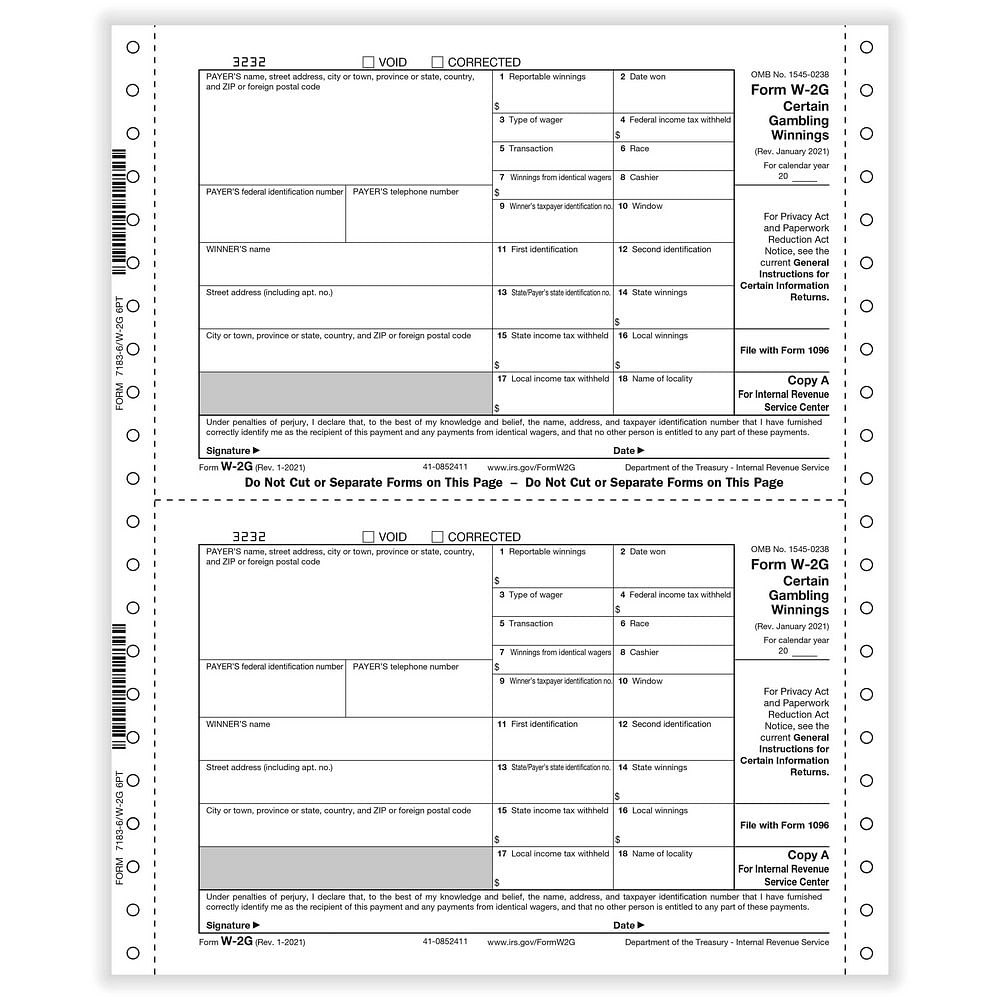

No 13 StatePayers state identification no. The person receiving the winnings must furnish all the information required by Form 5754.

Bw2geeb05 Form W 2g Certain Gambling Winnings Winner Federal Copy B Nelcosolutions Com

To confirm or update tax forms via desktop laptop or mobile web.

2022 w2g form. On Form W-2G you can report the following that have a dedicated box for each. Illinois begins accepting 2021. Informational Publication 202115 While myconneCT supports.

After this date you will not be able to opt out to receive mailed tax forms and will receive a digital download only. Two Websites To Get a W2 Online Copy for 2021 2022. W2G Forms of my gaming activity.

Description Illinois recently released an updated transmission guide for 2021 Forms W-2G and 1099s Filed in 2022. File the FR-900Q if you are required to pay monthly or quarterly. Deposits are due by January 20 2021 for the preceding calendar year.

