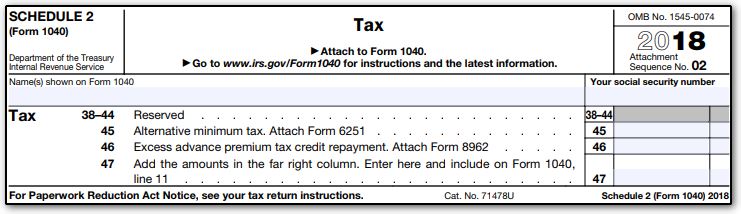

Beginning in tax year 2018 with the Tax Cuts and Jobs Act the 1040 was changed and many supplementary schedules were added. Enter your total itemized deductions as shown on federal Form 1040 or 1040-SR Schedule A line 17.

Names shown on Form 1040 1040-SR or 1040-NR.

Schedule 2 form 1040 line 46. If you do not have to file Form 1116 enter the smaller of your total foreign taxes or the total of the amount on line 16 of Form 1040 or Form 1040-SR and the amount on line 2 of your Schedule 2 Form 1040 Additional Taxes. Enter the total here and on Schedule 2 Form 1040 or 1040-SR line 4 or Form 1040-NR line 55. Full draft versions of these forms are available now on the IRSs website.

Income tax paid is the total amount of IRS Form 1040-line 14 minus Schedule 2-line 2. If the declarant has any taxation withdrawals that they cannot enter directly in Forms 1040 or 1040-RS they should use Additional Taxes Schedule 2 to compute and reflect the required data. Part I Taxes.

Other modifications were made to these forms that we did not address here including but not limited to line numbering changes. This information is now included on lines 1 and 2 of Form 1040 Schedule 2. If your employer provided more than 50000 of group-term life insurance coverage during the year the amount included in your income is reported as wages in Box 1 of Form W-2.

On your 2019 tax return your AGI is. The 2021 Schedule 2 Instructions are not published as a separate booklet. Prior to the Tax Cuts and Jobs Act this Tax section was included on lines 45 and 46 of Form 1040.

Then add 1647960 to the result. Line 8b You should always retain a copy of your tax return. Schedule 2 is now where the taxpayers taxes are calculated.

46 If Income Tax Paid is negative use zero. Your social security number. If one or both parents will file a federal tax return but have not yet filed subtract line 46 of Schedule 2 from line 13 of IRS Form 1040 from both tax returns to estimate the amount.

SCHEDULE 2 Form 1040 Department of the Treasury Internal Revenue Service Tax Attach to Form 1040. Instead you will need to read the Schedule 2 line item instructions found inside the general Form 1040 instructions booklet. Names shown on Form 1040.

132900 or less multiply line 4 by 153 0153. Schedule 2 line 46 is the Excess advance premium tax. Also it is shown separately in Box 12 with Code C.

If you and your spouse filed separate tax returns subtract schedule 2-line 46 from IRS Form 1040-line 13 from both tax returns and enter the total amount. If your parents filed separate tax returns subtract line 2 of Schedule 2 from line 14 of IRS Form 1040 on both tax returns add those two figures together and enter the result. Individual Income Tax Return 2021 12092021 Inst 1040.

TOTAL POSITIVE INCOME PER COMPUTER13249700 TENTATIVE TAX1574800. SCHEDULE 2 OMB No. What line is AGI on 1040 for 2019.

Line numbers have also been rearranged. Go to wwwirsgovForm1040 for instructions and the latest information. Line numbers have also been rearranged.

Then that amount went on Line 11 on your Form 1040. Go to wwwirsgovForm1040 for instructions and the latest information. Your social security number.

If they received too much they entered the excess amount on Line 29 of that form and then brought the amount over to Line 46 of IRS Schedule 2. More than 132900 multiply line 4 by 29 0029. The draft form of Schedule 2.

If you fill out Schedule 2 youll attach it to Form 1040 Form 1040-SR or Form 1040-NR. Instructions for Form 1040 or Form 1040-SR US. Enter the amount of taxes you paid included in Line 1 from federal Form 1040 or.

If the parents filed separate tax returns subtract line 46 of Schedule 2 from line 13 of IRS Form 1040 from both tax returns and enter the total amount. 2021 Form 1040 2021 Schedule 1 Form 1040 2021 Schedule 2. Learn about four refundable tax credits What is likely changing.

IRS Schedule 2 Form 1040 or 1040-SR. Income tax paid is the total amount of IRS Form 1040-line 13 minus Schedule 2-line 46. 1545-0074 Attachment Sequence No.

Line 13 minus schedule 2-line 46. SCHEDULE 2 Form 1040 2021 Additional Taxes Department of the Treasury Internal Revenue Service Attach to Form 1040 1040-SR or 1040-NR. Schedule 2 is now where the taxpayers taxes are calculated.

Form 1040 Schedule 2 Additional Taxes asks that you report any additional taxes that cant be entered directly onto Form 1040. So we are not sure what to enter. Many of the items listed on the second page of Schedule 2 are not that common.

Starting in tax year 2019 Schedules 2 and 4 are combined on to a single Schedule 2 Additional Taxes. On the final line you entered the sum of amounts from the other lines. Total Itemized Deductions from federal Form 1040 or Form 1040-SR.

Beginning in tax year 2018 with the Tax Cuts and Jobs Act the 1040 was changed and many supplementary schedules were added. 1545-0074 Additional Taxes Form 1040 Department of the Treasury Internal Revenue Service Go Attachment Sequence No. Individual Income Tax Return 2021 12222021 Form 1040 PR Schedule H Household Employment Tax Puerto Rico Version 2021 12212021 Form 1040 Schedule 1.

Enter the amount of your and your spouses income tax of 2018This is the total amount of IRS Form 1040. 2020 Form 1040 Schedule 2. Starting in tax year 2019 Schedules 2 and 4 are combined on to a single Schedule 2 Additional Taxes.

Download your fillable IRS Schedule 2 Form 1040 or 1040-SR in PDF. There are only three lines in this part. What Is Form 1040 Schedule 2.

Enter the result here and on Schedule 2 Form 1040 or 1040-SR line 4 or Form 1040-NR line 55. 02 Your social security number Name s shown on Form 1040 1040-SR or 1040-NR Part I 2020 Attach to Form 1040 1040-SR or 1040-NR. Credit for child and.

Schedule 2 Form 1040 - Items That Flow to Line 8.

Instructions For Form 1040 Nr 2020 Internal Revenue Service

What Was Your Income Tax For 2019 Federal Student Aid

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

1040 Schedule 2 Drake18 And Drake19 Schedule2

What Was Your Income Tax For 2019 Federal Student Aid

How To Answer Fafsa Question 85 Parents Income Tax

2021 Instructions For Schedule H 2021 Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Post a Comment

Post a Comment