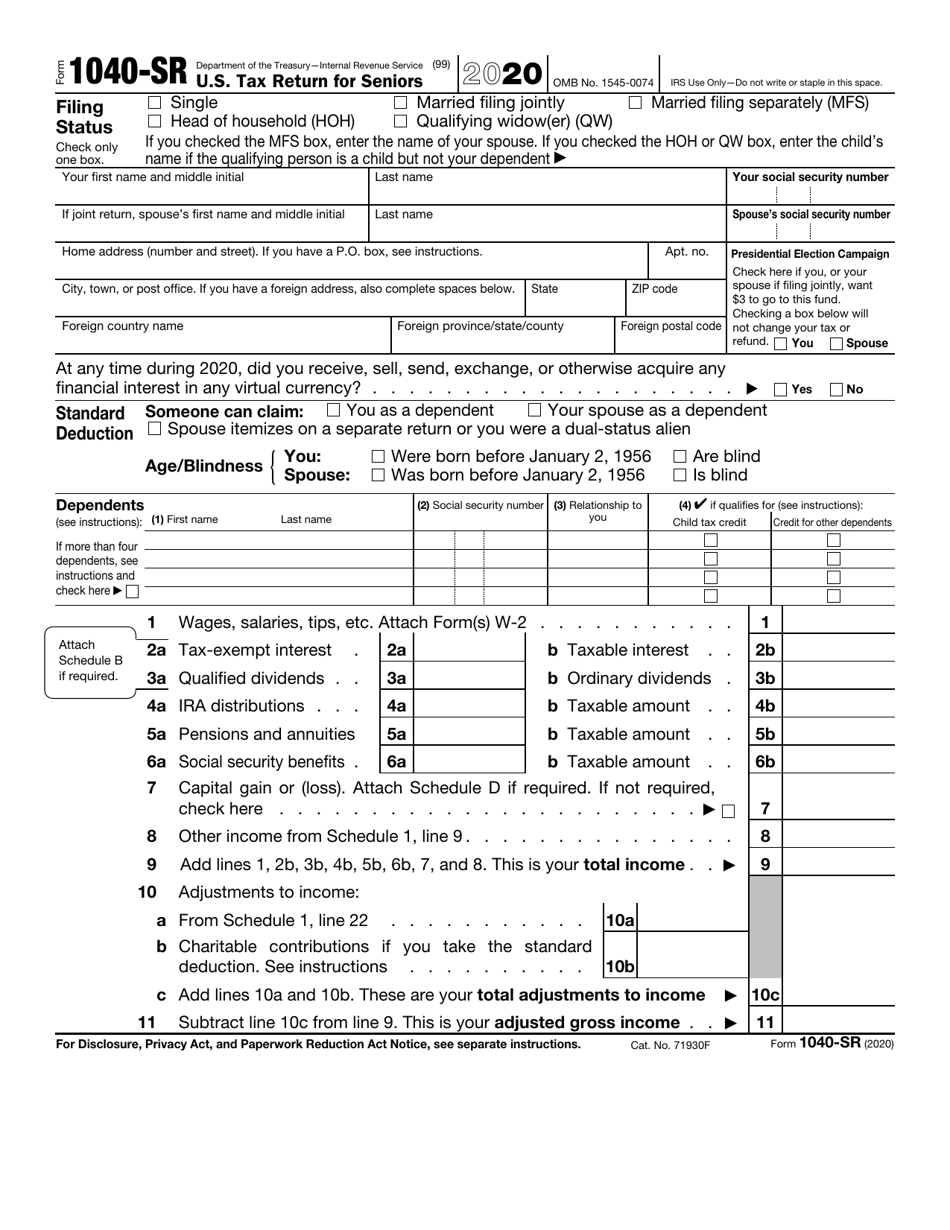

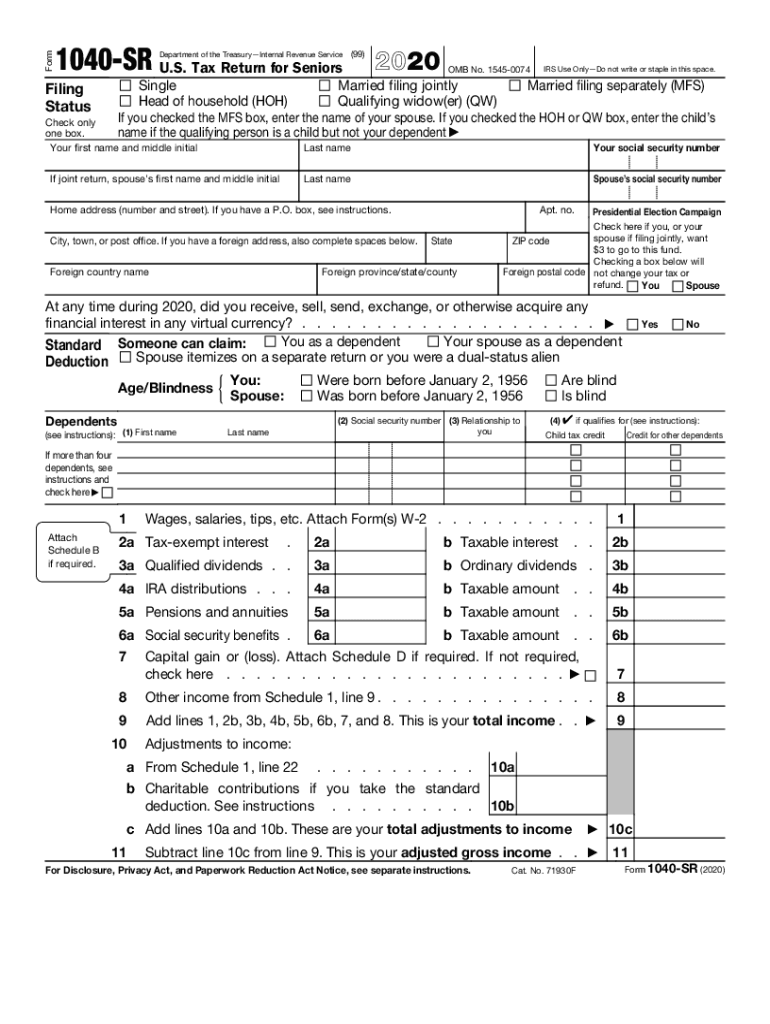

Only tax year 2019 and 2020 Forms 1040 and 1040-SR returns that were originally e-filed can be amended