This button is located on the top of right corner of the form. Click on column heading to sort the list.

What You Should Know About The New Form W 4 Atlantic Payroll Partners

This exemption is available if the employees income under 85000.

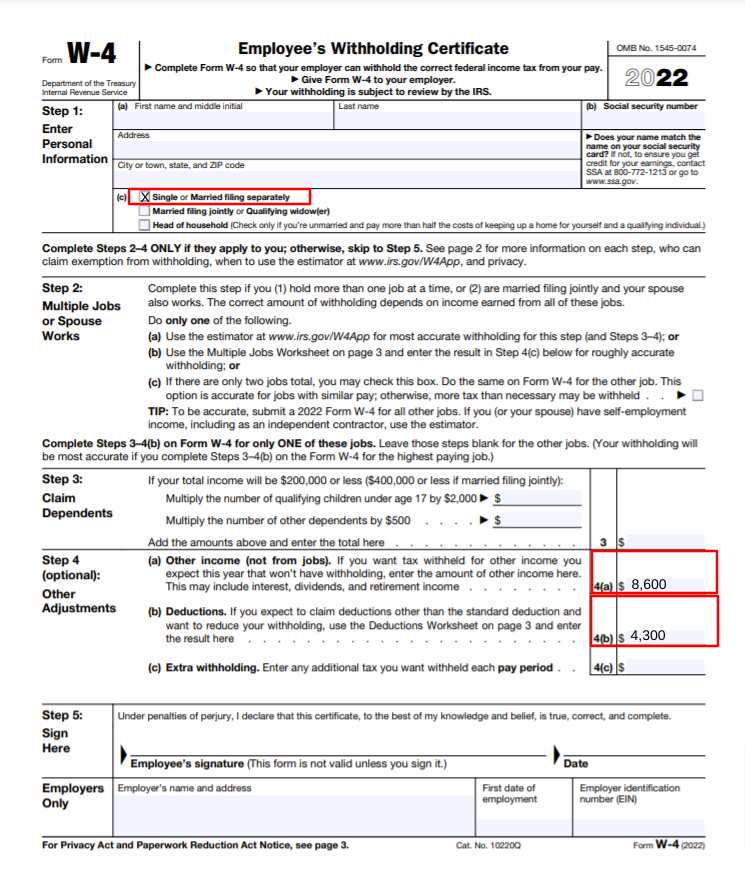

W4-t form. A W-4 with the 0 or 1 question indicates that your employer is using an outdated W. Tax liability for 2022. Enter 8600 into Step 4 a on the 2021 Form W-4.

If you are using Form WT 4 to claim the maximum number of exemptions to which you are entitled and your withholding exceeds your expected. Forms and Publications PDF Enter a term in the Find Box. An employee fills out a W-4 form with information about himself and his dependents and must make.

