Other parties need to complete fields in the document. Head of Household 5.

Nj W4 Fill Online Printable Fillable Blank Pdffiller

All forms are printable and downloadable.

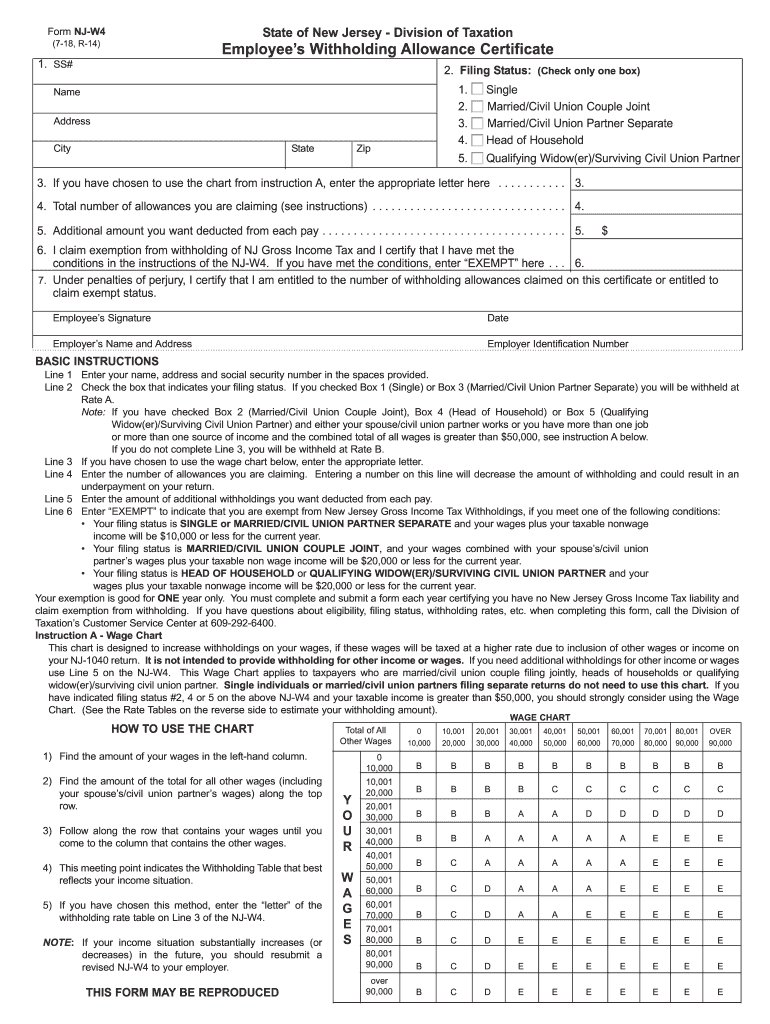

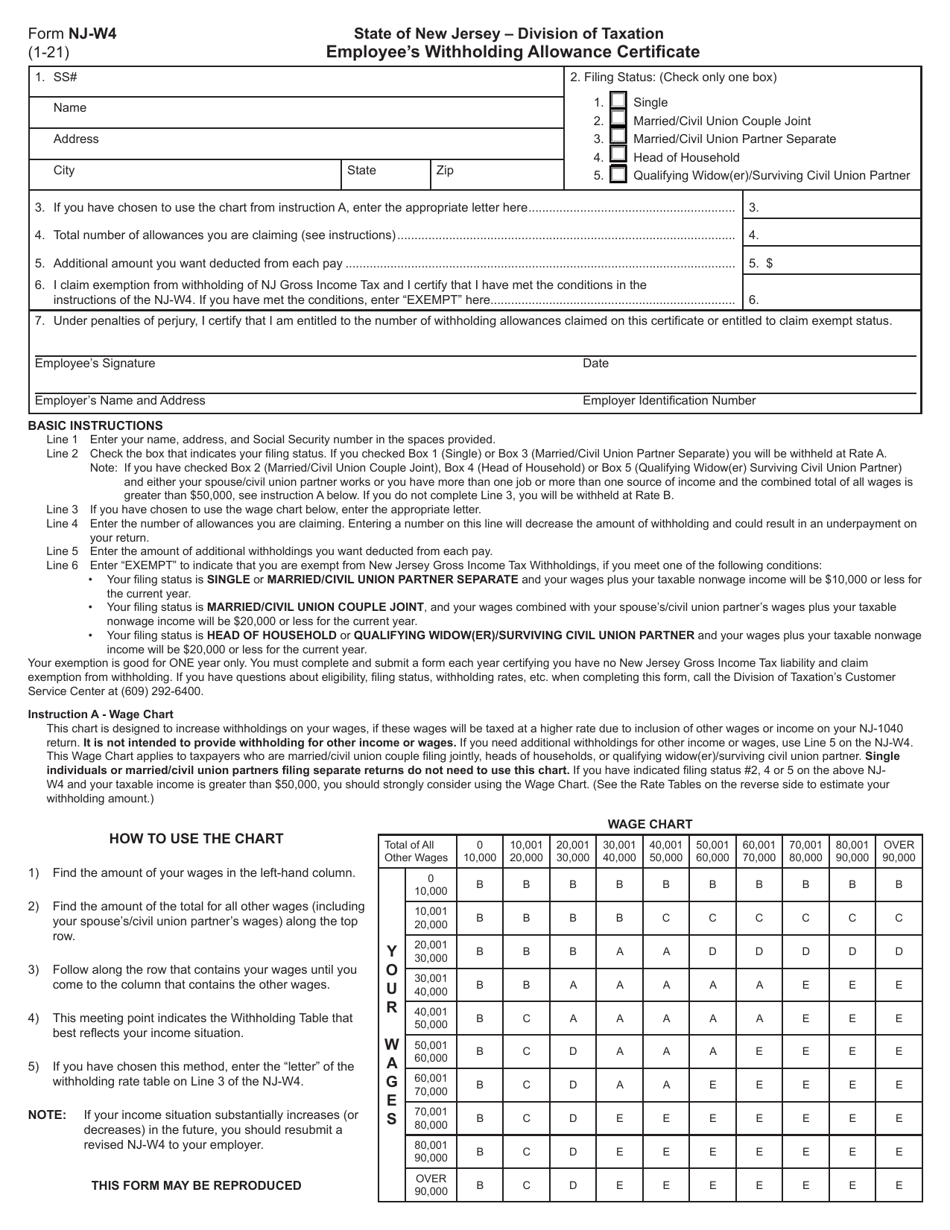

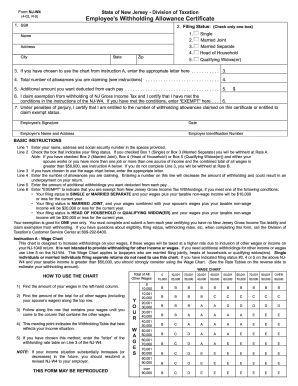

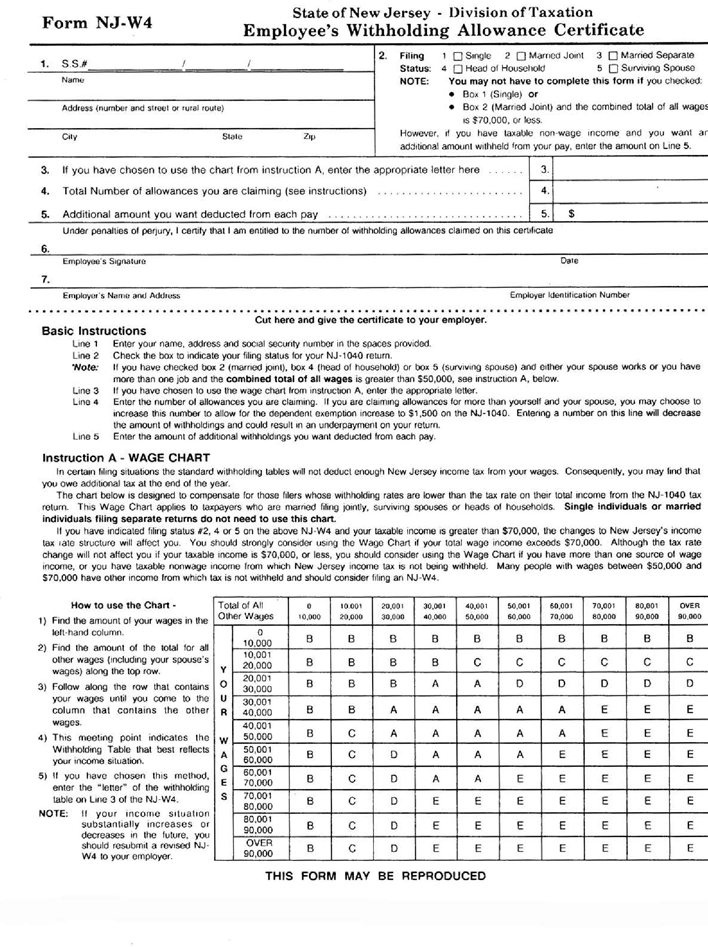

W4 form new jersey. MarriedCivil Union Partner Separate 4. If you have questions about eligibility filing status withholding rates etc. Employees should complete an Employees Withholding Allowance Certificate Form NJ-W4 and give it to their employer to declare withholding information for New Jersey purposes.

Determine the Total Number Of Allowances Claimed field as follows. Filing StatusCheck only one box 1. Princeton New Jersey - Wikipedia Princeton is a municipality with a borough form of government in Mercer County New Jersey.

Check only one box 1. Filing StatusCheck only one box 1. You will recieve an email notification when the document has been completed by all parties.

Your withholding is subject to review by the IRS. MarriedCivil Union Couple Joint 3. SS Address Name 4.

