Schedule D Form 8949 - Capital Gains and Losses FAQs. What is a 1099-B.

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Otherwise use the table below to enter form information on the appropriate input screens.

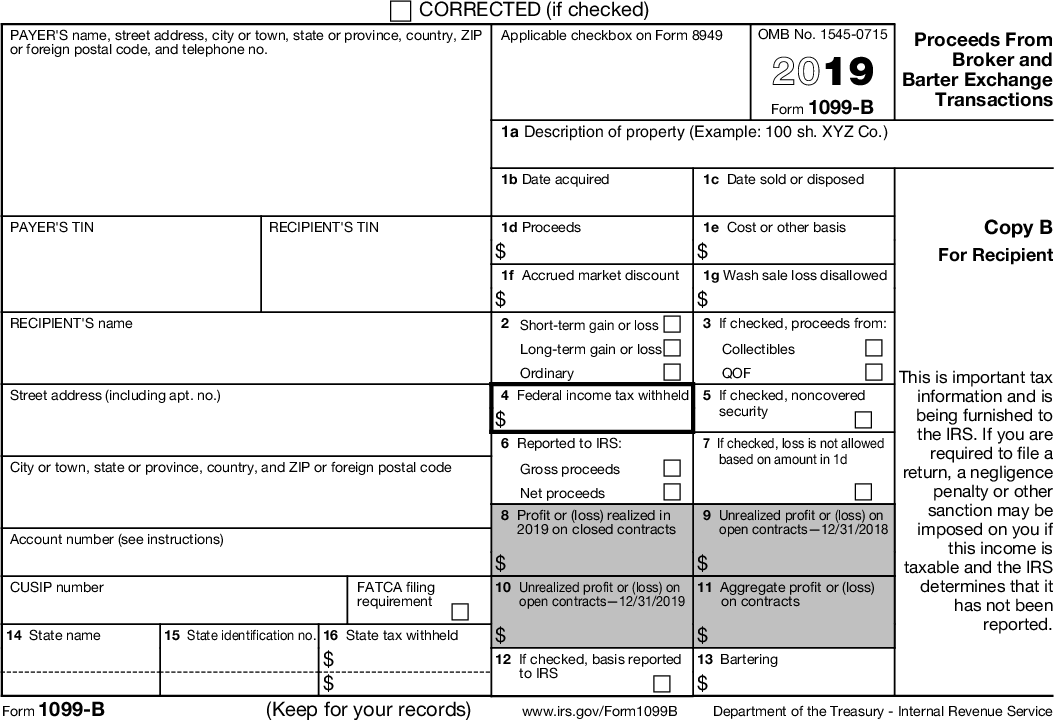

U.s. form 1099-b. You would use this information to complete Schedule D and possibly Form 8949 as well. It lists earnings and losses from brokered or bartered transactions such as the sale of stocks or bonds or the exchange of goods and services via trade over a. Form 1099-B is a document used by the Internal Revenue Service IRS a federal agency that collects and processes tax payments in the US to record income other than salaried wages.

The form lists the gains or losses of all broker or barter exchange transactions. You can enter this form information using the UltraTax CS Source Data Entry utility. It includes information about transactions of property or securities that were handled by a broker.

The Form 1099-B is also known as a Proceeds from Broker and Barter Exchange Transactions form. See the Instructions for Form 8938. This form will be used for tax filing purposes by the Internal Revenue Service in the United States.

Form 1099-B data entry. Form 8949 details Sales and Other Dispositions of Capital Assets. Wash sale data entry.

Otherwise use the table below to enter form information on the appropriate input screens. If you check box 5 you may leave boxes 1b 1e and 2 blank or you may complete. Form 1099-B data entry.

You may check box 5 if reporting the noncovered securities on a third Form 1099-B. Account for chapter 4 purposes as described in Regulations section 11471-4d2iiiA. Otherwise use the table below to enter form information on the appropriate input screens.

When you sell something for more than it cost you to acquire it the profit is a capital gain and may be taxable. At this time cryptocurrency is classified as property. Box C - Transactions that are not reported on 1099-B Due to the design of Form 8949 and the IRS matching program it is important that the Form 1099B column accurately reflect the transactions situation ie was a 1099-B issued how was it reported etc.

