2b Include all participants on line 2a that were terminated involuntarily including those. Plans eligible to file the Form 5500-SF will benefit from abbreviated reporting that includes only filing only the Form 5500-SF.

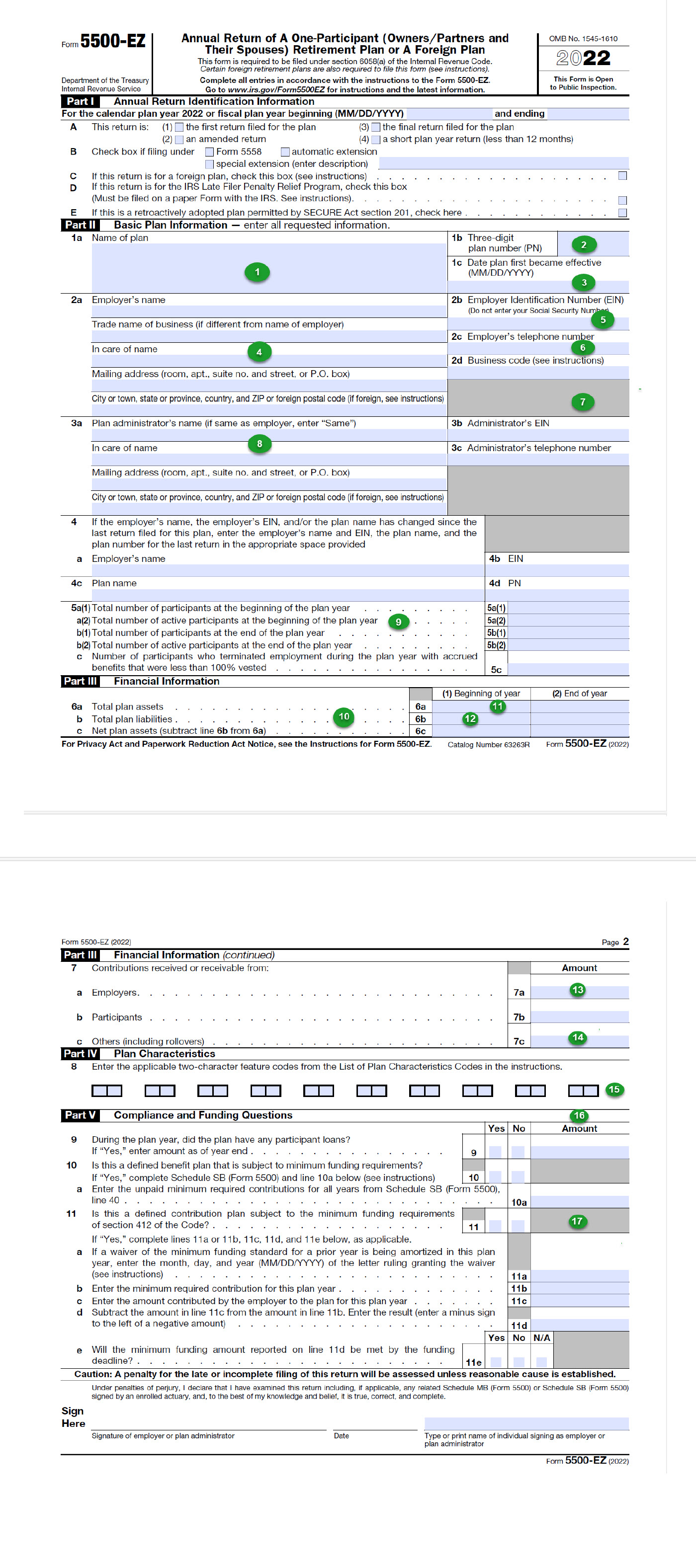

Form 5500 Ez Updated Instructions With Screenshots For Solo 401 K Plans Saber Pension

