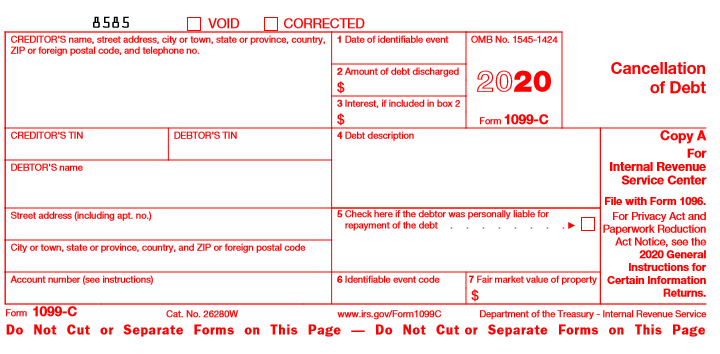

Instructions for Forms 1099-INT and 1099-OID Interest Income and Original Issue Discount. Form 1099-C is to be used only for cancellations of debts for which the debtor actually incurred the underlying debt.

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

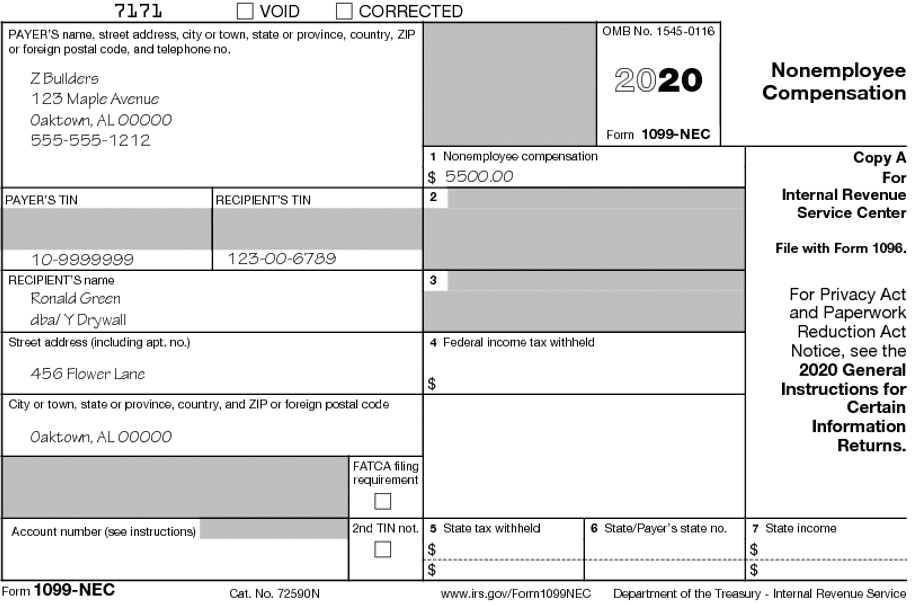

Form 1099 Misc Miscellaneous Income Definition

PDF editor makes it possible for you to make improvements in your 1099 c form Fill Online from any internet linked gadget.

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

1099-c form 2020. Do I need to send a 1099 to an incorporated company 2020. If its a business or farm debt use a Schedule C or Schedule F profit and loss from business or farming. IRS tax follows canceled debt But there are some rules including an important one on timing.

Put an electronic signature on your 1099 c form printable while using the help of Sign Tool. 1099-C 2020 Form IRS 1099-C Instructions. A Bankruptcy Title 11 BOther judicial debt relief.

CAUTION-2-Instructions for Forms 1099-A and 1099-C 2020. Include as income any interest you would have been eligible to deduct. You can eFile Form 1099-C Online for the year 2020 using Tax1099.

Reportable Life Insurance Sale 2019 11222019 Form 1099-LS. Fill Out Securely Sign Print or Email Your 2020 Form 1099-C. Save or instantly send your ready documents.

If you donate a vehicle that amounts to a sum greater than 500 you must file 1098-C. Available for PC iOS and Android. According to the IRS if you cancel any debt that has a value of 600 or more then the person who receives the copy needs to report it.

Each contribution constitutes a new form. Examples of income reported on a 1099-Misc include payments to an attorney health care payments royalty payments and substitute payments a person receives instead of dividends. Use Fill to complete blank online IRS pdf forms for free.

Easily fill out PDF blank edit and sign them. All boats and airplanes qualify. Inst 1099-INT and 1099-OID.

