Form 1099-G call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700 not toll free. See Menu Order Now.

New York State does not mail Form 1099-G.

1099 g form ny. Credited to estimated tax for a later year. All forms are printable and downloadable. To access this form please follow these instructions.

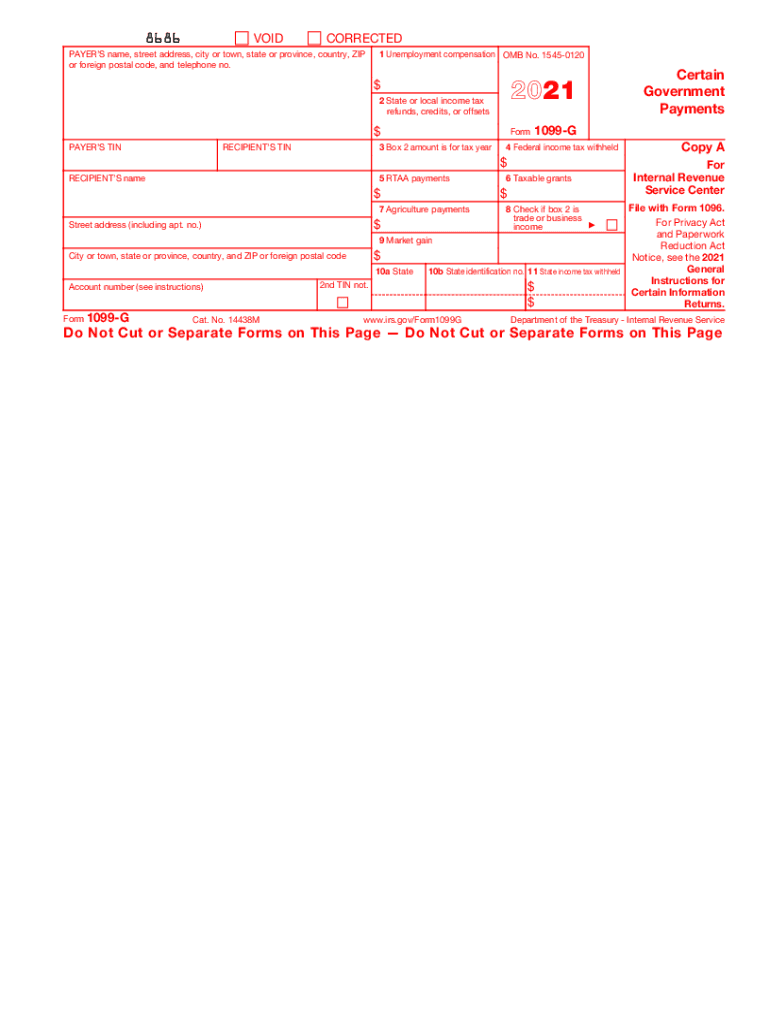

Use Fill to complete blank online NEW YORK STATE pdf forms for free. If the state issues you a refund credit or offset of state or local income that amount will be shown in Box 2 of your 1099-G form. If you received a refund offset or credit of New York State income taxes or MCTMT the amount on your New York State Form 1099-G Statement for Recipients of State Income Tax Refunds may differ from your actual refund you received because all or part of your overpayment was.

Enter the security code displayed below and then select Continue. 1099-G Form for state tax refunds credits or offsets. 3 From the Unemployment Insurance Benefits Online page below under the Get your NYS 1099-G section select the year you want in the NYS 1099-G drop-down menu box with an arrow and then select the Get Your NYS 1099-G buttonIf you get a file titled null after you click the 1099-G button click on that file.

Federal Form 1099-G Certain Government Payments is filed with the Internal Revenue Service IRS by New York State for each recipient of a New York State income tax refund of 10 or moreIf you received a refund in a particular year you may need federal Form 1099-G information when filing your subsequent years federal tax return. The following security code is necessary to prevent unauthorized use of this web site. To access your Form 1099-G log into your account at labornygovsignin.