electronically. Form 8879 is used to authorize the electronic filing e-file of original and amended returns.

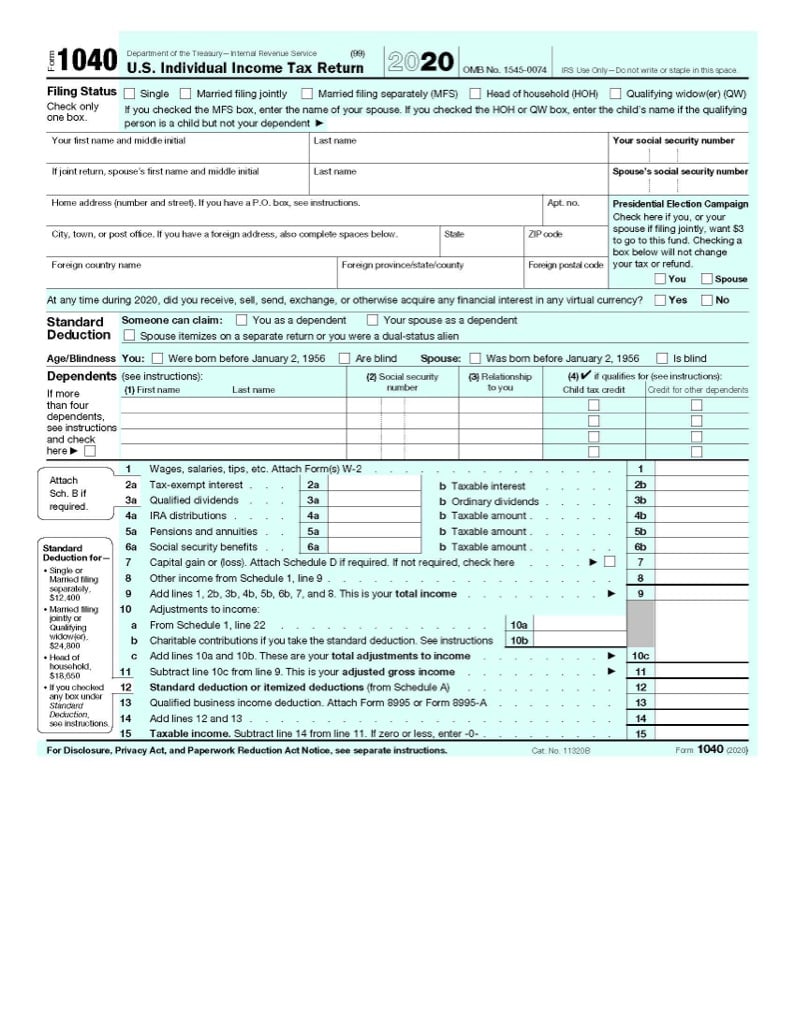

It is the same as the Form 1040.

