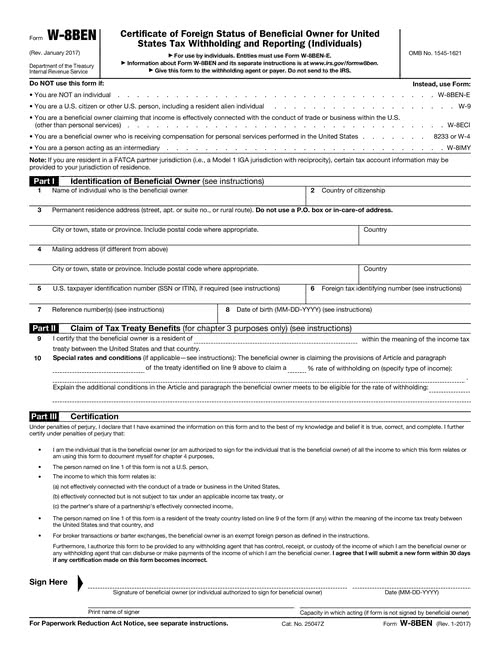

Branches for United States Tax Withholding and Reporting About Form W-9 Request for Taxpayer Identification Number and Certification. A W8 form is an IRS form that is for foreign companies to withhold taxes.

W-8BenE W8 is for non-US residents.

W8 and w9 forms. IRS Form W-9 is used to signNow to OppenheimerFunds that your Tax Identification Number is correct if you are an exempt payee or exempt from federal backup withholding and that you are a US. There are five W-8 forms. Payoneer will ask you to submit one of these documents to your accountPlease make sure you fill the corresponding W forms in a timely manner so you can receive payments from OneForma.

What are w8 and w9 forms. Possibly there are some mis. I am here to explain to you how to fill the W8 form for enabling payments in Oneforma.

What are the W8W9 forms. The W8 W8E or W9 form is required to be setup as a vendor in our financial system. You can find these three forms here.

Please note that US Persons are not eligible to trade in the US market through Phillip Securities Pte Ltd. What are the BEN W8 and W9 forms and why are they important for those who have overseas offshore bank accounts. You can find more information about the W-9 form on this link from Investopedia and the form can be found on the IRS website.

Non-US tax residents should complete a W-8BEN. Form W-8IMY is used by intermediaries that receive withholding payments on behalf of a foreigner or as a flow-through entity. Form W-9 is to be filled out by US workers that have a SSN or TIN while W-8 forms are filled out by foreign individuals and non-resident aliens who receive income from US sources.

What happens if Im asked to complete Form W9 and Im not a US person. Click Studios SA Pty Ltd is an Agile software development company specialising. With Hatch you get the benefit of owning your shares directly through your own US brokerage account.

The equivalent form that applies to non-US persons is W8-BEN for individuals and W8-BEN-E for entities. US tax residents should fill out a W9. W-8 W-9 Form.

There is a W8 BEN for non-US income and W8 ECI for US effectively connected income. W8 forms are filled in and filed by foreign entities that earn income in the US and filed with payers or withholding agents. The form is valid for 3 years it will remain in effect from the date that the form was signed until the last day of the third succeeding year unless a change in your circumstances makes any information on the form incorrect.

W9 forms are for US Citizens only though and Click Studios is located in Australia. But not both of them. The equivalent form that applies to non-US persons is W8-BEN for individuals and W8-BEN-E for entities.

Instead you will require the following W8 form for the IRS - W-8BEN-E. W-8BEN W-8BEN-E W-8ECI W-8EXP and W-8IMY. If you are a non-US individual then you need to be completing a W8.

Access and download ATT domestic and international W-8 and W-9 tax forms for all ATT legal entities with their own specific tax identification number. These tax forms are only used by foreign persons or entities certifying their. As far as I could get were talking about W8-BEN and W-9 here.

