Form 1120S Corporate Return 1120S Corp with K1 15 S Corporation Can be Owned by One Person Managing Shareholder Must Receive a Salary Business Income Reported on Form 1120S Income Reported on Form 1040s Schedule E Could also be W-2 wages or 1099 income All Shareholders of an S Corp are Issued K-1s. Other than an S-Corp whose only activity is passive.

How To File S Corp Taxes Maximize Deductions White Coat Investor

One of the key benefits of the S Corp is the simplified process for tax filing.

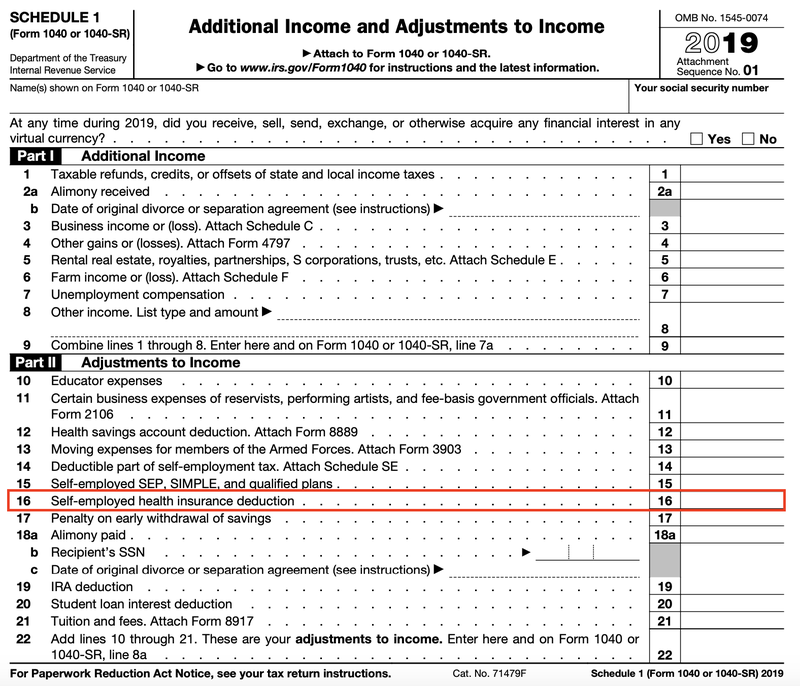

S corp w2 form. This will help those affected small business owners claim a self-employed health insurance deduction on their Form 1040. An S corporation is a business structure that elects to pass through to its shareholders any corporate income losses credits and deductions for federal tax purposes. This form is an information return that reports your businesss income.

If these fringe benefits are not included in the shareholders Form W-2 they are not deductible for tax purposes by the S corporation. This is the amount the shareholder deducts on page 1 of Form 1040 line 29 Self- employed health insurance deductionDec 13 2017. PA resident purchases goods on the Internet that are subject to PA sales tax.

Income Tax Return for an S Corporation reports the business income gain losses deductions and tax credits. Can a Shareholder-Employee of an S Corp Be Issued a Form 1099-MISC. Sent to the IRS as well as each shareholder this form reports any dividend distributions paid to stockholders.

On the other hand a W2 contractor is a person who provides employment services to another company just like an employee and is typically referred by a staffing agency. Improperly Receives a 1099-MISC. A W2 contract is relatively for a longer duration.

S CORP Shareholder-Employee Form 1099 or W-2. There are additional Form W-2 reporting requirements for a greater than 2 shareholder of an S corporation shareholder if their health care plan costs are paid by the S corporation. The shareholders then report the flow-through on their personal tax returns.

The officers are supposed to take reasonable compensation for the services they perform. You Need to Understand the Tax Consequences When an Owner of S Corp. For example if you withheld any Additional Medicare Tax from your employees wages the amount of Medicare tax that is reported on Forms 941 line 5c or Form 944 line 4c wont be twice the amount of the Medicare tax.

This also includes immediate family members of greater than 2 shareholders of an S corporation. The vendor selling the goods on the. This will be reported on your paystub each pay period and on your W2 at the end of the year.