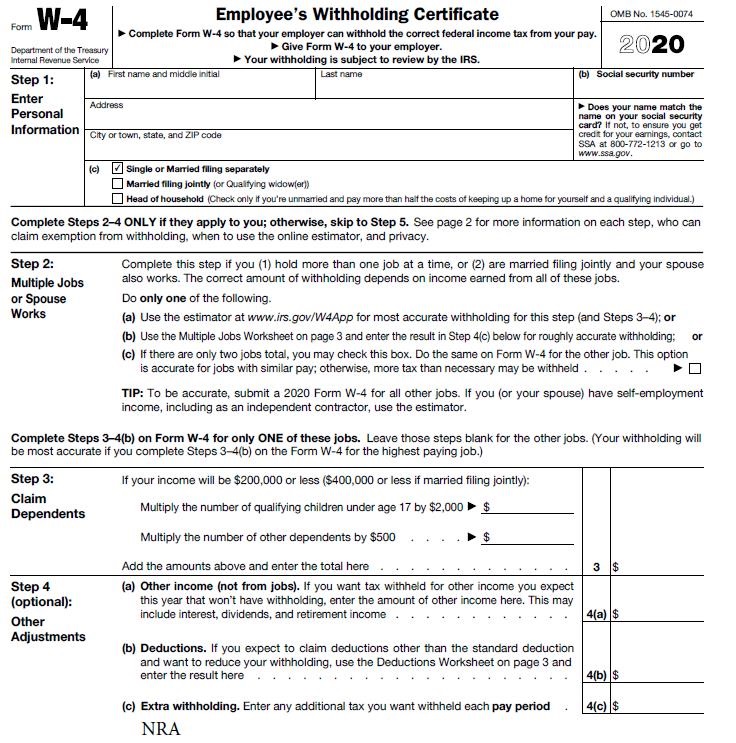

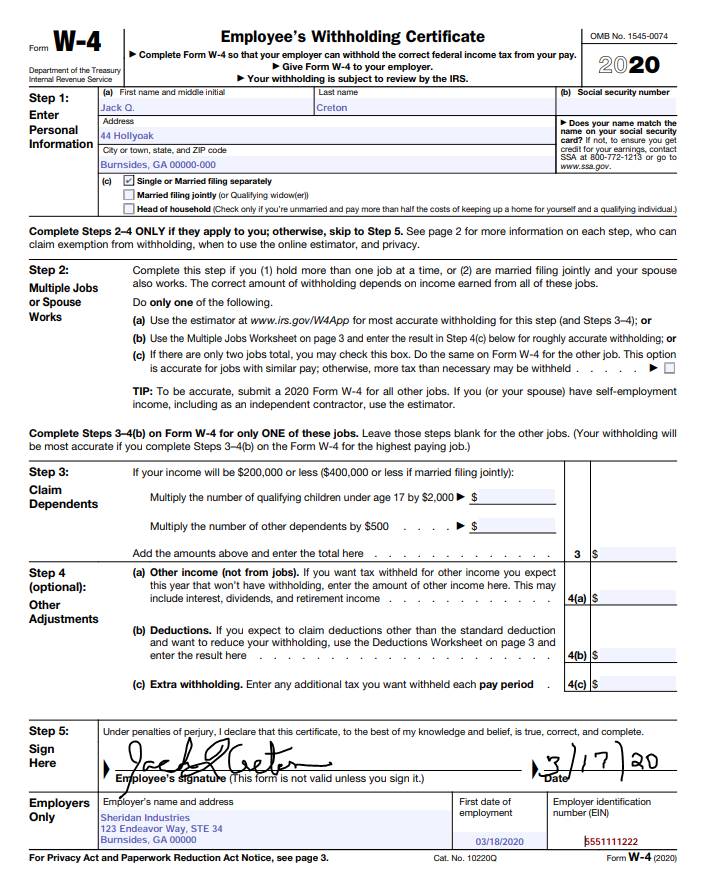

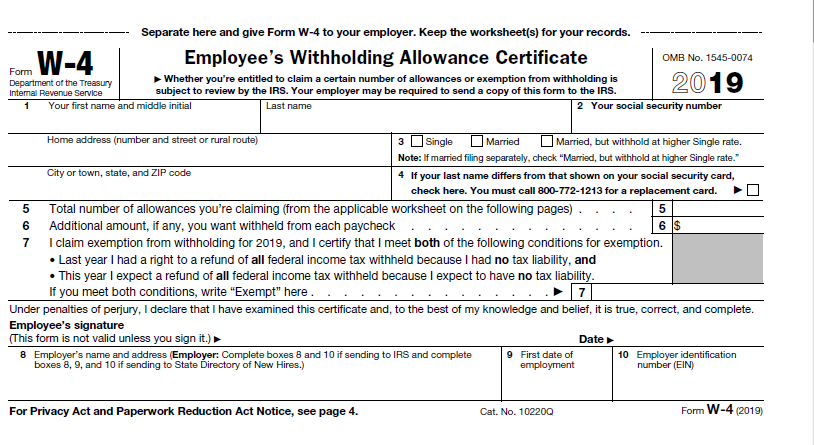

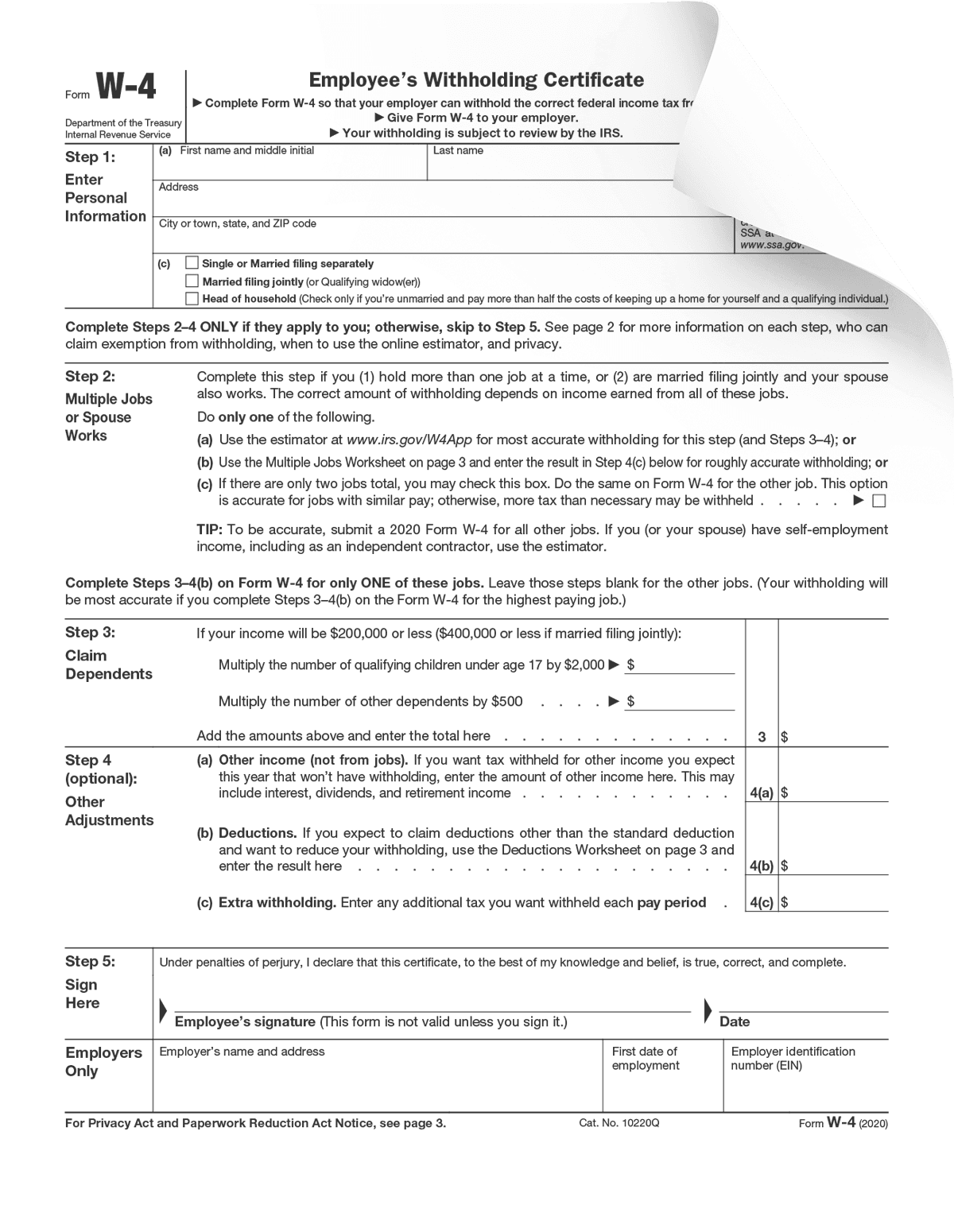

The W-4 is a form that you complete and give to your employer not the IRS for federal tax and the equivalent form for state tax withholding. Read the section titled Exemption from Withholding for more information. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

The W-4 communicates to your employer s how much federal andor state tax you - and your spouse if she works - wish to have withheld from each paycheck in a pay period. Before you complete the form consult an accountant or IRS literature to understand the ramifications of the choice you make. Select a category column heading in the drop down.

At the bottom of the form put an asterisk saying Protected by the Fifth Amendment to the US. This form guides an employers calculation of the amount of income tax to withhold from your paycheck. You may be able to enter.

Whatever form you file whether it be a W-4 or W-8 please make sure that you put Private under your SSN and your address on the form and stick an asterisk next to the word. Streaming Dan Unduh Video Bokep Indo W4t form 2020 Terkini January 2022 Film Bokep Igo Sex Abg Online streaming online video bokep XXX Bayaran Nonton Film bokep jilbab ABG Perawan. Please mail this form to the above address within 10.

On the 2021 W-4 form you can still claim an exemption from withholding. Withheld from their wages will be more than the employees estimated net. This letter has a postmark and has been sent via certified United States Postal Service with a.

A W-4 form is a form published by the Internal Revenue Service IRS in the United States. Click on the product number in each row to viewdownload. B Form and duration of agreement.

