518 431-8783 W-4P WITHHOLDING ELECTION AND CERTIFICATE If you are a Nonresident Alien please submit Form W-8 BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting instead of this form. If you transferred from another state agency your withholding elections will transfer with you.

New York State Form W 4 Download

What Is this Form for.

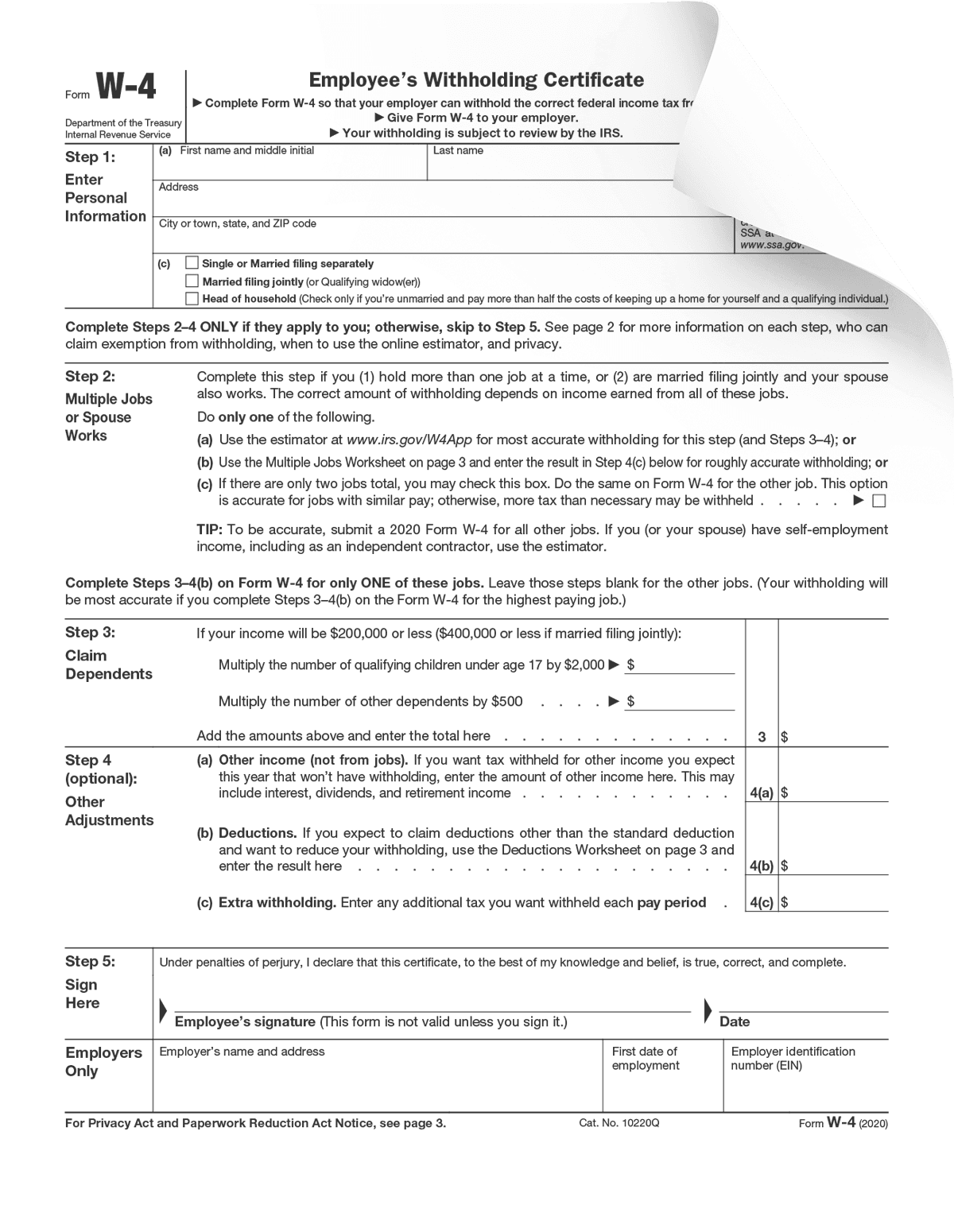

W4 form new york. The advanced tools of the editor will lead you through the editable PDF template. If you do not submit this form your withholdings will default to a filing status of single and you claim 1 allowances. Even if you havent just landed a new job you can file a new W-4 form with your employer if your personal or financial situation changes or if you have found that you have too high a tax bill or too large a refund when you file.

