This increases to 270 per form if you file after August 1 if you. W-3 is printed on plain paper.

1099R Tax Statements for 2020 will be available for reissue on AskDFAS beginning February 10 2021.

2020 w-2/1099 form. Employee RRTA tax deferred in 2020 that is withheld in 2021 and not reported on the 2020 Form W-2. Only report income from Forms W-2 1099-INT or 1099-DIV Are not claiming any credits except the Montana Elderly HomeownerRenter Credit. These forms are available from many sources including your local office supply store the IRS irsgov and various online vendors.

Forms W-2 and W-3 for filing with SSA. 1099 workers are also known as self-employed workers or independent contractors. An easy to use software which helps you to e-file 2020 W-2 1099 Forms NEC MISC INT DIV R S B K C G PATR online instantly.

These workers receive a 1099 form to report their income on their tax returns. Its 110 per form if you correctly file more than 30 days after the due date but by August 1. Refer to the Instructions for Forms 1040.

You may also print out copies for filing with state or local governments distribution to your employees and for your records. STANDARD FORMS - This software can process all the basic federal tax 12 forms including W-2 1099 NEC Misc Div Int B C R S 1096 W-3 1098 1098-T. Ive checked and double-checked the W-2 1 and 1099s 2 that Ive uploaded.

Here is information you need to quickly provide your constituents information on obtaining a DFAS-provided 1099-R W2 or 1042-S form. The penalty is 50 per W-2 form or 1099-NEC form if you correctly file within 30 days of the due date for filings due after December 31 2019 including the January 31 2020 due date. A bundle Sage Forms L99MBKDWS is available that will include the Federal 1099-MISC and 1096 red forms as well as the plain perforated 4-up forms needed for processing the 1099-MISC forms in Sage BusinessWorks.

While this may seem unfair the rationale is that. Employee RRTA tax deferred in 2020 that is withheld in 2021 and not reported on the 2020 Form W-2 should be reported in box 14 on Form W-2c. Timeline for processing W-2s Job groups used for W-2 processing Adjusting balances for W-2 processing Using and understanding the W-2 Confirmation Report.

You can also say that the 1099 MISC Form W-2 Form relate in one way. Included in this document you will find the following information. Employers need to send the 1099 MISC 2020 form to the contractors by 31 st Jan and to the IRS by the last date.

It includes some personal details of the contractor like name addresses along with either Social Security Number or Employer Identification Number. This information is being furnished to the Internal Revenue Service. PERFECT FOR SMALL BUSINESSES - This 2021 TaxRight formally TFP Accounting Software is easy to use and.

Based on the information below. I the petitioner received a request to submit all the W-2s and 1099s for my 2018 tax return which I did. If you are a Form 1099 worker you will be responsible for the entire 153 FICA tax on the net income from your business which is usually referred to as the self-employment tax.

The 1099s were accepted and the W-2 rejected with the. Then I got a message after 3 weeks making the same request. 1099 MISC 2020 form reports the money paid to the independent contractors in a year.

No form needs to be purchased. It is time to order W-2s and 1099s for the 2021 calendar year. MT QuickFile is for filing a Montana State Tax Return Only.

Important 2020 W-2 1099 Changes As of March 10 2020 W-2 Truncation of social security number SSN on employee copies of Form W-2Employers may now truncate the employees SSN on employee copies of Form W-2. Hi I received a message today that the NVC APPROVED my Affidavit of support and my Tax Return. Enter tax year 2020 in box c and adjust the amount previously reported as Tier 1 tax in box 14 of the Form W-2 to include the deferred amounts that were withheld in 2021.

The red ink form is not required. I have a Case FE notice asking me to submit every 2020 W-21099 forms. For the 2020 tax year employers must provide employees with a Form W-2 by February 1 2021.

Wage and Tax Statement. The basic W-2 and 1099 software program runs 119 for the first. They requird an updated civil document which I took care of.

The maximum amount of dependent care assistance benefits excludable from income may be increased for 2021. W-2 workers are also known as employees. Notice to Employee Do you have to file.

Year-end processes that produce W-2 and 1099 forms for the year. They serve the same purpose help individuals in filing tax returns. The paper forms are not included but available in other packages from our store.

The same deadline applies for completing and providing the 1099-NEC. Civilian and Military W2 Tax Statements for tax years 2016. W-2G - Reprogramming required.

1099-R and W-2 Tax Statement Requests. Do not truncate the employees SSN on Copy A. Get updates about all the upcoming IRS filing deadline for W-2 1099 940 941 944 and 1095 Forms for 2021 tax year.

Both the Form W-2 and Form 1099 serve a similar purposeto report income you earned from sources throughout the tax yearbut each is issued under different circumstances and requires slightly different approaches for tax season planning. Enter tax year 2020 in box c and adjust the amount previously reported in box 4 of the Form W-2 to include the deferred amounts that were withheld in 2021. 1099s and W-2s are the tax forms employers use to report wages and taxes withheld for different workers.

Form W-2 should be reported in box 4 Social security tax withheld on Form W-2c. W-2 and 1099 form information for 2021 year-end. Department of the TreasuryInternal Revenue Service.

Any of these vendors can provide forms that will work well. Copy BTo Be Filed With Employees FEDERAL Tax Return. Support State Filing postal Mailing.