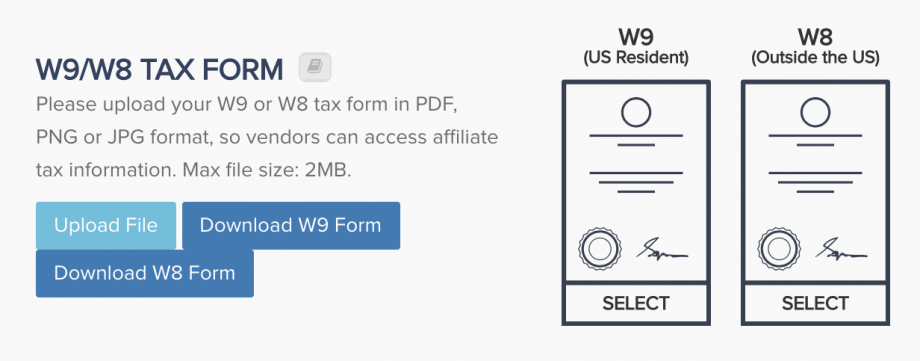

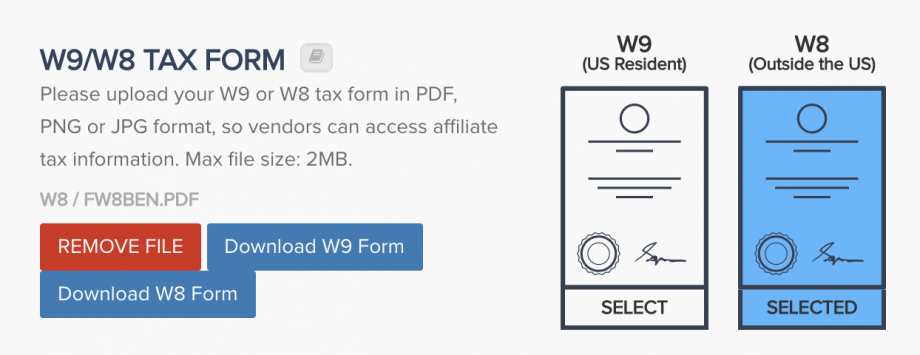

In certain situations we may ask you to use form W8E for entities. For non-US residents who earned money from US based online affiliate programs you will be asked to submit a W8Ben form. These documents are compulsory if you foresee that youre going to earn more than 300USD within a year.

Form W9 is intended for US persons as explained in question 2. What are W-8BEN and W9 tax forms. If you are requested to complete and sign the wrong form for your status inform the form requester of correct status and.

ATT W-8 and W-9. Which form you have to complete and upload depends on where you are a tax resident. It is likely that each US entity you are doing business with will ask you to submit a W8 form but you will send the same W8 form to each US entity.

Or by foreign business entities who make income in the US. There is only one Form W-9 but five different types of W-8. W8 form W-8 forms are Internal Revenue Service IRS forms that foreign individuals and businesses must file to verify their country of residence for tax purposes certifying that they qualify for a lower rate of tax withholding.

A W9 form is a form a company gives an individual so a 1099 can be sent at the end of the year. Let the US residents figure the W9 form procedure by themselves. Form W9 is only for US individuals.

About Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Depending on your tax residency a compulsory W-8BEN or W9 form will be completed on your behalf to ensure you pay the right tax in the US. US tax law requires Bootstrap Themes to collect tax information from our sellers.

Note that you will also need to submit a copy of your passport and visa. Form W8 W 8BEN or W8 form is used by non-resident aliens who do work andor make income in the US. W9 forms are generally.

If youre a legal citizen of the United States at no point will you have to worry about filling out the form. Most likely if you are a US resident you already know how to do it. W9 forms are filed by employees who are US citizens or resident aliens to their employers in order to verify their identity for tax purposes.

The thing is if your mother is an American citizen then she must file only W-9 with the very service shes got access to. Form W9 is intended for US residents. Form W-9 Documentation of Investors and W-8 Print Share.

The W9 form is required to be submitted by US residents and asks for more specific details. W-8 Form is a requirement by the US Inland Revenue Service for account holders to declare that the beneficiary owner of the amount received from US sources is not of US origin. You complete the appropriate form based on the nature of.

Non-US organizations should complete a W-8BEN-E. The W8 and the BEN W8 are a set of American tax forms which certify your tax status in relation to the American authorities the IRS. W-9 A Form W-9 is a document issued by the United States Internal Revenue Service IRS for certain taxation purposes.

Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding. If you are NOT a US citizen use the W8 form. W-8Ben W8Ben is for non-US residents Individuals.

W 8 And W 9 Instructions University Of Missouri System

W 8 Forms Collected By Stripe Stripe Help Support

Form W 8ben Internal Revenue Service

What Risk Would I Take By Filling Out A W8 Or W9 For A Firm That Asks For One Personal Finance Money Stack Exchange

Irs W 8ben Form Template Fill Download Online Free Pdf

Mengisi Formulir W 9 Investarter 2022 Talkin Go Money

Where Do I Find A W9 W8 Tax Form To Complete Paykickstart Help Center

23 Printable W 8 Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

W 8 And W 9 Forms For Private Funds

Form W8 Instructions Information About Irs Tax Form W8

W 8 Or W 9 Form Not Sure What You Need Let Us Help You

Where Do I Find A W9 W8 Tax Form To Complete Paykickstart Help Center

Post a Comment

Post a Comment