Filing a Small Claim with DEC - In accordance with state law the New York State Department of Environmental Conservation DEC may consider and authorize payment for claims for personal injury or property damage provided such damages were due to the fault or actionable conduct. Contact the IRS at 800-829-1040 to request a copy of your wage and income information.

New York State Department Of Taxation And Finance Ppt Video Online Download

If you need assistance completing this form please contact your insurer for guidance on the best method of reporting work-related accident information.

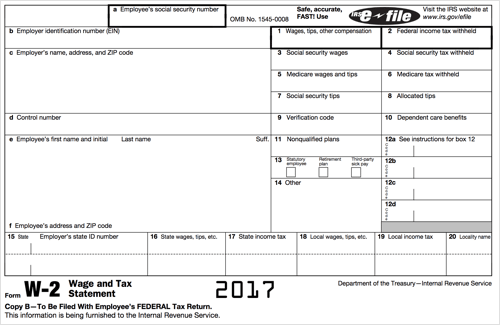

W2 form nys. Form 1099-A acquisition or abandonment of secured property Use Form W-9 only if you are a US. Hello cbhay99 For NYS unemployment you should have received a 1099G. You can find.

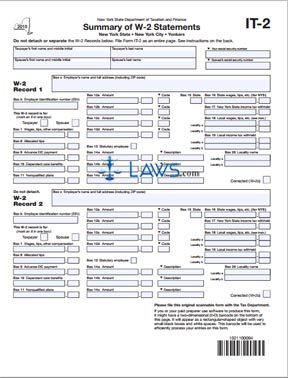

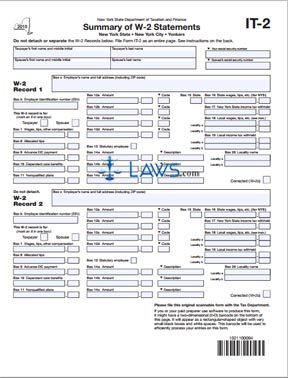

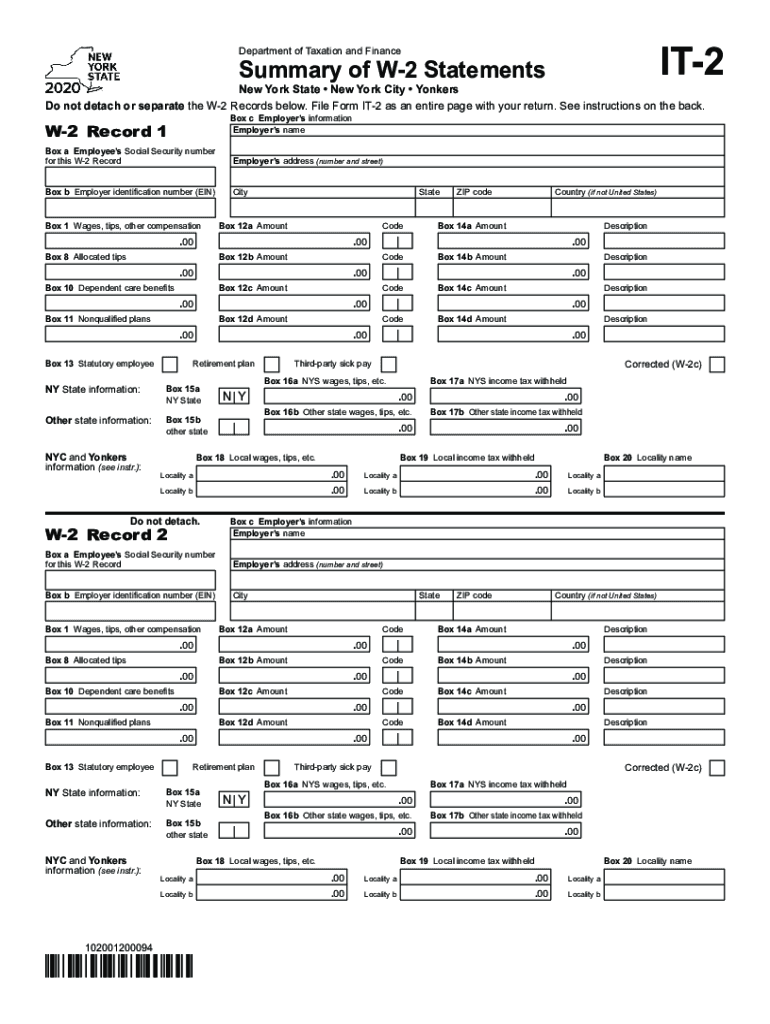

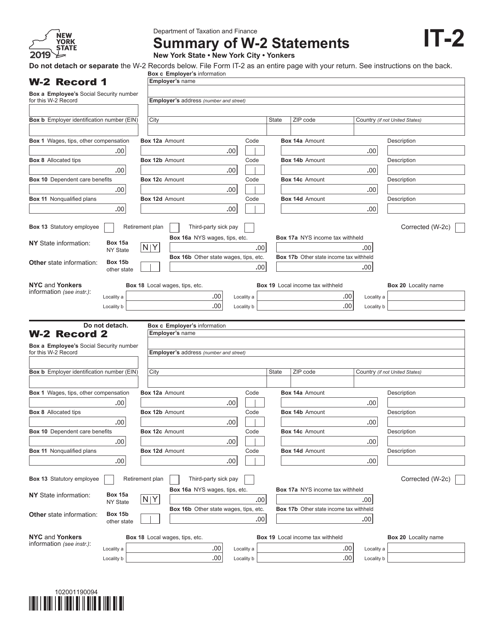

Enhanced Form IT-2 Summary of W-2 Statements Enhanced paper filing with a fill-in form. To start the blank utilize the Fill Sign Online button or tick the preview image of the document. Instead fill out a Form IT-2.

247 Customer Support 1 855 906-2266. When do w2 come out 2022. Enter Personal Information a.

Logging into your account at selecting 1099G at the top of the menu bar View next to the desired year Print or. Boxes 15b through 17b Other state information If the federal Form W-2 has wages and withholding for a state other. Is this Form Mandatory.

Pease contact your Payroll Atnnlstrator any questions One ottne ot using NYSROis that y. How to Complete this Form. What Is this Form for.

