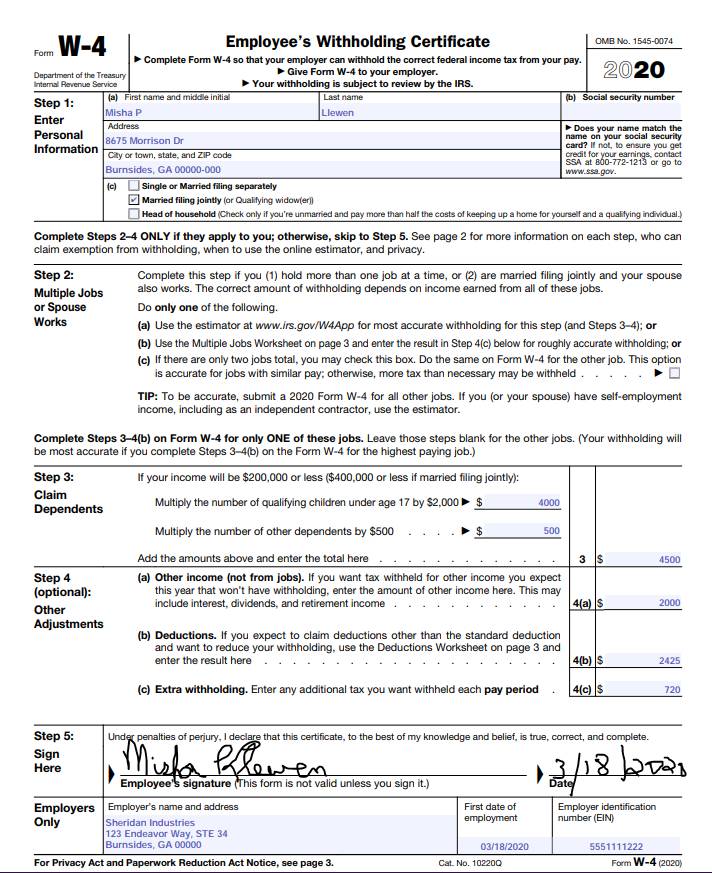

When specifying the address on this form indicate the address to which you receive your mail. You must have more than half of your annual income more than half your Social Security taxes and the dependent must be either related to you or any person.

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg)

W 4 Form How To Fill It Out In 2022

Would the proper or correct answer be for each of our W4 claiming of allowancesdependentsexemptions - Myself claiming Married with 2 Dependents myself and my daughter with my employer and my wife claiming Married with 1 Dependent for herself with her employer.

W4 form 2 dependents. You do this on the Form W-4 for the highest paying job. When youre filling out a W-4 form there are a few requirements for claiming dependents. Leave those steps blank for the other jobs.

There could be other reasons such as side income for you to reduce the number of allowances you claim. Number of Allowances on W-4 Forms and Tax Withholdings. If youre claiming an IRS dependent for the first time its important to know the dependent definition before you use the Personal Allowances Worksheet on your W-4.

Thanks for updating us. The 2021 W4 Form needs to be filled out by all new employees and existing employees who want to update their withholding. We didnt update the W-4 after that fact so dont know how they came up with the number.