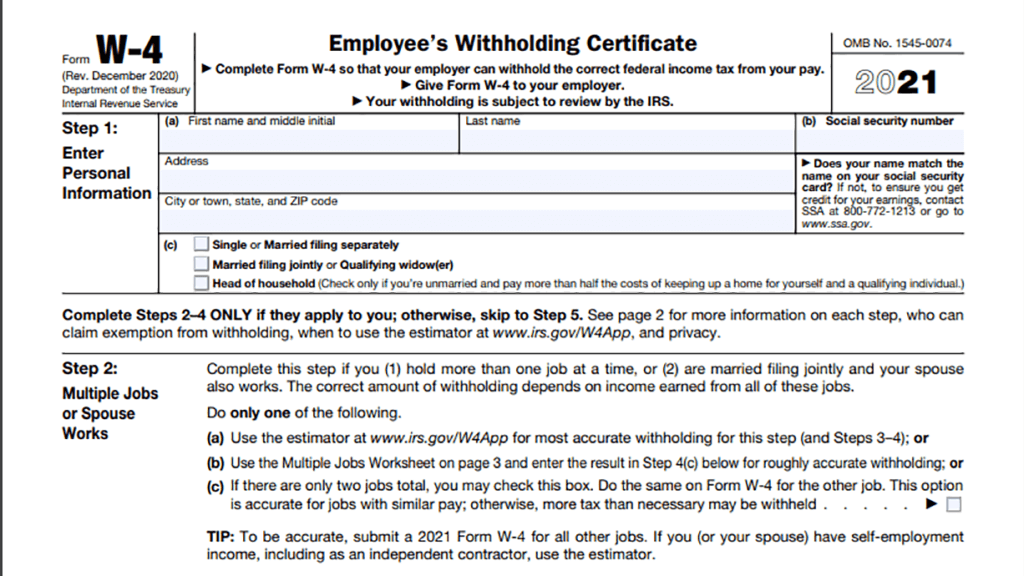

Worksheet For Employee Withholding Agreement. Accurately completing your W-4 will help you avoid overpaying your taxes throughout the year or owing a large balance at tax time. The W-4 form has been changed for 2021 and looks different than the W-4 forms from previous years.

The employees filing status on the 2021 Form W-4 would be Single. The 1995 W-4 was probably modified. This will keep the IRS off your back and make it very difficult if they do get a.

If you prefer to submit a paper form instead you can submit the W-4 forms links below in person to your department PayrollHR office or to the Office of Human Resources at 21 N. Income tax liability you may use Form WT4A to minimize the over withholding. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

Heres how the computational bridge would look in action. Your withholding is subject to review by the IRS. Give Form W-4 to your employer.

For security reasons you should press the Reset Form button after printing your completed form to clear your personal data. Form WT-4A is an agreement between the. An employee and his employer may enter into an agreement under section 3402 b to provide for the withholding of income tax upon.

B Form and duration of agreement. December 2020 Department of the Treasury Internal Revenue Service. 313402 p-1 Voluntary withholding agreements.

1I Except as provided in subdivision ii of this subparagraph an employee who desires to enter into a n agreement under section 3402p shall furnish his employer with Form W-4 withholding exemption certificate executed in accordance with th e provisions of section 3402f and the regulations thereunder. WT-4 Instructions Provide your information in the employee section. Your withholding is subject to review by the IRS.

Fill out the latest W-4 form which is the 2021 Form W-4. Who may use this form for 2022. The W-4 form is provided by employers to new employees to determine how much federal and state income tax is to be withheld from an employees paycheck.

Stochastic Differential Equations SDE A ordinary differential equation ODE dxt dt ftx dxt ftxdt 1 with initial conditions x0 x0 can be written in integral form xt x0 t 0 fsxsds 2 where xt xtx0t0 is the solution with initial conditions xt0 x0An example is given as dxt dt. 313401 a-3 made after December 31 1970. December 2020 Department of the Treasury Internal Revenue Service.

Park Street Suite 5101. Tracking number on it. Give Form W-4 to your employer.

Form W-4 Employees Withholding Certificate. Every so often the IRS changes the documents to make them more accessible for people to understand and to correspond with changes in tax rules and exemption guidelines. The form has changed to use a more comprehensive formula for determining tax withholdings.

Payments of amounts described in paragraph b 1 of Sec. As noted above box 7 on the W-4 allows the taxpayer to declare exemption form income tax withholding but not the FICA and Medicare taxes. Please make sure to enter the FEIN of the business in the appropriate field and forms do not enter a personal social security number.

Multiply the employees claimed withholding allowance 1 by 4300 to get 4300. Effective March 10 2020 most employees can enter and update their tax withholding information using the Payroll Information module in MyUW. Nonton Dan Download Video Bokep Indo W4t form irs Terkini December 2021 Film Bokep Igo Sex Abg Online streaming online video bokep XXX Gratis Nonton Film bokep jilbab ABG Perawan.

Dear IRS Representative This letter is a formal request for the W4T form. Form WT-4A may be filed by an employee who determines that the amount. The W-4 Form is the IRS document you complete for your employer to determine how much should be withheld from your paycheck for federal income taxes and sent to the IRS.

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

What Is Form W 4 What Do I Do As An Employer Updated For 2019 Gusto

How To Fill Out 2020 2021 Irs Form W 4 Pdf Expert

Making Sense Of Irs Form W 4 Changes Syndeo

2022 New W 4 Form No Allowances Plus Computational Bridge

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

How To Fill Out The New W 4 Form Correctly 2020

What Is A W4 Form And How Does It Work Form W 4 For Employers

W4 Form 2021 Printable Fillable

Fill And Sign W4 Form Online For Free Digisigner

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

Post a Comment

Post a Comment