New Jersey Division of Taxation. General Instructions Form 1040X will be your new tax return changing your original return to include new information.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

This form is for income earned in tax year 2021 with tax returns due in April 2022.

Nj 1040 form 2018 instructions. Fill in if your address has changed. We last updated New Jersey Individual Tax Instructions in January 2022 from the New Jersey Division of Revenue. Form 1040 Schedule 1 2019 PDF.

Other New Jersey Individual Income Tax Forms. Form 1040 Schedule 3 2019 PDF. Your filing status is single if you were not mar-ried or a partner in a civil union on the last day of the tax.

Fill in only one box. Nonresident return use Form NJ-1040NR for the appropriate tax year and check the box at the top of the return. Its simple and easy to follow the instructions complete your NJ tax return and file it online.

Enter the amount from Line 21 of Form NJ-1040. You can download or print current or past-year PDFs of Individual Tax Instructions directly from TaxFormFinder. Attach copies of the following if applicable to Form 1045 for the year of the loss or credit.

Do not use Form NJ-1040X to amend a nonresident return. Instructions for Form 1040 2019 PDF. Check box if application for Federal extension is enclosed or enter confirmation IMPORTANT.

2018 Form NJ-1040X 1 Line-by-Line Instructions Use of Form NJ-1040X You must use Form NJ-1040X for the appropriate tax year to change amend any information reported on your original resi-dent Income Tax return Form NJ1040 or return that was filed using NJ WebFile or approved vendor software. Quick steps to complete and eSign 2018 nj 1040 online. We last updated the Form NJ-1040 Instructions in January 2022 so this is the latest version of Individual Tax Instructions fully updated for tax year 2021.

Property Tax Credit See instructions NJ-1040. A home is not permanent if it is maintained only for a temporary period to accomplish a particular purpose eg temporary job as-signment. State of New Jersey Division of Taxation Revenue Processing Center PO Box 222 Trenton NJ 08646-0222.

