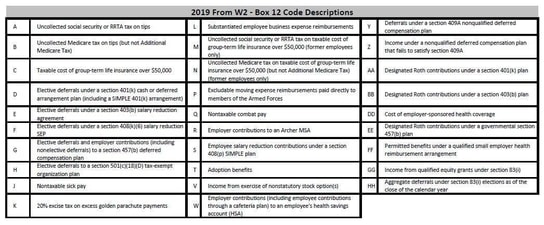

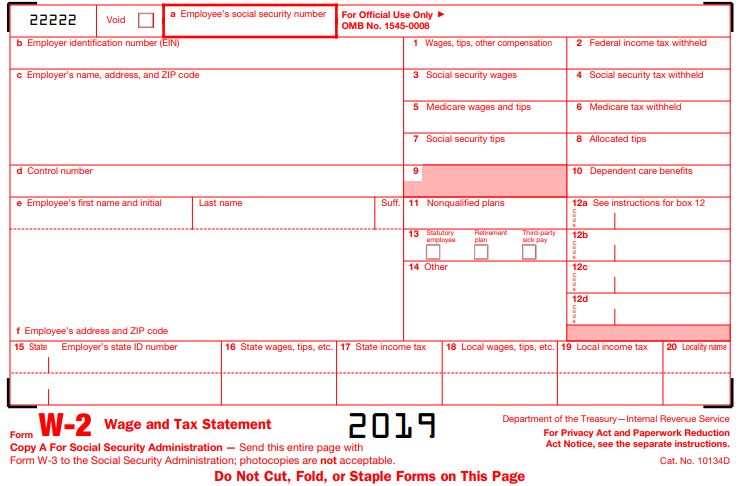

Fortunately theres a way that business owners can avoid huge tax penalties in 2019. A B D K L or M.