8 Employees Withholding Allowance Certificate 2. An employee completes a new form only when they want to revise their withholding information. Head of Household 5.

Form NJ-W4 1-21 State of New Jersey Division of Taxation Employees Withholding Allowance Certificate 1. First Position - If Item 3 of the NJ-W4 Contains. You have successfully completed this document.

State or Federal Exemptions. If the federal Form W-4 you most recently submitted to your employer. Head of Household 5.

Entering basic information about yourself is what it all starts with. The process of filling out the W4 form is not as complicated as it seems. The employee puts the amount of allowances that shes claiming on Line 4 of the form.

Employees Withholding Allowance Certificate Form NJ-W4 Employees should complete an Employees Withholding Allowance Certificate and give it to their employer to declare withholding information for New Jersey purposes. When completing this form call the Division of Taxations Customer Service Center at 609-292-6400. Give Form W-4 to your employer.

However any employee who claims to be exempt from New Jersey withholding because their income is below the minimum filing threshold must submit a new form every year. State of New Jersey - Division of Taxation Employees Withholding Allowance Certificate Form NJ-W4 1-10 R-13 2. The more allowances claimed the lower the amount of tax withheld.

I will be starting a new job in about a month and I know I have to face the dreaded W4. Check only one box 1Single 2 MarriedCivil Union Couple Joint 3 MarriedCivil Union Partner Separate 4Head of Household 5Qualifying WidowerSurviving Civil Union Partner BASIC INSTRUCTIONS. MarriedCivil Union Couple Joint 3.

Qualifying WidowerSurviving Civil Union Partner BASIC INSTRUCTIONS. NJ Division of Taxation - Form W-4 and NJ-W-r - NJgov Dec 30 2019 Employees should complete an Employees Withholding Allowance Certificate Form NJ-W4 and give it to their employer to declare withholding. This tax calculator aids you identify how much withholding allowance or extra withholding must be noted on your W4 Form.

