Form NJ-W4 State of New Jersey Division of Taxation 1-21 Employees Withholding Allowance Certificate 1. 1221 Wisconsin Department of Revenue.

What Does The New Checkbox For Two Total Jobs On The 2020 W4 Form Do Calculation Wise R Personalfinance

MarriedCivil Union Couple Joint 3.

:max_bytes(150000):strip_icc()/Deductions-Worksheet-3ac3d23a5f51472e98e676fcc3f88fcf.jpg)

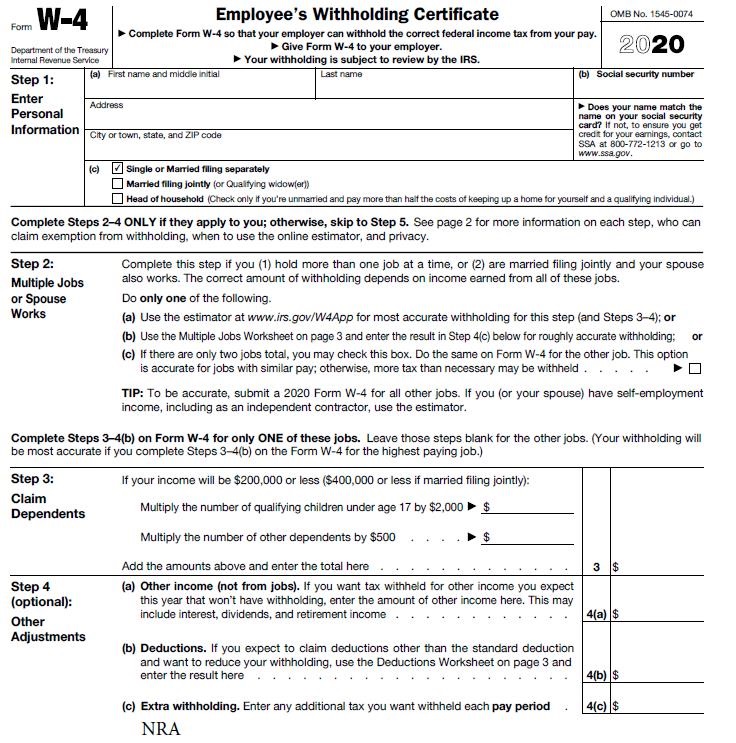

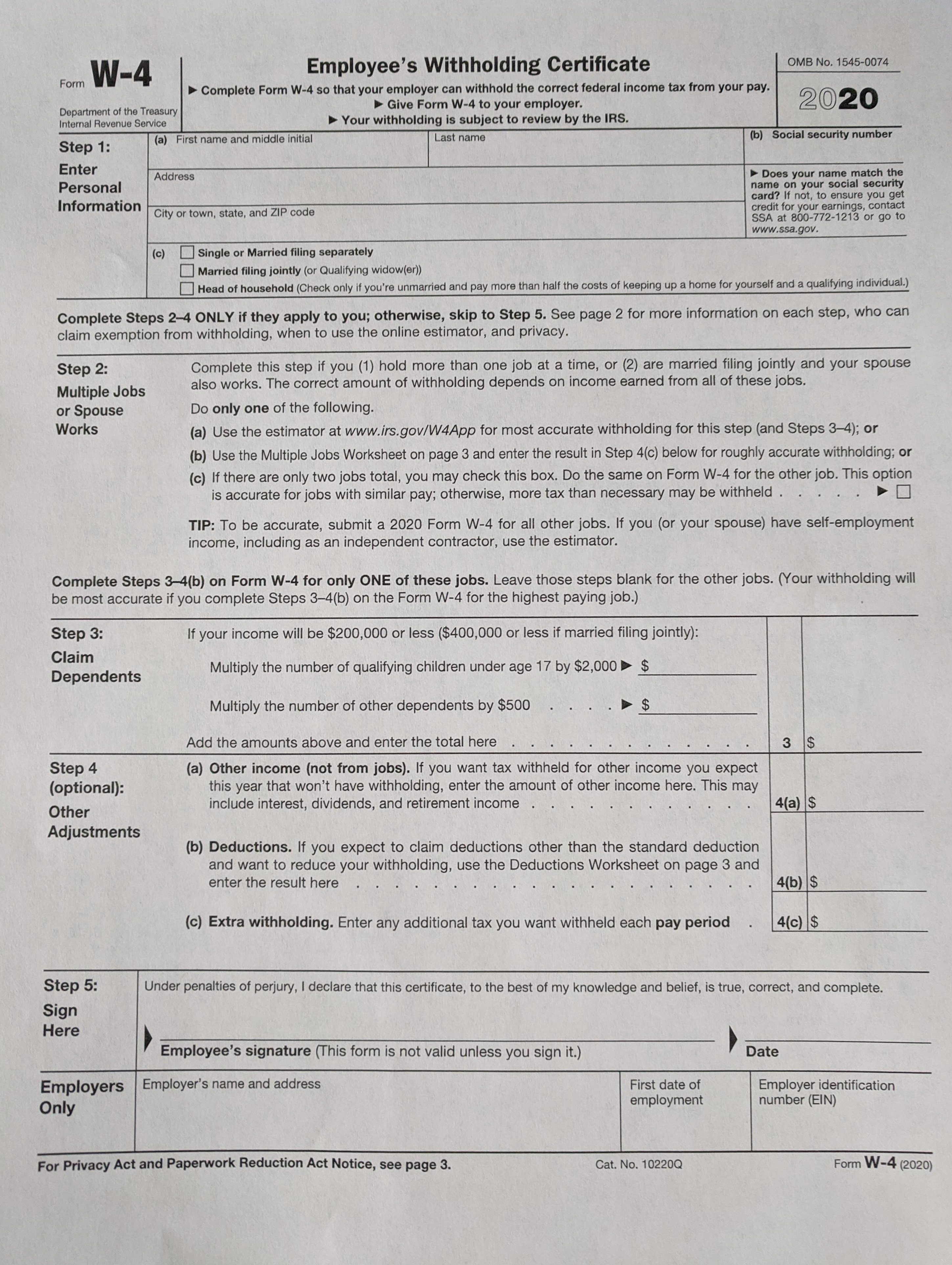

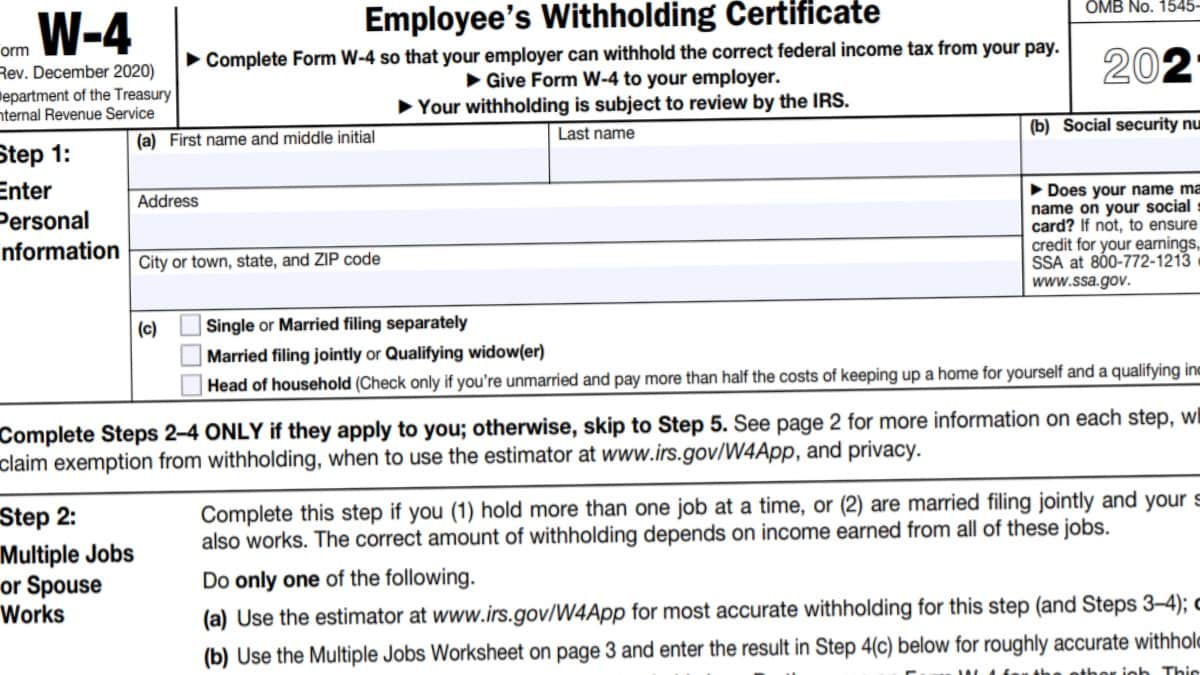

Form w4-r. Do I select Multiple Jobs on both W4s and not mess with withholdings at all on my. You can also submit a new W-4 to your HR or payroll department when you have a life event that affects your taxes eg getting married or divorced or having a baby or if you paid too little or too much in taxes. Enter Personal Information a.

Form WT4 will be used by your employer to determine the amount of. States either use their own state W-4 form or the federal Form W-4. Head of Household 5.

Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings. Federal Form W-4 can no longer be used for Rhode Island withholding purposes. As we hear more we will keep you posted.

Employees Withholding Certificate is filled out by an employee to instruct the employer how much to withhold from your paycheck. Once you have completed Form RI W-4 for your employer Form RI W-4 only needs to be completed if you are making changes to your withholding allowance or have a new employer. Enter 2 if you are both 65 or over AND blind.