You may use MT QuickFile to claim your Montana Elderly HomeownerRenter credit if you otherwise meet the criteria above. Both are created by employers but the former is for independent contractors the latter is for employees. However Form W-2 employees only pay 765 of the FICA tax with the employer covering the remaining 765.

Both W-3 and 1096 summation forms are also due to the appropriate government agency by February 1 2021 unless you file online. Here are some tips to decode these two forms and what to expect when preparing your taxes. The 2020 version of W-21099 has not yet been released but those interested can download the 2019 version to try out if desired.

Pin By Jr Tax On Taxation In 2021 Tax Return Nec Form

Form 2290 Online Filing Irs Forms Filing Taxes Irs

1 Expressefile Efile Express Twitter In 2021 Express Efile Tax Forms

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

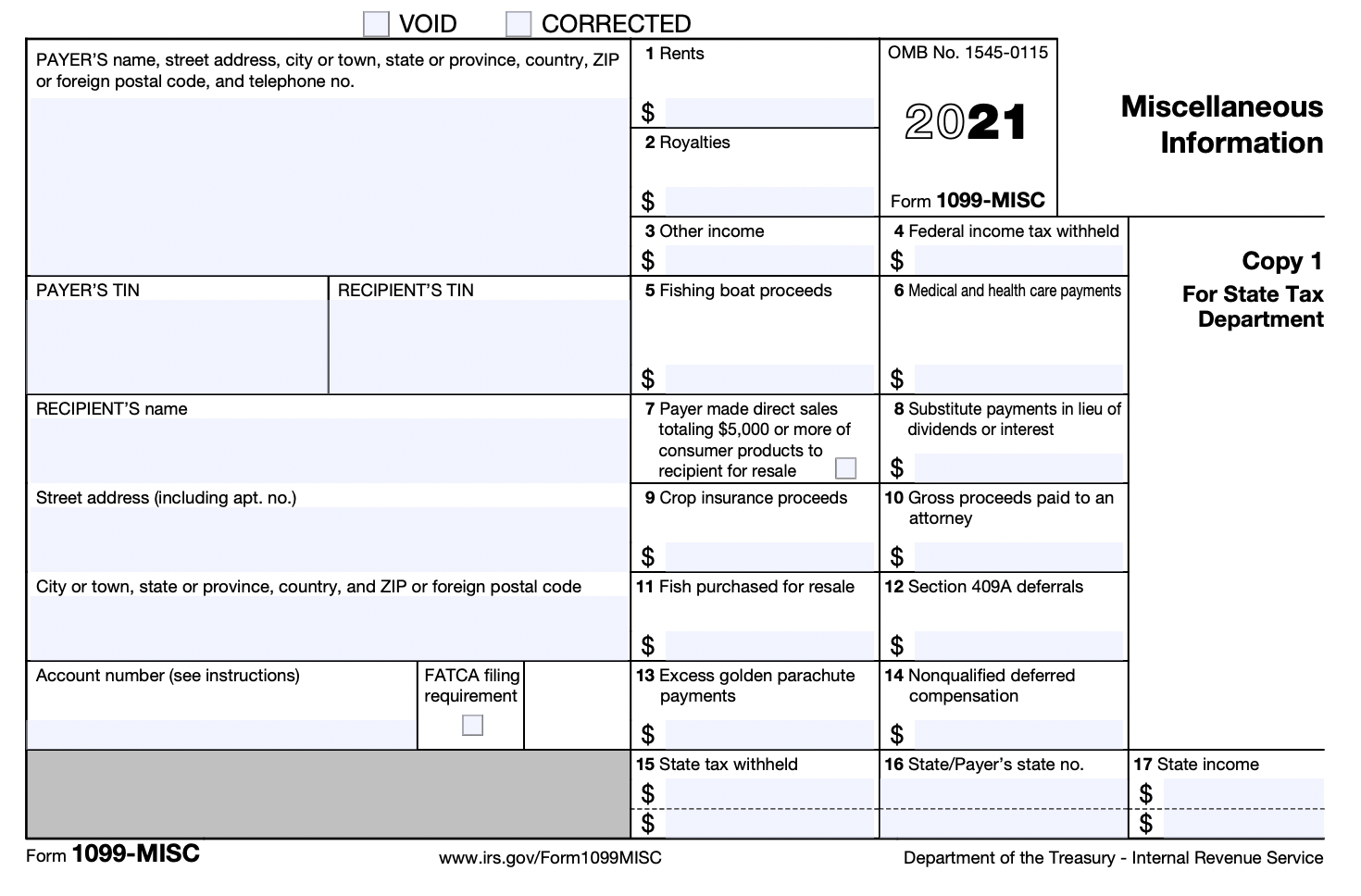

Form 1099 Misc Miscellaneous Income Definition

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

E File W 2 1099 940 941 And 1095 Tax Forms Taxbandits In 2021 Tax Forms Form Tax

Missing An Irs Form 1099 Don T Ask For It

What Is The Difference Between A W 2 And 1099 Aps Payroll

E File W 2 1099 940 941 And 1095 Tax Forms Taxbandits In 2021 Tax Forms Job Info Tax

How To Read Your 1099 Justworks Help Center

Easy Tax Pro Llc Easy Tax Pro 2020 Easy Tax Workbook For 2019 Tax Returns Paperback Walmart Com In 2021 Tax Refund Tax Return Workbook

Post a Comment

Post a Comment