To sign a form 4952 investment interest expense deduction 1040com right from your iPhone or iPad just follow these brief guidelines. Tax on Lump-Sum Distributions Form 5074.

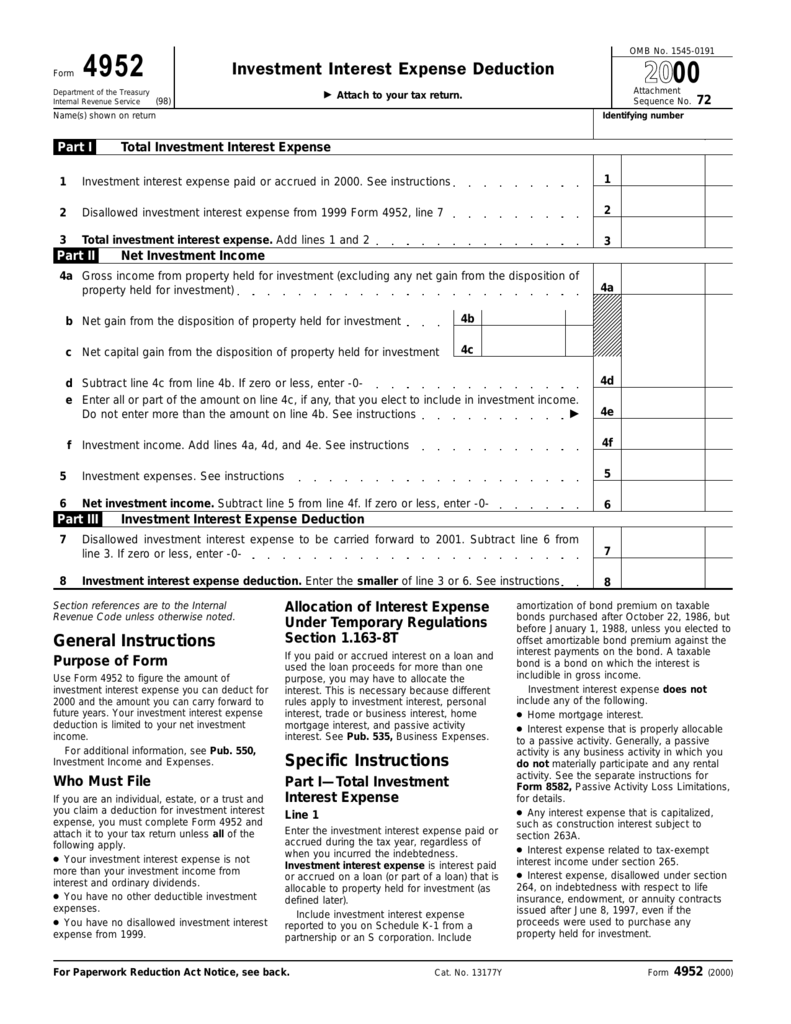

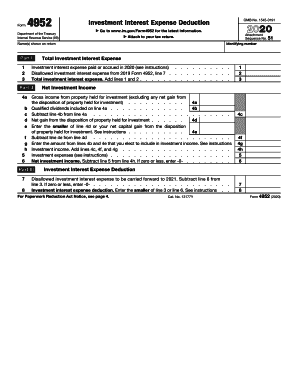

Investment Interest Expense Deduction

Your investment interest expense deduction is limited to your net investment income.

1040 form 4952. Tax on Accumulation Distribution of Trusts Form 4972. On this form figure these. As for your tax return you can file the 4952 Form either in paper form by mail or online using the specifically developed electronic system.

