every year we send a 1099-G to people who received unemployment benefits. The State of Georgia requires Form 1099-NEC to be filed only if there is state withholding. Form 1099 - 1099-NEC 1099-MISC 1099-INT 1099-DIV 1099-R 1099-B 1099-G 1099-K 1099-PATR.

The Gig Wage platform is designed for innovators who want a simplified way of managing contractor payments so they can recruit and retain world-class 1099 talent. I authorize the State of Georgia to deposit payment for goods andor services received into the provided bank account by the Automated Clearing House ACH. Georgia State 1099 Filing Information.

Box 105685 Atlanta GA 30348-5685. Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to-use intuitive interface to fill out Georgia 1099 Misc Form online e-sign them and quickly share them without jumping tabs. When filing state copies of forms 1099 with Georgia department of revenue the agency contact information is.

1099-MISC 1099-NEC and 1099-R. The Georgia Department of Revenue mandates the filing of the 1099 Forms only if there is a state tax withholding. Make sure you double-check your Form 1099-G even if you did claim and receive unemployment insurance benefits.

Form 1099 1099-MISC 1099-NEC 1099-K 1099-B and 1099-R Form W2 - Wage and Tax Statements. The 1099 form is used to report non-employment income to the Internal Revenue Service IRS. We also send this information to the IRS.

If you file 250 or more 1099 forms with Georgia you must file electronically. It is important to note that Atlanta companies should continue to use Form-1099 MISC to report payments to individuals and businesses for any of the following purposes. Ad The best PDF signer to complete contracts and send them to clients for final e-signature.

Does Georgia require the filing of Form 1099-NEC. Georgia requires that all 1099 forms be filed by February 28th. Georgia 1099 filers must send the 2020 1099 state copy to the GA department of revenue by February 12021.

TaxBandits supports the filing of Form 1099 with both the Federal and State of Georgia. Some of the 1099 forms are listed below. What states require a copy of 1099-Misc.

February 28 2022 for Georgia State Taxes withheld. For Individuals the 1099-G will no longer be mailed. Deadline to File Georgia Filing Taxes.

If you file 250 or more 1099 forms with Georgia you must file electronically. Who else might know if I actually was sent a 1099-G. Printing and scanning is no longer the best way to manage documents.

The Form 1099-NEC has been reintroduced for the tax year 2020 to report nonemployee compensation made to independent contractors including royalties rent and more. Out of the box Gig Wage gives you ready-to-go payroll and payments infrastructure. I further acknowledge that this agreement is to remain in full effect until such time as changes to the bank account information are submitted in writing by the vendor or individual named below.

When filing federal copies of forms 1099 with the IRS. You received a Form 1099-G reporting in Box 1 unemployment insurance benefits that you never received or an amount greater than what you actually received during the year. Georgia Department of Revenue Processing Center P.

What to be filed. Ad The best PDF signer to complete contracts and send them to clients for final e-signature. For Privacy Act and Paperwork Reduction Act Notice see the.

Copy A For Internal Revenue Service Center. 1099-G Form 2 Answers Hi I am using the HR block basic on-line program to file my taxes. The 1099-G tax form includes the amount of benefits paid to you for any the following programs.

The amount showing in Box 1 might be overstated if your identity was. Handy tips for filling out Georgia 1099 Misc Form online. File the following forms with the state of Georgia.

The 1099 forms that reflect Georgia income tax withholding must be submitted to the state. Use PDF signer to sign documents online with no need to travel to collect signatures. Unemployment Insurance Payments IRS Form 1099-G are issued by the Georgia Department of Labor.

The Fed copy A must be filed by Monday February 12021.