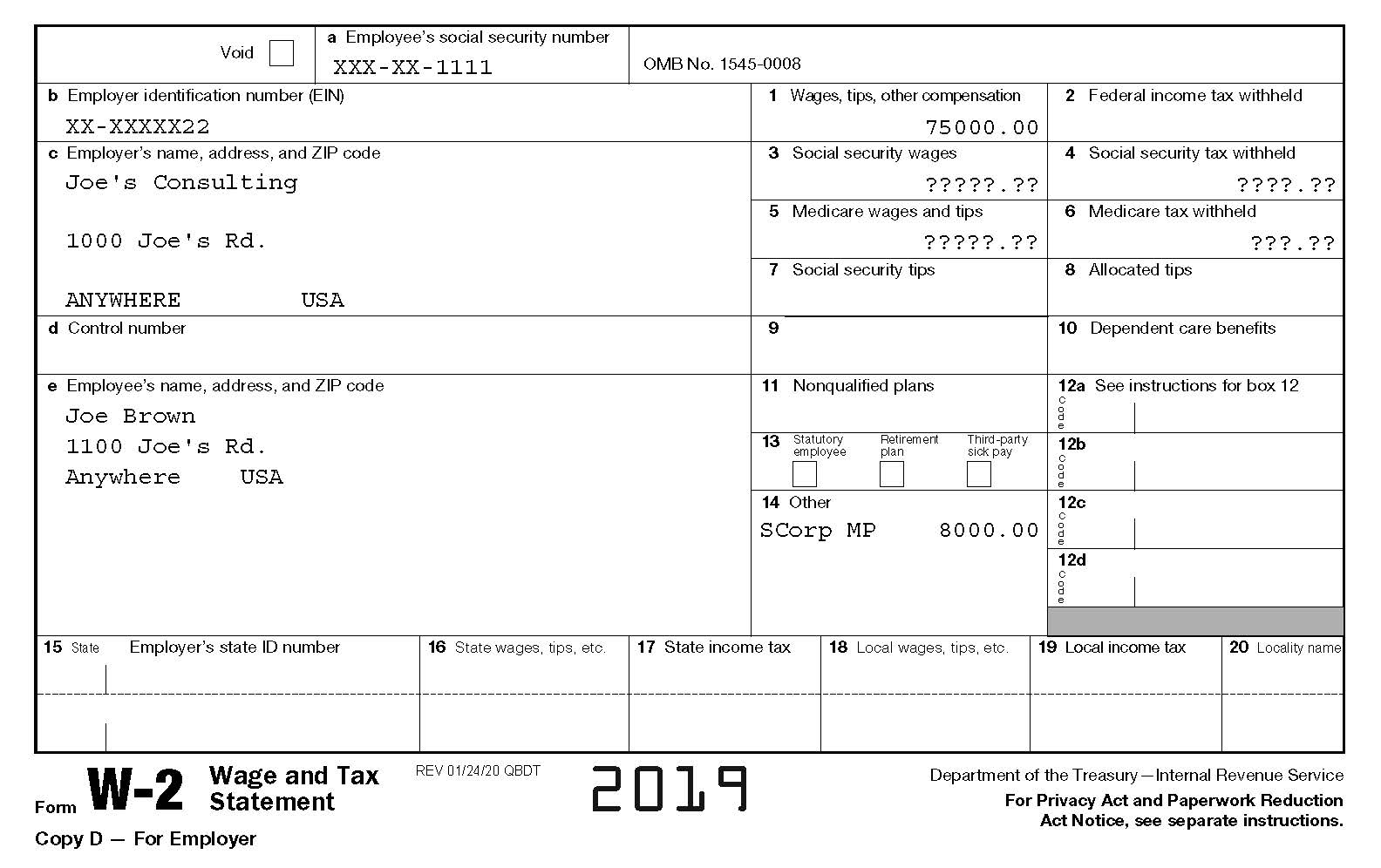

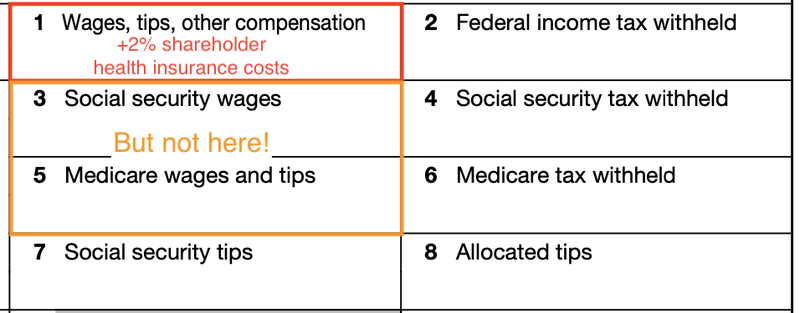

Health and accident insurance premiums paid on behalf of a greater than 2-percent S corporation shareholder-employee are deductible by the S corporation and reportable as wages on the shareholder-employees Form W-2 subject to income tax withholding. So you can gain expertise in the. Here is the winner.

