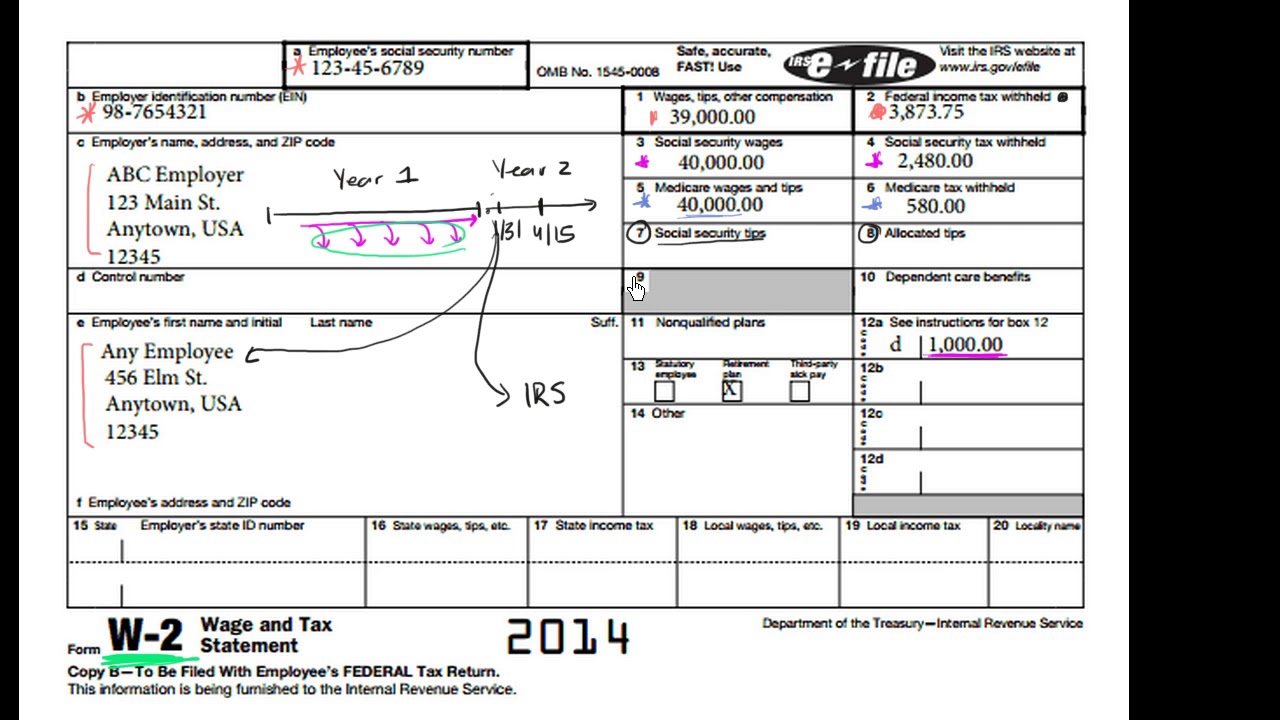

This is probably the most familiar part of reading a W-2. See Form 1040 instructions to determine if you are required to complete Form 8959.

Tax Reporting For Stock Compensation Understanding Form W 2 Form 3922 And Form 3921 The Mystockoptions Blog

How to Read a W-2 Form the Right Way.

W2 form how to read. The social security number. Once you know what each box means reading your W-2 form is. How To Read And Understand Your Form W-2 At Tax Time TaxThe form also includes taxes withheld from your pay as well as social security and medicare payments made.

Box B - Your employers tax identification number. They contain your employers information and yours. Employees social security number This is the employees social security number.

An employer has specific reporting withholding and insurance requirements for employees that are a bit different from. On Form 8959 Additional Medicare Tax. Plus breakouts for Social Security wages Medicare wages and Social Security tips.

