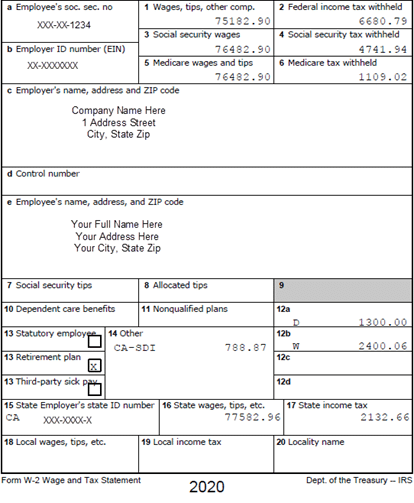

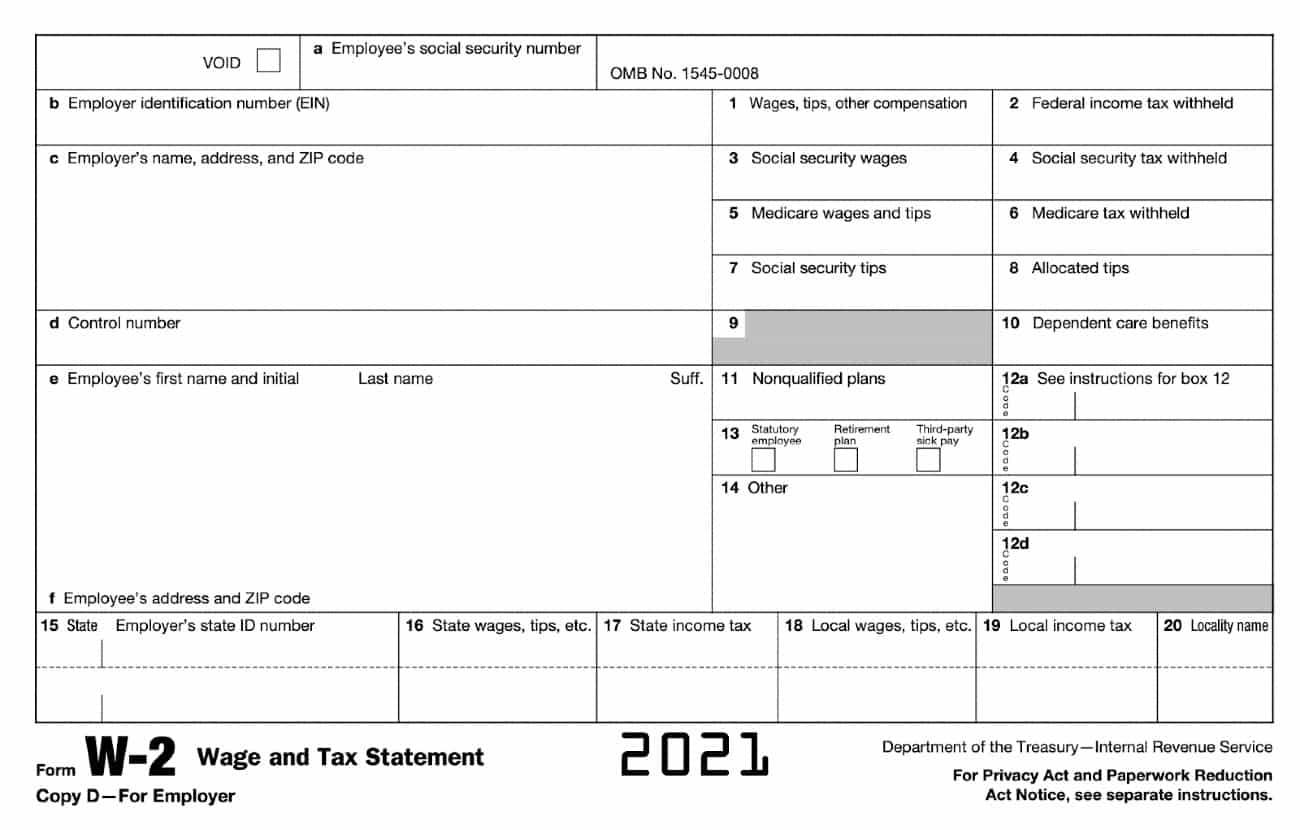

In 2019 I was a grad student who spent half the year paid by a fellowship that was not taxed and is thus not reported on my W2 and the other half with a taxed paycheck. Box 3 Total wages subject to Social Security tax.

Understanding Your W 2 Controller S Office

If the figures dont match taxpayers Form W-2 correct the data so that it matches the information on Form W-2.