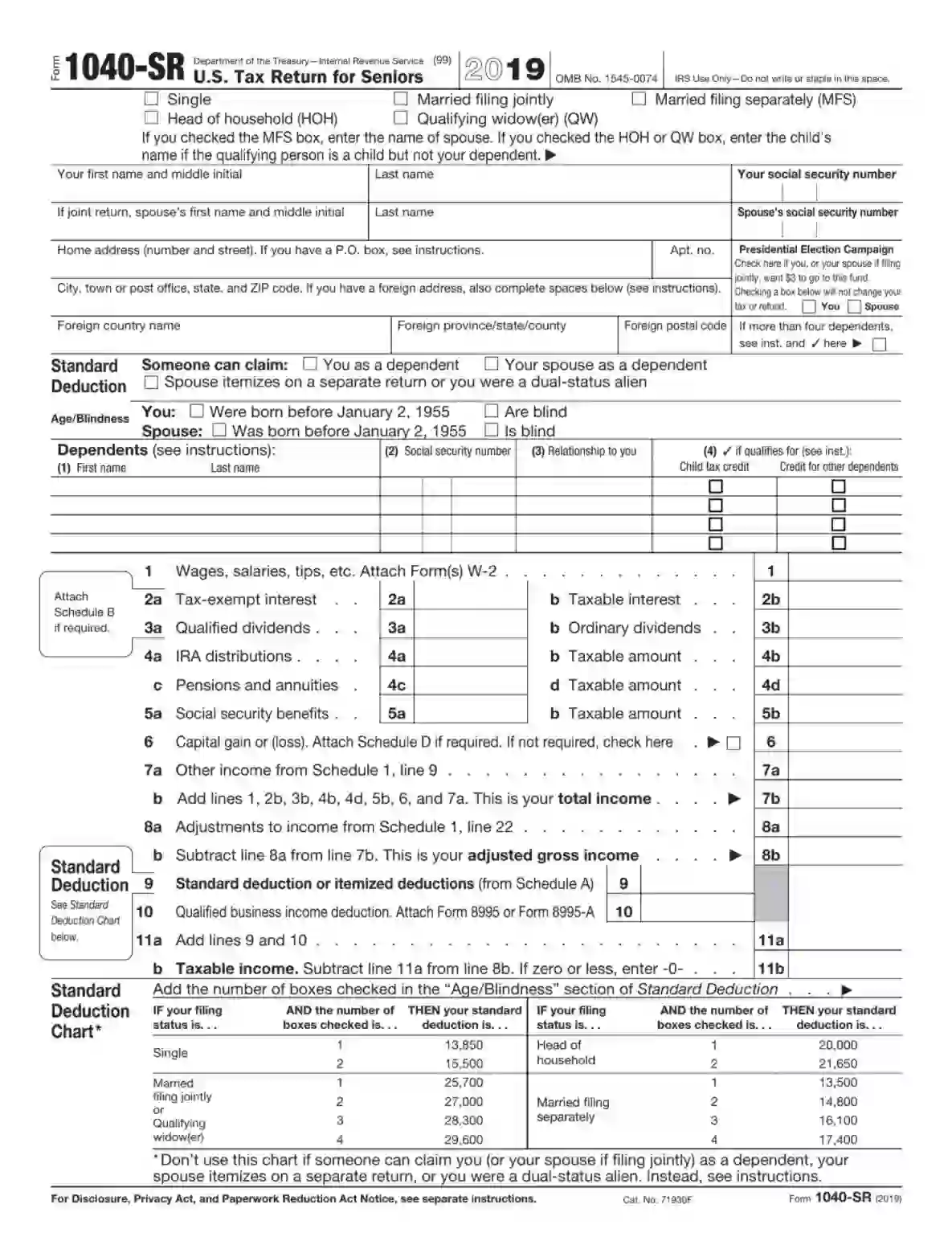

E-file form 1040-sr. Margaret other than the larger font the other main difference on the 1040-SR is that the chart for the higher standard deduction is printed on the form itself instead of see instructions presumably to cut down on errors for those folks that are still preparing paper returns by hand. Can I file form 1040-SR ON turbotax. This applies to everyone even those who are not usually required to submit a Federal tax return.

It CAN be filed electronically. Taxpayers with an annual income of 72000 or less may file their Federal tax return online for free with the IRS Free File platform. Only tax year 2019 Forms 1040 and 1040-SR returns can be amended electronically.

You can now submit the Form 1040-X Amended US. For those who dont know IRS Form 1040SR is a larger print version of the 1040 used by seniors who mostly have investment type income. Include this amount on Schedule 2 Form 1040 line 6.

Complete this part if you contributed more to your traditional IRAs for 2020 than is allowable or you had an amount on line 17 of your 2019 Form 5329. When done the tax app will then calculate your. Your TurboTax fee will depend as always on.