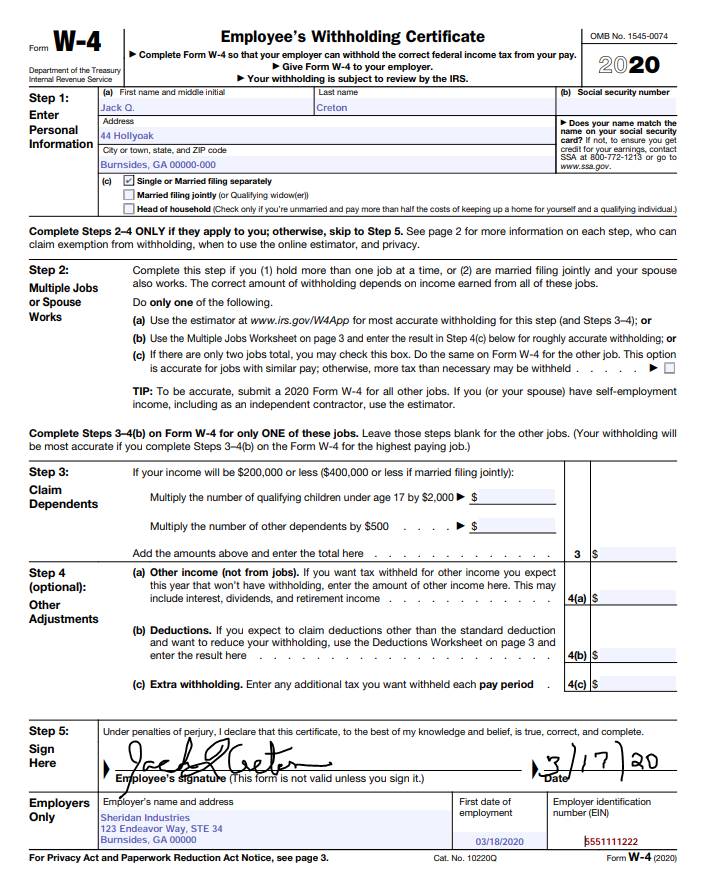

However your W-4 form -- which you submit to your employer so it knows how much to withhold for taxes -- does account for dependents. Step 3 refers to the Child Tax Credit. The number of allowances you claim on your W-4 doesnt have to match the actual number of dependents or family members you have on your tax return.

These exemptions may equal the number of allowances you decide to claim on your W-4 but they also may not. Anyway the person in charge of pay claims with 2 dependents she doesnt owe any taxes. Claim dependents from 2020 W4 to Quickbooks.

We submitted the same W-4. Form W-2 will be sent to this address unless you opt to have it delivered to you electronically. How do dependents work on W4.

Now we contacted the employer they claim they listed 2 dependents. If you are happy with your withholding and you already submitted a W4 to your employer during a previous year you do. Your withholding will be most accurate if you complete Steps 34b on the Form W-4 for the highest paying job Step 3.

How many dependents can you claim on w4. In this video Im talking about the IRS Form W4 step 3 adding dependents. Exemptions on your Form 1040 decrease the amount of income youre able to be taxed on which lowers your tax obligation.