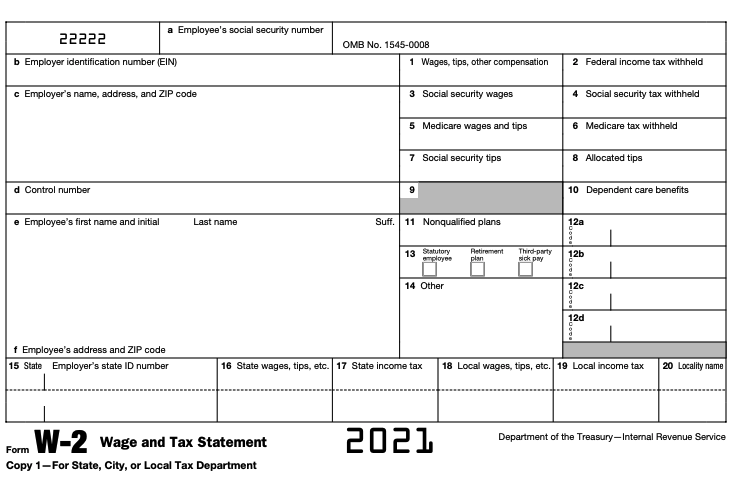

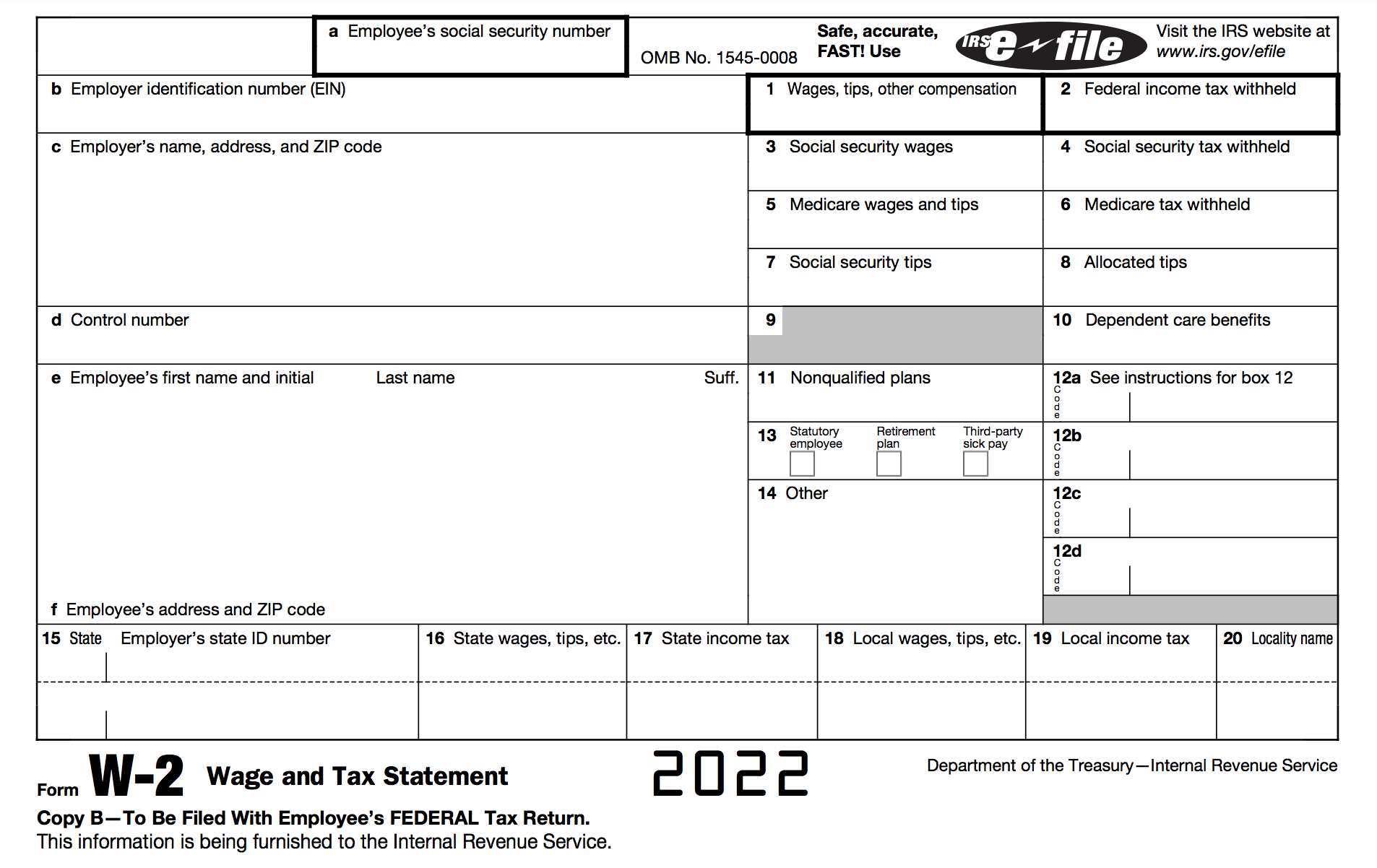

Each form is divided into state and federal sections since you may have to pay taxes on both. The employers tax ID name and address are also listed. BOX 1 FEDERAL TAXABLE WAGES Box 1 includes your wages bonuses commissions tips and other compensation.

The information on your W-2 helps determine your taxable income and shows the amount of tax youve already paid through withholding. The letter boxes at the top left of your W2 form are for identification purposes. Every W-2 has the same fields no matter who the employer is.

How to read your W-2. How to Read Your W2 The letters and numbers listed below coordinate to the letters and numbers listed in the boxes on your W2 form. The left side of the W2 form has the numbered boxes which produce a lot of questions.

Box D - A reference or control number used by your employer. Wage and Tax Statement. In Box 1 youll see how much of your income was taxable and itll break down how much you earned in your wages salary bonuses and tips.

Boxes A through F. Boxes a-f reflect company information and the demographic information you have on file with the employer that has provided the W-2. Name and address of your employer.

If you look below A through F youll see Boxes 1 and 2. In Box 2 youll see how much federal income tax the employer took out from your wages that you earned. The W-2 format is horizontally divided.

Youll see two types of boxes on your W2 - boxes marked with letters on the left and boxes marked with numbers on the right. You should however be cautious about the correctness of these boxes. Box C - The name and address of your employer including its zip code.

The lettered boxes on a W-2 include. The employees Social Security number name and address are all listed in these boxes. There are boxes marked with letters on the left and right and boxes marked with numbers.

The lettered boxes are self-explanatory and easy to read. Its important to hang onto your W-2 form. How to Read a W-2 Earnings Summary Form.

How to Read a W2 Form. If your form W-2 contains this code you or your tax professional should enter it when prompted using software electronically filed. Heres a summary of each section.