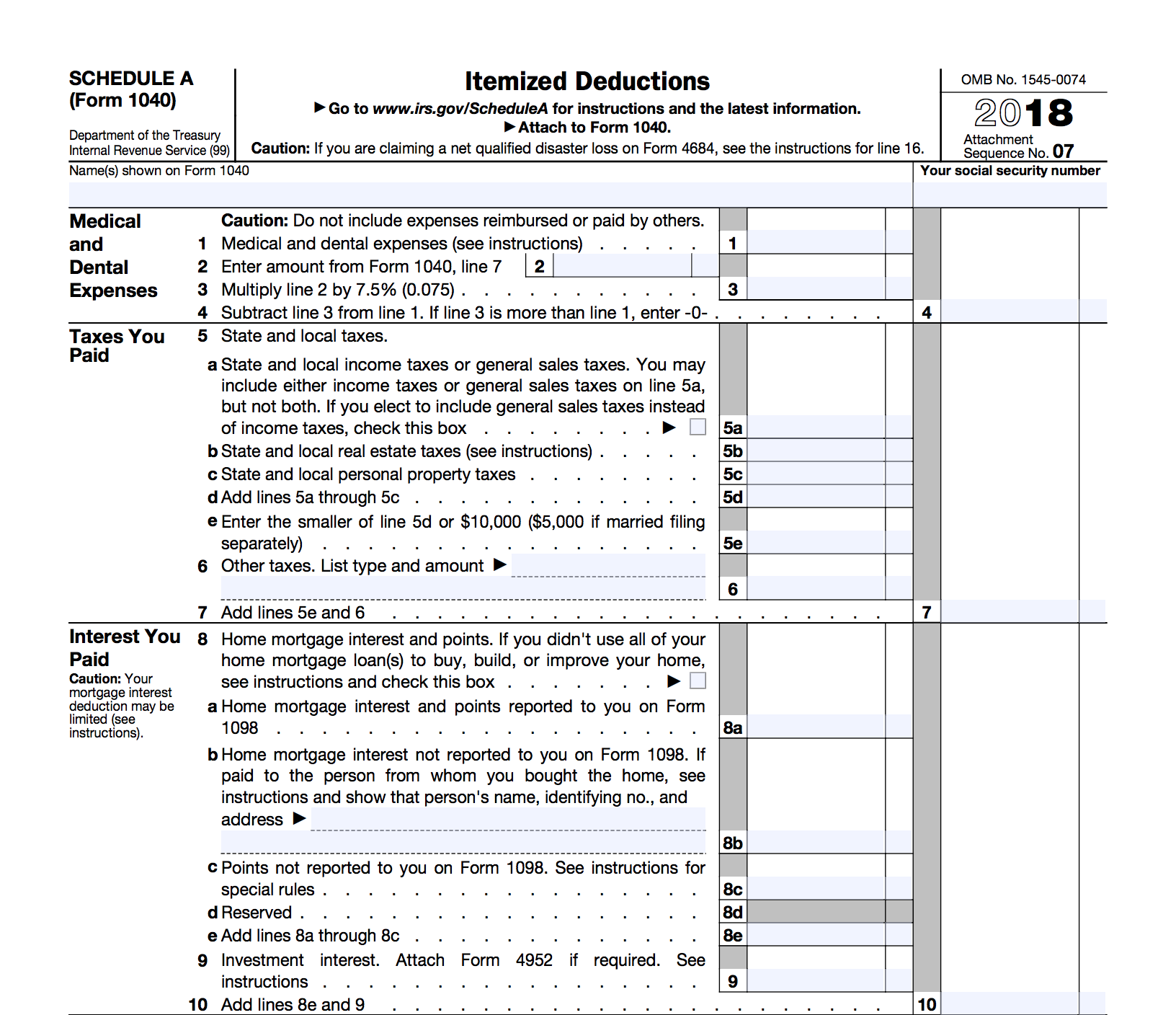

It itemizes allowable deductions in respect to income rather than standard deductions. Allocation of Individual Income Tax to Guam or the Commonwealth of the Northern Mariana Islands CNMI. If there is an excess of total gains over total losses from the disposition of property held.

Install the signNow application on your iOS device. Form Department of the Treasury Internal Revenue Service 99 Name s shown on return Part I Go to wwwirsgovForm4952 for the latest information Attach to your tax return Attachment Sequence No 51 Identifying number Total Investment Interest Expense Investment interest. Your form must be sent alongside your tax return.

Form 1040A is the US. Upload the PDF you need to e-sign. Record of Authorization to Electronically File FBARs Print only.

FORM 1040 SCHEDULE A FORM 4952 SCHEDULE 1 Please complete the 2020 federal income tax return for Bob and Melissa Grant. Federal Individual Income Tax Return. Form 4952 Investment Interest Expense Deduction concerns both.

1 max for spouse filing separately. We last updated Federal Form 4952 in January 2022 from the Federal Internal Revenue Service. Can carry forward to future years.

You may have to include Form 4952 as well. Use this form to figure the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. Recomputed Investment Interest Expense Deduction for AMT Form 4952.

Other Federal Individual Income Tax Forms. Report of Foreign Bank and Financial Accounts 1 max for taxpayer. Individual Income Tax Return 1 max per return.