These three factors are considered to determine the income tax to be withheld from the employees wages. Request for Federal Income Tax Withholding from Sick Pay. Your withholding is subject to review by the IRS.

An employee completes a new form only when they want to revise their withholding information. The W-4 form tells the employer the amount of tax to. Youll be asked to fill one out when you start a new job.

Give Form W-4 to your employer. My current job is around 115k total with bonuses and the one I am about start 12422 will be about 70k total with bonuses. However any employee who claims to be exempt from New Jersey withholding because their income is below the minimum filing threshold must submit a new form every year.

She will have 0 withholding with the basic setting since a married couple making 25k would owe 0 taxes but her w4 wont know about your income. You need to fill out a new w4 now that your spouse also works. The Withholding Exemption Certificate Form 499 R-41 is the document used by the employee to notify hisher employer of the personal exemption exemption for dependents and the allowance based on deductions.

Remember Sophie selected Married Filing Jointly as her filing status and checked the box in line in Step 2 on her W-4. Printing and scanning is no longer the best way to manage documents. Complete form L-4 so that your employer can withhold the correct amount of state income tax from your salary.

Withholding Certificate for Pension or Annuity Payments. The Form W-4P and the Form W-4 differ on the withholding approach where there are multiple sources of withholding eg multiple pensions or a job and an annuity. Sorry if this is repetitive.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Employee Withholding Exemption Certificate L-4 Louisiana Department of Revenue Purpose. Filing StatusCheck only one box 1.

Report this number of allowances to your employer on Delaware Form W-4. Update on Pending Withholding Forms W-4P and W-4R. A state W-4 Form is a tax document that serves as a guide for employers to withhold a specific amount on each paycheck to go towards state taxes.

IRS Form W-4 tells your employer how much federal income tax to withhold from your paycheck. Form RI W-4 must be completed each. Thats what it means to put the adjustment on only one w4 form.

Your withholding is subject to review by the IRS. R W A G E S 0 10000 B B B B B B B B B B 10001 20000 B B B B C C C C C C 20001 30000 B B B A A D D D D D 30001 40000 B A E 40001 50000 C A E 50001 60000 B C D A A A E. SS Name Address City State Zip State of New Jersey - Division of Taxation Employees Withholding Allowance Certificate Form NJ-W4 1-10 R-13 2.

Therefore the system programming for Form W-4 may not always be compatible. Effective on or after January 1 2020 every newlyhired employee is required to provide a completed Form WT4 to each of their employers. Handy tips for filling out Form Nj W4 3 07 R 12 online.

If youve changed your address recently update your address with WRS before mid. Qualifying WidowerSurviving Civil. It works similarly to a federal form W-4 in that it tells your employer about your withholding needs.

Enter 1 for your Spouse 2 if 60 years old or older if no one else claims your spouse as a dependent Enter number of dependents other than your spouse that you will claim Enter 1 for you are 65 or over OR blind. I havent found a solid Reddit post for W4 help on 2 full time jobs. Form W-4 is an Internal Revenue Service IRS tax form that is filled out by employees to indicate their tax situation to their employer.

So we use the table on the right title Form W-4 Step 2 Checkbox Withholding Rate Schedules and look under Married Filing Jointly. You must complete Form RI W-4 for your employers. Retirees who havent received their 1099-R form by the middle of February should call WRS to request a duplicate.

WRS mails 1099-R forms by January 31 of each year. R W A G E S 1. WHO MUST COMPLETE.

In general an employee only needs to complete Form NJ-W4 once. Form W-4 Department of the Treasury Internal Revenue Service Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. December 2020 Department of the Treasury Internal Revenue Service.

The 52000 falls between 51675 and the. W4 form for 2nd full time job. Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to-use intuitive interface to fill out Form Nj W4 3 07 R 12 online e-sign them and quickly share them without.

Give Form W-4 to your employer. Check only one box 1. Yes just on your w4.

Employees who are subject to state withholding should complete the personal allowances worksheet indicating the number of withholding. MarriedCivil Union Partner Separate 4.

Challenges Of The New Form W 4 For 2020

Irs W4 2021 Form W4 Form 2022 Printable

Form W4 Allowances 2022 W 4 Forms Zrivo

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg)

W 4 Form How To Fill It Out In 2022

Illinois W4 Form 2021 Fill Online Printable Fillable Blank Pdffiller

:max_bytes(150000):strip_icc()/Deductions-Worksheet-3ac3d23a5f51472e98e676fcc3f88fcf.jpg)

W 4 Form How To Fill It Out In 2022

How To Fill Out The New W 4 Form Correctly 2020

2016 2022 Pr Form 499 R 4 1 Fill Online Printable Fillable Blank Pdffiller

New 2020 Form W 4 Answerline Iowa State University Extension And Outreach

What You Should Know About The New Form W 4 Atlantic Payroll Partners

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

Post a Comment

Post a Comment