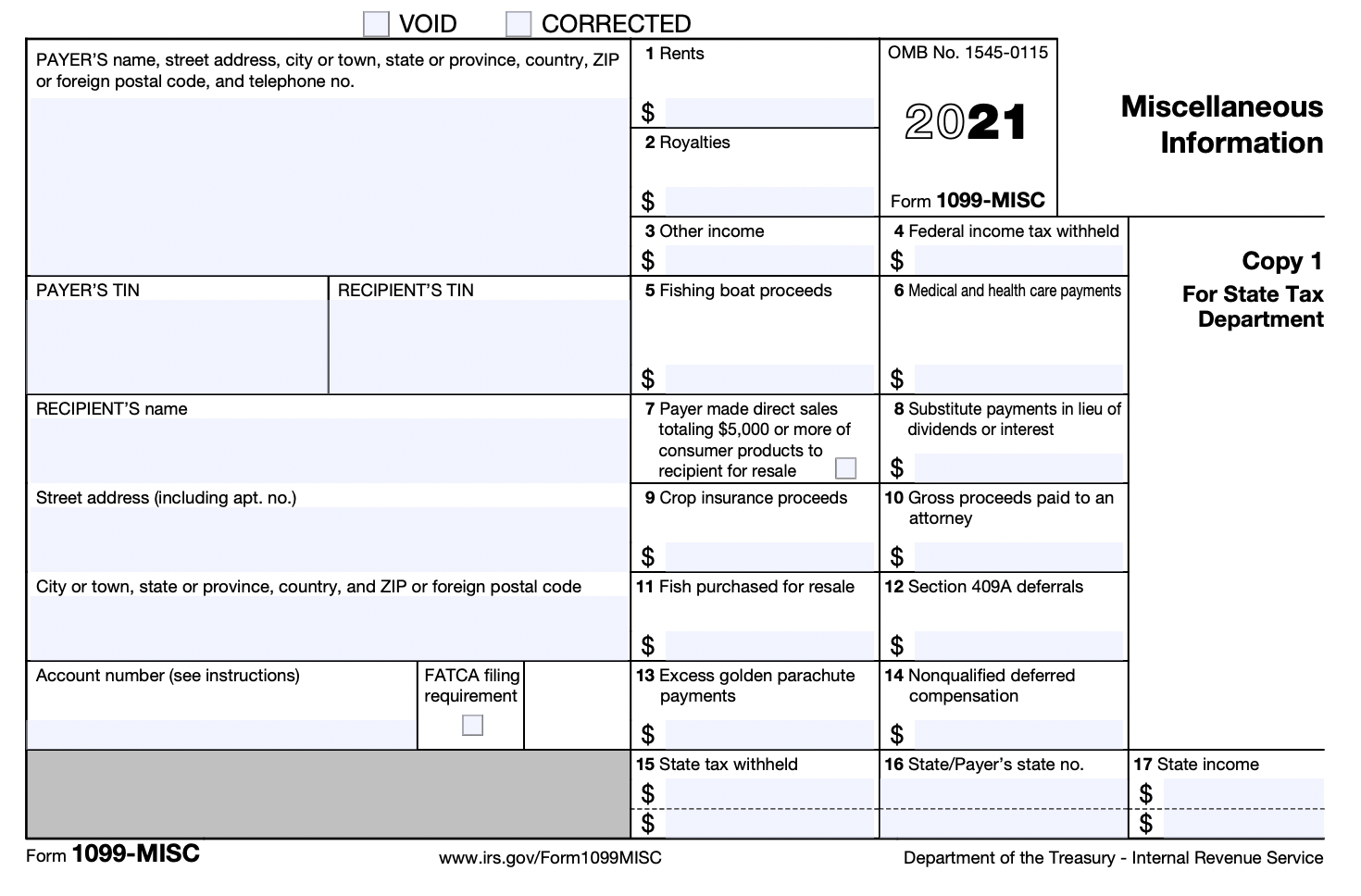

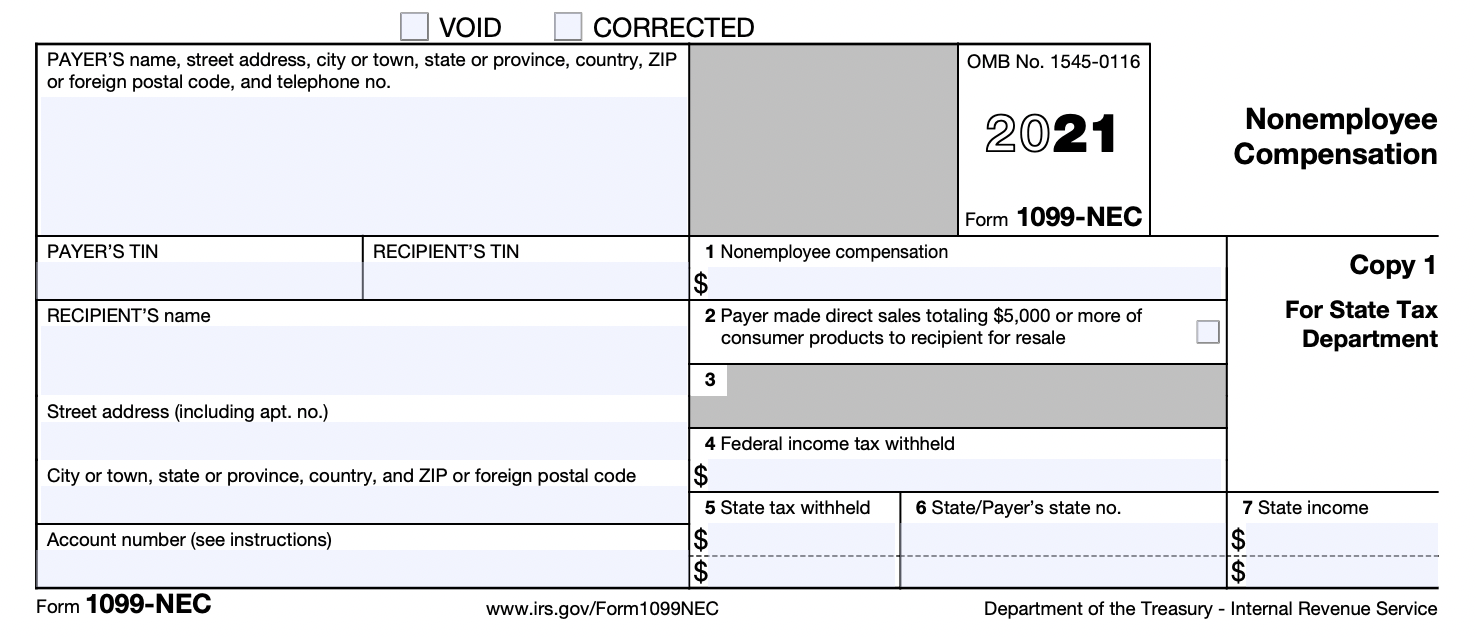

Do not combine with any other codes. The 1099 MISC Form now includes the change for the removal of Box 7 as Non-employee Compensation and restructure under the new 1099-MISC format for 2020 filing and beyond.

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Code 1 still applies even if the participant made the distribution to cover medical expenses qualified higher educational.

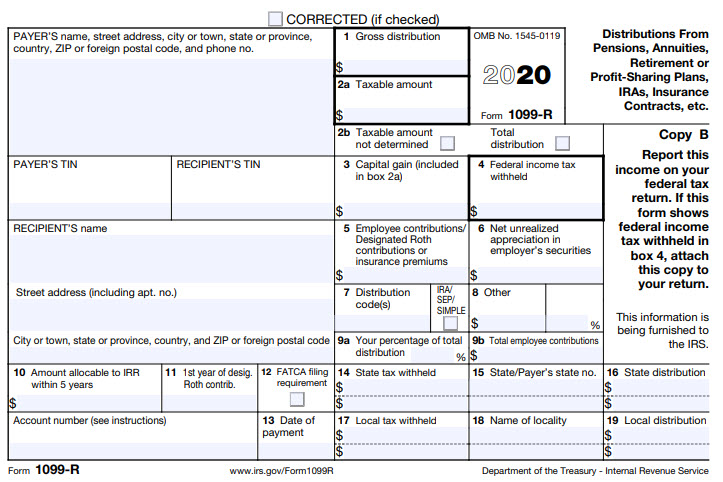

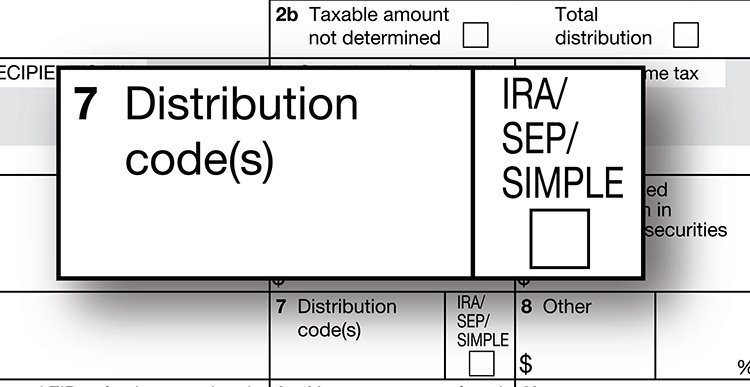

1099 form box 7 codes. That is something that OPM enters on the 1099-R and does not comply with the IRS approved codes for box 7. Form 1099-R Common Distributon Codes Box 7. Retirement Early Distributions with Exceptions Only visible of client type is 1099s R 1099-R.

Participant is under age 59 ½ and there is no known exception such as for medical expenses first-time home purchase qualified educational expenses or a qualified reservist distribution. Early distribution no known exception. Per IRS instructions distributions with code 8 that are not from an IRA SEP or SIMPLE are reported on Form 1040 line 1 Wages and Salaries.

We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Do not combine with any other codes. 1 Early distribution no known exception in most cases under age 59-12.

May be subject to a 10 penalty as well as income taxes. Use code 7 Normal distribution when the IRA owner or plan participant is age 59½ or older. Form 1099-R Early Distribution Box 7 Code 1 The CARES Act made several changes to retirement plans.