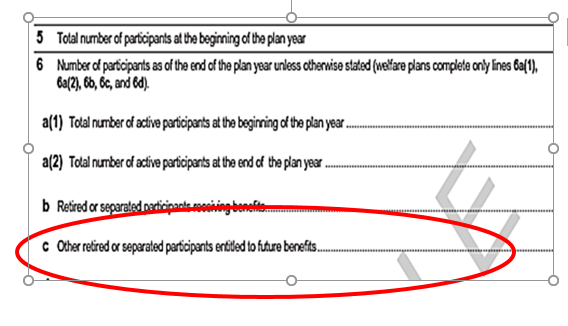

5 Total number of participants at the beginning of the plan year 5 123456789012 6 Number of participants as of the end of the plan year welfare plans complete only lines 6a 6b 6c and 6d.

Active participants form 5500. Certain welfare benefit plans with less than 100 participants at. Certain multiple-employer plans must report total contributions for the plan year. ERISA plans with 100 or more participants at the beginning of the plan year are required to file a Form 5500.

5500 should be filed in accordance with the plan year. A participant count question is added to the 5500 Line 6a1 which requests the number of active participants at the beginning of the plan year. Private-employer plan sponsors collectively reported on their Form 5500s for 2009 that there were 63570000 participants with an account balance The Department of Labor defines a participant with an account balance as any worker currently in employment emphasis added covered by a plan who is earning or retaining credited service under a plan.

Form 5500 is an annual IRSDOL form that must be completed by organizations offering benefit plans subject to ERISA regulations and have at least 100 participants in the plan as of the first date of the plan year. 11694These changes include enhanced reporting for multiple-employer plans MEPs. With the Form 5500 deadline fast approaching 401 k plan sponsors should be aware of common mistakes that can easily occur when filing the form.

