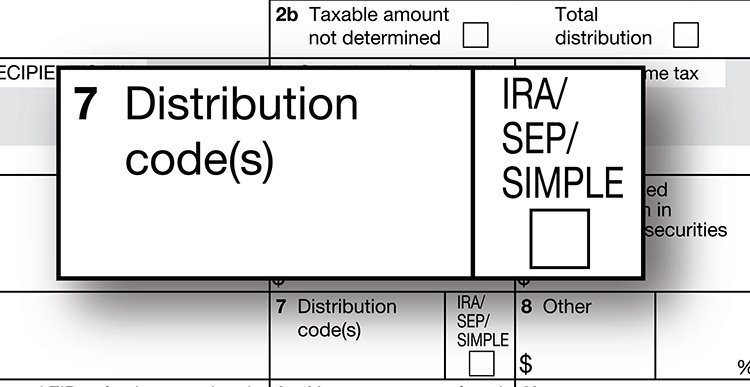

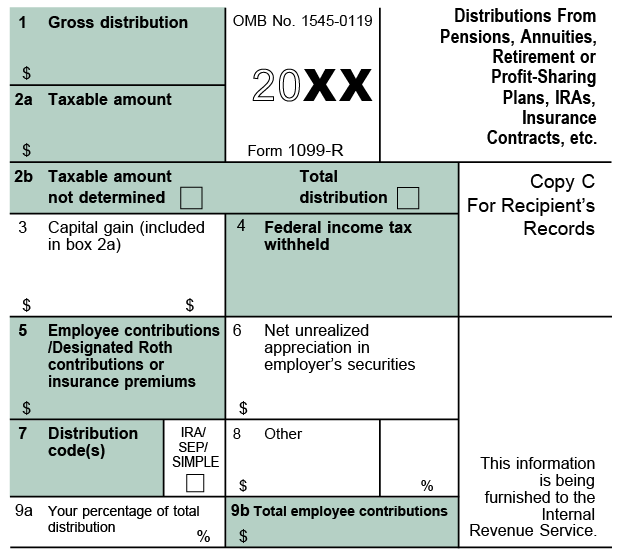

Box 7 of 1099-R identifies the type of distribution received. IRC 72t2Ai Contact form 1099-R issuer to ask if the 1099-R.

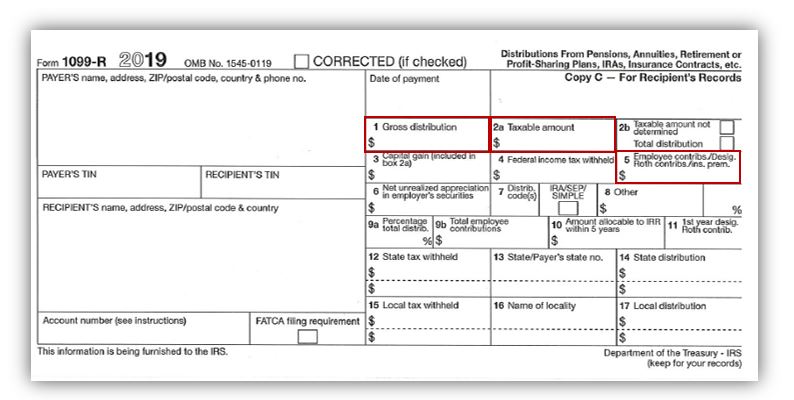

Understanding Your 1099 R Form Kcpsrs

See Form 5329 For a rollover to a traditional IRA of the entire taxable part of the distribution do not file Form 5329.

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

What is code 7 on a 1099 r. Governmental section 457b plans. Code 7 on Box 7 of the 1099-R tax form means Normal Distribution states TurboTax. Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this type of distribution.

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Report on Form 1099-R not Form W-2 income tax withholding and.

This code is in scope only if taxable amount has been determined. Corrective refunds taxable in current year. Do not combine with any other codes.

What does code 7 mean on a 1099 R. However if the distribution is from an annuity and the distribution code is 7D the distribution is taxable to the extent its. If Box 7 of your 1099-R shows a 7 in it this distribution isnt taxable if you met the plan requirements the age andor years of service required by the plan for retirement and you retired after meeting those requirements.

P Taxable in prior year of the 1099-R yearthe year the refunded contribution was made Code 7. Early distribution no known exception in most cases under age 59½. Box 7 of Form 1099-R shows the distribution code for the transaction.

Code 8 According to the 2020 Instructions for Forms 1099-R and 5498 Code 8 Excess contributions plus earningsexcess deferrals andor earnings taxable in 2020 signifies that excess contributions were deposited and returned in the same year regardless of the year for which the excess was. Governmental section 457b plans. Code G is used for rollovers from one institution to another that are tax-free.