Use a check mark to point the choice wherever required. The tax tables and methods have been revised for payrolls made on or after January 1 2018. Is this Form Mandatory.

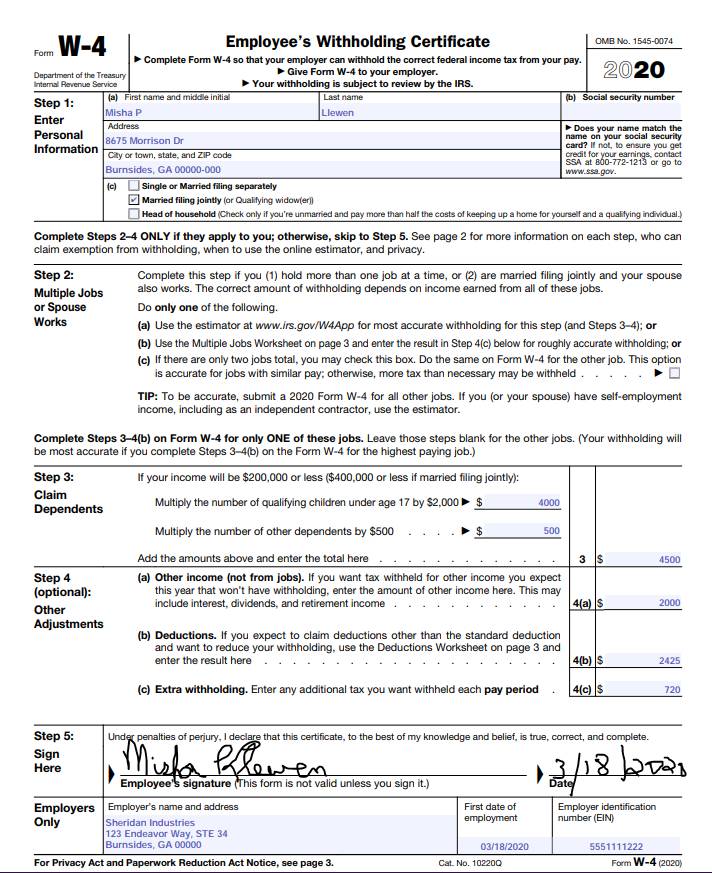

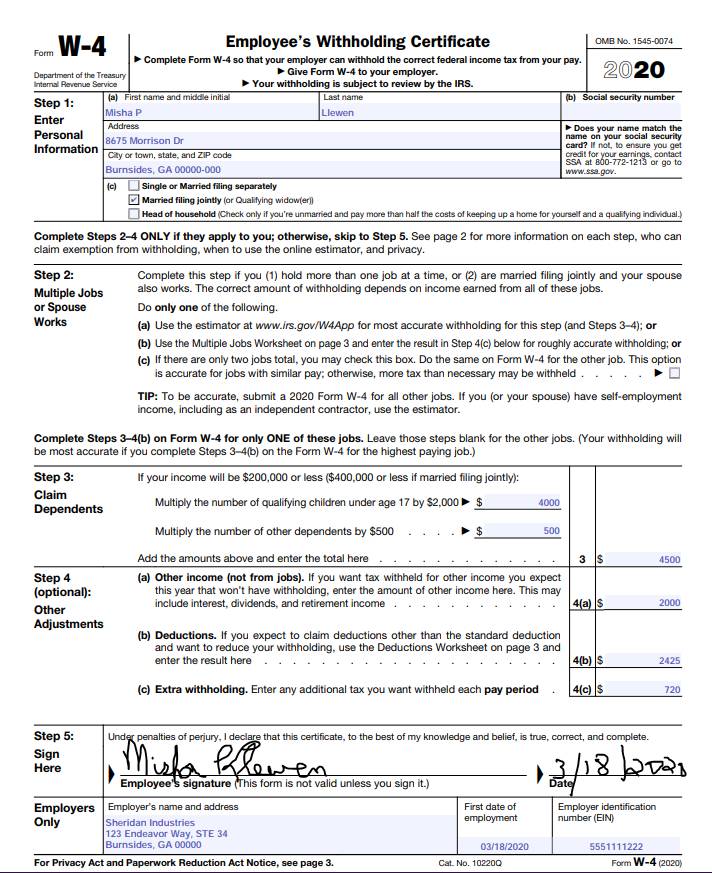

Questions Answered Every 9 Seconds. The form was redesigned for 2020 which is why it looks different if youve filled one out before then. Your withholding is subject to review by the IRS.