Reminders In addition to these specific instructions you should also use the current General Instructions for Certain Information Returns. To request electronic tax forms via desktop laptop or mobile web. The candidates will only be issued the admit card if they will submit IIFT application form and fee in the prescribed format.

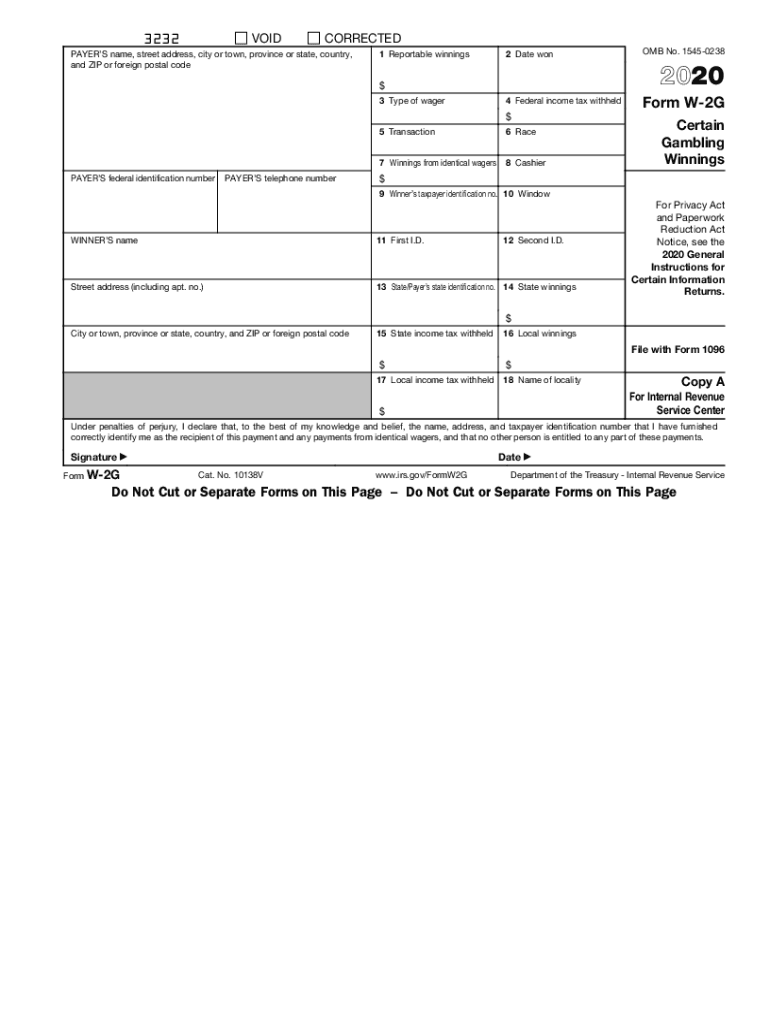

Fantasy app customers can change their IRS Form W-9 via desktop laptop or mobile web. Form W-2G tax form is the information return for reporting gambling income. Prepare Form 5754 Statement by Persons Receiving Gambling Winnings if another person is entitled to any part of these winnings.

American Samoa Wage and Tax Statement Info Copy Only 2022 01142022 Form W-2. The type of gambling the amount of the gambling winnings and. 2022 01142022 Form W-2GU.

Starting in January every year companies mail out W2s to their employees by January 31st the due date set by the IRS. 2022 Tax Returns are due on April 15 2023. Why did I receive a W2G.

If all information on the screen is correct eSign with your SSN or ITIN. On the Confirm Your W-9 Filing page review your Citizenship Name and mailing address and if youd prefer Only issue me electronic tax forms. If you dont want to receive a physical tax form in the mail you can opt to receive electronic-only tax forms instead.

A taxpayer will need to file a Form W-2G if they receive 600 or more in gambling winnings and the payout is at least 300 times the amount of the wager other than winnings from bingo keno and slot machines. After this date you will not be able to opt out to receive mailed tax forms and will receive a. Window WINNERS name 11 First identification 12 Second identification Street address including apt.