What Do The Codes In Box 12 On My W 2 Mean And Should I Care

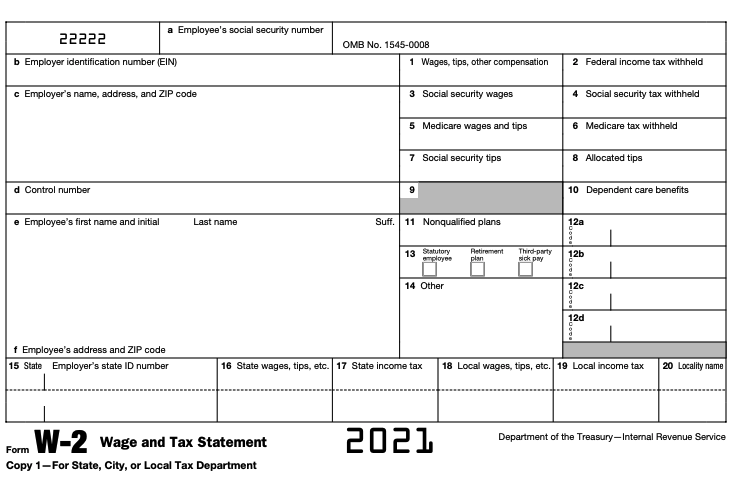

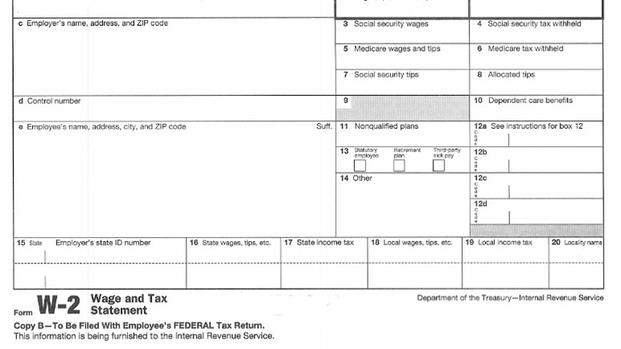

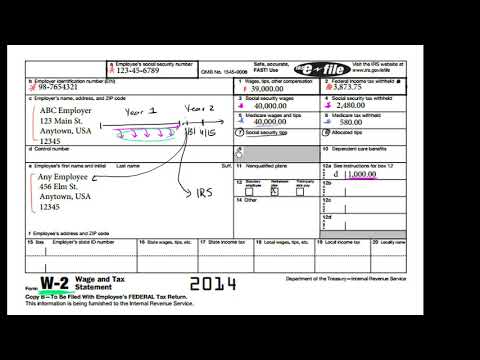

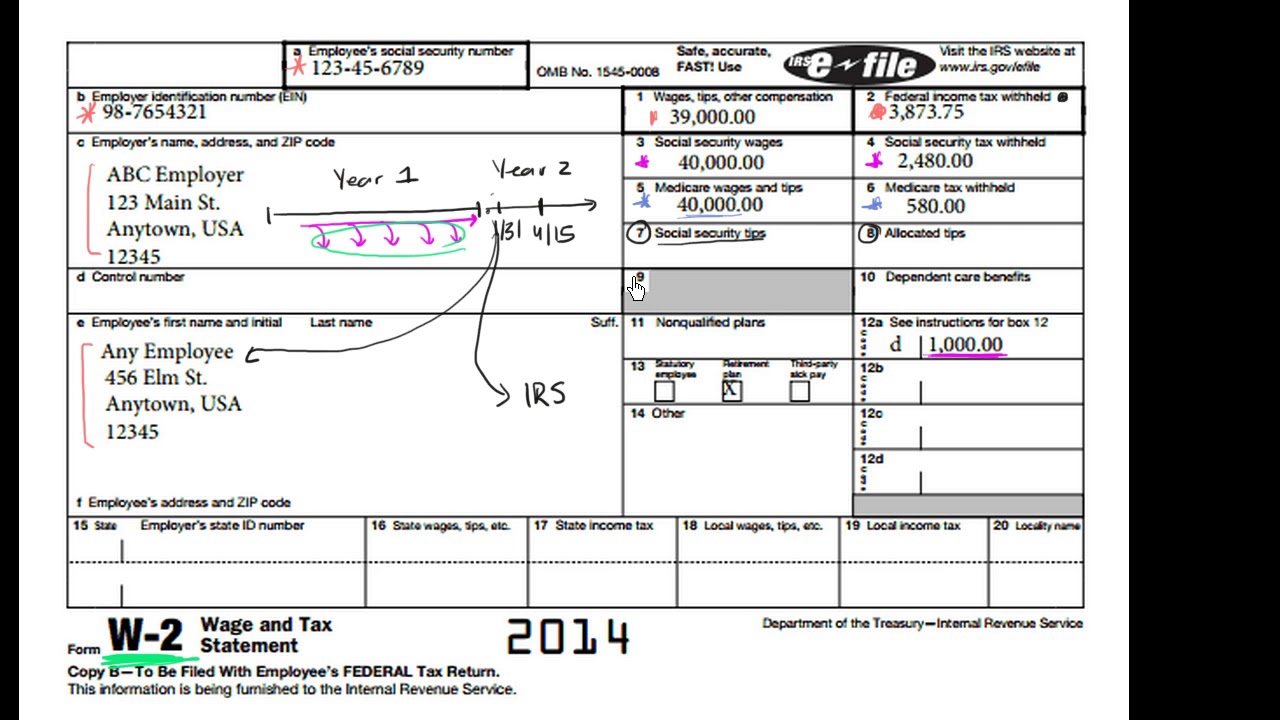

In part 1 of this two-part series I attempted to demystify the W2 forms by exploring and explaining boxes 1 through 9.

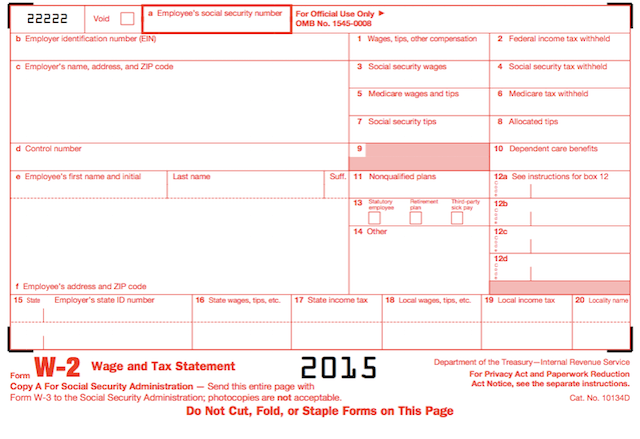

Box d on w2 form 2019. The Box D Control Number is a code that identifies your unique W-2 form in your employers records. Dependent Care Box 10 of the W2 forms is used to report flexible spending FSA for dependent care. Form W-2 wage statement Box D is called the Control Number field.

Other parties need to complete fields in the document. It is usually located below the Employers Name and Address on the top left side of your W-2 form. Box C - Services rendered in agricultural labor.

Complete Form 2441 Child and Dependent Care Expenses to compute any taxable and nontaxable amounts. Box D is on the top left of your W-2 form. Use Code 8 for an IRA distribution under section 408d4 unless Code P applies.