What is a reasonable salary for S corp owners. So lets say you make 500K at your W-2 job and your S Corp salary is 50K and you decide to pay yourself an extra 10K in salary in order to increase your 199A deduction. Again since the S Corp doesnt have to file federal taxes a separate corporate tax return isnt necessary.

This could include separate forms if you receive both S Corp proceeds as well as C. S Corporation health insurance premiums paid by the employer for 2 shareholder employees. The health insurance premiums paid by the S corporation are reported on Form W-2 Box 14 S.

Reports an individual shareholders income deductions and tax credits. In addition to deducting your wage as an expense you can take advantage of the full benefits of owning an S-Corp. The disallowed deduction creates a mismatch of benefits and expenses among shareholders with some shareholders paying more tax than if the fringe benefits had been properly reported on Form W-2.

In essence a corp-to-corp arrangement is one where you offer your services to a company through your own company business entity to business entity. Reporting S Corp shareholder distributions. The S Corporation must also prepare and file Form 1099-DIV reports.

Box 14 SCorp MP number is way low compared to quick report amount on payroll items. Payroll tax returns have to be filed and payroll taxes that are withheld need to be paid in on a timely basis. Schedule K-1 Form 1120-S Shareholders Share of Income Deductions Credits etc.

Failure can result in substantial penalties. Income Tax Return for an S Corporation to report your distributions. Though you can read between the lines to know the differences between W2 and C2C we have mentioned them distinctly here.

See the Instructions for Form 2553 PDF for all required information and to determine where to. That has to be reported on a w-2. As an employee and taxpayer you will receive a W-2 a Schedule K-1S and possibly a Form 1099-DIV from your business.

Then report your portion of S corp earnings on part two of Form 1040 Schedule E a catch-all form for supplemental income and Form 1040 Schedule 1. If your business makes a lot of money ie. More than 157500 for a single person or 315000 for a married couple filing jointly having an S Corp could help you qualify for the tax break of the century when you may not have otherwiseImagine youre a single person and your business earns a 250000 profit next yearIf your business is structured as a.

Do S Corp shareholder health insurance premiums go on w2. It can be helpful for your record keeping to have S-Corp W2 medical benefits explained. In order to become an S corporation the corporation must submit Form 2553 Election by a Small Business Corporation signed by all the shareholders.

Suggestion on where look for the issue. However if you are an owner in an S Corp you might have to file several forms along with your personal return. Scorp 2 SH medical deduction and company paid payroll items appear to be set up correctly including tax tracking.

This increases your 199A deduction by 5K and if you have a marginal tax rate of 37 like I do that would save you 1850 in federal income taxes. See our S Corp Insurance PayDay After-tax employee contributions to an HSA can be reported in Box 14 with the. Strictly speaking if you are a significant owner or the sole owner of an S-Corporation and you actively perform services for it then you would enter your W-2 wages as Officers Compensation rather than Employees Salary.

Instead of a W-2 your S Corp files IRS Form 1120S US. Reporting Reminder for Greater Than 2 S Corp Shareholder. We are sure that you must have gained a better understanding of W2 and C2C Corp-to-Corp forms of employment by now.

You report the income in the form of a W2 and the business can deduct your salary and the company portion of payroll taxes. Your W-2 income goes on line one of Form 1040. Amounts reported on Forms W-2 W-3 and Forms 941 or Form 944 may not match for valid reasons.

I Own An S Corp How Do I Get Paid Clearpath Advisors

What Is A C Corporation What You Need To Know About C Corps Gusto

Formulir W2 Foto Stok Unduh Gambar Sekarang Istock

A Beginner S Guide To S Corp Health Insurance The Blueprint

How To File S Corp Taxes Maximize Deductions White Coat Investor

Why An S Corp Doesn T Mix Well With A W 2 Job White Coat Investor

The Benefits Of Owning An S Corp W2 Wages Clearpath Advisors

Taxability Of S Corp Health Premiums Included In Salary Cpa Certified Public Accountant Income Taxes Accounting Services Gary Boyd Cpa

Tax Blog Why Blu Tax Accounting

A Beginner S Guide To S Corporation Taxes The Blueprint

A Beginner S Guide To S Corp Health Insurance The Blueprint

A Beginner S Guide To S Corp Health Insurance The Blueprint

Tax Blog Why Blu Tax Accounting

Why S Corp Officers Require Payroll Asap Help Center

Post a Comment

Post a Comment