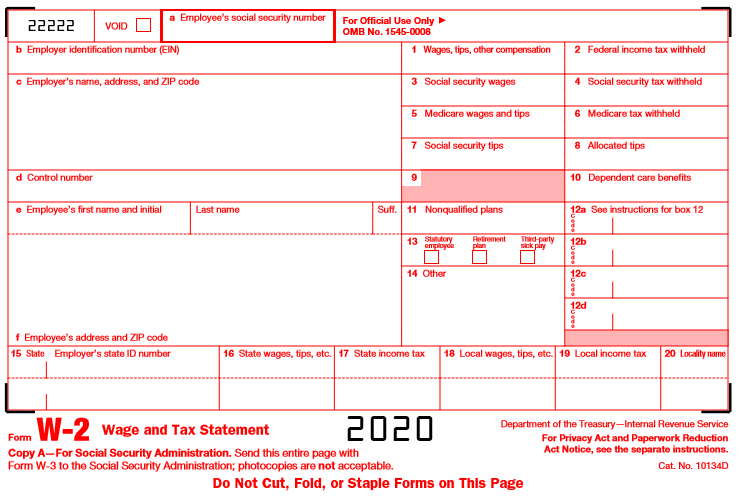

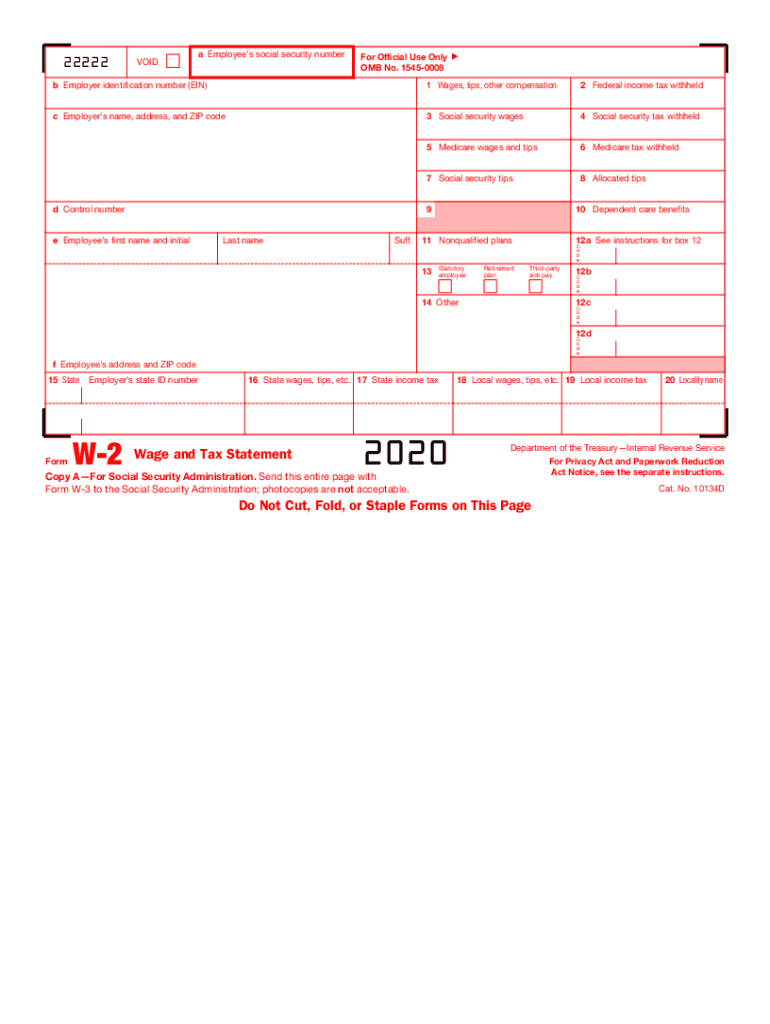

W2 form 2020 box 5. Box 5 includes income subject to federal income tax Box 1 as well as income that is not subject to federal income tax. The entries in boxes 3 4 5 6 and 16 will auto-populate based on the Box 1 entry. Wage and Tax Statement.

It reports the annual wages of an employee and the amount of taxes withheld from his or her salary to the Internal Revenue Service IRS. My 1098T reports values in Box 1 and Box 5. The W-2 form contains details regarding employees total gross earnings Social Security earnings Medicare earnings and federal and state taxes withheld from the employee.

Section 125 deductions medical dental vision dependent care pre-tax commuter benefits etc. Employers need to provide a W-2 form to each employee to whom they paid. Box 6 Total Medicare tax withheld from Box 5.

Box 3 on the W2 forms represents Social security wages and Box 4 are the social security taxes on those wages. The Medicare tax a flat rate of 145 of your total Medicare paycheck for the 2020 tax year. Compensation paid to the employee for that year.

Section 125 deductions medical dental vision dependent care pre-tax commuter benefits etc. Box 5 indicates wages subject to Medicare taxes. For Privacy Act and Paperwork Reduction Act Notice see the separate instructions.