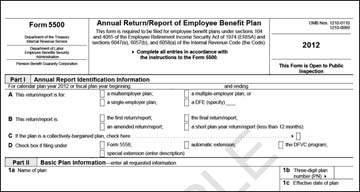

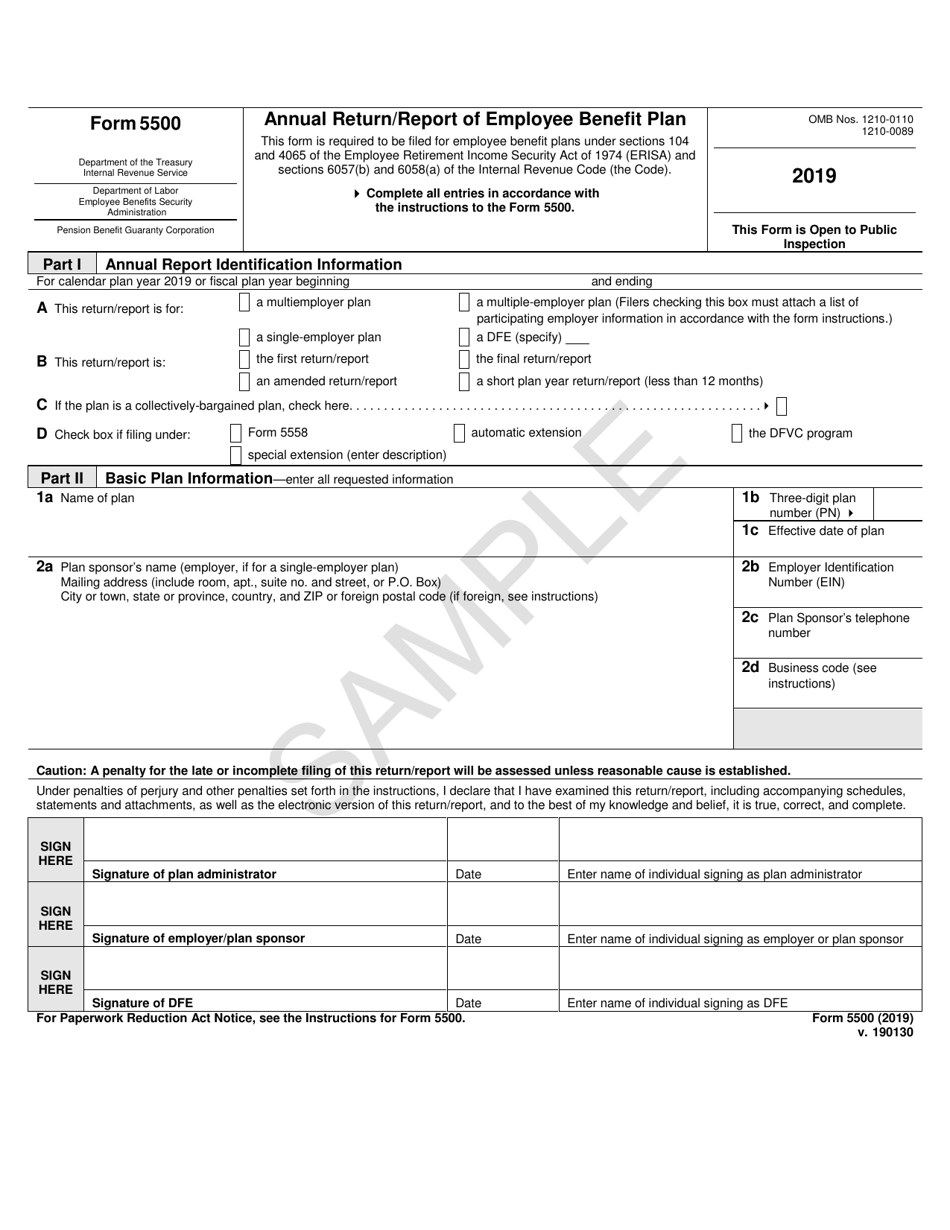

An ERISA financial audit may also be required. A Form 5500 must be filed for each benefit plan with more than 100 participants on the first day of the plan. This form is required to be filed for employee benefit plans under sections 104 and 4065 of the Employee Retirement Income Security Act of 1974 ERISA and sections 6047e 6057b and 6058a of the Internal Revenue Code the Code.

Proposed changes to Form 5500 Annual ReturnReport of Employee Benefit Plan and supporting Department of Labor DOL regulations would implement provisions in the Setting Every Community Up for Retirement Enhancement SECURE Act of 2019 Div. The feds dont do a very good job of defining the term participant but any benefits pro knows that there are people who fall into gray areas and its crucial to know whether to include them in the tally. The Form 5500 is filed annually which reports information to the Department of Labor DOL on the plan sponsor plan provisions and participant counts.

Are those who were on furlough during 2020 to be counted in the 5500 as active participants of the Plan. Small plans with less than 100 participants at the beginning of the plan year may be eligible to file Form 5500-SF. Form 5500-SF Short Form Annual ReturnReport of Small Employee Benefit Plan The Form 5500-SF is filed for certain small plans with less than 100 eligible participants at the beginning of the plan year.

Per 5500s instructions. Former employees who have left their 401k funds in the plan are also included in the participant count. Active participants include any individuals who are currently in employment covered by a plan and who are earning or retaining credited service under a plan.

Form 5500 Department of the Treasury Internal Revenue Service Department of Labor. Before we get into some of the nuts and bolts of the answer we do want to remind you that the counts of the Form 5500 are to be snapshots on the first day of the ERISA Plan year and the last day of the. These plans could include your health reimbursement account HRA medical flexible spending account FSA and Voluntary Employee.

Large plan filers and certain small plan filers will file Form 5500 including applicable schedules. Please note that the number of active participants on line 2a will most likely not coincide with the number of total participants on Form 5500 line 5 which includes participants who terminated in prior years who are entitled to future benefits. Active participants exclude beneficiaries and separated vested participants.