Code 1 still applies even if the participant made the distribution to cover medical expenses qualified higher educational. Report on Form 1099-R not Form W-2 income tax withholding and. Form 1099-R Box 7 Distribution Codes continued Box 7 Distribution Codes Explanations A May be eligible for 10-year tax option This code is Out of Scope.

Are reported to recipients on Form 1099-R. B Designated Roth account distribution Code B is for a distribution from a designated Roth account. Code 12 Exceptions Distribution on or after the date the participant turned age 59½ if box 7 Form 1099-R incorrectly indicates it is an early distribution with codes 1 J or S.

A B D K L or M 8. Early distribution no known exception in most cases under age 59½. 1099-R Box 7 Codes Generally distributions from pensions annuities profit-sharing and retirement plans IRAs insurance contracts etc.

Do not combine with any other codes. The codes entered in Box 7 of Form 1099-R indicate the type of distribution received and its taxability. Early distribution exception applies under age 59½.

D Annuity payments. What is a Code 7 Normal Distribution. 2020 1099-R Box 7 Distribution Codes.

B Designated Roth DWC Notes. What does Distribution Code 7 mean on a 1099. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

The codes in Box 7 of your 1099-R helps identify the type of distribution you received. Simply so what is distribution code 7 on Form 1099 R. This is an identifier the IRS uses to help determine if the transaction is taxable.

A 1099-R form uses a variety of numbered and lettered codes to indicate the type of distribution. We told client the 1099-R should have been issued with code G and to call the issuer to get the 1099-R corrected. See the instructions for Form 1040.

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Box 7 is used to report income to you. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities.

Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Find the explanation for box 7 codes here.

Client took a distribution and received a 1099-R code 7. Use Code 1 only if the solo 401k participant was not age 59 12 or older at time of the distribution AND codes 23 and 4 do not apply. Governmental section 457b plans.

Therefore correct entry of these codes is really important. These codes descriptions are taken directly from the back of form 1099-R. Early distribution exception applies under age 59½.

These codes descriptions are taken directly from the back of form 1099-R. Do not combine with any other codes. 1 Early distribution no known exception in most cases under age 59-12.

30 rows Code 7 can be combined with the following codes. The different codes within box 7 tell what the tax treatment of any distribution amounts should be. 7 is the code for Normal Distribution which means it was distributed to taxpayer after age 595.

Code 7 may be used in combination with codes A B D K L or M. Money from distribution was then put into another retirement account within the 60-day window - in other words it was a rollover. Code 7 may be used in combination with codes A B D K L or M.

Use code 7 Normal distribution when the IRA owner or plan participant is age 59½ or older. They are entered in Box 7 on the form. A for a normal distribution from a plan.

Here are the various codes listed in box 7 of Form 1099-R. Scenario 8 SIMPLE IRA Early Distribution. Codes for Box 7 of the 1099-R tax form include number or a letter in the alphabet states the Prudential website.

The normal distribution is for individuals who are older than 59-12 and the distribution does not have a penalty. Identifying the Distribution Code. The distribution is after age 59 12.

Box 7 of 1099-R identifies the type of distribution received.

Form 1099 R Instructions Information Community Tax

Things To Remember Around Tax Time If You Ve Made A Qualified Charitable Distribution Merriman

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

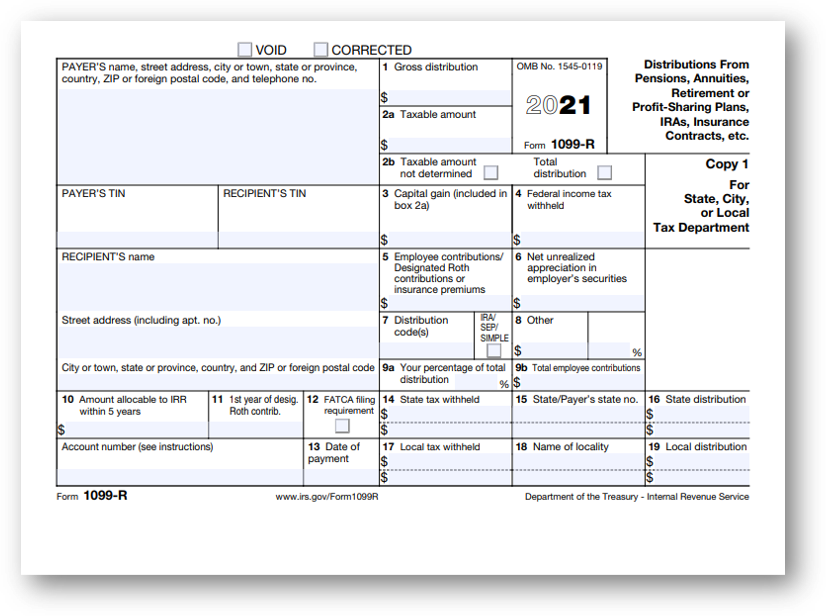

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Irs Form 1099 R Box 7 Distribution Codes Ascensus