The 2020 FR-900A is due January 31 2021. This page is being updated for Tax Year 2022. File this form to report gambling winnings and any federal income tax withheld on those winnings.

Those general instructions include information about. Benefit from a electronic solution to generate edit and sign documents in PDF or Word format on the web. You must sign Form W-2G if you are the only person entitled to the winnings and the winnings are subject to regular gambling withholding.

Who do I contact if I did not receive a W2G form. This form is used to report income and withholding that is related to a taxpayers gambling winnings. Winnings from identical wagers.

January 1 - December 31 2022. Generally the ratio of the winnings to the wager. You may verify your current information on file by visiting or calling the Resort Club at 18448524386 or by contacting your VIP host.

Data put and request legally-binding electronic signatures. The requirements for reporting and withholding depend on. Guam Wage and Tax Statement Info Copy Only 2021 12162021 Form W-2GU.

Federal income tax withheld. How to opt-out of W2G Online. W2G FORM Your W2G Forms will be sent to your address on record at the Resort Club or you may pick up your forms at the casino.

About Form W-2 G Certain Gambling Winnings. Instructions for Forms W-2G and 5754 Certain Gambling Winnings and Statement by Persons Receiving Gambling Winnings 0121 02182021 Form W-2GU. Return the signed form to the payer who will give you your copies.

How to Opt In. Transform them into templates for multiple use insert fillable fields to gather recipients. The payer is required to file Forms W-2G based on Form 5754.

View All Result. Navigate to the DraftKings Tax ID form. 14 State winnings City or town province or state country and ZIP or foreign postal code 15 State income tax withheld 16 Local winnings 17 Local income tax withheld.

You must file a copy and attach it to your federal income tax return. Navigate to the DraftKings Tax ID form. Forms W-2G may be issued immediately or by January 31 following the year of the payment.

Get the job done from any device and share docs by email or fax. Guam Wage and Tax Statement Info Copy Only 2022 01142022 Form W-2AS. Before filling the IIFT application form the candidates must check the eligibility criteria because ineligible candidates will not be granted admission.

The due date for filing Form 1099K is no later than 30 days after filing with the IRS. El cortez casino win loss statement is the el cortez casino open. The due date for filing Forms 1099R 1099MISC 1099NEC and W2G for tax year 2021 is January 31 2022.

Why did I receive multiple W2G forms. Instructions For Forms W 2G And 5754 Rev January Irs 2021-2022. The exam date for IIFT 2022 has also been shifted to December 03 2022.

The W-2 forms typically get there by the end of January but there is a way to get a free copy of your W2 online faster than in the mail. Most changes to the transmission guide are the result of consolidating information from other sources clarifying information from the previous guide or updating dates to reflect the new tax year. Withholding Tax Forms for 2022 Filing Season Tax Year 2021 File the FR-900A if you are an annual wage filer whose threshold is less than 200 per year.

IRS Income Tax Forms Schedules and Publications for Tax Year 2022. In consideration of this I agree to release and hold harmless The Casino at Dania Beach and all of its directors employees officers managers affiliated persons and representatives from any and all claims causes of action liabilities costs. Wage and Tax Statement Info Copy Only 2022 01142022 Inst 8804-W.

Fillable Online W2g Idms Form Fax Email Print Pdffiller

W 2g Form 2021 2022 Irs Forms Taxuni

:max_bytes(150000):strip_icc()/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

Irs Form W 2g Software 289 Efile 449 Outsource W 2g Software

W 2g Software To Create Print E File Irs Form W 2g

Cw2g056 Form W 2g Certain Gambling Winnings 6 Part Carbonless Greatland Com

W 2g 6 Part 1 Wide Certain Gambling Winnings Carbonless Dateless 100 Forms Pack

W 2g Gambling Winnigs Copy A Dateless W 2taxforms Com

/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

W 2g Form 2021 2022 Irs Forms Taxuni

/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

22c1042s055 2022 Form 1042 S Foreign Person S U S Source Income 5 Part Carbonless Greatland Com

/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

Irs W 2g 2020 2022 Fill Out Tax Template Online Us Legal Forms

Post a Comment

Post a Comment