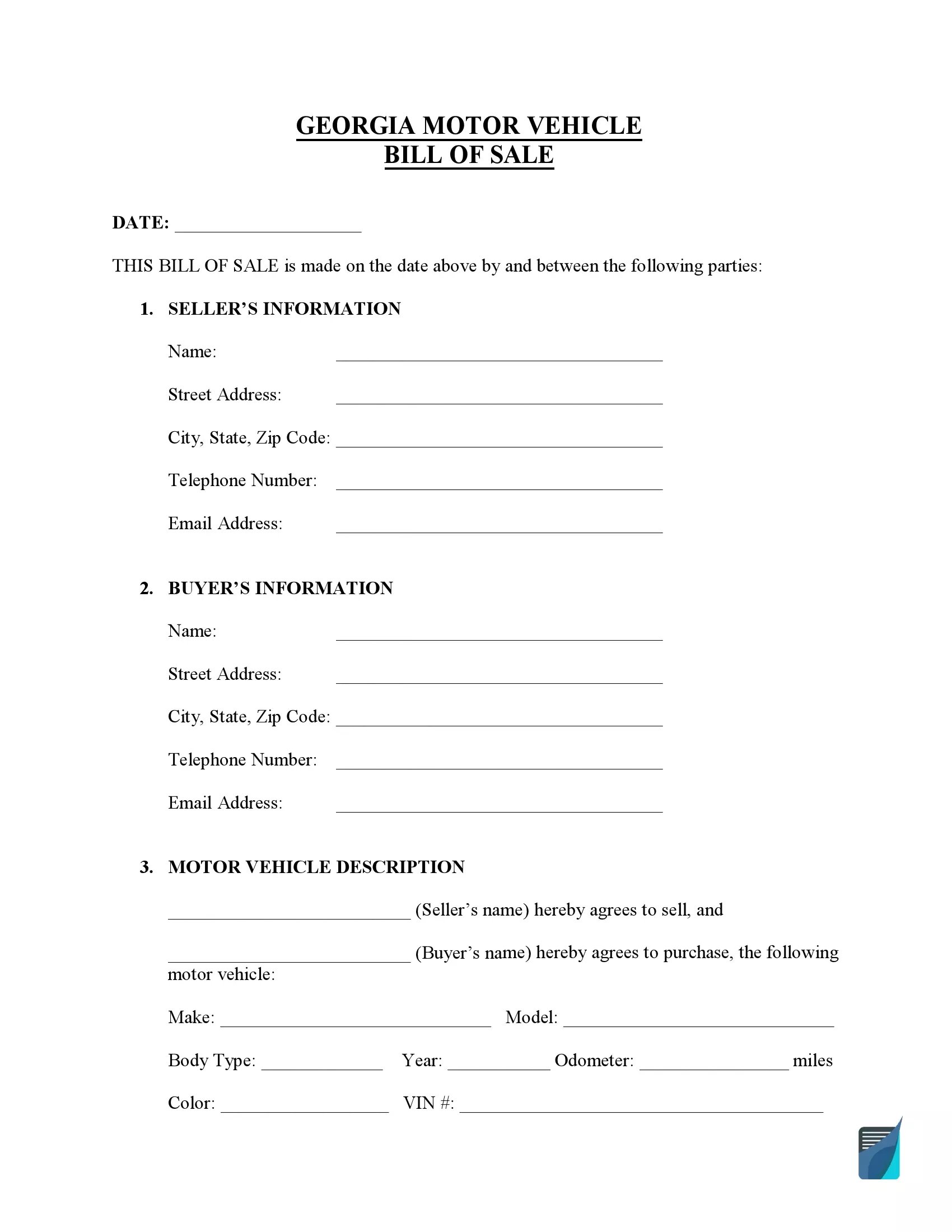

Free Georgia Bill Of Sale Forms Formspal

Georgia Tax Forms 2019 Printable State Ga Form 500 And Ga Form 500 Instructions Tax Forms Estimated Tax Payments Income Tax Return

Pin By Freda Baker Sims On Delta Diagram Floor Plans Visualizations

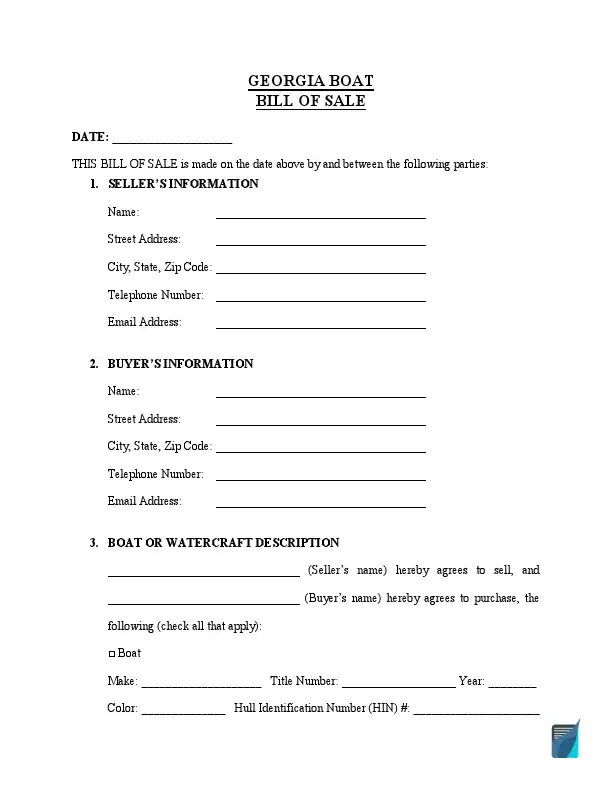

Free Georgia Boat Bill Of Sale Form Pdf Formspal

Georgia W2 Form Fill Online Printable Fillable Blank Pdffiller

Ga Preparing Form G 1003 For E File Cwu W2 W3

Ga How To E File Quarterly Tax And Wage Report Cwu

Ryzen Small Form Factor Fans Rejoice Gigabyte Introduced The Ga Ab350n Gaming Wifi Mini Itx Am4 Motherboard At Computex Joining The Gigabyte Motherboard Wifi

Netspend Direct Deposit Form The Shocking Revelation Of Netspend Direct Deposit Form Reading Lesson Plan Template Quickbooks Reading Lesson Plans

.jpg)

Post a Comment

Post a Comment