Your New York State Form 1099-G statement reflects the amount of state and local taxes you overpaid through withholding or estimated tax payments. Ad G Sushi is Available for Delivery on Seamless. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

Ad G Sushi is Available for Delivery on Seamless. Use the Cross or Check marks in the top toolbar to select your answers in. If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124.

Persons with a hearing or speech. Once completed you can sign your fillable form or send for signing. Form 1099-G call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700 not toll free.

Make use of a digital solution to create edit and sign documents in PDF or Word format on the web. Information put and ask for legally-binding electronic signatures. Persons with a hearing or speech disability with access to TTYTDD equipment can call 304-579-4827 not toll free.

The Request for 1099-G Review New York State form is 1 page long. For most people the amount shown on their 2020 New York State Form 1099-G statement is the same as the 2019 New York State income tax refund they actually received. Ad A Tax Advisor Will Answer You Now.

See the Instructions for Form 1099-MISC for more information. Brooklyn Delivery on Seamless. When a federal state or local government files Form 1099-G the IRS receives Copy A the state tax.

Start completing the fillable fields and carefully type in required information. Statements to Recipients If you are required to file Form 1099-G you must furnish. Brooklyn Delivery on Seamless.

The Tax Department will report your 1099-G information to the Internal Revenue Service IRS if you had an overpayment from your New York State income tax return and you itemized your deductions on your federal income tax return for that same tax year. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Fill out securely sign print or email your Notice see the 2019 instantly with SignNow.

If you do not have an online account with NYSDOL you may call. Turn them into templates for numerous use insert fillable fields to collect recipients. View Your 1099-G Information.

There are five copies of the 1099-G. More information about Form 1099-G. Use Get Form or simply click on the template preview to open it in the editor.

Questions Answered Every 9 Seconds. Certain amounts that are not reportable on Form 1099-G such as compensation for services prizes and certain incentives may be reportable on Form 1099-MISC Miscellaneous Income. Available for PC iOS and Android.

This is the fastest option to get your form. The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021. View Menu Order Delivery Here.

To quickly get a copy of your 1099-G or 1099-INT simply go to our secure online portal MyTaxes at httpsmytaxeswvtaxgov and click the Retrieve Electronic 1099 link. Quick steps to complete and e-sign Ny 1099 g online. How to Get Your 1099-G online.

Certain Government Payments. Work from any gadget and share docs by email or fax. Click the Unemployment Services button on the My Online Services page.

To request a copy of your 1099-G or 1099-INT by phone please call 558-3333. If you are using a screen reading program select listen to have the number announced. View Menu Order Delivery Here.

Where to Mail Form 1099-G. The most common reason for receiving a refund is because of an overpayment of state taxes as explained in the example below. See Menu Order Now.

Request for 1099-G Review New York State On average this form takes 4 minutes to complete. Start a free trial now to save yourself time and money.

1099 G Unemployment Compensation 1099g

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Student Information

Kingdom Of Bohemia 1883 Map Bohemia Czechrepublic Kingdom Of Bohemia Map Art Cartography Map

1099 G Tax Information Ri Department Of Labor Training

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

W7 Form To Print W7 Form To Print Is So Famous But Why W2 Forms Business Letter Template Business Letter Format

This Little Known Tax Code Could Save Founders And Investors Millions Business Tax Small Business Tax Tax Payment

1099 G Tax Form Why It S Important

1099 G Software To Create Print And E File Irs Form 1099 G 2020 Irs Forms Ways To Get Money Letter Of Employment

Food Bank Volunteer Resume Sample Resumesdesign Sample Resume Resume Work Good Resume Examples

1099 G Tax Form Department Of Labor

1099 G Software To Create Print And E File Irs Form 1099 G 2020 Irs Forms Ways To Get Money Letter Of Employment

2021 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

Post a Comment

Post a Comment