The Illinois Department of Revenue mandates the filing of Form W-2 if you satisfy any one of the following conditions. Does Illinois require any additional forms to be submitted while filing W-2.

Perfect Termination Letter Samples Lease Employee Contract Poor Performance Sample And Professional Cover Letter Template Cover Letter Sample Lettering

Electronic filing methods for Forms W-2 and W-2c.

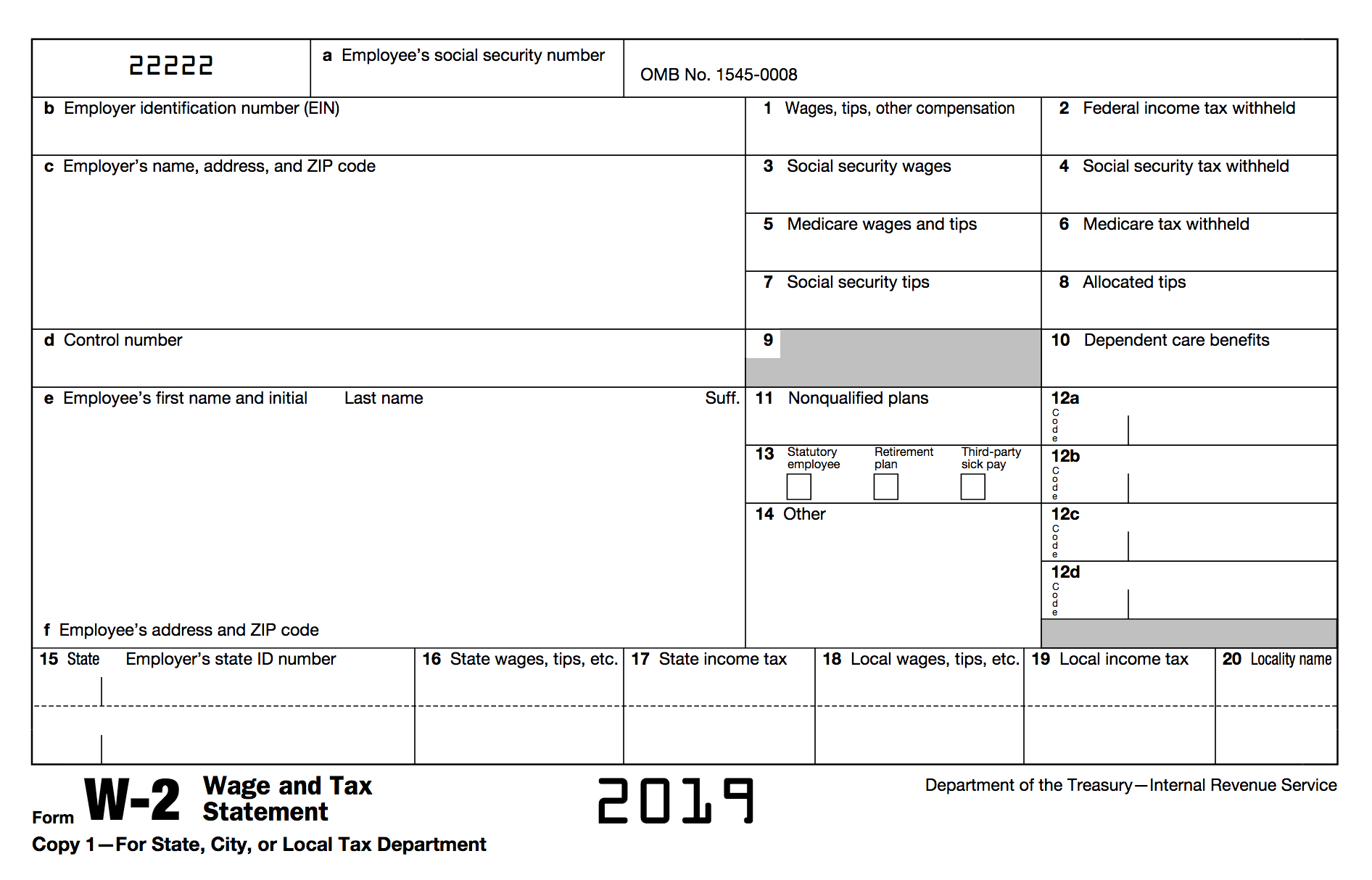

W2 form illinois. 2021 Tax Year For withholding taxes 01012021 through 12312021 2020 Tax Year For withholding taxes 01012020 through 12312020 2019 Tax Year For withholding taxes 01012019 through 12312019 2018 Tax Year For withholding taxes 01012018 through 12312018 2017 Tax Year For withholding taxes. On Form 4137 you will calculate the social security and Medicare tax owed on the allocated tips shown on your Forms W-2 that you must report as income and on other tips you did not report to your employer. Form W-2 Wage and Tax Statement is prepared by your employer.

You have paid employee compensation in Illinois. Illinois Withholding Income Tax Return Due Dates. Electronic Signature Solutions by SignNow.

The filing due date for both Form W2 and IL-941 with Illinois is January 31. Withholding Tax Payroll - IL-941. Step 1 Company Information Step 2 Employee Information Step 3 More Information Step 4 Preview Your Stub.

