Note that if a business is required to. About Form 1099-MISC Miscellaneous Income About Form 1040-NR US.

Electronic 1099 filing through eNC3 - Web Text File Upload is mandated for all filers.

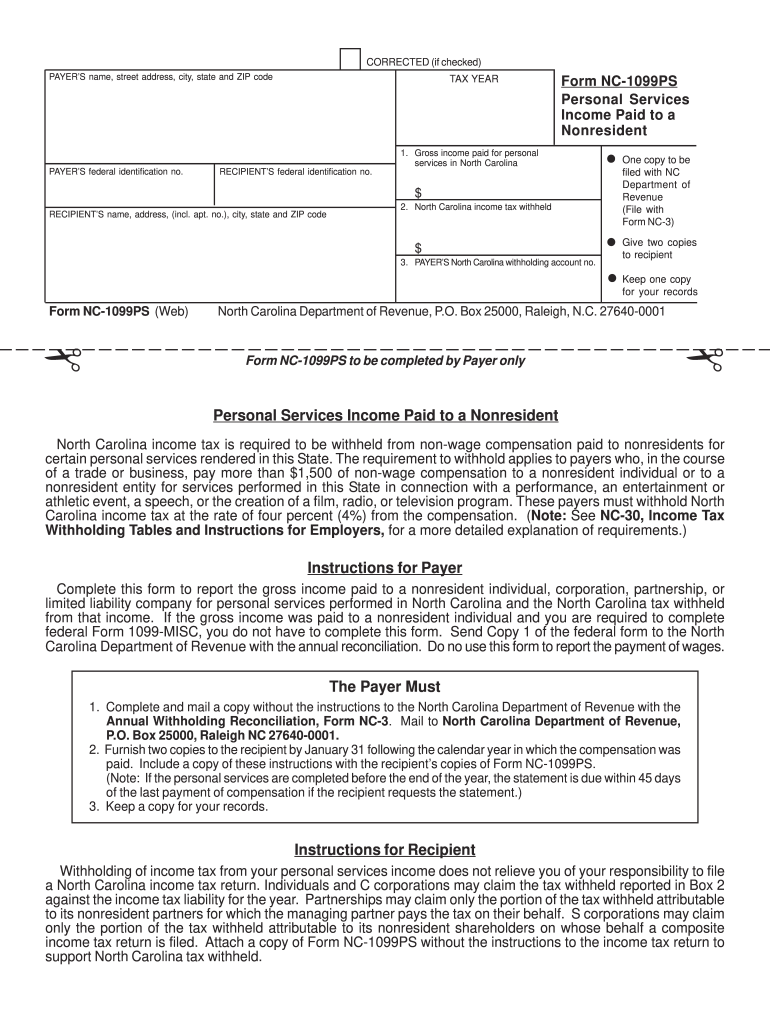

1099 form nc. North Carolina Department of Revenue PO Box 25000 Raleigh NC 27640-0640. Form NC-1099 is a North Carolina Other form. Sellers Information See instructions on reverse NC-1099NRS Web-Fill 10-03 Fill in applicable circleIndividual Partnership Estate Trust Other Specify Mail To.

When filing state copies of forms 1099 with north carolina department of revenue the agency contact information is. New 1099 Form for 2020. Nc department of revenue compliance rules.

1099 Tax Form North Carolina what is a form 1099-g north carolina A 1099 is a form that reports specific kinds of income that an individual taxpayer has earned throughout the year. Form 1099MISC is also issued to employees and vendors for royalties. Form NC-1099-ITIN Compensation Paid to an ITIN Contractor.

1099-G forms are delivered by email or mail and are also available through a claimants DES online account. It can be used for cash dividends that are received to purchase stock or interest earnings from. Persons with a hearing or speech disability with access to TTYTDD equipment can call 304-579-4827 not toll free.