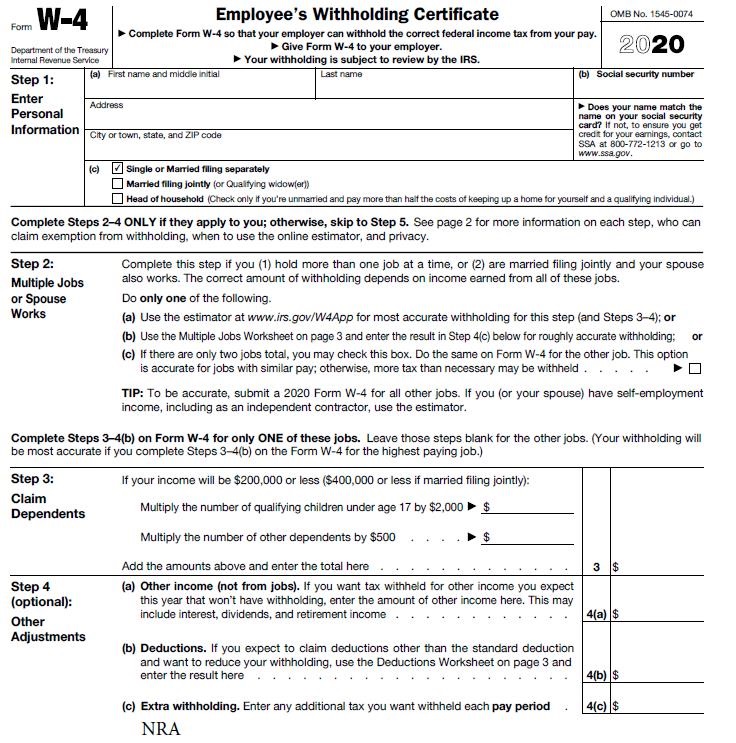

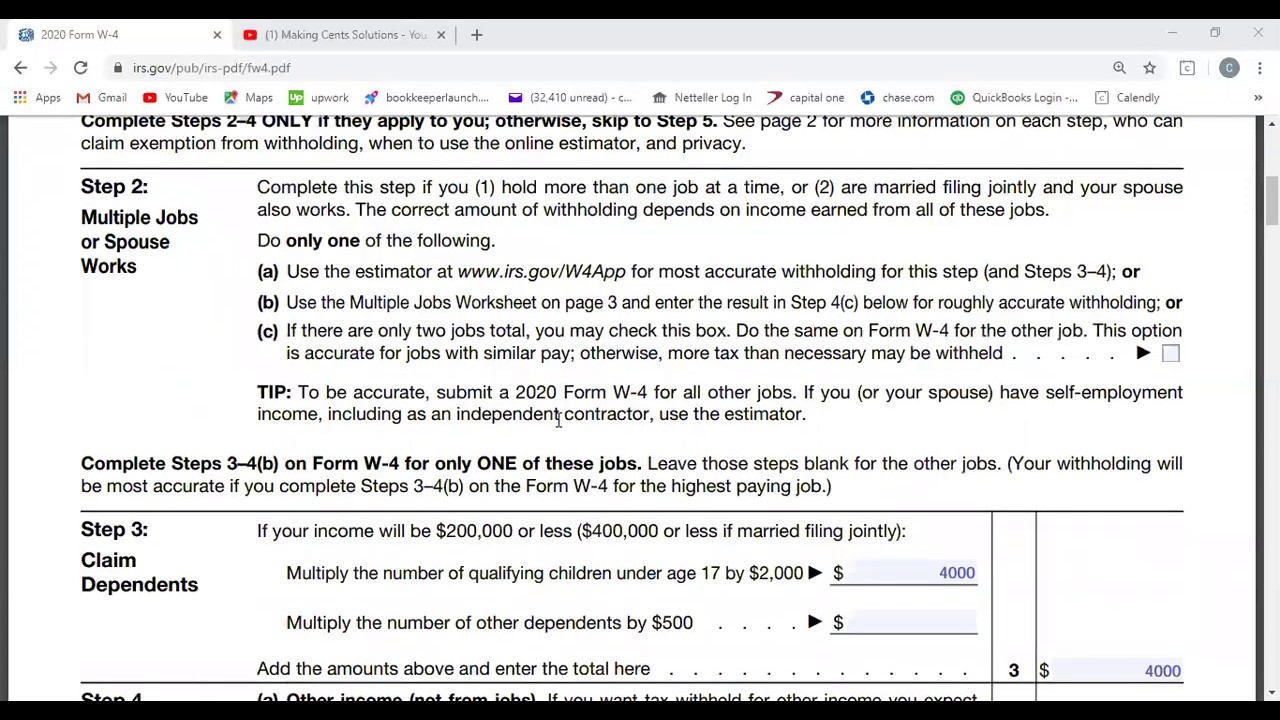

The w4 step 3 is for the dependent and child tax creditThe biggest mistake is ju. If the employees income will be 200000 or less 400000 or less if married filing jointly youll want to multiply the number of children younger than 17 by 2000. The form makes sure your employer can withhold the correct amount of federal income tax from your pay.

You fill this out if you earn 200000 or less or 400000 or less for joint filers and have dependents. A personal exemption is worth 1 allowance a dependent is worth 1 allowance a certain amount of itemized deductions is worth 1 allowance etc. If your total income is under 200000 or 400000 if filing jointly you can enter how many kids and dependents you have and multiply them by the credit amount.