First the 1040-SR Form is primarily for senior citizens as opposed to the 1040 form. Single Married filing jointly. Purpose of Form Form 8879 is the declaration document and signature authorization for an e-filed return.

January 2021 to authorize e-file of your Form 1040 1040-SR 1040-NR 1040-SS or 1040-X for tax years beginning with 2019. Yes if you were 65 or older your return will be on a Form 1040SR. Enter your excess contributions from line 16 of your 2019.

Check only one box. Statement forms like W-2 1099 and 1098 you might receive by January 31 2022 all depending your personal income sources or deductions. Once completed you can sign your fillable form or send for signing.

At Jackson Hewitt We Get You Your Biggest Refund Guaranteed. While filing this amendment form the taxpayer is also required to file the entire 1040 or 1040-SR along with other attached schedules and forms even if they were not amended. You can now submit the Form 1040-X Amended US.

All forms are printable and downloadable. Use this Form 8879 Rev. On average this form takes 25 minutes to complete.

IRS Use OnlyDo not write or staple in this space. Only tax year 2019 and 2020 Forms 1040 and 1040-SR returns that were originally e-filed can be amended electronically. File this form if you as a resident of Puerto Rico or spouse if filing a joint return had net earnings from self-employment from other than church employee income of 400 or more.

Tax Return for Seniors 2021 Department of the TreasuryInternal Revenue Service 99 OMB No. But yes file your next 1040SR online at no cost at the IRS website. Check only one box.

Individual Income Tax Return electronically using available tax software products. File with Jackson Hewitt Tax Pro For Our Biggest Refund Guarantee. File with Jackson Hewitt Tax Pro For Our Biggest Refund Guarantee.

The Form 1040-SR Tax Return for Seniors 2019 form is 2 pages long and contains. This implies that to be eligible for filing the 1040-SR form you must be at least 65 years old. Here are three of them.

There is no extra fee for that tax return form. IRS Use OnlyDo not write or staple in this space. The Recovery Rebate Credit is claimed through either Form 1040 or Form 1040-SR.

Part III Additional Tax on Excess Contributions to Traditional IRAs. You can now submit the Form 1040-X Amended US. Married filing separately MFS Head of household HOH Qualifying widower QW.

Yes she can also file form 1040-SR. Individual Income Tax Return electronically using available tax software products. Form 1040-SR Department of the TreasuryInternal Revenue Service.

Individual Income Tax Return electronically using available tax software products. Form 1040-SR Tax Return for Seniors 2019. If you have your 2020 Return in front of you look for your AGI amount on the 2020 Form 1040 or 1040-SR Line 11.

As a senior whether you are retired or still working you are still eligible for the 1040-SR as long as you meet the age requirement. 100 Tax Calculation Accuracy. Or a taxpayer and spouse - if married filing jointly - had church employee income of 10828 or more.

Until this year and the pandemic mess there is no particular reason to do so. Married filing separately MFS Head of household HOH Qualifying widower QW. Posted August 1 2020.

Use Fill to complete blank online IRS pdf forms for free. The print is just bigger. Taxpayers can e-file Form 1040-X or send it to the IRS by mail but the electronic tax filers will get a faster response if they are expecting a check.

Tax Return for Seniors. 99 Filing Status. Gather these documents by using the prep-to-tax-prep checklist.

Form 1040SR is the form you automatically get if you were 65 or older at the end of 2019. Single Married filing jointly. At Jackson Hewitt We Get You Your Biggest Refund Guaranteed.

Nov 03 2021 Form 1040-NR is for non-residents as a permanent resident she would have to file form 1040 instead. Form 1040-SR is a simplified version of form 1040 with larger characters.

Fillable Form 1040 Schedule C 2019 Irs Tax Forms Credit Card Statement Tax Forms

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa W2 Forms Irs Forms Irs

Form 1040 Sr Should You Use It For Your 2019 Tax Return The Motley Fool

Irs Releases Form 1040 For 2020 Tax Year Taxgirl

Form 1040 Sr U S Tax Return For Seniors Video Tax Return Bookkeeping Services Tax

Irs Form 1040 Sr Download Fillable Pdf Or Fill Online U S Tax Return For Seniors 2020 Templateroller

Irs Form 1040 Sr Fill Out Printable Pdf Forms Online

Irs Looks To Update Form 1040 Irs Tax Forms Tax Forms Irs Taxes

Irs Looks To Update Form 1040 Irs Tax Forms Tax Forms Irs Taxes

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Irs Approved Blank W2 G Gambling Winnings Forms File This Form To Report Gambling Winnings And Any Federal Tax Forms The Secret Book Card Templates Printable

2020 Form Irs 1040 Sr Fill Online Printable Fillable Blank Pdffiller

Form 1040 1040 Sr Everything You Need To Know

Post a Comment

Post a Comment