Here are the various codes listed in box 7 of Form 1099-R. What does code 7 mean on a 1099 R. The image below highlights the 1099-R boxes most frequently usedand their explanationsfor defined contribution plan distributions.

Box 7 Code 2. Dec 27 2021 Cat. Use Code 1 only if the solo 401k participant was not age 59 12 or older at time of the distribution AND codes 23 and 4 do not apply.

1 Early distribution except Roth no known exception. Form 1099-R Box 7 Distribution Codes continued Box 7 Distribution Codes Explanations A May be eligible for 10-year tax option This code is Out of Scope. For Microsoft Dynamics NAV 2015 and earlier the report will need to be pulled.

Report on Form 1099-R not Form W-2 income tax withholding and. The following chart provides the distribution codes for Box 7 for defined contribution plan distributions of. Governmental section 457b plans.

Early distribution no known exception in most cases under age 59½. D Annuity payments. A for a normal distribution from a plan including a traditional IRA.

You use code 7 - Normal Distribution in box 7. Death regardless of the age of the employeetaxpayer to indicate to a decedent. Form 1099-R must be sent no later than January 31 following the calendar year of the distribution.

Code 7 may be used in combination with codes A B D K L or M. This is an identifier the IRS uses to help determine if the transaction is taxable. If Form 1099-R Box 7 has a 1 in it we should ask the taxpayer some follow-up questions.

28 rows Use Code 7. Codes for Box 7 of the 1099-R tax form include number or a letter in the alphabet states the Prudential website. These codes descriptions are taken directly from the back of form 1099-R.

This code is in scope only if taxable amount has been determined. The new 1099 Form Box codes NEC-01 and MISC-14 and a new form Vendor 1099 NEC were added. Box 7 of Form 1099-R shows the distribution code for the transaction.

B Designated Roth account distribution Code B is for a distribution from a designated Roth account. Scenario 8 SIMPLE IRA Early Distribution. Governmental section 457b plans.

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. The normal distribution is for individuals who are older than 59-12 and the distribution does not have a penalty. Code 8 According to the 2020 Instructions for Forms 1099-R and 5498 Code 8 Excess contributions plus earningsexcess deferrals andor earnings taxable in 2020 signifies that excess contributions were deposited and returned in the same year regardless of the year for which the excess was.

Code 7 may be used in combination with codes A B D K L or M. Distribution Trust Estate Benefits. This code is in scope only if taxable amount has been determined.

Nonqualified deferred compensation box 15. Code G is used for rollovers from one institution to another that are tax-free. 30 rows Use Code 7.

See the instructions for Form 1040. A for a normal distribution from a plan including a traditional IRA section 401k or section 403b plan if the employeetaxpayer is at least age 59 12. The code s in Box 7 of your 1099-R helps identify the type of distribution you received.

2020 1099-R Box 7 Distribution Codes. Box 7 Code 3. Use code A if filing Form 4972 - Lump-Sum Distribution.

Early distribution exception applies under age 59½. Retirement Early Distributions Disability Payment Only visible of client type is 1099s R 1099-R. Code 7 on Box 7 of the 1099-R tax form means Normal Distribution states TurboTax.

There is not such code for 7 - Nondisability. If Form 1099-R has distribution code D along with another code enter the other. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.

And c to report a distribution from a life insurance annuity or endowment contract and for reporting income from a failed life insurance. Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this type of distribution. Form 1099-R Box 7 Distribution Codes continued Box 7 Distribution Codes Explanations A May be eligible for 10-year tax option This code is Out of Scope.

Per Form 1099-R Instructions the IRS suggests that anyone who receives a Form 1099-R with a distribution code P Excess contributions plus earnings excess deferrals taxable in YYYY in box 7 for the refund of an IRA contribution under Section 408d4 including excess Roth IRA contributions advise payees at the time the distribution is made that the earnings are taxable. The most significant change for our clients is the waiver of the 10 penalty for early withdrawal in certain cases. Box 7 Code 1.

B Designated Roth account distribution Code B is for a distribution from a designated Roth account. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. 2 Early distribution except Roth exception.

View solution in original post. See Form 5329 For a rollover to a traditional IRA of the entire taxable part of the distribution do not file Form 5329. You may either file Form 1099-MISC box 7 or Form 1099-NEC box 2 to report sales totaling 5000 or more of consumer products to a person on a buy-sell a deposit-commission or other commission basis for resale.

Below are the instructions for the 1099-R Box 7 data entry and what each code means. B for a Roth IRA conversion if the participant is at least age 59 12. Box 7 of 1099-R identifies the type of distribution received.

What does Distribution Code 7 mean on a 1099. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities.

How To Read Your 1099 Justworks Help Center

Form 1099 R Instructions Information Community Tax

Eagle Life Tax Form 1099 R For Annuity Distribution

Irs Form 1099 R Box 7 Distribution Codes Ascensus

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Irs Form 1099 R Which Distribution Code Goes In Box 7 Ascensus

How To Read Your 1099 Justworks Help Center

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Post a Comment

Post a Comment