Box 4 Total Social Security tax withheld from Box 3. Box 3 on the W2 forms represents Social security wages and Box 4 are the social security taxes on those wages. Income not subject to federal income tax includes employee contributions to a SIMPLE retirement account or other elective deferrals which will be taxed later on.

Box 2 Total federal income tax withheld from Box 1. Box 5 Total wages subject to Medicare tax. For information on how to report tips on your tax return see the Form 1040 instructions.

This is for Social Security and Medicare taxes. Form W-2 Wage and Tax Statement is filed by an employer for each employee from whom income Social Security or Medicare tax was withheld. Box 4 shows the total of Social Security taxes withheld for the year.

Form W-2c reporting of employee social security tax. Similarly Box 5 represents Medicare wages and Box 6 are the taxes on those Medicare wages. With the User ID youve given from the previous page complete the phone registration.

Medicare taxes generally do not include any pretax deductions and will include most taxable benefits. Form W-2 2020 Filing Instructions. Boxes 5 and 6.

Similarly Box 5 represents Medicare wages and Box 6 are the taxes on those Medicare wages. The 2020 federal income tax filing due date for individuals has been extended from April 15 2021 to May 17 2021. If there is an entry in Box 10 Form 2441 Child and Dependent.

W-2G - REPROGRAMMING REQUIRED Continuous use formForm W-2G has been converted from an annual revision to. Now you can start filing as many W-2 as you like. Box 1 Total taxable wages for the year.

Copy AFor Social Security Administration. Box 3 on the W2 forms represents Social security wages and Box 4 are the social security taxes on those wages. Department of the TreasuryInternal Revenue Service.

Medicare wages and tips. 51 the instructions for your respective employment tax form and the Caution under Reconciling Forms W-2 W-3 941 941-SS 943 944 CT-1 and Schedule H Form 1040 for more information. Difference between Box 1 Box 3 and Box 5.

You must include in boxes 1 3 and 5 or 14 if railroad retirement taxes apply the cost of group-term life insurance that is more than the cost of 50000 of coverage reduced by the amount the employee paid toward the insurance. This is the amount subject to Medicare tax. Do not file with the W-2 until you get an explanation or a corrected W-2 from them.

This amount includes the 62 Social Security Tax withheld on Social Security wages in Box 3 up to 137700 wages or 853740 tax. Form W-2 Instructions continued Review Box 2 and box 17 to ensure tax withheld was entered and is correct. The wages in box 5 of Form W-2 must be equal to or greater than the wages in box 3 of Form W-2.

Send this entire page with Form W-3 to the Social Security Administration. This is the wage amount subject to Social Security Tax up to a maximum of 137700 the 2020 maximum Social Security wage base. Schedule H Form 1040 if you utilized any of the COVID-19 tax relief for 2020.

Similarly Box 5 represents Medicare wages and Box 6 are the taxes on those Medicare wages. Section 125 deductions medical dental vision dependent care pre-tax commuter benefits etc. You need to contact your employer and find out why Boxes 3 and 5 are blank.

Boxes 7 and 8. Thus my W2 reflects half of what I earnedhalf of what my school processed for me. Box 6 This box shows in W2 form the taxes that will be withheld from your paycheck.

The value in Box 5 is higher than Box 3 if the employee earned more than the Social Security salary base. This amount includes the 145 Medicare Tax withheld on all Medicare wages and tips shown in box 5 as well as the 09 Additional Medicare Tax on any of those Medicare wages and tips above 200000. Enter tax year 2020 in box c and adjust the amount previously reported as Tier 1 tax in box 14 of the Form W-2 to include the deferred amounts that were withheld in 2021.

2020 Form W-2 should be reported in box 14 on Form W-2c. Once you submit your information get to the Business Services Online homepage and click Complete Phone Registration. This amount is not included in box 1 3 5 or 7.

Wage Tax Statement Form W 2 What Is It Do You Need It

W 2 Form Fillable Printable Download Free 2021 Instructions Formswift

W 2 2020 Public Documents 1099 Pro Wiki

Reporting Paid Covid 19 Sick Or Family Leave On Form W 2 News Illinois State

W 2 Wage And Tax Statement Data Source Guide Dynamics Gp Microsoft Docs

2020 Form Irs W 2 Fill Online Printable Fillable Blank Pdffiller

How To Read Your W 2 University Of Colorado

Kroger W2 Form Online Kroger W2 Form 2020

Wage Tax Statement Form W 2 What Is It Do You Need It

How To Read A W 2 In An Illinois Divorce Page 1 Of 0 Russell Knight Divorce Lawyer

Understanding Your W2 Innovative Business Solutions

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

Post a Comment

Post a Comment