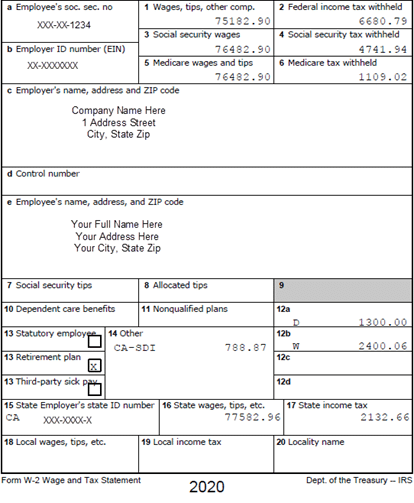

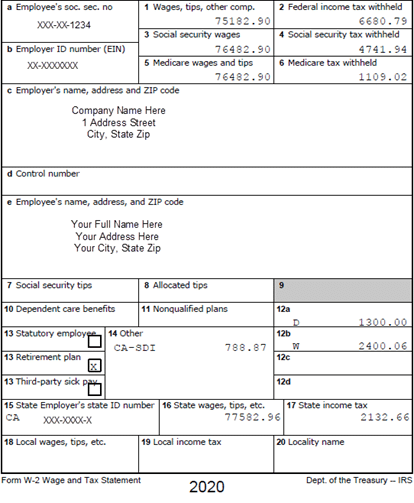

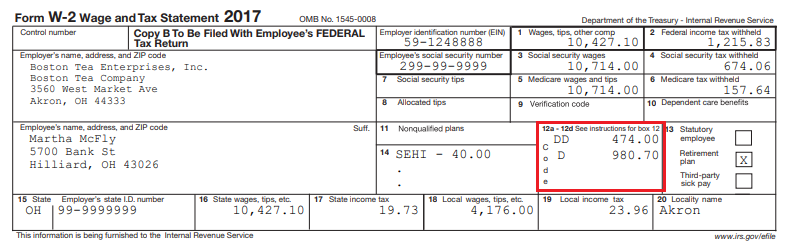

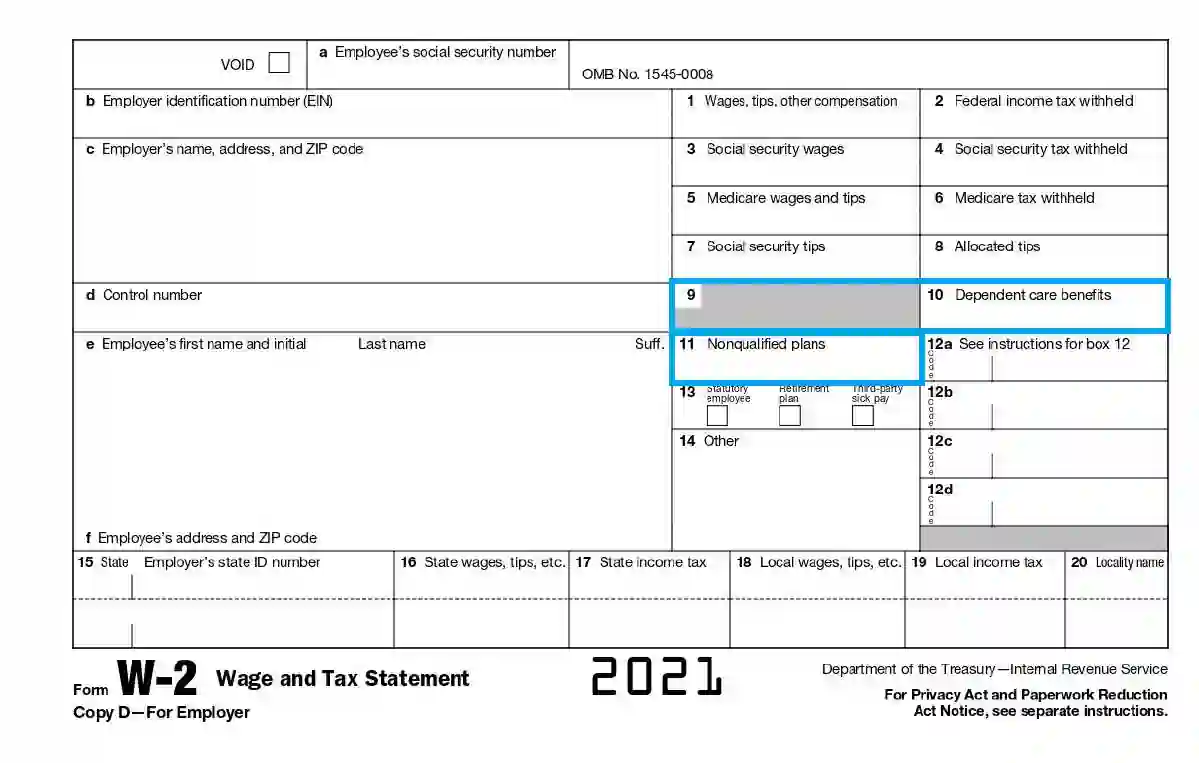

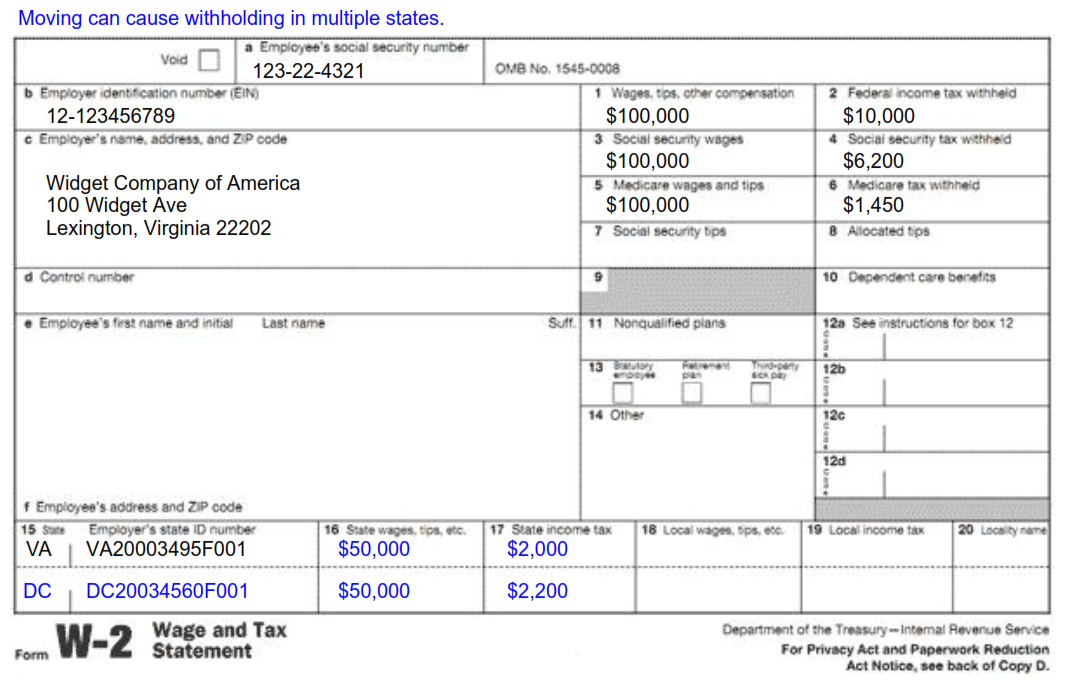

A W-2 includes information about an employees gross wages withheld taxes tip income and deferred compensation. They are not included in Box 1 Wages tips other compensation Box 5 Medicare wages and tips or Box 7 Social security tips of your Form W-2 Wage and Tax Statement.

Understanding Your W2 Innovative Business Solutions

The official printed version of this IRS form is scannable.

Box 5 w2 form. Section 125 deductions medical dental vision dependent care pre-tax commuter benefits etc. Cost of employer-sponsored health coverage. You may also print out copies for filing with state or local governments distribution to your employees and for your records.

This is for Social Security and Medicare taxes. Knowing the differences in Boxes 1 3 and 5 on a W-2 is important in determining income. W-2 Box 1 is the amount of pay subject to income tax.

Section 125 deductions medical dental vision dependent care pre-tax commuter benefits etc. Generally you must report the tips allocated to you by your employer on your income tax return. Boxes 5 and 6.

Box 3 on the W2 forms represents Social security wages and Box 4 are the social security taxes on those wages. Similarly Box 5 represents Medicare wages and Box 6 are the taxes on those Medicare wages. If the income of employee is more than 200k the employer has to deduct the additional Medicare tax at 090.

A completed W-2 form will include IRS required information on an employee. Box 3 on the W2 forms represents Social security wages and Box 4 are the social security taxes on those wages. Copy A appears in red similar to the official IRS form.