To-tal participants include beneficiaries. Cash balance plans or any plans using characteristic code 1C on line 8a of Form 5500 reporting 1000 or more active participants on line 2b3c column 1 must also provide average cash balance account data regardless of whether all active participants have cash balance accounts. Eligible participants as of January 1st but only 25 active participants.

Health and Welfare Form 5500 Question. Different schedules need to be attached to the Form 5500 depending on whether a plan sponsor is a large plan or small plan says Cindy Dwyer president. I believe they are participants because they have serviceparticipation credits even though they dont accrue any benefit.

Form 5500 2003 Page 2 3a Plan administrator s name and address If same as plan sponsor enter Same 3b Administrator s EIN 3c Administrator s telephone n umber. Official Use Only 4 If the name andor EIN of the plan sponsor has changed since the last returnreport filed for this plan enter the name EIN and the plan number from the last r eturnreport below. The Form 5500 statistics defines an active participant in a defined contribution plan as a worker with a positive account balance with his or her current employer.

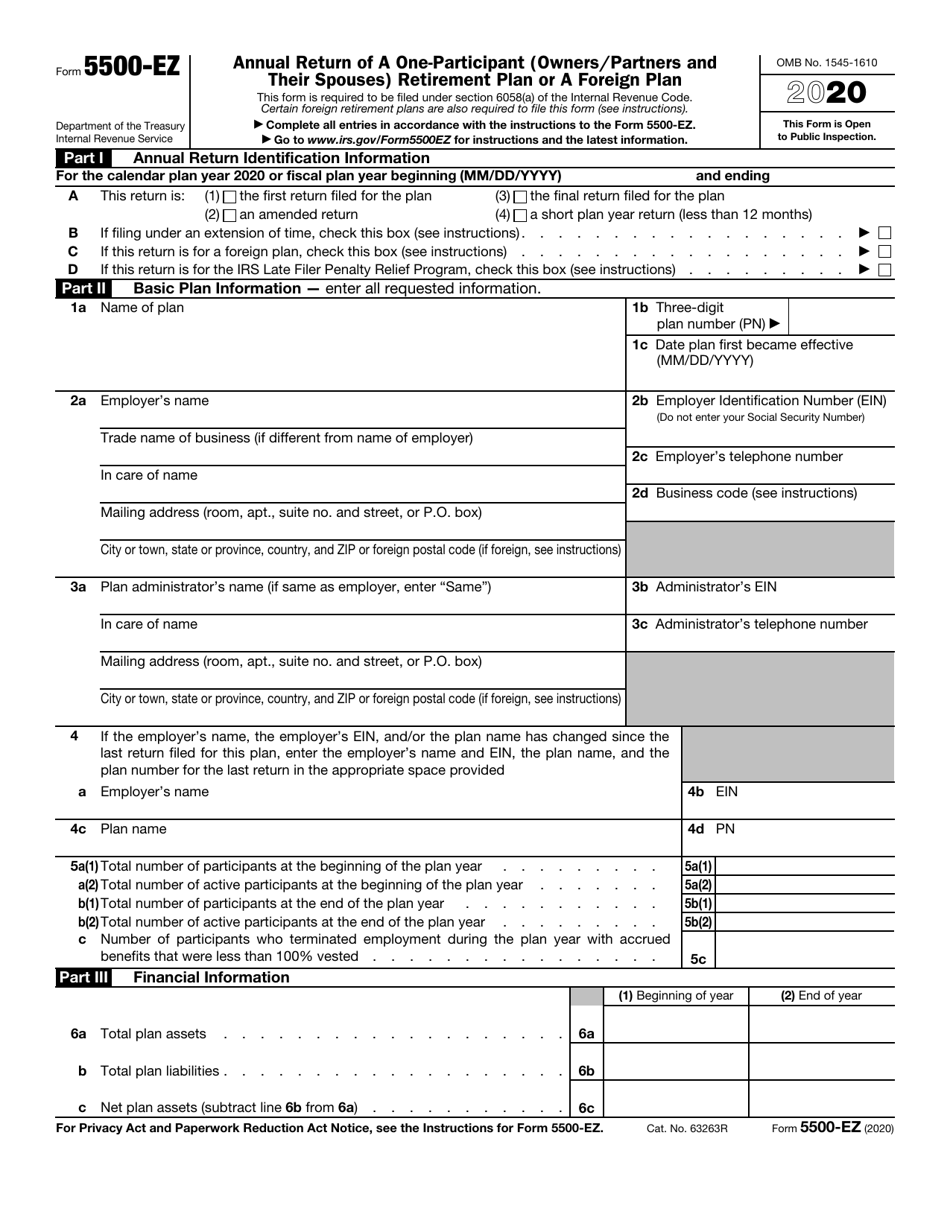

Complete all entries in accordance with the instructions to the Form 5500. The Form 5500-EZ generally is used by one-participant plans as defined under Specific Instructions Only for One-Participant Plans on page 6 that are not subject to the requirements of section 104a of ERISA to satisfy certain annual reporting and filing obligations imposed by the Code. Participant count common trip-up with Form 5500.

Note the active participant count at the end of the plan year will be labeled at Line 6a2. For the Form 5500 filing the audit will need to be completed and submitted with the Form 5500 to the IRS. Large Or Small Plan Filer If your plan had 100 or more eligible participants this includes active employees who are.