Distribute the prepared blank by using electronic mail or fax print it out or save on your device. For a motor vehicle to be qualified its manufactured purpose must be mainly for use on highways roads and public streets. When You Need to File 1098-C.

Persons with a hearing or speech disability with access to TTYTDD equipment can call 304-579-4827 not toll free. Instructions for Form 1099-G Certain Government Payments. All forms are printable and downloadable.

Sole proprietors partnerships and unincorporated contractors do. Reportable Life Insurance Sale 1219 01172020 Form 1099-LTC. CStatute of limitations or expiration of deficiency period.

The IRS provides instructions and information about 1099-C forms and cancellation of debt in general. Do not file Form 1099-C when fraudulent debt is canceled due to identity theft. Form 1099-C entitled Cancellation of Debt is one of a series of 1099 forms used by the Internal Revenue Service IRS to report various payments and transactions excluding employee wages.

Once blank is done click Done. A 1099-C is a tax form that the IRS requires lenders use to report cancellation of indebtedness income. Many 1099-C forms contain errors and experts say its one of the more confusing tax forms.

IRS 1099-C Form. The Form 1099-C 2020 Cancellation of Debt form is 4 pages long and contains. Information about Form 1099-C Cancellation of Debt Info Copy Only including recent updates related forms and instructions on how to file.

On average this form takes 11 minutes to complete. Complete IRS 1099-C 2020-2021 online with US Legal Forms. The lender files this form with the IRS and a copy is supposed to be sent to the taxpayer as well.

Printed by Atlassian Confluence 760. That includes a list of potential codes that might be found in Box 6. 1099 C Cancellation of Debt.

File 1099-C for canceled debt of 600 or more if you are an applicable financial entity and an identifiable event has occurred. Instructions for Form 1099-H Health Coverage Tax Credit HCTC Advance Payments. Form 1099-C formerly known as Cancellation of debt is used to report the details of a debt that was canceled or forgiven.

How to eFile 1099-C Form for the Year 2020. Form 1099-C call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700 not toll free. Powered by Atlassian Confluence 760.

Reporting 1099-C Income If you get a 1099-C for a personal debt you must enter the total on Line 21 of Form 1040 personal income tax. Common examples of when you might receive a Form 1099-C include repossession foreclosure return of property to a lender. The Most Secure Digital Platform to Get Legally Binding Electronically Signed Documents in Just a Few Seconds.

Youll receive a Form 1099-C Cancellation of Debt from the lender that forgave the debt. According to the IRS nearly any debt you owe that is canceled forgiven or discharged becomes taxable income to you. Once completed you can sign your fillable form or send for signing.

Cancellation of Debt Instantly with SignNow. Dont wait for the deadline eFile Now. You are not required to send a 1099-MISC form to a corporation.

Form 1099-C Due Date for the 2021 Tax Year Updated on December 7 2021 - 1030 AM by Admin TaxBandits. An easy way to remember the IRS rule is that corporations do not receive 1099 forms regardless of whether they are S or C corporations. Lenders that file a 1099 form with the IRS are required to send you a 1099-C form by Jan.

Tax1099 is the go-to source for your 1099 filings. Start a Free Trial Now to Save Yourself Time and Money. A 1099-Misc form is a tax form used to report miscellaneous payments that a company made for the reporting tax year.

This form must be filed in certain circumstances where more than 600 in debt is cancelled or goes unpaid for a certain period of time. Form 1099-C 2020 Cancellation of Debt. Payment Card and Third Party Network Transactions 2021 12032021 Form 1099-LS.

Irs Courseware Link Learn Taxes

Cancellation Of Debt Form 1099 C What Is It Do You Need It

Cancellation Of Debt Form 1099 C What Is It Do You Need It

What Is A C Corporation What You Need To Know About C Corps Gusto

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

Should I Issue A 1099 Form If My Ex Tenant Owes Rent Masslandlords Net

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Form 1099 Nec For Nonemployee Compensation H R Block

All You Need To Know About The 1099 Form 2021 2022

/1099c-5606545f559b4f28883a0de35905889b.jpg)

Form 1099 C Cancellation Of Debt Definition

What Is An Irs Schedule C Form

Printable Form 1099 Misc 2021 Insctuctions What Is 1099 Misc Tax Form

1099 Nec Form Copy C 2 Payer Discount Tax Forms

Post a Comment

Post a Comment