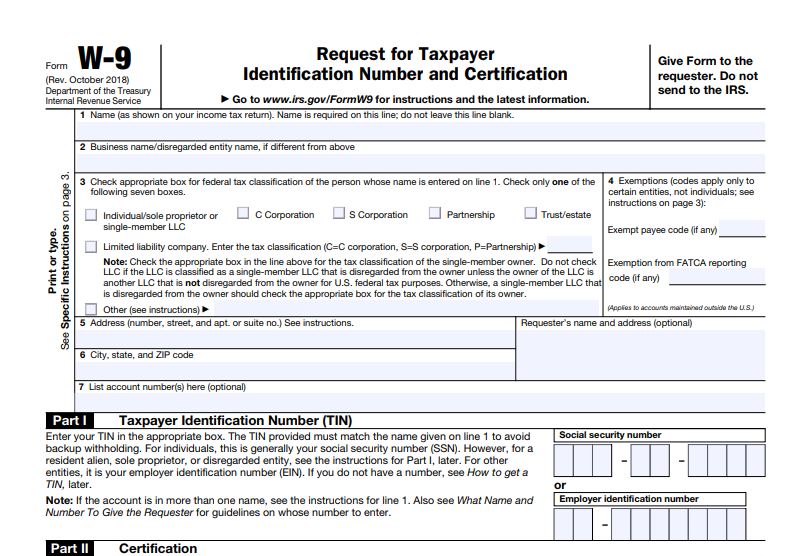

Properly completed signed Form W-9 to you with Applied For written in Part I. Once youve applied or if you plan on applying right away you can write Applied For in the space for the TIN sign and date the form as you normally would and give it to the requester.

A C Moore Fundraising Events Fundraising Fundraise

If you are requested to complete a Form W9 pay particular attention to these.

How to fill out a w9 if you are a 501c3. Person and enter the date to certify that the information you entered is accurate and that under IRS regulations your nonprofit is not subject to backup withholding because your nonprofit is. Here is how you should fill it out. Sign and Date the W-9 Sign the form next to the words Signature of US.

Name your nonprofit Every state in the United States has different rules and regulations when it comes to establishing a nonprofit. We are 501c3 organization and service the poor. If you have applied for an EIN but have not received it yet you can write applied for on the W-9 form.

The recipients are being asked to fill out a W9 form. To complete a W-9 tax form start by accessing the form on the IRS website or requesting one from your client if you dont already have one. Leave it blank unless you are conducting business under a registered trade name.

Sign and Date the W-9 Sign the form next to. The Internal Revenue Service classifies nonprofit corporations as being tax-exempt but it requires them to complete a W-9 Form Request for Taxpayer Identification Number and Certification if they provide services to another business. Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document.

Fill Out Your W-9 The Right Way - Avoid Errors W Our Form Building Software - 100 Free. If a landlord refuses to provide us with a completed W9 form can we still pay the landlord fo. A step-wise guide to help you fill out Form W-9 easily.

If you do not receive the payees TIN at that time you must begin backup withholding on payments. BASIC INSTRUCTIONS FOR FILLING OUT AN IRS W-9 FORM. All income are in the form of donations.

This is an awaiting-TIN certificate. As businesses accelerate their vendor onboarding processes they need to verify the tax details of the vendors. In line 5 enter your address.

Otherwise youre an unincorporated association which you would then list on the other line. Name of the organization Line 3. When you fill out the W-9 you are required to enter the legal name of your nonprofit the tax-exempt code under which your corporation operates which is usually a 501 c 3 your organizations business address and your Taxpayer Identification Number.

If you intend to start a 501c3 expect to pay between 275 if you fill out the simpler Form 1023-EZ and 600 for the more complex Form 1023 which has more detail. If the browser you are using doesnt allow you to type directly into the W-9 form then save the form to your desktop and reopen. 2 File With IRS Online - Instantly.

Someone should have a copy of the Articles of Incorporation filed with your state for you to be able to figure that out. Sign and date the certification. If your organization operates under a name different from its registered name enter that name here.

If you still havent received or applied for your TIN you can write the word Pending in the space provided. Once you have the form enter your basic personal information like your name and address. If you still havent received or applied for your TIN you can write the word Pending in the space provided.

The W-9 form is an informational reporting tax form meaning that it provides information to the IRS about taxable entities. Usually this means you have 60 days to provide your TIN to whoever requested a. Taxpayer identification number or TIN along with the name of the vendor business address and other information is requested through Form W-9.

Lines 1 and 2 Put your name or business name exactly as you file your taxes. 324 C Avenue Swoyersville PA 18704 City state and ZIP code List account numbers here optional Part I Taxpayer Identification. The payee has 60 calendar days from the date you receive this certificate to provide a TIN.

X C-Corporation or - Answered by a verified Financial Professional We use cookies to give you the best possible experience on our website. If someone incorporated your organization in whatever state youre located in youre a corporation. Get and Sign How to Fill Out a W9 for a Church Form.

Enter the name of your nonprofit corporation as it appears in your Articles of Incorporation. If you are paid and file taxes under your business name please put it exactly as it is on your tax return and put the appropriate number in Part I that you use when you file. Or suite no Requesters name and address optional PM Investment Foundation Inc.

Keep in mind that youll need to fill out a W-9 for every client you worked for and made 600 or more. We are a 501c3 corporation we are filling out form W-9 Not sure which box to check. Fill in the words nonprofit corporation in the blank provided along with the IRS Code that applies to your organization.

Typically for nonprofits this is code 501c3. If you are using the services of an independent contractor or freelancer youll need to have them complete the form and then keep it in your files for reference at tax time. Do 501c3 fill out W9.

Do not fill in the boxes for a Social Security number. If you are a business owner who has contracted with an individual or another company to do work for you then you may need to have them fill out a W9. Once you have an EIN enter that number in the boxes on the W-9 form.

Select OTHER and then write in nonprofit corporation. Refer to the instructions provided with Form W-9 for the appropriate code to use if you believe your business is exempt from potential backup withholding. Those who should fill out a W 9 are those who are working as independent contractors or freelancers because the W-9 is the form used by the IRS to help gather information about such workers.

If you do not fall in any of the categories listed in the instructions for form W-9 you are not required to provide that form. If you have already provided the requester an address and this is a new address write new at the top. A company can only request you to fill out form W-9 if they need to file an information return on you form 1099 or 1098.

Ccorporation Ppartnership Other see instructions Exempt payee Address number street and apt.

How To Fill Out A W 9 For Nonprofits Step By Step Guide

Exempt From Backup Withholding What Is Backup Withholding Tax Community Tax

What Is A W 9 Business Attorney Nonprofit Attorney

W9 Writeable 2021 In 2021 Irs Forms Tax Forms Calendar Template

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

How To Fill Out A W 9 For Nonprofits Step By Step Guide

How To Fill Out A W 9 For A Nonprofit Corporation Legalzoom Com

Printable W 9 Federal 2021 In 2021 Tax Forms Irs I 9 Form

W9 Form Basics For Small Business Owners Small Business Trends

How To Complete An Irs W 9 Form Youtube

Learn How To Fill Out A W 9 Form Correctly And Completely

/ScreenShot2021-02-09at11.45.57AM-685a3de0020a41b7a4b15d2226d2a93b.png)

Post a Comment

Post a Comment