S M C D E Number of Exemptions. New W4 Calculator The tax withholding estimator 2021 allows you to definitely compute the federal income tax withholding. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

S M C D E Number of Exemptions. I live in NJ but work in NYI claim ONE single on my federal and have an offer for 70Kyr. MarriedCivil Union Partner Separate 4.

State or Federal Exemptions. Use Fill to complete blank online ESSEX COUNTY COLLEGE pdf forms for free. Check only one box 1.

When I fill out the W4 worksheet I. Determine the Total Number Of Allowances Claimed field as follows. New Jersey new hire online reporting.

New Hire Operations Center. Head of Household 5. Fill Online Printable Fillable Blank Form NJ-W4 State of New Jersey Division of Essex County College Form.

This certificate Form IT-2104 is completed by an employee and given to the employer to instruct the employer how much New York State and New York City and Yonkers tax to withhold from the employees pay. In general an employee only needs to complete Form NJ-W4 once. Lets walk through each step of the form W4 for 2021.

MarriedCivil Union Partner Separate Employees Withholding State of New Jersey This document is locked as it has been sent for signing. Form NJ-W4 State of New Jersey Division of Taxation 1-21 Employees Withholding Allowance Certificate 1. A manager at the employers office can tell you how to fill out a W4 correctly or you can do it on your own.

Form NJ-W4 State of New Jersey - Division of Taxation 10-01 REV. About Form W-4 Employees Withholding Certificate. New Jersey employers must furnish Form NJ-W4 to their employees and withhold New Jersey Income Tax at the rate selected.

Qualifying Widower BASIC INSTRUCTIONS Line 1 Enter your name address and social security number in the spaces provided. I have no other deductions and will likely not be itemizing this year. A New Jersey employer is supposed to give employees a NJ-W4 form or Employees Withholding Allowance Certificate to complete which helps him to determine the amount of state income tax to withhold from each employees paychecks.

Form W-4 Department of the Treasury Internal Revenue Service Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. New Jersey New Hire Reporting. Under penalties of perjury I certify that I am entitled to.

Consider completing a new Form W-4 each year and when your personal or financial situation changes. Once completed you can sign your fillable form or send for signing. Enter Personal Information a.

First Position - If Item 3 of the NJ-W4 Contains. Although there is no. This estimator can be utilized by virtually all taxpayers.

NJ Division of Taxation - Form W-4 and NJ-W-r Best wwwstatenjus. You must complete and submit a form each year certifying you have no New Jersey Gross Income Tax liability and claim exemption from withholding. State of New Jersey - Division of Taxation Employees Withholding Allowance Certificate Form NJ-W4 7-18 R-14 2Filing Status.

Employers should retain all. Qualifying WidowerSurviving Civil Union Partner Name Address City State Zip 3. State of New Jersey - Division of Taxation Employees Withholding Allowance Certificate Form NJ-W4 4-02 R-9 2.

W4 Form Nj Fill Out And Sign Printable Pdf Template Signnow

New Jersey State Form W 4 Download

Form Nj W4 Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate New Jersey Templateroller

Bill Of Sale Form New Jersey Form Nj W4 Templates Fillable Printable Samples For Pdf Word Pdffiller

Free New Jersey Form Nj W Pdf 534kb 2 Page S

New Jersey Form Nj W4 Pdfsimpli

Nj W4 2021 Fill Out And Sign Printable Pdf Template Signnow

Form Nj W 4 Employees Withholding Allowance Certificate

Figuring Out Your Form W 4 Under The New Tax Law How Many Allowances Should You Claim In 2018 Pinterest Advice Power Of Attorney Form Allowance

Form Nj W4 Employee S Withholding Allowance Certificate

Form Ds 160 Blank 2 Blank Form Edison New Jersey Application Form

2021 Form Nj Dot Nj W4 Fill Online Printable Fillable Blank Pdffiller

64 Awesome Websites For Teaching And Learning Math Education Math Middle School Math Learning Math

Fillable Online Nj W4 State Of New Jersey Division Of Taxation Employee Fax Email Print Pdffiller

Post a Comment

Post a Comment