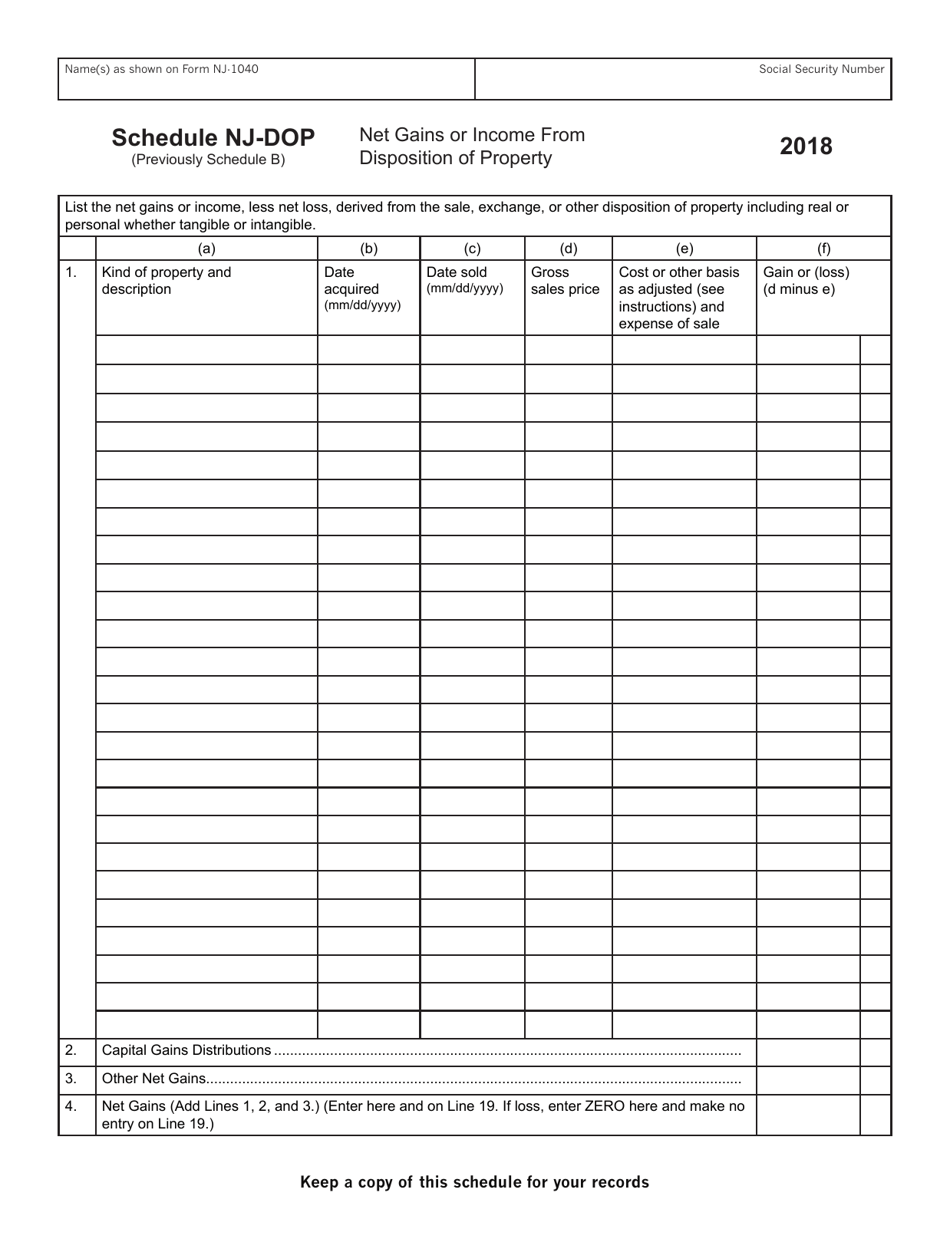

Dont include Form 1045 in the same envelope as your 2018 income tax return. 12 rows NJ-1040 Schedule DOP 2018 only Net Gains or Income from Disposition of Property. NJ Form NJ-1040 2018.

Month Year ending. Any resident or part-year resident can use it to file their 2020 NJ-1040 for free. State of New Jersey TGI.

Use Get Form or simply click on the template preview to open it in the editor. Enter the amount from Part I Line 4 of Schedule NJ-BUS-1 Form NJ-1040. New Jersey form NJ-1040 is designed for state residents to report their annual income.

See the instructions for Form NJ-1040-HW on page 47. New Jersey Individual Resident Income Tax Return. Lines 15 Filing Status In general you must use the same filing status as you do for federal purposes.

Your Social Security Number SpousesCU. To access this feature you will need to validate that you did so by providing the New Jersey Gross Income amount from your prior year New Jersey Income Tax. You may file both federal and State Income Tax returns Available to both full-year and part-year residents.

You can print other New Jersey tax forms here. Form 1040 2019 US Individual Income Tax Return for Tax Year 2019. 2018 NJ-1040 Your Social Security Number reuired - - SpousesCU Partners SSN if filing jointly - - CountyMunicipality Code See Table page 50 Fill in if federal extension filed.

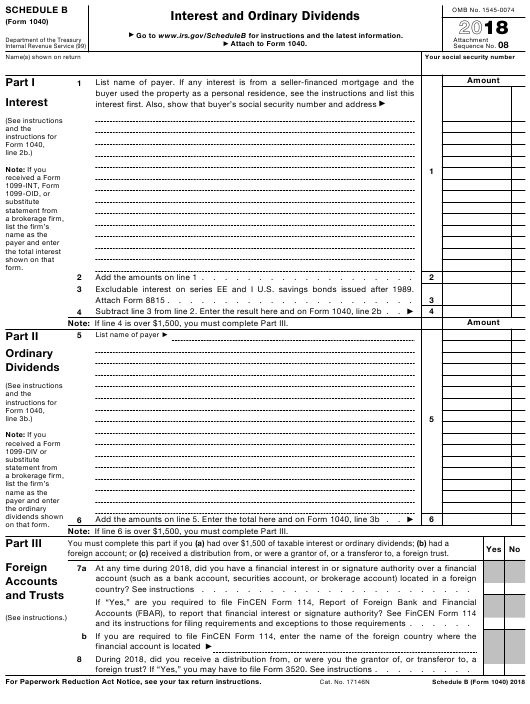

If you are an individual pages 1 and 2 of your 2018 Form 1040 and Schedules 1 through 6 and A D F and J. Enclose payment along with the NJ-1040-V payment voucher and tax return. Enclosures with Form NJ-1040X If you are amending an item of income deduction or credit that requires supporting documents you must enclose the applicable.

State of New Jersey Division of Taxation Revenue Processing Center Payments PO Box 111 Trenton NJ 08645-0111 Include Social Security number and make check or money order payable to. The New Jersey 1040 instructions and the most commonly filed individual income tax forms are listed below on this page. Form 1040 Schedule 2 2019 PDF.

Or other tax year beginning. Enter the amount from Line 22 of Form NJ-1040. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

For tax year Jan. Utilize the Circle icon for other YesNo questions. The form features space to include your income marital status as well as space to.

This service allows you to prepare and electronically file your current year New Jersey return if you filed a New Jersey return for the previous year. Total Tax Due Add Lines 49 50 and 51. The state income tax table can be found inside the New Jersey 1040 instructions booklet.

A resident of New Jersey you also may need to file a New Jersey resident return Form NJ-1040. Enter the amount from Part II Line 4 of Schedule NJ-BUS-1 Form NJ-1040. You can file your Form NJ-1040 for 2020 using NJ E-File whether you are a full-year resident or a part-.