So youre able to file the form without this field on. Whats more the IRS issues fines for every month that employees did not receive an offer of coverage. As federal income taxes this box includes the amount your employer has withheld.

Use code D in Box 12 and check the box below Retirement plan in Box 13. The Form W-2 contains all wages and tax information for an employee. Box D of your W-2 form is populated by a unique control number for employer records.

Excess contributions plus earningsexcess deferrals andor earnings taxable in 2019. This amount is a reported in box 1 if it is a distribution made to you from a nonqualified deferred compensation or nongovernmental section 457b plan or b included in box 3 andor 5 if it is a prior year. Not all W-2 forms however includes a code in Box D since the control number itself is optional.

Uncollected social security and Medicare tax on tips. Box eEmployers Federal EIN. Meaning of Numbered Boxes in W2 Form.

Complete Edit or Print Your Forms Instantly. W2 Forms Box 10. It is usually located below or near the Employers Name and Address.

D Elective deferral under a Section 401k cash or arrangement plan. Box gEmployers state ID number. The 2019 Form W - 2 includes warrantspayments with issue dates of January 1 2019 through December 31 2019.

C Taxable costs of group-term life insurance over 50000 included in W-2 boxes 13 up to Social Security wages base and box 5. If you get errors when attempting to e-file with an empty box D just enter any number in this format. A Control Number box D is used by many payroll departments to uniquely identify a W-2 in their system.

This document is locked as it has been sent for signing. Also use this code for corrective distributions of excess deferrals excess contributions and excess aggregate contributions unless Code P applies. A W-2 form is a wage and tax statement prepared by the employers every year for each employee.

However these contributions are subject to Social Security and Medicare taxes. Ad Access Any Form You Need. Box hEmployers originally reported Federal EIN.

The Form W -2 reflects wages paid by warrantsdirect deposit payments issued during the 2019 tax year regardless of the pay period wages were earned. Boxes 1 through 8 10 and 11. Box dNumber of Forms W-2c.

5 digits space 5 digits for example 12345 67890. It is not reported separately on Form 1040. This includes the total wages as taxes to the Social Security Administration tax.

In 2018 the IRS increased the penalties for any reporting employer who doesnt report health insurance on W2 forms of employees. You have successfully completed this document. Include this tax on Form 1040 Schedule 2 line 8 check box c and identify as UT.

Boxes C and D indicate if the remuneration includes payments to the employee for the following services. Box jEmployers incorrect state ID number. E0 Employee Wage Record position 390-390 - Services rendered in agricultural labor.

This amount is already included in the taxable income of the Form W-2. It provides the employees with the necessary data that they must include in their income tax form. List of Box 12 Codes.

Completed 21 July 2020. You will recieve an email notification when the document has been completed by all parties. It has two-fold uses.

Form W-2 wage statement Box D is a Control Number field. The Dependent Care FSA also known as. The Box D Control Number is a code that uniquely identifies your particular W-2 document in your employers records.

If your W-2 doesnt have one its no big deal. Box iIncorrect establishment number. Included in box 1.

Lets continue this exploration by reviewing the rest of the W2 detail starting with. This includes the entire amount from wages that can be considered total taxable wages. Report the amount of an employees retirement plan contributions on Form W-2.

Lines a b c and d of Box 12 on Form W-2 contain miscellaneous additional compensation and benefits each identified with a letter code. The IRS doesnt care whats in box D. This amount represents the social security and Medicare tax on the tips you reported to your employer.

Usually this number is assigned by most payroll processing software to track the form in their system. This document has been signed by all parties. Taxable cost of group-term life insurance over 50000 included in boxes 1 3 up to social security wage base and box 5.

Box D - Services rendered by a minister of a church or by a member of a. It is used by employers to report the wage and tax information of their employees to the IRS.

How To Read Your W 2 Justworks Help Center

What And Where Is Box D In A W2 Form Quora

![]()

W2 Employee Everything You Need To Know Excel Capital Management

How To Read Your Military W 2 Military Com

Former Gap Employee W2 Online Shopping Has Never Been As Easy

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

2019 Tax Information Form W 2 Wage And Tax Statement Form 1099

Intro To The W 2 Video Tax Forms Khan Academy

Intro To The W 2 Video Tax Forms Khan Academy

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

How To Read Your W 2 Form To Correctly File Your Tax Returns

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

What Is A W2 Form Instructions Deadlines W2 Form 2019

Post a Comment

Post a Comment