By filing Form 4137 your social security tips will be credited to your social security record used to figure your. The unemployment insurance program in the state of illinois is administered by the illinois department of employment security ides. The Illinois Department of Revenue does not accept Forms W-2 and W-2c that are submitted by mail.

Ad signNow Allows You to Edit Fill and Sign any Documents on any Device. The University of Illinois System has contracted the services of Greatland Software for the annual mailing of year-end statement of wages Forms W-2 1042-S and Form 1095-C. Electronic Signature Solutions by SignNow.

Step 1 - Company Information Step 2 - Employee Information Step 3 - More Information Step 4 - Preview Your Stub. Payroll Authorization Form Managed by Human Resources Federal W-4. Tuition Remission Taxation Policy and Schedule.

Timesheet Adjustment for Non Exempt. This number can be found on your w2 or 1099 form if you were employed there last year. 1709 Sample of W-2 Wage statement that is mailed to each employee at year-end.

Payroll providers and employers must electronically submit Forms W-2 and W-2c using one of the following methods. Finally if you claim 15 or more exemptions on your Form IL-W-4 without claiming at least the same number of exemptions on your federal Form W-4 and your employer is not required to refer your federal Form W-4 to the IRS for re-view your employer must refer your Form IL-W-4 to the department for review. Timesheet Adjustment for Exempt.

Create your W-2 Form. FORM W-2 will be mailed to University of Illinois System employees on January 31st unless it falls on a weekend then it would be the next business day to the mailing address listed on. If the form is lost missing or you cant find it online contact your employer immediately.

36 rows Form W-2 Wage and Tax Statements Forms W-2 are sent to all employees each. You must submit Form IL-W-4 when Illinois Income Tax is required to be withheld from compensation that you receive as an employee. The W 2 form is usually mailed to you or made accessible online by the company you work for.

In the worst-case scenario you can fill out Form 4852 and. Form W-2 officially the Wage and Tax Statement is an Internal Revenue Service IRS tax form used in the United States to report wages paid to employees and the taxes withheld from them. Remember Illinois allows only the electronic filing of W-2.

Electronic filing of Forms W-2 and W-2c is mandatory. Employers must complete a Form W-2 for each employee to whom they pay a salary wage or other compensation as part of the employment relationship. You may file a new Form IL-W-4 any time your withholding allowances increase.

Ad signNow Allows You to Edit Fill and Sign any Documents on any Device. Please contact your employer to request a copy. Timesheet Adjustment for Time In Time Out.

Click here to file your IL-941 return or pay your IL-501 in MyTax Illinois. In addition its a good idea to call the IRS if you dont receive the W2 by mid-February. If the number of your claimed allowances decreases you must file a new Form IL-W-4 within 10 days.

Payment Coupon and Instructions Due Dates. Along with Form W-2 you are also required to file Form IL-941. When it comes to e-filing Illinois W-2 taxes Form we provide and support all of the forms you need including the transmittal Form IL-94.

Request for Duplicate Tax Form W-2 1042-S. First of all a W2 Form is really a type of tax return thats submitted by a taxpayer. The penalty of 250 or 2 of your unpaid taxes will be imposed on you for each Form W2 not filed on time with the state of Illinois.

Click here for information about filing your W-2s and 1099s. You have withheld Illinois income tax. Form W-2c is the correction for any Form W-2 errors and Form IL-941 is the annual reconciliation to transmit these to the Illinois state department.

Federal Form W-2 Wage and Tax Statement updated. Its used to provide information on just how much income the taxpayer has just how much income she or he has paid out and what deductions and credits have been claimed on a tax return. 052120 Employees Wage and Tax Statement.

Illinois Department of Revenue Form IL-W-4 Employees Illinois Withholding Allowance Certificate updated. You worked in illinois during the past 12 months. In that case your Form IL.

Form W-2 - Wage and Tax Statements Form IL-941 - Withholding Income Tax Return. Il444-3212 - wic program vendor complaint form pdf il444-3470 s - consentimiento informado de basede datos para visitas a domicilio pdf il444-5234 covid-19 attendance exemption form for centers and licensed homes pdf il444-5444 - clientpatient discharge with national outcome measures - noms darts data entry form pdf.

W 2 And W 4 A Simple Breakdown Bench Accounting

Income And Expense Statement Template New In E And Expense Statement Template Excel Format Pr Statement Template Financial Statement Mission Statement Template

2019 Tax Information Form W 2 Wage And Tax Statement Form 1099

2020 Form W 2 Distributed News Illinois State

Financial Agreement Form Sample Forms Financial Contract Template Agreement

Illinois Tax Forms 2020 Printable State Il 1040 Form And Il 1040 Instructions

Elders Car Insurance Claim Form 2021 Doctors Note Template Fillable Forms Car Insurance Claim

2013 Tax Information Form W 2 Wage And Tax Statement Form 1099

Irs Illinois Form Il 4852 Pdffiller

Car Title Templates Pdf Fill Online Printable Fillable Blank Pdffiller Fillable Forms Irs Forms Irs

Da 2062 Form Template Cover Sheet Template Fax Cover Sheet Job Application Form

Form W 2 State Filing Deadlines West Virginia District Of Columbia Wyoming

How To Fill Out A W 4 Form H R Block Finances Money Finance Tax Prep

Post a Comment

Post a Comment