Form 1040 2019 PDF. The entries you make on Form 1040X under the column headings Correct amount and Correct number or amount are the entries you would have made on your original return had it been done. Use the labels provided with the envelope and mail to.

Where to Mail Your Estimated Payment Mail Form NJ-1040-ES along with your check or money order to. - Dec 2014. Write your Social Security number on your check.

Preparation of your New Jersey income tax forms begins with the completion of your federal tax forms. Fill in if the address above is a foreign address. Instructions NJ-1040 Check box if Form NJ-2210 is enclosed.

Start completing the fillable fields and carefully type in required information. YOU MUST ENTER YOUR SSNs. Total New Jersey Income Tax Withheld.

Income Tax Resident Form. NJ Income Tax Resident Return. Instructions for your 2018 income tax return.

A home used only for vacations is not a permanent home. You can file your Form NJ-1040 for 2018 using NJ E-File whether you are a full-year resident or a part-year resident. New Jersey Residents WorkingLiving Abroad.

Use tax software you purchase go to an online tax preparation website or have a tax preparer file your return. Enter the amount from Line 18 of Form NJ-1040. NJ 1040 Rev 5 102014.

Annual income tax return filed by citizens or residents of the United States. We will update this page with a new version of the form for 2023 as soon as it is made available by the New Jersey government. Several of the New Jersey state income tax.

Taxes From A To Z 2018 L Is For Line Of Credit Line Of Credit Finance Paying Taxes

/ScreenShot2021-02-11at10.43.53AM-9e425788de3d4ad493784be2f13f752d.png)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

Taxhow New Jersey Tax Forms 2019

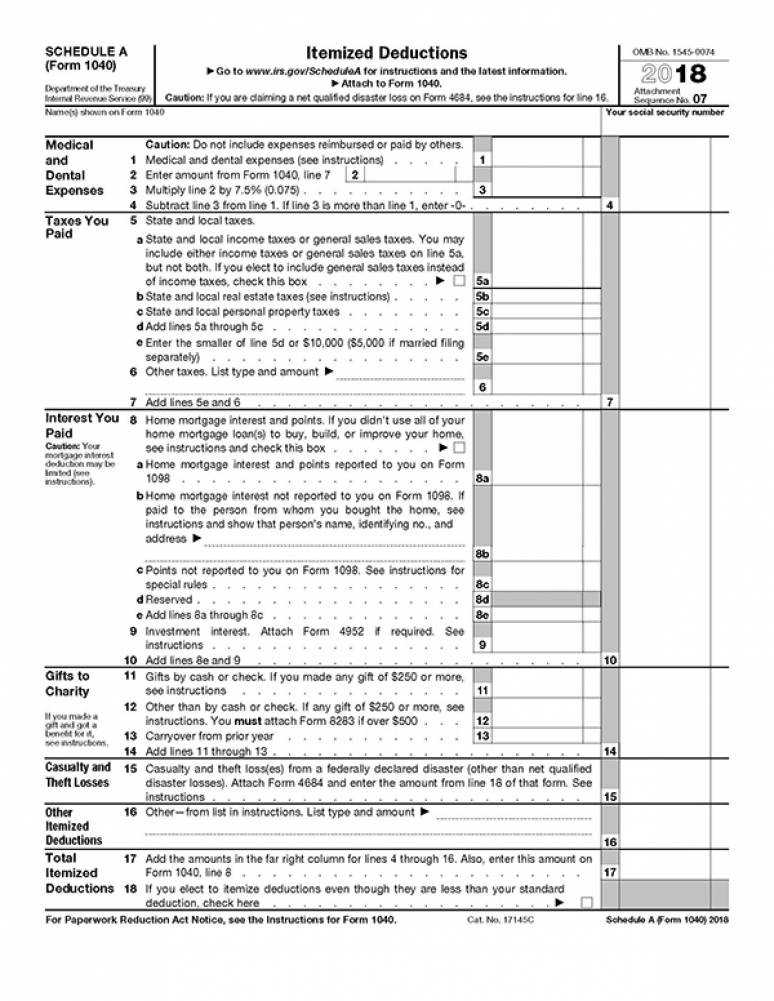

2018 Irs Tax Forms 1040 Schedule A Itemized Deductions U S Government Bookstore

Nj 1040 Fill Online Printable Fillable Blank Pdffiller

The New 1040 Form For 2018 H R Block

2021 1040ez Form And Instructions 1040 Ez Easy Form

2018 Irs Tax Forms 1040 Schedule A Itemized Deductions U S Government Bookstore

Da Form 1687 2018 Da 1687 Form Social Security Disability Benefits Business Plan Template Social Security Disability

The New 1040 Form For 2018 H R Block

Do You Need To File A Tax Return In 2018

Form Nj 1040 Schedule Nj Dop Download Fillable Pdf Or Fill Online Net Gains Or Income From Disposition Of Property 2018 New Jersey Templateroller

Post a Comment

Post a Comment