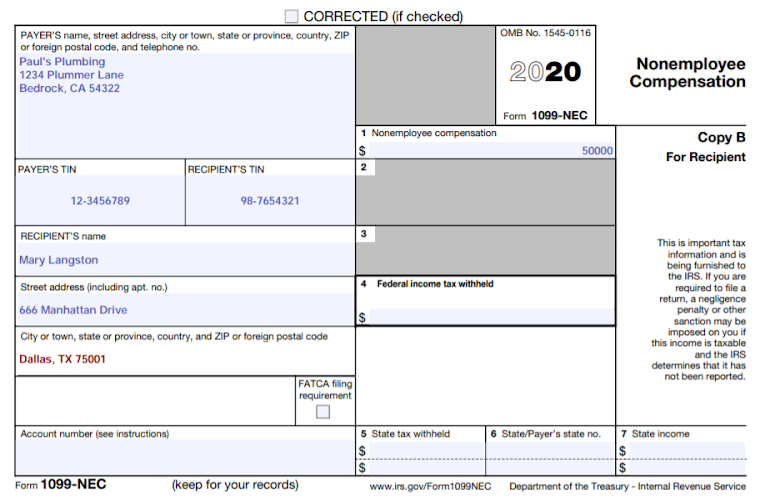

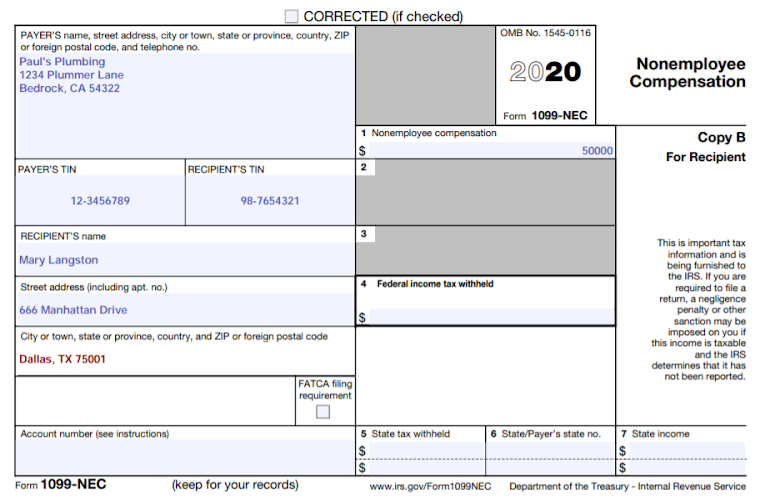

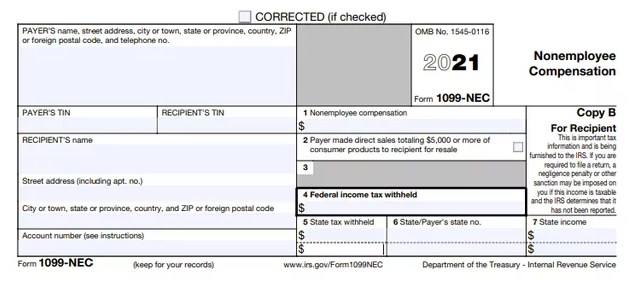

NEC stands for non-employee compensation and this new form must be used in lieu of a 1099 MISC for reporting payments to individuals other than employees. North Carolina Department of Revenue Central Examinations Section PO. This is the only form i have not received in the mail and i want to go ahead and file my taxes if i wont be receiving this form from the state.

Box 871 Raleigh NC 27602-0871. North Carolina income tax is required to be withheld from ITIN contractors. PAYERS name street address city state ZIP code and telephone no.

A 1099 form is crucial because it is used to document the non-employment income of taxpayers. Ad Easily sign PDF documents online from any device with a top e-signature solution. E-File North Carolina 1099-MISC 1099-K 1099-NEC 1099-B 1099-R and W-2 directly to the North Carolina State agency with Tax1099.

ENC3 Specifications for 1099 Reporting are supported by. Get started with TaxBandits today and stay compliant with the State of North Carolina. Form 1099-NEC call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700 not toll free.