Lets walk through each step of the form W4 for 2021. If you claim 2 on your W-4 you are claiming 2 withholding allowances not exemptions or dependents or anything else. The worksheet says 8.

Entering basic information about yourself is what it all starts with. This step provides instructions for determining the amount of the child tax credit and the credit for other dependents that you may be able to claim when you file your tax return. The number of dependents you have factors into your overall W-4 allowances.

Its a simple calculation where you multiply the number of children under age 17 by 2000 and the number of other dependents by 500 and add the two sums. If youre looking for where to claim dependents on your W-2 youre actually looking at the wrong form. Since we have a new child this is correct.

Caveats to Claiming Dependents on W-4 Forms. To qualify for the child tax credit the child must be under age 17 as of December 31 must be your. As a single parent with two kids you can claim more than 2 allowances if you only have one job.

How many dependents should I claim on my w4. You can request an allowance for each child if you have more than two when you are single. How do I enter Step3.

For example if you use the W4 form and find that you can claim 2 allowances you can only claim 2 allowances TOTAL between your W4s for your workplaces so for workplace 1 you could claim 2 allowances but for your second job. There are no maximum dependents you can claim as long as you are eligible to claim them. Complete Steps 34b on Form W-4 for only ONE of these jobs.

It does not show how many dependents you claimed. If you claim 8 then I can guarantee you that you will owe the IRS money at tax time because enough with not be withheld from each paycheck to meet your tax liability. A W-2 form is completed by your employer at the end of the year and shows how much money you made during the year.

If your total income will be 200000 or less 400000 or less if married filing jointly. Here youll be able to state other income and list your deductions which can be used to reduce your withholding. Many people simply count their family members and put that number down as the number of allowances on W-4 Form.

If you have more than one job youll still use the same W4 form to find how many allowances you need but the allowances are in TOTAL. Finally Section 4 of the W-4 is a bit more open ended. Second the total number of dependents you claim also has a significant effect on your total withholding so make sure you claim the correct number of dependents in Step 3.

On your W-4 Form you claim allowances which your employer uses to calculate the tax withheld from your paycheck. This video will show you how to complete the W-4 form if your filing status is Single with 2 jobs and dependents.

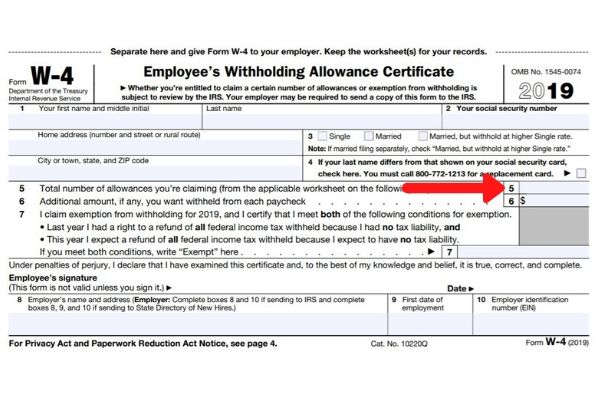

Irs Amends Form W 4 For 2020 Employee Withholding Onyx Tax Tax Relief Irs Representation Charleston Sc

The New Irs Form W 4 Has Many Scratching Their Heads Here S What You Should Know Komo

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

How To Fill Out The New W 4 Form Arrow Advisors

How To Fill Out The New W 4 Form Correctly 2020

How To Complete The W 4 Tax Form The Georgia Way

W 4 What It Is Who They Re For How To Fill It Out

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

What Is A W4 Form And How Does It Work Form W 4 For Employers

Challenges Of The New Form W 4 For 2020

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

What Is A W4 Form And How Does It Work Form W 4 For Employers

How To Fill Out 2020 W 4 As Head Of Household With Dependents Youtube

How To Fill Out 2020 2021 Irs Form W 4 Pdf Expert

Post a Comment

Post a Comment