This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2021 as well as any adjustments or tax withholding made to your. Person including a resident alien to provide your correct TIN. Choose the sample you require in our library of legal templates.

The Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be available in mid-January 2022 for New Yorkers who received unemployment benefits in calendar year 2021. Enter your official contact and identification details. If you opted into electronic delivery.

Your withholding is subject to review by the IRS. Click the fillable fields and include the necessary data. On screen W2 box 14 enter the code SDI or DI in the left column and the amount in the right column.

Give Form W-4 to your employer. The amount will flow to the federal Schedule A. Form W-4 Department of the Treasury Internal Revenue Service Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

If you submit this form to the Board please send it to PO. Do not attach your W2 Form to the NYS return. Due to a system upgrade NYS Onþne nil be unavaeb½ from Wednesday February 10 2021 through Monday rebruary IS 2021.

Step 1 - Company Information Step 2 - Employee Information Step 3 - More Information Step 4 - Preview Your Stub. Box 5205 Binghamton NY 13902 and provide a copy to your insurer. In New York the easiest way to find your 1099-G is by logging in to the state Department of Labors web portal.

NYSDEC nForm Portal - NYSDECs eBusiness Portal information and links. Call the IRS at 1-800-829-1040 after February 23. Enter in box 17a the NYS withholding labeled as State income tax on federal Form W-2.

Step 1 Company Information Step 2 Employee Information Step 3 More Information Step 4 Preview Your Stub. Click here for the Request for Change in Withholding Status form. See when your 2021 W-2 form comes out in 2022 and get an early start on tax filing.