Brokers and barter exchanges must mail 1099-B forms by January 31. Applicable Checkbox on Form 8949. You may also have a filing requirement.

Alerts and notices Leave Feedback. On this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code. Complete IRS 1099-B 2021-2022 online with US Legal Forms.

The US tax form 1099-B provides transactional information detailing capital gains and losses from disposing of capital assets. At this time cryptocurrency is classified and treated as property. Blank 1099 forms and the related instructions can be downloaded from the IRS website.

Save or instantly send your ready documents. Schedule D - Transactions reported on Form 1099-B showing basis was reported to the IRS and no adjustment is required Due to the design of Form 8949 and the IRS matching program it is important that the 8949 Box column accurately reflect the transactions situation such as it was a 1099-B issued how was it reported etc. If your number of transactions is greater than 2000 attach a summary totals statement to represent each brokerage statement.

See your tax return instructions for where to report. At this time cryptocurrency is classified as property. Sometimes the individual sections of the composite forms do not include all of the information that is available on a standard 1099 form such as the check boxes for short-term and long-term transactions on the standard 1099-B form.

The TaxAct program allows you to enter up to 2000 items on Form 1099-B for capital gain and loss transactions. About Publication 1179 General Rules and Specifications for Substitute Forms 1096 1098 1099 5498 and Certain Other Information Returns. The following table provides information for each variant.

About Publication 542 Corporations. Sale of the noncovered securities on a third Form 1099-B or on the Form 1099-B reporting the sale of the covered securities bought in April 2021 reporting long-term gain or loss. The US tax form 1099-B provides transactional information detailing capital gains and losses from disposing of capital assets.

Form 1099-B data entry. The US tax form 1099-B provides transactional information detailing capital gains and losses from disposing of capital assets. You can enter this form information using the UltraTax CS Source Data Entry utility.

Form 1099 is also used to report interest 1099-INT dividends 1099-DIV sales proceeds 1099-B and some kinds of miscellaneous income 1099-MISC. Wash sale data entry. Proceeds From Broker and Barter Exchange Transactions is an Internal Revenue Service IRS tax form that is issued by brokers or barter exchanges.

The information on Form 1099-B helps you fill out Schedule D and Form 8949. Proceeds from Broker and Barter Exchange is a federal tax form used by brokerages and barter exchanges to record customers gains and losses during a tax year. Online Ordering for Information Returns and Employer Returns.

Shows your total compensation of excess golden parachute payments subject to a 20 excise tax. The information on Form 1099-B helps you fill out Schedule D and Form 8949. Payer that is reporting on Form 1099-B as part of satisfying your requirement to report with respect to a US.

A form issued by a broker or barter exchange that summarizes the proceeds of all stock transactions. In addition check the box if you are a US. Specifically figures from form 1099-B are used on IRS Form 1040 Schedule D.

The sale of a stock will be accompanied by a gain or loss which must be reported to the IRS when you file your taxes. It is used to report the proceeds from these types of transactions on the yearly tax return forms. Instead of entering each sales transaction individually list the details of each sale on a statement similar in format to Form 8949 Sales.

Easily fill out PDF blank edit and sign them. You can enter this form information using the UltraTax CS Source Data Entry utility. This form deals with capital gains tax.

All Form 1099-B Revisions.

1099 Div Software To Create Print E File Irs Form 1099 Div

1099 B Software To Create Print E File Irs Form 1099 B

1099 B Noncovered Securities 1099b

Deciphering Form 1099 B Novel Investor

/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png)

Form 1099 Div Dividends And Distributions Definition

What Are The Requirements To Not Report All Stock Transactions On The Tax Return 1099 B Personal Finance Money Stack Exchange

1099 B Form 4 Part Carbonless Discount Tax Forms

1099 B User Interface Proceeds From Broker And Barter Exchange Transactions Data Is Entered Onto Windows That Resemble The Actual Irs Irs Forms Accounting

Difference Between 1099 K And 1099 B Tax Forms From Cryptocurrency Exchanges Taxbit Blog

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Difference Between 1099 K And 1099 B Tax Forms From Cryptocurrency Exchanges Taxbit Blog

/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png)

Form 1099 Div Dividends And Distributions Definition

:max_bytes(150000):strip_icc()/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Post a Comment

Post a Comment