More FAQ on 1099 State Filings. Local governments need to be aware that there is a new 1099 form for 2020 filing the 1099 NEC. Download or print the 2020 North Carolina Form NC-1099 Report of Sale of Real Property by Nonresidents for FREE from the North Carolina Department of Revenue.

IRS approved Tax1099 allows you to eFile North Carolina forms online with an easy and secure filing process. North Carolina Department of Revenue. Shown on the Form 1099-R are the amount of your retirement benefits the taxable portion if any the amount of tax withheld if any and.

Ask for it from the Employment Security Commission of North Carolina which processes unemployment benefits. Secure online PDF signer that makes electronic signing incredibly easy for the client. 1099-MISC 1099-NEC and 1099-R.

1099R Income Tax Statements. Many states have separate versions of their tax returns for nonresidents or part-year residents - that is people who earn taxable income in that state live in a different state or who live in the state for only a portion of the year. If you are required to complete a federal Form 1099-MISC or Form 1099-NEC to report the non-wage.

The 600 reporting minimum still applies as does the no minimum. 1099-G keep for your records Department of the Treasury - Internal Revenue Service. Ad Easily sign PDF documents online from any device with a top e-signature solution.

1099-R if Box 12 State tax withheld is populated and North Carolina income tax has been withheld andor the recipients address is located in North Carolina Distributions from Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. North carolina 1099 state reporting. You should receive Form 1099-G by mail if you have been granted unemployment compensation but you can also request it.

Sign date and mail your Form NC-3 Annual Withholding Reconciliation along with your 1099 returns to. File the state copy of form 1099 with the North Carolina taxation agency by January 31 2021. Each year by January 31 a Form 1099-R similar to Form W-2 Statement of Income and Tax Withheld that you received annually while you were working will be sent to you.

What is the IRS Form 1099-G for unemployment benefits. Report of Sale of Real Property by Nonresidents North Carolina Department of Revenue Part 1. File the following forms with the state of North Carolina.

If you have questions please call 919 707 -1237. An ITIN is issued by the IRS to a person who is required to have a taxpayer identification number but does not have and is compensation other than wages. Secure online PDF signer that makes electronic signing incredibly easy for the client.

Non-NC residents who perform specific services within North Carolina must have withheld 4 on services provided for the year in excess of 1500. The 1099-G form is a federal tax form used to report unemployment compensation paid by the state of North Carolina. Nonresident Alien Income Tax Return About Form 8919 Uncollected Social Security and.

Mail your Form 1099s along with NC-3 to the following address. 31 2021 all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security. For more information refer to.

The North Carolina Department of Revenue has announced that effective January 1 2020 businesses are required to use new Form NC-1099M Compensation Paid to a Payeeto report the nonwage compensation paid to a payee for services performed in North Carolina and the North Carolina income tax withheld from that income. This North Carolina state. EMPLOYMENT SECU RITY COMMISSION OF NORTH CAROLINA.

For non-wage compensation paid on or after January 1 2020 complete Form NC-1099M to report the nonwage compensation paid to a payee for services performed in North Carolina and the North Carolina tax withheld from that income.

Nc 1099 Form Printable Fill Online Printable Fillable Blank Pdffiller

Form Nc 1099 Report Of Sale Of Real Property By Nonresidents Web Fill In

1099 Nec Form Copy B C 2 Recipient Payer Discount Tax Forms

10 Ways To Refresh Your Portfolio Without Going Crazy Going Crazy You Better Work Portfolio

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

Cease And Desist Letter Sample Check More At Https Nationalgriefawarenessday Com 14675 Cease And Desist Letter Sample

Irs Form 1099 Reporting For Small Business Owners In 2020

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Filing 1099s For 2021 Who Gets One Capforge

2021 Form 1099 Nec Explained Youtube

1099 Nec Form Copy A Federal Discount Tax Forms

Affidavit Of Secured Party Creditor Debtor Creditors Business Law Budgeting Finances

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

1099 R Software E File Tin Matching Print And Mail 1099 R Forms And Envelopes Data Is Entered Onto Windows That Resemble The Irs Forms Irs Tax Forms

Post a Comment

Post a Comment