This type of Form 5500 is much smaller and places significantly fewer reporting responsibilities on employers for filing their reports. What Deadlines Apply to my Audit and Form 5500 Filing. This form is required to be filed for employee benefit plans under sections 104 and 4065 of the Employee Retirement Income Security Act of 1974 ERISA and sections 6057b and 6058a of the Internal Revenue Code the Code.

Form 5500-SF is used for the annual filing of plans that contain between one and 100 plan participants. A Active participants. A one-participant plan may also be eligible to file Form 5500-SF.

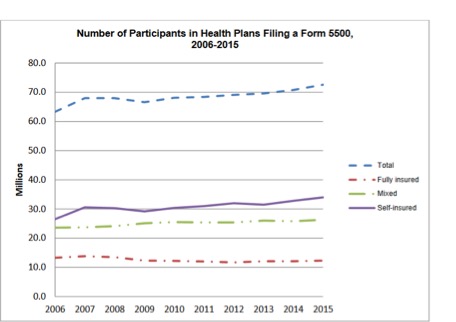

One of the trickiest areas in completing Form 5500 is properly tallying and reporting the number of participants in your benefit plans. Between the years 2006 and 2015 an average of 48900 group health plans covering an average of 68 million participants filed a Form 5500 annually per the DOLs 2018 Annual Self-Insured Health Plan Report to Congress which analyzed the 2015 Data The DOLs Semi-Annual Regulatory Agenda Has Been Released.

Form 5500 Erisa Plans With 100 Or More Participants Are Required

Irs Form 5500 Ez Download Fillable Pdf Or Fill Online Annual Return Of A One Participant Owners Partners And Their Spouses Retirement Plan Or A Foreign Plan 2020 Templateroller

How To Fill Out Irs Form 5500 Ez White Coat Investor

Irs Form 5500 Ez Download Fillable Pdf Or Fill Online Annual Return Of A One Participant Owners Partners And Their Spouses Retirement Plan Or A Foreign Plan 2020 Templateroller

Cobra Counts And The 2020 Form 5500 Wrangle 5500 Erisa Reporting And Disclosure

Understanding The Form 5500 For Defined Contribution Plans Fidelity

Irs Form 5500 Download Fillable Pdf Or Fill Online Annual Return Report Of Employee Benefit Plan 2019 Templateroller

Solving The Mystery On Participants Wrangle 5500 Erisa Reporting And Disclosure

Form 5500 Audit Requirements Do You Need A Form 5500 Audit Warren Averett Cpas Advisors

2019 Updated Filing 5500 Ez Solo 401k

Post a Comment

Post a Comment