W10 Form And Tax Return What Makes W10 Form And Tax Return. Somewhere on the form should be your total taxable wages for the year. The wages subject to Medicare Tax are the same as those subject to Social Security Tax Box 3 except that there is no maximum for Medicare Tax.

On the right side of the W2 form are boxes A to F where you need to fill in employee and employer information such as social security number employer identification number your full name job address and current address. Income Youll see your total wages tips and other compensation. How To Read Your W-2.

How to Read Form W-2. If you lose it issuing a new one can take. Your name and address.

How to Read a W-2 Tax Form. Be sure to review your information for accuracy and contact your employer if any changes need to be made. All W2 forms should be more or less the same.

An employer issues a form W-2 form downloads as a PDF to an employee. W-2 forms include both numbered and lettered boxes that an employer must fill out and reflects how much you earned and taxes withheld. Box A - Your social security number.

Your social security number. There are a bunch of little boxes on your W-2 form but dont let them overwhelm you. A form should have your name and mailing address as well as your social security number and your employers identification number.

They might look somewhat different but they all contain similar information. Names numbers and address This includes your employers name and address plus your Social Security number. PLUS Personal use of a company car Non-accountable expense reimbursements such as car allowances Your employers cost of providing you with group term life insurance GTL in excess of 50000.

How To Read Your W 2 Justworks Help Center

How To Read Your Military W 2 Military Com

Imperialism Treaba Prin Casa Aparat Foto W2 Form Box 12 Sultansofsax Net

Wage Tax Statement Form W 2 What Is It Do You Need It

Tax Reporting For Stock Comp Understanding Form W 2 Form 3922 And Form 3921 The Mystockoptions Blog

Intro To The W 2 Video Tax Forms Khan Academy

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

Tax Reporting For Stock Comp Understanding Form W 2 Form 3922 And Form 3921 The Mystockoptions Blog

Understanding Tax Season Form W 2 Remote Financial Planner

Understanding Your W 2 Controller S Office

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

Post a Comment

Post a Comment