Keep to these simple steps to get Attach W2 It 201 Form ready for submitting. State wages exactly as reported on federal Form W-2. The way to complete the Get And Sign Nys W2 Correction 2017-2019 Form on the internet.

The advanced tools of the editor will guide you through the editable PDF template. Create your W-2 Form. New York requires total Federal wagesto be reported in Box 16 --does this statement mean that box 16 should also contain the 2005 income even though I didnt earn in NY state because of this I get less refund from State tax.

New York State Withholding Certificate IT-2104 Use to identify and withhold the correct New York State New York City andor Yonkers tax. Open the form in our online editing tool. To access your Form 1099-G online log into your account at and select 1099G at the top of the menu bar on the home page.

247 Customer Support 1 855 906-2266. The requirement for employers is that W2s must come out in the mail or make their W2s available online no later than January 31st. If you prefer to have your Form 1099-G mailed you may request for a copy to be mailed by.

FAQ Stub samples reviews Create A PayStub Now. Look through the guidelines to determine which information you will need to give. The Form IT-2 is a summary of the W2 form that should be prepared and attached to the NYS return.

Can I Get My Kentucky Unemployment W2 Online. Employee Name WCB Case Number JCN Date of Injury. Log in with your NYGOV ID then click on Unemployment Services and ViewPrint your 1099GYou can also request a copy by completing and mailing the Request.

If you do not return Form W-9 to the requester with a TIN you might be subject to backup withholding. What is backup withholding later. Can Form W-2 Wage ant.

If you are using itemizing deductions on the NY return it also will flow from the federal to. To view and print your current or. NYSDI is for state disability insurance.

If you need a copy of your 1099G you can view and print your 1099G for calendar year 2013 on the NYS Department of Labor website. A W-2 reports. Accurate calculations guaranteed with our online tool.

If you have no New York State wages or withholding leave boxes 16a and 17a blank. Create your form W-2 today with our easy to use form W2 generator. In my w2 form there is small note which is as follows.

How to find form 1099-G on the New York Department of Labors website. Form W-2 also known as the Wage and Tax Statement is the document an employer is required to send to each employee and the Internal Revenue Service IRS at the end of the year. Mail the completed form to.

Electronic filing is the fastest safest way to filebut if you must file a paper Summary of W-2 Statements use our enhanced fill-in Form IT-2 with 2D barcodes.

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

Tax Workshop Presented To New York State Nonresident Students Scholars Spring Ppt Download

/ScreenShot2020-01-28at5.14.18PM-95d56fcae5014d0086b8b50d0f01c9ac.png)

Form 1099 Q Payments From Qualified Education Programs Definition

Free Form It 2 Summary Of W 2 Statements Free Legal Forms Laws Com

2020 2022 Form Ny Dtf It 2 Fill Online Printable Fillable Blank Pdffiller

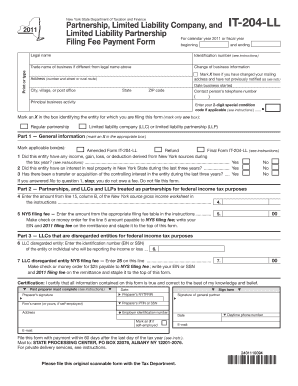

Fillable Online Tax Ny Form It 204 Ll The New York State Department Of Taxation And Tax Ny Fax Email Print Pdffiller

2020 2022 Form Ny Dtf It 370 Fill Online Printable Fillable Blank Pdffiller

Ny Dtf It 1099 R 2018 Fill Out Tax Template Online Us Legal Forms

How To Find My Employer S State Id Number

Form It 2 Download Fillable Pdf Or Fill Online Summary Of W 2 Statements 2019 New York Templateroller

Internal Revenue Service Wage And Investment Stakeholder Partnerships Education And Communication Spring Ppt Download

International Students And Scholars Ppt Video Online Download

New York State Department Of Taxation And Finance Ppt Video Online Download

Post a Comment

Post a Comment