Investment Interest Expense Deduction 2014 Form 4952. Investment Interest Expense Deduction 2011 Form 4952. FormSchedule E-file E-file Notes 2020 1040 Federal and State E-filed Forms FinCEN Form 114.

This is entered on line 1 of screen 4952. Therefore if you have an other increase from the passthrough entity for investment income you will need to add that increase amount to passthrough interest dividends and royalties to avoid the subtraction. Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4e or 4g even if you dont need to file Schedule D.

There is no disallowed investment interest carried over from. There are no other deductible investment expenses Form 4952 line 5. Ignore the requirement to attach the forms W-2 to the front page of the Form 1040.

Investment Interest Expense Deduction 2012 Form 4952. Includes property that produces gain or loss not derived in the ordinary course of a trade or business from the disposition of property that produces these types of income or is held for investment. You may force or zero out the amount of capital loss carryover reported on Form 4952 by using the applicable carryover Force fields provided in Screen 4952.

Click the Federal tab. The amount flowing to Form 4952 Line 4a is 10000 and the statement behind Form 4952 will show a negative adjustment for the difference 1000. This year 2021 it is set on April 15.

The IRS advises in Publication 550 that its not necessary to file Form 4952 if you meet all the following tests. The IRS allows certain taxpayers to take a tax deduction for the interest expense on some loans using Form 4952. Use the Schedule D Tax Worksheet in the instructions for Schedule D to figure the amount to enter on Form 1040 or 1040-SR line 16 if you have to file Form 4952.

Form 4952 is an IRS tax form determining the investment interest expense that may be either deducted or carried forward to a future tax year. Investment Interest Expense Deduction 2013 Form 4952. Get and Sign Form 4952 2018-2022.

This form is for income earned in tax year 2021 with tax returns due in April 2022. To force Form 4952 to print if it has data and whether or not it is required choose Setup 1040 Individual. We will update this page with a new version of the form for 2023 as soon as it is made available by the Federal government.

Click the Tax Return button in the Collation group box. About Form 4952 Investment Interest Expense Deduction. Investment Interest Expense Deduction 2010 Form 4952.

You dont have to file Form 4952 if all of the following apply. They are due each year on April 15 of the year after the tax year in question. Click the Tax Return button in the Collation group box.

Form 4952 - Investment Interest Expense Deduction and Investment Expenses Investment margin interest deduction is claimed on Form 4952 Investment Interest Expense Deduction and the allowable deduction will flow to Schedule A Form 1040 Itemized Deductions Line 9 to be claimed as an itemized deduction up to the amount of your investment income. Amount of investment income to carry over to future years if any. Investment interest expense - Interest paid on money the taxpayer borrowed that is allocable to property held for investment.

This is where you designate the amount of qualified dividends and long-term capital gains you want to treat as investment income. Amount of investment interest you can deduct. So the deadline will be the same as for returns.

Do that by pulling it from your internal storage or the cloud. Investment Interest Expense Deduction Form 4970. Form 4952 is not required to be filed if all of the following conditions are true.

Create an account using your email or sign in via Google or Facebook. Investment expenses are a deduction on Schedule A of Form 1040. However the tax ramifications of investment interest can be complicated as the IRS only allows a deduction for certain types of investment interest.

Investment interest expense does not exceed investment income from interest and ordinary dividends minus any qualified dividends. Capital gains and qualified dividends. Your investment income from interest and ordinary dividends minus any qualified dividends is more than your investment interest expense.

To deduct investment interest you must file a Form 4952 with your return. Click the Federal tab.

Resources Taxschool Illinois Edu

Irs Form 4952 Fill Out Printable Pdf Forms Online

Irs Form 4952 Fill Out Printable Pdf Forms Online

Irs Form 4952 Fill Out Printable Pdf Forms Online

Form 4952 Investment Interest Expense Deduction

Form 4952 Investment Interest Expense Deduction

Form 4952 Fill Out And Sign Printable Pdf Template Signnow

4952104 Form 4952 Investment Interest Expense Deduction Nelcosolutions Com

Form 4952 Investment Interest Expense Deduction

Irs Standard Deduction Standard Deduction 2021

2021 Form Irs 4952 Fill Online Printable Fillable Blank Pdffiller

Common Questions For Form 4952 Investment Interest Expense Deduction

4952104 Form 4952 Investment Interest Expense Deduction Nelcosolutions Com

Post a Comment

Post a Comment