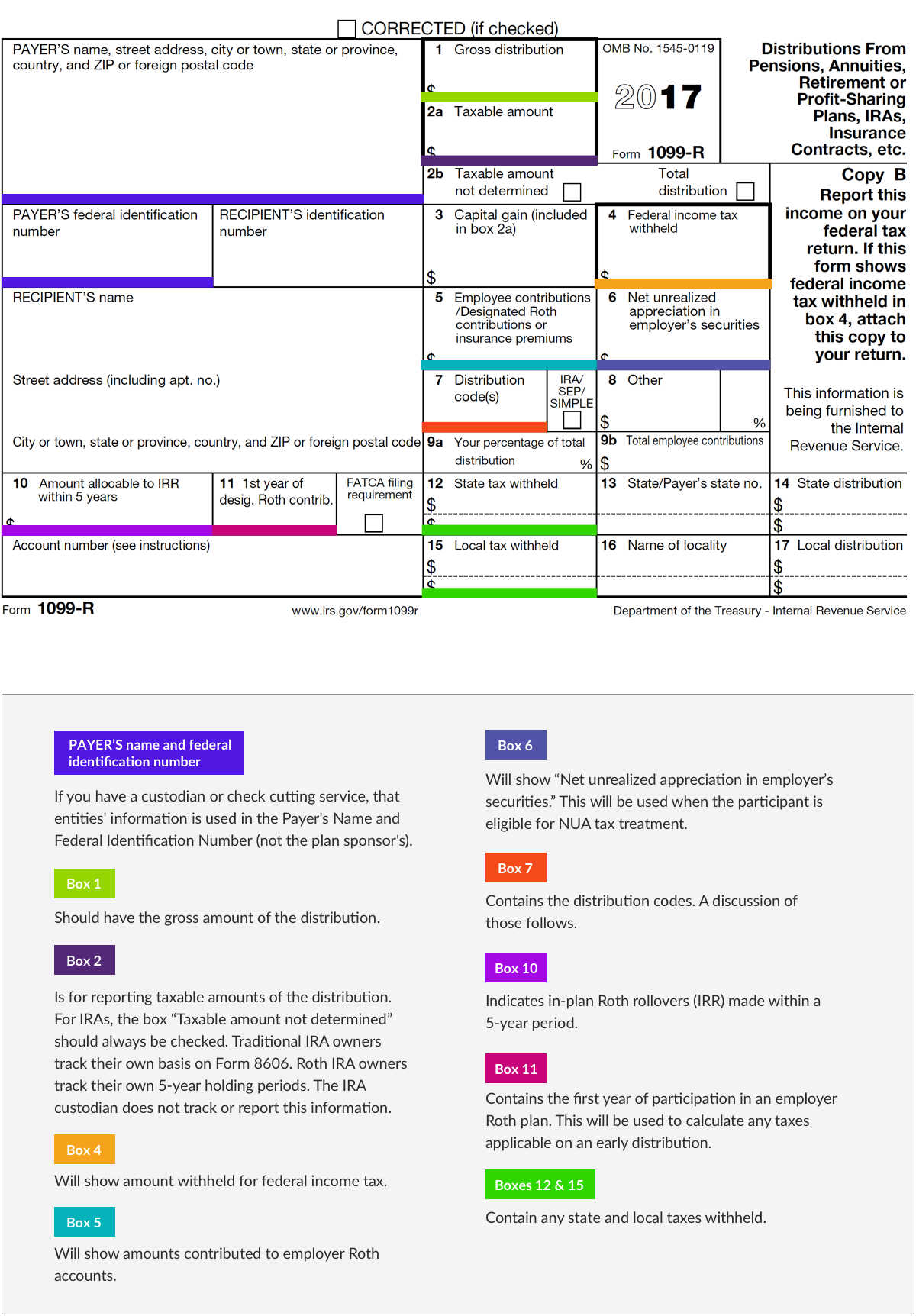

Tax Form Focus Irs Form 1099 R Strata Trust Company

Form 1099 R Distribution Codes For Defined Contribution Plans Dwc

Form 1099 R Distribution Codes For Defined Contribution Plans Dwc

How To Calculate Taxable Amount On A 1099 R For Life Insurance

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Irs Form 1099 R Which Distribution Code Goes In Box 7 Ascensus

Post a Comment

Post a Comment