You will find three available alternatives. To start the blank utilize the Fill Sign Online button or tick the preview image of the blank. Law this may result in the wrong amount of tax withheld for New York State New York City and Yonkers.

Give Form W-4 to your employer. Enter your official identification and contact details. Using this form you can calculate the payroll taxes and send the amount to the state and the IRS on behalf of your employee.

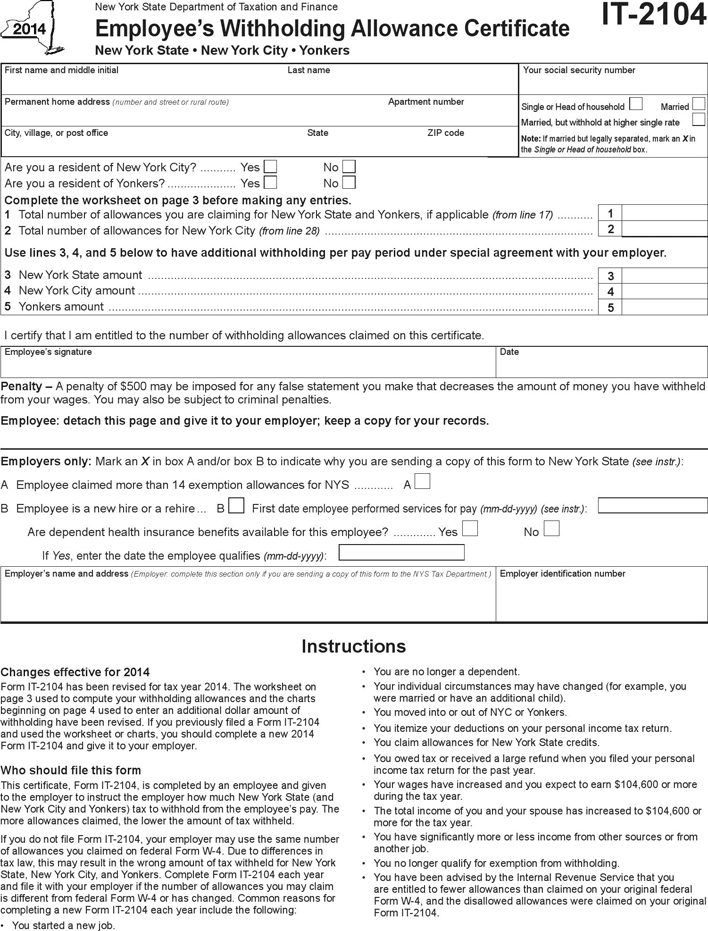

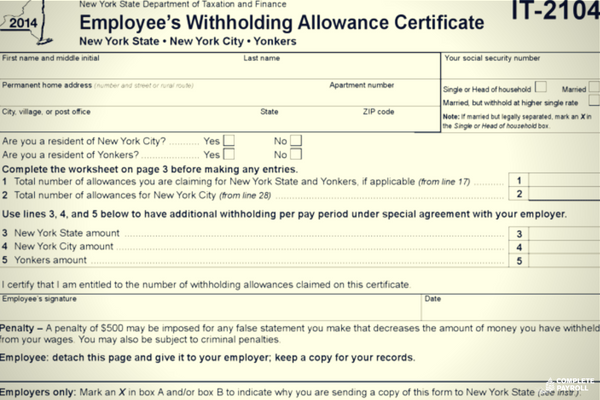

New York State Withholding Certificate IT-2104 Use to identify and withhold the correct New York State New York City andor Yonkers tax. However if your form asks for a 1 or 0 take a look at the date on the top of the W. If your income is under 32000 you can claim one more for the New York State Household Credit.