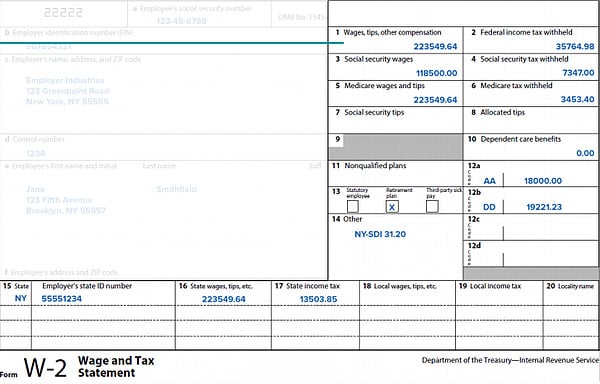

Similarly Box 5 represents Medicare wages and Box 6 are the taxes on those Medicare wages. The amount reported with Code DD is not taxable. It is 145 of box 5.

The W2 boxes and codes show the wages youve earned and any taxes paid through withholding. The rate is 145 of the Medicare wage base. The costs of this type of insurance for this type of employee can result in Box 1 being greater than Box 3 and Box 5 on a Form W-2.

Similarly Box 5 represents Medicare wages and Box 6 are the taxes on those Medicare wages. This amount includes the 62 Social Security Tax withheld on Social Security wages in Box 3 up to 137700 wages or 853740 tax. This is total reported tips subject to social security tax.

You may be required to report this amount on Form 8959 Additional Medicare Tax. Do not file with the W-2 until you get an explanation or a corrected W-2 from them. You can downlaod W2 form online with this link.

Copy A of this form is provided for informational purposes only. Box 5 tells the employees earning that was subject to Medicare taxes and Box 6 tells the total Medicare tax that was withheld. Similarly Box 5 represents Medicare wages and Box 6 are the taxes on those Medicare wages.

Box 6 Medicare tax withheld. This information in table1 table2 table3 will be also seen in w2 form. However if this scenario doesnt seem to apply to you it would probably be worthwhile to contact your employer.

Taxable cost of group-term life insurance over 50000 included in boxes 1 3 up to social security wage base and 5. W2 Form Column wise Explanation. Medicare wages and tips.

Pre-tax contributions to a 401k or 403b will not show in Box 1 but will be in Box 3 and 5 amounts. Taxable wages federal wages Federal Income taxes. This is total wages and tips subject to the Medicare component of social security taxes.

Box 3 on the W2 forms represents Social security wages and Box 4 are the social security taxes on those wages. There is no instruction for the inclusion of such costs in Box 5. You need to contact your employer and find out why Boxes 3 and 5 are blank.

Box 7 Social Security Tips. The wages in box 5 of Form W-2 must be equal to or greater than the wages in box 3 of Form W-2. Box 3 on the W2 forms represents Social security wages and Box 4 are the social security taxes on those wages.

Know Your W-2 Form. If you dont get W2 form after 15 days of February you need to contact your employer for it. Boxes 7 and 8.

This is the wage amount subject to Medicare Tax. Forms W-2 and W-3 for filing with SSA. Box 5 Medicare wages and tips.

This is Medicare tax withheld from your pay for the Medicare component of social security taxes. Boxes 3 4 5 and 6. Section 125 deductions medical dental vision dependent care pre-tax commuter benefits etc.

Family Lawyers Know Income Determination is Critical for Spousal and Child Support. Box 7 specifies the total tips received by the employee and Box 8 tells how much tip the employer tells he has given to the employee. Similarly Box 5 represents Medicare wages and Box 6 are the taxes on those Medicare wages.

Section 125 deductions medical dental vision dependent care pre-tax commuter benefits etc. Box 3 on the W2 forms represents Social security wages and Box 4 are the social security taxes on those wages. Include this amount on the wages line of your return.

You must include in boxes 1 3 and 5 or 14 if railroad retirement taxes apply the cost of group-term life insurance that is more than the cost of 50000 of coverage reduced by the amount the employee paid toward the insurance. If you have more than one Form W-2 or you are married and your spouse also has one or more W-2s the total of all forms Box 1 will be shown on Form 1040 line 1.

Understanding Your W 2 Controller S Office

W 2 Wage And Tax Statement Data Source Guide Dynamics Gp Microsoft Docs

W 2 Box And Label Guidance For Deductions

W2 Form Irs Tax Form Filing Instructions Online

Irs Form W 2 Fill Out Printable Pdf Forms Online

Understanding Tax Season Form W 2 Remote Financial Planner

Making Sense Of Data Named Entity Extraction From Kaggle Dataset For W2 Forms By Saurabh Jain Medium

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

How To Read Your W 2 University Of Colorado

Wage Tax Statement Form W 2 What Is It Do You Need It

A Quick Guide To Your W 2 Tax Form The Motley Fool

Post a Comment

Post a Comment