Enter Personal Information a. December 2020 Department of the Treasury Internal Revenue Service. Ad A Tax Advisor Will Answer You Now.

If youre filling out a Form W-4 you probably just started a new job. If you own a home and pay property taxes you can claim one more exemption. A W-4 form formally titled Employees Withholding Certificate is an IRS form employees use to tell employers how much tax to withhold from each paycheck.

Your withholding is subject to review by the IRS. Every employee must pay federal and state taxes unless youre in a state that doesnt have state income tax - but New York is definitely not one of those states. Total number of allowances you are claiming for New York State and Yonkers if applicable from line 20 2.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. 319 Please type or print clearly in blue or black ink. Switch on the Wizard mode on the top toolbar to have extra tips.

Retirement System check one Employees Retirement System ERS Police and Fire Retirement System PFRS. Click on the orange Get Form button to start editing and enhancing. Therefore if you submit a federal Form W-4 to your employer for tax year 2020 or later and you do not file Form IT-2104 your.

For tax years 2020 or later withholding allowances are no longer reported on federal Form W-4. This publication contains the wage bracket tables and exact calculation method for New York City resident withholding. I want to thank you again for your information and time Youve been a great help.

The W-4 takes care of withholding for federal income tax and the IT-2104 Form takes care of New. The IT-2104 Form is the form to set up employee income tax withholding for New York State. NEW YORK STATE TEACHERS RETIREMENT SYSTEM 10 Corporate Woods Drive Albany NY 12211-2395 Fax.

Social Security Number. To identify and withhold the correct New York State New York City andor Yonkers tax. Completing both Form W-4 and Form IT-2104 helps ensure employees have the proper amounts withheld for both state and federal taxes.

Or maybe you recently got married or had a baby. Indicate the date to the form using the Date feature. Ad A Tax Advisor Will Answer You Now.

Click the Sign tool and make an e-signature. Total number of allowances for New York City from line 35 Use lines 3 4 and 5 below to have additional withholding per pay period under special agreement with your employer. Give Form W-4 to your employer.

A W4 Tax Form or Employees Withholding Certificate is an IRS document containing information regarding the amount of tax to withhold from your employees paycheck. The W-4 also called the Employees Withholding Certificate tells your employer how much federal income tax to withhold from your paycheck. You can claim another 3 credits if your child is between 4 and 16 years old and your income is under 110000 for the Empire State Child Credit.

Questions Answered Every 9 Seconds. FORM W-4P Withholding Certificate For Pension or Annuity Payments RS 4531 Rev. New York City resident withholding tax tables and methods.

Form W-4 Department of the Treasury Internal Revenue Service Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Updating Your W-4 Form. Complete each fillable area.

What Is this Form for. NYS-50-T-Y 122 Yonkers resident and nonresident withholding tax tables and methods. Employers use the W-4 to calculate.

How to Complete this Form. Ensure that the details you add to the New York W4 is updated and correct. Due to changes in the 2021 guidelines the number 0 or 1 you write down on your W-4 form will no longer significantly impact your paycheck during the year.

I even found a form IT 2104 which lets me claim a different amount for NYS withholding than just using the W4 for federal and state. This is acceptable for existing employees however differences between New York State and Federal tax law may result in the wrong amount of tax withheld for New York State.

Free Ny It 2104 Employee S Withholding Allowance Form Pdf 516kb 7 Page S

Everything You Need To Know About The New W 4 Tax Form Mycentraloregon Com

New York State Form W 4 Download

File Form W 4 2012 Pdf Wikipedia

Bill Of Sale Form Ny It 2104 Employees Withholding Allowance Form Templates Fillable Printable Samples For Pdf Word Pdffiller

What Is A W4 Form And How Does It Work Form W 4 For Employers

Irs Releases Updated Withholding Calculator And 2018 Form W 4 Abacus Group Blog

Form It 2104 Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate 2021 New York Templateroller

State W 4 Form Detailed Withholding Forms By State Chart

2017 W4 Fillable Fill Online Printable Fillable Blank Pdffiller

Everything You Need To Know About The New W 4 Tax Form Mycentraloregon Com

It 2104 Form New York State Income Tax Withholding

Post a Comment

Post a Comment